Elon Musk doesn't need official announcements to shake up the crypto market: an image is enough. In April 2023, he replaced Twitter's logo with that of Dogecoin, triggering an immediate surge. Two years later, he lightly revives this episode, calling the act a "great idea." Behind this wink, the community perceives a message: Dogecoin hasn't left the stage. This statement once again opens up speculation about its future role in the X ecosystem.

One World Loyalty Posts To Read RSS

The star cryptocurrency sneezes below $110,000, and here come the alarm bells: frozen RSI, silent volume, absent traders... Guaranteed suspense before the deadline!

Crypto is sparkling! Ethereum, still in the shadow of Bitcoin, is on the rise. Does this resurrection hide a new windfall or just a flash in the pan?

XRP draws attention with 73% long positions. Discover why this crypto asset could soon soar.

The crypto world is entering a new phase. As platforms compete to deliver smoother, more accessible, and more cost-effective experiences, Kraken+ is breaking the mold with a bold promise: to make crypto investing simpler, cheaper, and more powerful. With a fully redesigned app, a low-cost premium subscription, and real benefits like zero trading fees, Kraken+ stands out as a catalyst for adoption—whether you're a beginner or a seasoned investor.

A study conducted by the Massachusetts Institute of Technology reveals a major flaw in artificial intelligence (AI): its inability to properly understand negation. This shortcoming could have dramatic consequences in critical sectors such as healthcare.

Solana persists and signs with Seeker, its Web3 smartphone. After a neglected Saga, the company finally unveils the release date of a toy promised to crypto fans.

Bitcoin has just broken a mythical ceiling of 111,000 dollars, heightening the hope for a financial revolution. But behind this euphoria, the threat of a sharp drop looms. This new record reveals as much the strength as the fragility of a market shaken by scarcity, regulation, and global tensions.

The SEC is slowing the momentum of crypto ETFs and postponing decisions on the XRP ETF, Ethereum ETF staking, and Dogecoin ETF until the summer of 2025. These delays illustrate the regulatory complexity surrounding the integration of cryptocurrencies into traditional finance, hindering their adoption by institutional investors. However, an unexpected candidate may well be approved much sooner than anticipated.

A new record is in the works for bitcoin. Good news from the US is piling up and even better news is on the way soon.

In a world where DeFi still has to prove itself, Credefi emerges at the right moment. Its mission? To offer useful finance, rooted in the real economy. At TOKEN2049, the global summit of Web3, the team was able to connect investors and tangible assets. Their model, based on European SMEs, combines security and yield. Away from the noise, Credefi moves forward methodically. And this is just the beginning. If Europe is its foundation, the United States will be its next conquest, with a discreet yet solid strategy. The direction is clear. The tempo, perfectly controlled.

The online trading giant Robinhood has taken a bold step by submitting a detailed proposal to the U.S. SEC. The goal? To create a national framework for the tokenization of real-world assets. But behind this initiative lies a much larger ambition: to revolutionize the traditional financial infrastructure.

After a notable recovery, Bitcoin is testing a key threshold again. Find our complete analysis and the current technical outlook for BTC.

"BlackRock sounds the quantum alarm: is Bitcoin ready?" This phrase resonates as a major warning for the crypto world. The asset management giant reveals a growing threat: quantum computing. This emerging technology could eventually compromise the cryptography protecting Bitcoin. Despite this warning, Bitcoin ETFs continue to attract record inflows, a sign that confidence remains strong. Meanwhile, Naoris Protocol establishes itself as the native post-quantum response, already deployed to protect Web3 and Web2 infrastructures. This advancement prepares the ecosystem for a future where quantum power will no longer be just a theory but a reality.

