Tensions are escalating around Nasdaq-listed CEA Industries (BNC), a company closely linked to the Binance ecosystem through its sizable BNB treasury. Binance-affiliated investment firm YZi Labs has publicly accused asset manager 10X Capital of failing to comply with U.S. securities disclosure rules. The allegations surface amid active negotiations over BNC’s asset management structure, turning what began as a regulatory dispute into a broader governance confrontation.

Nasdaq OMX Group

Bitcoin has just erased its hard-earned gains after last week's crash. The world’s leading cryptocurrency falls back towards $65,000, a collateral victim of a panic that hits the tech sector hard. Even precious metals are not spared.

Facing a crypto ecosystem in search of clear landmarks, Nasdaq and CME Group combine their expertise to establish a new benchmark index. With the Nasdaq CME Group Crypto Index, the two giants aim to structure a still fragmented market by providing a robust, transparent, and calibrated framework for the needs of institutional investors. A strategic initiative that could redefine the standards of crypto exposure in traditional finance.

Is Bitcoin bored? Not really. Between wild OGs, voracious ETFs, and complicit regulations, the beast calms down... but could bite again where it's least expected.

Kindly MD thought it could reinvent itself with bitcoin. Listed on the Nasdaq, the company refocused its strategy around the flagship asset after its merger with Nakamoto Holdings. However, the initial euphoria gave way to a sharp drop in the price, resulting in a formal warning from the American stock exchange. Without a rapid recovery, the company now risks delisting.

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.

Nasdaq has formally reprimanded TON Strategy for violating listing rules tied to its $272.7 million Toncoin purchase and related PIPE financing. The company, formerly known as Verb Technology Company, failed to secure shareholder approval before issuing stock to fund the deal, according to a recent SEC filing.

Hyperliquid shakes the crypto market with a spectacular increase of 11.91%. This surge comes as the company unveils ambitious plans: a Nasdaq IPO and a $1 billion fundraising. Institutional investors are closely monitoring this project that aims to become a bridge between decentralized finance and traditional markets.

The tokenization of securities divides the giants of finance: Nasdaq wants to revolutionize Wall Street, but Ondo Finance cries out for lack of transparency. Who is right? Dive into this battle that could redefine the future of crypto and your investments. The outcome will surprise you.

What if an overly soft banker awakened the bitcoin beast? Behind the Trumpian nominations, a financial parabola ready to explode… Novogratz lights the fuse, hide the dollars!

Gemini makes its debut on the Nasdaq under the symbol GEMI. The Winklevoss brothers' crypto platform successfully launched its IPO at 28 dollars per share, a price set beyond initial expectations. This listing comes as the crypto sector tries to regain market confidence in a climate still marked by regulatory uncertainties and the quest for profitability.

Nasdaq has officially filed a request with the SEC to authorize trading of shares and ETPs in tokenized form. A breakthrough that could disrupt Wall Street and accelerate the integration of blockchain into traditional financial markets.

The Canadian company SOL Strategies reaches a historic milestone by obtaining its entry ticket to the prestigious Nasdaq. This listing, scheduled for September 9 under the symbol STKE, marks a major turning point for the Solana ecosystem, increasingly sought after by institutional investors.

Gemini has officially filed for its IPO, a step that could bring the decade-old platform to Nasdaq under the ticker symbol GEMI.

Crypto ETF issuers are just waiting for the SEC to release its stamp. They move forward, file, correct, refine. Like a conductor confident in his score, Grayscale continues to play its own regulatory symphony. And this time, it is Cardano taking the stage, ready to secure its ticket to Wall Street. The countdown is on, the lines are moving, and investors are already sharpening their order books.

A promoter in deficit, a crypto in the spotlight, a 60% jump on the stock market... What if LINK became the reinforced concrete of ruined treasuries?

Donald Trump re-enters the crypto arena. Through Trump Media, his group partners with Crypto.com and Yorkville Acquisition to launch a structure valued at 6.42 billion dollars, entirely based on CRO. The goal is to build the largest public crypto treasury, with a planned listing on Nasdaq.

Gemini, the exchange founded by the Winklevoss brothers, has officially filed its S-1 with the SEC for a Nasdaq IPO. In a context marked by the multiplication of crypto IPOs, this initiative raises as much enthusiasm as questions. The platform's repeated losses and the market's persistent volatility indeed call for a thorough analysis. Will Gemini manage to attract Wall Street despite disappointing financial results?

