A hijacked NPM account was at the center of a major supply-chain breach, putting the JavaScript ecosystem and crypto users at risk.

One World Loyalty Posts To Read RSS

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

XRP has just signed its strongest accumulation phase in two years, against the backdrop of an uncertain market. While altcoins struggle to find a second wind, Ripple's crypto stands out through unusual accumulation activity. This surge, supported by significant volumes, reactivates speculation about a possible lasting rebound.

Cloned Drake, TaTa invented by Timbaland, Grimes shares her voice... When AI thinks of itself as the new pop star, artists shout genius or scandal.

As artificial intelligence radically transforms the job market and particularly threatens several positions, OpenAI launches an ambitious counter-offensive. The parent company of ChatGPT is developing a job platform specialized in AI, positioned as a direct competitor to LinkedIn.

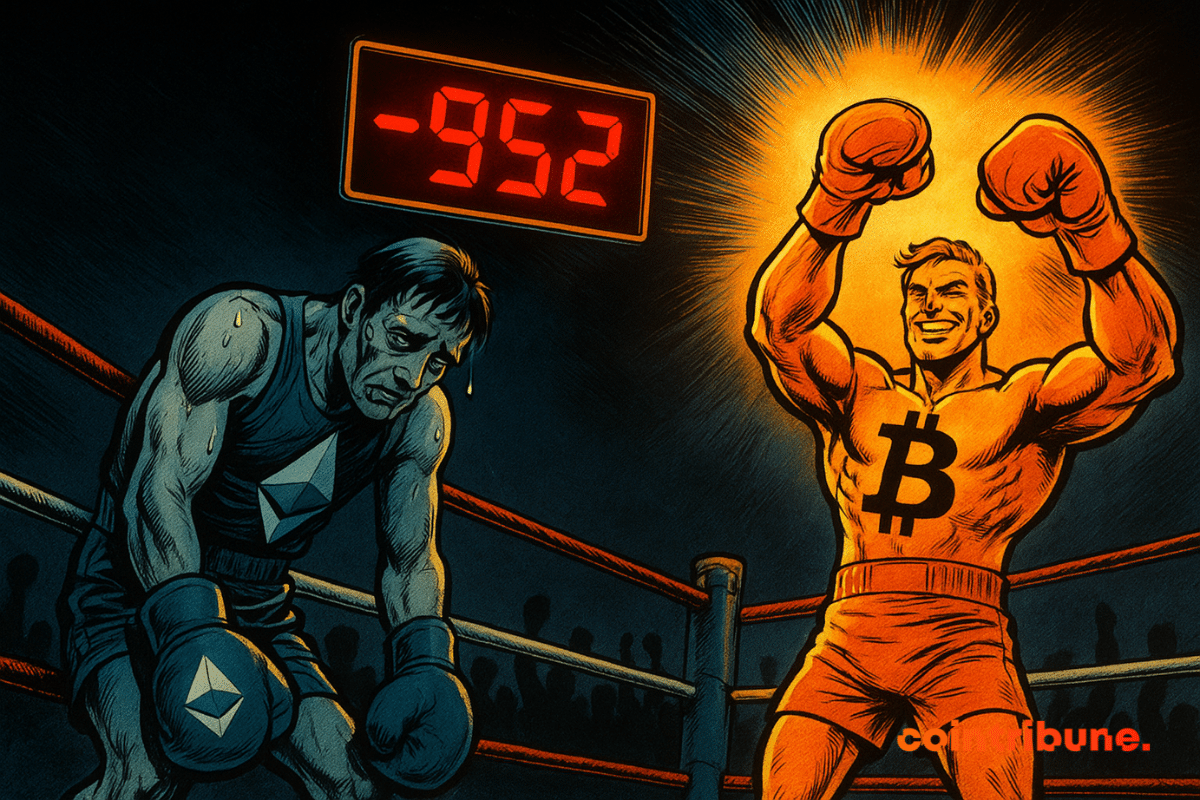

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.

Since its creation, Ethereum (ETH) has continually surprised the markets. But the latest indicator marks an unprecedented milestone. For the first time, Ethereum's exchange balance has turned negative: in other words, more ETH leave trading platforms than enter. This rare phenomenon could be the fuel for a surge towards $7,000, according to several analysts.