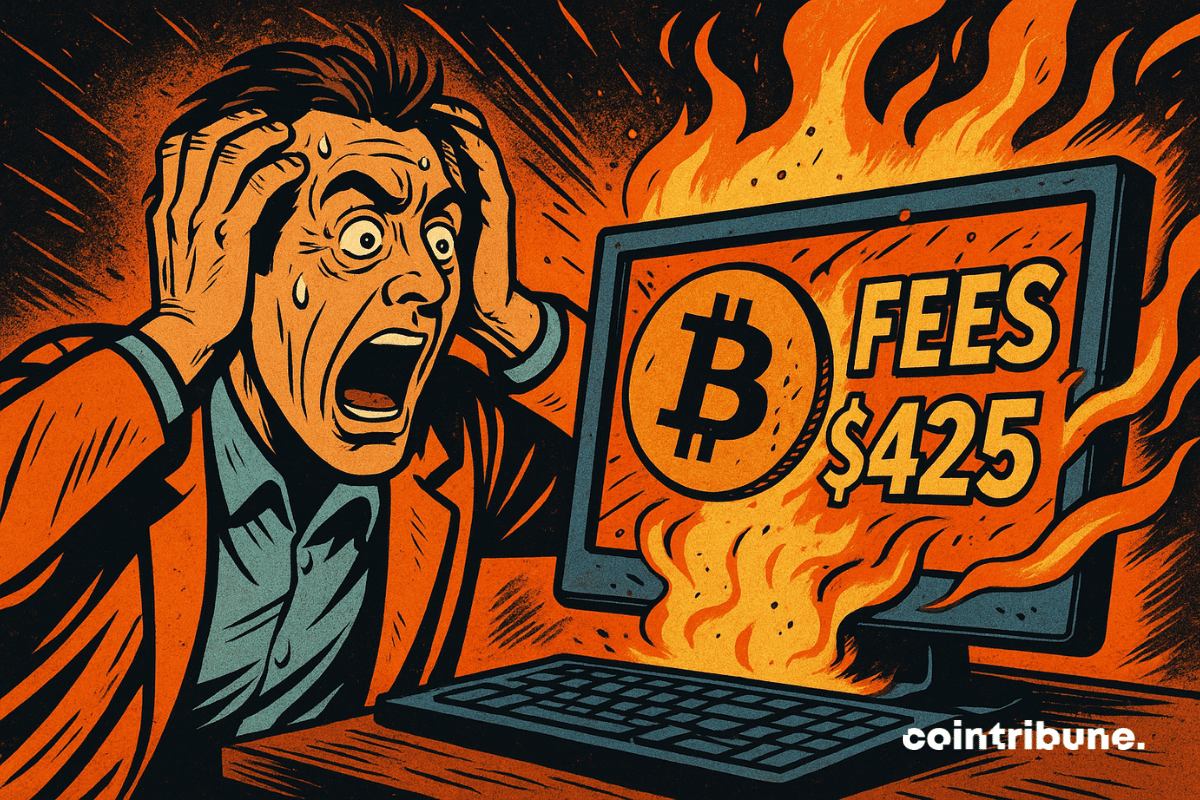

Spring 2025 may be mild, but the Bitcoin blockchain is heating up like never before. On Sunday, the price of BTC brushed against $106,000 again, awakening old FOMO instincts. However, the noisiest indicator isn't the quote, but these micro-amounts that add up: transaction fees. With a moving average of $2.40 — one dollar more than at the beginning of the month — they are already breaking the annual record. Behind this seemingly trivial detail lies an unfiltered X-ray of the network's state and the psychology of holders.

