A struggling Spanish coffee chain abandons its cup to embrace digital gold. Salvador Martí, the boss of Vanadi Coffee, wants to transform his business into a pure Bitcoin machine. But will this bold strategy actually save the company from bankruptcy?

One World Loyalty Posts To Read RSS

The old guard built walled gardens. Ultra is tearing them down. Today, gamers juggle launchers, subscriptions, and fragmented digital economies. But what if one platform could simplify everything and put players back in control?

A Trump Wallet without Trump inside? Here comes a crypto wallet, loaded with rewards... but the heirs swear they never scanned the QR code.

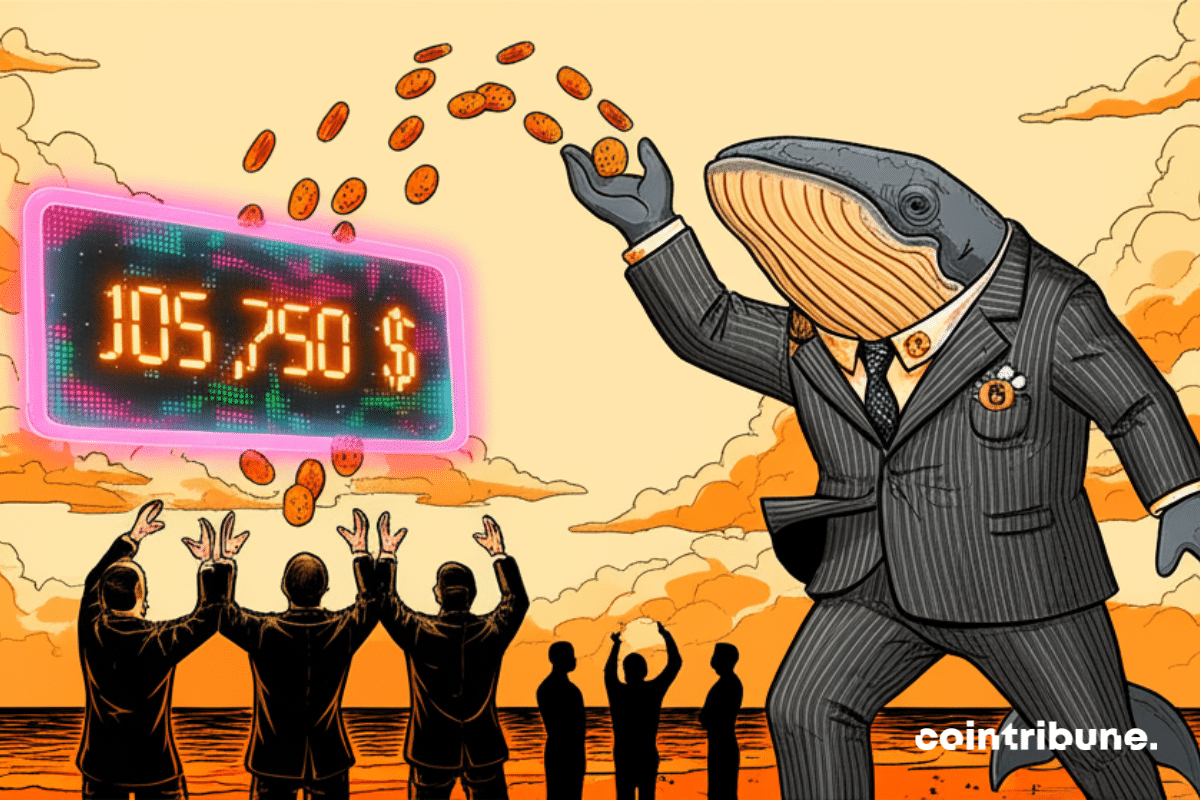

Bitcoin: $500 million in profits per hour indicate strong profit-taking activity. Discover the details in this article!

What if your Visa card became your ultra-secure crypto wallet? Discover Tangem Pay, the revolution that combines self-custody, bankless payments, and Web3 technology. An innovation that could transform your spending... into financial freedom.

The new South Korean president, Lee Jae-myung, is very favorable to bitcoin. The list of pro-bitcoin countries is growing day by day.

Russia's largest bank reaches a historic milestone by offering structured bonds backed by Bitcoin. This initiative by Sberbank is part of a broader strategy by Moscow to circumvent Western sanctions.

In the ever-evolving world of cryptocurrencies, simply holding your assets is not always enough. With the rise in popularity of passive income solutions like staking, many crypto holders are looking for ways to make their holdings work for them. Kraken, a trusted name in the crypto industry, offers users the opportunity to earn up to 17% annual percentage yield (APR) through staking and restaking, all while maintaining full control over their assets. Whether you are new to staking or an experienced crypto investor, Kraken's platform is designed to cater to the needs of all types of users. Let’s explore how to get started and take advantage of these opportunities.

Robinhood is betting big on crypto with Bitstamp! 200 million, 50 licenses, institutional players, and a plan to regulate tokenized assets... The platform is scaling up. Discover why this acquisition could revolutionize global digital finance. Thought you knew it all? Wait until you read the rest.

The month of May brought a bitter surprise for NFT supporters. While Bitcoin shone with a notable increase in its trading volumes in the non-fungible token market, the entire sector plunged into a new phase of decline. This shows that the health of a flagship asset is not always enough to lift an entire ecosystem.