In just three days, the American stock market witnessed a rare spectacle: eight of the largest tech companies saw their capitalization jump by 420 billion dollars. A lightning movement that repositions Google at the center of the game and confirms how regulatory decisions and advances in artificial intelligence now influence Wall Street.

Quantum computer and Bitcoin. Here is a hot series that is not about to fade, especially after IBM's latest experiment.

Reports from the U.S. labor market sent shockwaves through the financial markets, prompting risk assets like Bitcoin to experience sharp price swings. With job data for August coming in lower than expected, predictable alarms erupted regarding a looming recession, which could drive fresh appetite towards risk assets.

The tokenized real-world asset (RWA) market reaches a new milestone with Ondo Finance's groundbreaking announcement: the deployment of over 100 American stocks and ETFs directly on the Ethereum blockchain. This major initiative propels the ONDO token to new heights, flirting with the symbolic 1 dollar mark.nThe enthusiasm around Ondo Finance signifies a silent revolution redefining access to traditional financial markets. By eliminating intermediaries and offering 24/7 trading, tokenization fundamentally transforms how investors interact with traditional assets.nThis evolution is part of a broader movement where blockchain becomes the new standard for democratizing investment, from real estate with players like RealT to listed stocks with Ondo Finance. A breakdown of a sector that could well disrupt traditional finance.n

Tesla is betting everything on Elon Musk with an unprecedented compensation plan. We provide you with all the details in this article.

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

Analysts say Bitcoin could fall below $100K before recovering, with key levels and market trends guiding the outlook.

The decentralized finance (DeFi) landscape continues evolving beyond traditional crypto-collateralized lending, with platforms like Credefi pioneering a revolutionary approach that bridges digital assets with tangible real-world collateral. This innovative platform addresses one of DeFi's most persistent challenges: the volatility inherent in crypto-backed lending protocols.

The European Central Bank intensifies its communication around the digital euro. Piero Cipollone, board member, presented new arguments in favor of the project to the European Parliament. Will the ECB manage to rally users who are still largely detractors?

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

While bitcoin and Ethereum take center stage, Solana (SOL) quietly establishes itself as the new asset to watch. Driven by strong technical signals and record interest in derivative markets, the crypto is now assigned a target of $1,000. However, behind this bullish momentum lies a paradox: real activity on the network is collapsing. Between speculative frenzy and on-chain exhaustion, Solana intrigues as much as it questions.

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

After the January explosion, interest in memecoins sees a more measured return. Google searches indicate persistent curiosity, but less euphoric, reflecting a new caution among investors. Without the usual noise from social networks and Crypto Twitter, this crypto dynamic could mark an evolution towards a more mature market approach.

In August, bitcoin miners generated revenues close to 1.65 billion dollars, a level almost identical to that of July. This maintenance reflects an impressive resilience of the sector, despite a context marked by rising costs and energy pressure. But behind this apparent stability lie structural vulnerabilities that raise questions: can the current mining model really hold in the long term?

Gemini has officially filed for its IPO, a step that could bring the decade-old platform to Nasdaq under the ticker symbol GEMI.

The debt is making headlines again on both sides of the Atlantic. Bitcoin is ready to soar if the Fed and the ECB were to bring back the printing press.

What if the next crypto cycle was not only bullish but a historic turning point? At the WAIB Summit 2025, several experts stated that a single cycle could be enough to increase crypto users from 659 million in December 2024 to 5 billion users within ten years. A global adoption underway, driven not only by speculation but by the rise of concrete use cases, the maturity of blockchain technologies, and renewed interest from individuals as well as institutions.

In South Korea, Tesla no longer embodies the dream of retail investors. According to Bloomberg, nearly 1.8 billion dollars vanished in four months, including 657 million in August alone, marking the largest outflow since 2019. Behind this disenchantment, a growing unease: lacking a new narrative around AI or autonomous driving, the manufacturer no longer captivates as much. Result: despite its status as the most held foreign stock, Korean investors are abandoning Tesla for bets considered more dynamic and quicker.

Tokenized stocks captivate the crypto world, but ESMA warns of risks of confusion for investors. Details here!

The market for tokenized gold has reached new all-time highs, crossing $2.57 billion in market cap, as spot gold itself approaches its April peak. The rally shows renewed demand for gold-backed crypto tokens as investors seek safe haven assets amid global uncertainty.