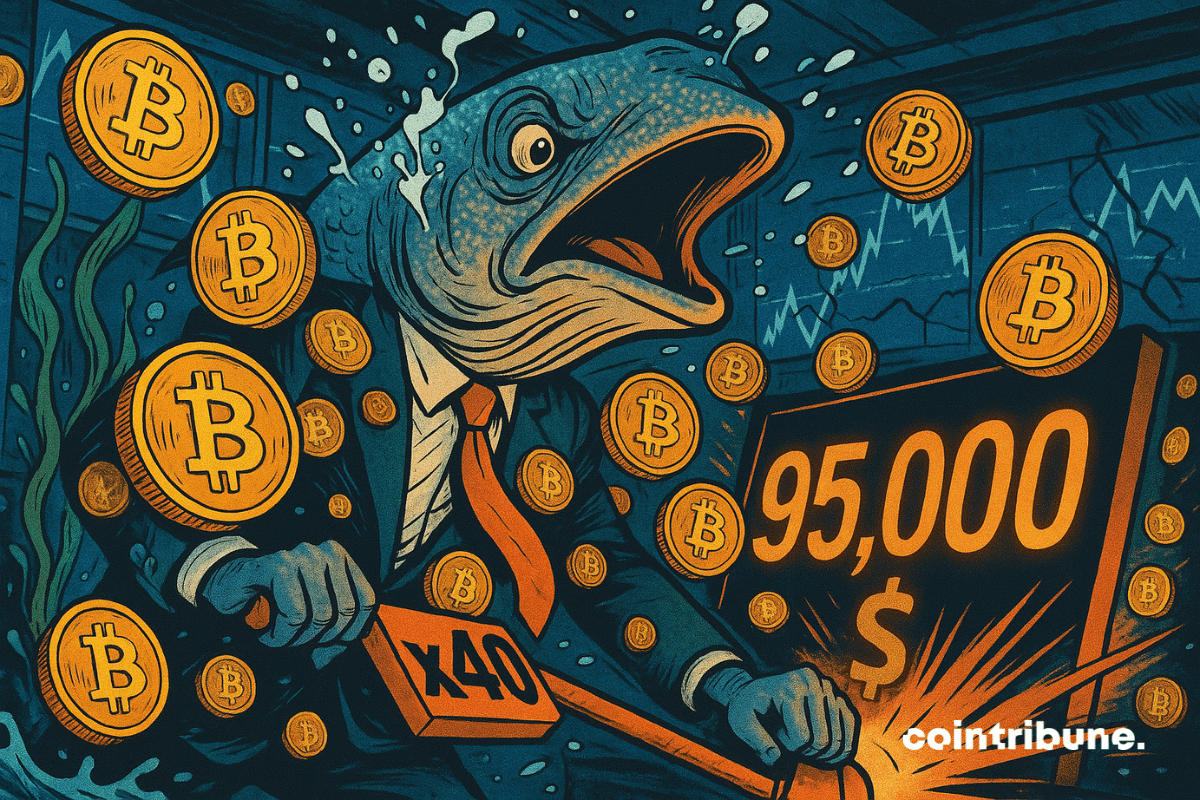

This weekend, the crypto community was shaken by an exceptional revelation: a leading trader on Hyperliquid took a long bitcoin position with 40x leverage, with a notional value of around 392 million dollars. This bold initiative, with a liquidation threshold around 95,000 dollars, raises important questions about the outlook for the crypto market.

Has a post by Javier Milei served as a lever for a concealed speculative operation? In Argentina, the judiciary is now interested in the potential gains that President Javier Milei and his sister could have derived from the artificial surge of the cryptocurrency $LIBRA. The investigation is taking a decisive turn with the lifting of their banking secrecy.

In a crypto environment marked by volatility, stablecoins are emerging as the preferred safe haven for venture capital investors. Despite geopolitical tensions and market fluctuations, these digital currencies pegged to traditional currencies are garnering increasing attention. Why does this particular segment generate so much enthusiasm among the most discerning financiers?

Washington cuts in post-crash regulation: a small snip to the SLR to inflate the economy... or the next bubble? Thrilled banks, shivering taxpayers. Who pays the price?

As cryptocurrencies emerge as a major lever of individual financial sovereignty, the United Kingdom decides to tighten its regulations. Starting in 2026, every transaction will be scrutinized, every user identified. Anonymity, the cornerstone of the crypto ecosystem, falters under the blows of fiscal regulations.

Amid a reconfiguration of global economic balances, the Central Bank of Russia surprises everyone. In its latest report, it ranks bitcoin at the top of financial assets for 2025. This unexpected acknowledgment comes from an institution that has so far been cautious regarding cryptocurrencies. This turnaround highlights both the remarkable performance of the asset and its growing integration into investment strategies, even within a financial environment as controlled as that of Russia.

Attacks against cryptocurrency exchanges, especially those targeting market-leading companies, have taken a worrying turn in recent years. Coinbase, one of the most popular exchanges in the crypto market, has just faced a major extortion attempt of 20 million dollars. This situation not only reveals the vulnerabilities of crypto platforms but also highlights how Coinbase has responded, thereby reinforcing its reputation for excellence in security. In an environment where data and fund protection is becoming paramount, security is now the number one criterion for cryptocurrency investors.

After several years of hostility towards Bitcoin, Taiwan may soon reconsider its viewpoint given its precarious geopolitical situation.

A crooked smile, an evasive response. During a recent episode of The Block's Crypto Beat podcast, Dan Finlay, co-founder of MetaMask, reignited speculation about a hypothetical native token for the Ethereum wallet. "Maybe," he dropped, implying a long-simmering possibility behind the scenes. While the idea of a home crypto has excited the community since 2021, Finlay's statements reveal as much enthusiasm as caution. Amid gradual decentralization, shifting regulations, and fears of fraud, MetaMask is navigating a landscape where every step counts.

Every year, billions lie dormant in fixed assets: real estate, raw materials, receivables. The economy suffers, investment stagnates, and inclusion decreases. What if the solution came from Web3? Real believes that everyone should own a share of the real world. Through its dedicated blockchain, it finally makes tokenization fluid, transparent, and inclusive.

Bitcoin is nearing $104,000, but the enthusiasm of retail investors is collapsing. Google searches and downloads of trading apps have reached an unprecedented low. This contrast reveals a worrying paradox: where have the retail investors gone in this historic bull cycle?

When quantum computers succeed in breaking the encryption algorithms that protect our blockchains, it won’t come as a surprise to everyone. For years, researchers and experts have been warning us: this revolution will be swift. And Web3—meant to ensure trust and security—may suddenly become vulnerable. The infrastructure behind many current chains is not ready. Complex updates, costly migrations, risky forks. That’s where Naoris Protocol comes in, a pioneer of a new paradigm: the Decentralized Post-Quantum Infrastructure, operating deep below all traditional blockchain layers. “Q-Day is closer than you think: here’s how Naoris is preparing your blockchain for the future, with no need for a fork.”

Ethereum soars with a 50% increase in one week, reigniting enthusiasm in the crypto market. Technical indicators align, inflation slows, and a decrease in interest rates becomes plausible. Could this explosive context propel ETH towards $4,000 as some suggest? The current momentum seems promising.

The American deficit is set to explode by 2.5 trillion dollars. This Republican fiscal bomb could paradoxically become the fuel for a historic rally for bitcoin in the face of the inevitable devaluation of the dollar.

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.