American indices continued their rise, boosted by July inflation below forecasts. This macroeconomic signal propelled expectations of a Fed rate cut as early as September, now almost certain in investors' eyes. Driven by this momentum, optimism also spreads to the crypto market and Asian tech giants, drawing a global movement where macroeconomics, traditional finance, and DeFi advance together.

Argo Blockchain risks delisting from Nasdaq after its shares fell below $1 for over 30 days, sparking investor concerns.

"For several weeks now, Coinbase's (COIN) stock has been on the rise, reaching a historic high of $382 before closing at $369.21. This surge is not coincidental: it reflects both a major regulatory turning point in the United States and the profound strategic transformation undertaken by the crypto company, which is determined to become one of the pillars of global digital finance."

For a long time reserved for bitcoin, the role of strategic treasury asset is now expanding to other cryptos. Upexi, listed on Nasdaq, is a concrete illustration of this: it has strengthened its treasury with 735,692 SOL, valued at over 105 million dollars. And that's not all: the company also announces the tokenization of its shares on the Solana blockchain.

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

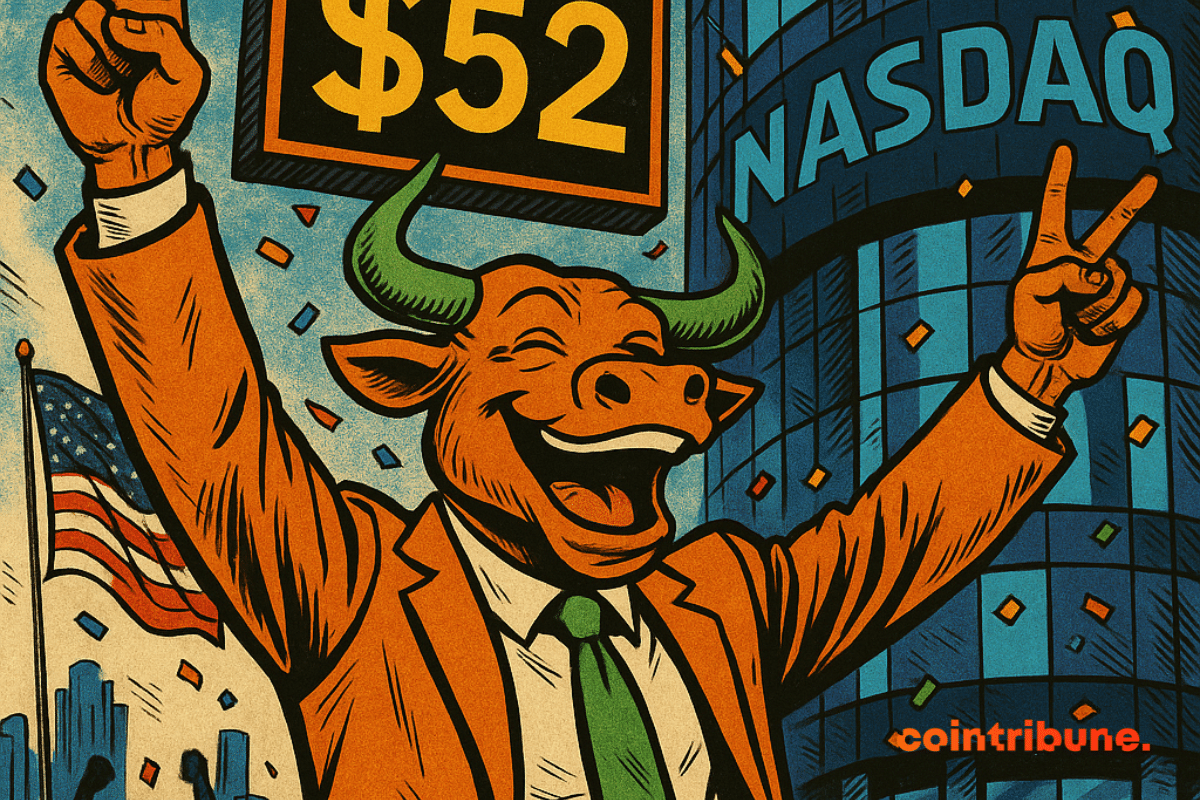

eToro's IPO launches on Nasdaq at $52 per share, exceeding expectations. The company raises $310 million, valuing it at $4.2 billion, and positions itself to compete with platforms like Robinhood.