Ethereum (ETH) is back in the spotlight. The recent Pectra upgrade, activated on May 7, 2025, introduced significant improvements, including raising the staking limit to 2,048 ETH, boosting network efficiency, and enhancing wallet features. These upgrades aim to strengthen Ethereum’s position against competitors like Solana. In parallel, speculation around Ethereum spot ETFs, which might include staking, is fueling investor enthusiasm. Combined with a potential “altcoin season,” now may be the ideal time to ride ETH’s next bullish wave. But how can you benefit without spending hours analyzing charts? The answer may be Runbot.

With a new market capitalization record, stablecoins are further increasing their dominance in the crypto market.

WisdomTree already has its ETF, but the SEC wants to rethink the rules. Bitcoin in-kind? Possible. Behind this step towards innovation, the agency is sharpening its tools to maintain control.

At 10 years old, David Carvalho wrote his very first computer virus. It didn’t steal passwords, nor did it erase hard drives. It simply displayed a terrifying message on the screen: "You have been infected by Sunday. Your hard drive is being formatted." A prank, certainly, but in retrospect, it heralded something much larger: the emergence of a mind that would later advise NATO on cyber warfare and build what could become the most important security infrastructure of the post-quantum era. This journey, from a curious child in rural Portugal to the CEO of Naoris Protocol, is now recounted in a captivating interview on When Shift Happens. Carvalho reveals his personal evolution, but more importantly, why the trust model on the Internet is fundamentally broken, and how he plans to fix it.

Medellín, dubbed the "city of eternal spring," has become a symbol of urban transformation in Latin America. With its modern infrastructure, commitment to sustainability, and exceptional quality of life, the city is increasingly attracting international investors. The El Poblado neighborhood, and more specifically Provenza, is at the heart of this dynamic, offering a unique blend of vibrant nightlife and residential serenity. And all of this is now within reach thanks to RealT.

Elon Musk keeps redefining the contours of digital communication. With XChat, his new messaging service integrated into platform X (formerly Twitter), he is not only innovating on features. He draws from Bitcoin's DNA to enhance security. The result? A messaging tool that promises to shake up Telegram, Signal, and even WhatsApp.

When six words and a simple bitcoin graphic are enough to spark excitement, it means Michael Saylor has struck again. The co-founder of Strategy, a leading figure in BTC maximalism, posted a message on X that is as short as it is eloquent: "orange is my favorite color." Behind this wink lies a new strategic purchase operation, in a climate where his company continues to acquire bitcoin. An enigmatic statement, but unequivocal for insiders.

A large judicial operation is shaking up the French crypto ecosystem. The Paris prosecutor's office has just indicted 25 individuals, including six minors, for their alleged involvement in several kidnapping attempts targeting figures in the crypto sector. Does this offensive finally mark a turning point in the fight against this new form of crime?

Bitcoin has just crossed a major psychological threshold by surpassing 64% market dominance in the crypto space. This constant progression over the past few weeks now places the queen of cryptocurrencies in a historical resistance zone.

In a few days, the euphoria has evaporated from the crypto market, giving way to a cold caution. While Bitcoin fell after peaking at around $112,000, the Crypto Fear and Greed Index abruptly shifted from "extreme greed" to neutrality. Set at 50, this score indicates a clear psychological turning point among investors. This dual inflection, between technical pullback and emotional disenchantment, reflects a major strategic turning point in the market dynamics.

When a project touted for its mass adoption collapses under market pressure, the signal is strong. The PI token of Pi Network dropped by 22%, reaching $0.61 on May 31, 2025. This decline comes as the overall crypto market has seen more than $170 billion evaporate in a week. The magnitude of the downturn now raises questions about the project's viability and the confidence that its historical investors can still place in it.

Ethereum traces its path, ready to challenge the peaks of the market. But in its wake, an army of altcoins is assembling for battle. Technical signals, historical indicators, and the buzz of analysts converge on a hypothesis: Ethereum could reignite the flame of an altseason of unprecedented scale. What if 2025 became the remake of the great years 2017 and 2021, with even more power?

Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

FTX is (finally) refunding other former clients... but not as planned! 5 billion at stake, anger from creditors, and scams lurking. Why could this refund reignite the turmoil? Discover what this shocking operation conceals.

Solana is going through a tumultuous period with a 10% drop that has surprised investors. Amid the collapse of popular memecoins and concerns over upcoming massive token unlocks, the flagship blockchain finds itself at a decisive crossroads. Does this temporary storm hide deeper fragilities?

Donald Trump has just lost a key battle over his tariff rights: a U.S. court has put the brakes on him. Discover how this decision shakes China, the markets, and challenges presidential powers.

Ethereum is making a notable comeback to the forefront of the crypto scene. With 163 million dollars injected into its ETFs in a few days, technical and fundamental signals are aligning. The market wonders: will the 2,900 dollar threshold be surpassed? An explosive momentum seems to be emerging, driven by institutional investors.

While the crypto market is buoyed by a bullish cycle, a silent shift is taking place: Ethereum appears to be gaining ground against a slowing Bitcoin. Driven by clear institutional signals and a more favorable yield mechanism, the momentum of ETH is no longer just a market rotation, but a structural repositioning. This potential reversal of hierarchy, supported by concrete indicators, is reshaping the power dynamics within the crypto ecosystem.

"Ledger sorts its Visa crypto card in the USA with Bitcoin cashback. Discover all the details in this article."

The debate between gold and bitcoin is no longer theoretical. It is now decided by those who shape global markets. At the Bitcoin 2025 conference, BlackRock made an impression. Its message: the future is digital. And bitcoin now has the upper hand.