Tether has just acquired nearly half a billion dollars in bitcoin as part of a major strategic operation. This transaction prepares the launch of Twenty One, a new Bitcoin treasury company set to enter Nasdaq through a SPAC merger. A maneuver that could redefine the standards of institutional crypto management.

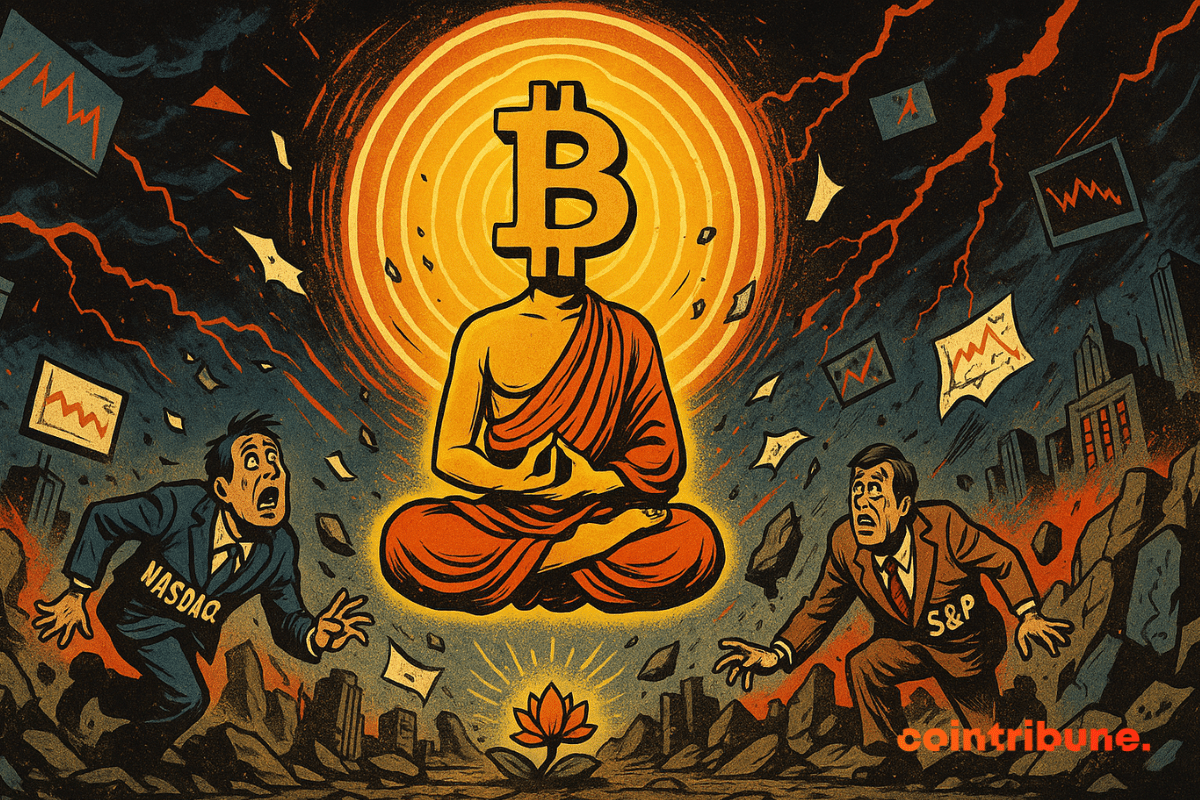

In a crypto market where volatility is the norm, Bitcoin has just reached an unexpected milestone. It is now less unstable than the S&P 500 and the Nasdaq. This discreet yet significant shift, revealed by Galaxy Digital, challenges a decade of perception of an asset deemed too risky for traditional portfolios. More than just a technical indicator, this signal could mark a lasting status change for the first cryptocurrency.

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

eToro will raise $500 million and targets a $4 billion valuation. We tell you everything about this IPO that is shaking up the crypto sector.

The Nasdaq calls on the Securities and Exchange Commission (SEC) to treat certain cryptos as traditional financial securities. In a letter dated April 25, Nasdaq urged the SEC to classify certain cryptocurrencies as "stocks," emphasizing the need for clearer regulatory standards for digital assets.

While Trump plays the customs officer, Tesla wavers, Alphabet holds firm, and Wall Street takes on water. The markets, on the other hand, brace for the next presidential tweet.