S&P 500 rejected Strategy’s inclusion despite its Bitcoin holdings, with JPMorgan calling it a blow to crypto treasuries.

Short news

Poll results from decentralized betting site Polymarket show that bettors are heavily tipping former Binance CEO Changpeng Zhao (CZ) to be granted a presidential pardon. Following a guilty plea and subsequent application for a pardon, indications suggest that most within the crypto circle expect a favourable ruling from the White House.

The speculative momentum around bitcoin clashes with the reality of markets. Driven by the fervor of records and the unexpected support from Donald Trump, several publicly traded companies that based their financial strategy on accumulating BTC are undergoing a severe correction. Their shares sometimes fall below the value of their crypto holdings, exposing the limits of a model relying almost entirely on bitcoin's volatility.

This Wednesday, the publication of a falling PPI for August immediately revived speculation around a Fed rate cut. Bitcoin gained 0.5% within the hour, driven by this signal perceived as favorable to monetary easing. Approaching the FOMC, investors now scrutinize every economic indicator, aware that the slightest variation can trigger a market repositioning.

Nasdaq has officially filed a request with the SEC to authorize trading of shares and ETPs in tokenized form. A breakthrough that could disrupt Wall Street and accelerate the integration of blockchain into traditional financial markets.

The SEC changes its tone and no longer considers crypto assets as securities. Discover all the details in this article!

Weaker US jobs data boosts interest in DeFi tokens as market watchers anticipate potential Federal Reserve rate cuts.

GameStop's crypto strategy is starting to pay off. The iconic video game retailer, once chronically struggling, has managed to limit its losses in the second quarter of 2024 thanks to a bold decision: to record bitcoin on its balance sheet. A bet that illustrates how the boundary between traditional finance and digital assets is increasingly fading.

From Moscow, allegations are multiplying. A close advisor to Vladimir Putin claims that Washington uses stablecoins and gold to lighten the overwhelming burden of a public debt now exceeding 37 trillion dollars. A strategy that, if confirmed, could disrupt the balance of global finance.

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.

OpenSea, the leading NFT marketplace, has launched a $1 million reserve to acquire and preserve culturally important digital art. The reserve began with the purchase of CryptoPunk #5273, marking a new chapter for the platform in showcasing NFTs as historical and artistic artifacts.

Malicious actors are at it again, this time targeting the account of a well-known software developer's node package manager (NPM). Investigations revealed that the hackers added malware to popular JavaScript libraries, primarily attacking crypto wallets. However, after launching what industry sleuths describe as the largest supply chain attack in crypto history, the hackers managed to steal only $50 worth of crypto assets.

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

While most nations are still hesitant to take the step, Kazakhstan is accelerating. Its president, Kassym-Jomart Tokayev, has just announced the creation of a national cryptocurrency reserve, accompanied by a clear call to build a true ecosystem of digital assets. A bold decision for this Central Asian country, already a major player in global mining.

With more than 9.2 billion dollars in assets and cash, BitMine Immersion establishes itself as the new key player in crypto treasuries. Under the leadership of Tom Lee, the company listed on NYSE American accelerates its Ethereum-focused strategy, becoming the largest holder of ETH among listed companies. In a context of growing crypto balance sheets, BitMine redraws the contours of financial management by betting on Ether as a strategic reserve asset.

While bitcoin wavers, Michael Saylor forces a smile: he spends 217 million, stacks 638,460 BTC, and transforms Strategy into a financial factory dedicated to cryptos.

Germany allegedly let 5 billion in bitcoin slip away in the Movie2K case. Discover all the details in this article.

El Salvador marked the fourth anniversary of its Bitcoin Law with a symbolic purchase of 21 BTC, just as analysts warned that September 8 often proves unfavorable for the cryptocurrency.

XRP has just signed its strongest accumulation phase in two years, against the backdrop of an uncertain market. While altcoins struggle to find a second wind, Ripple's crypto stands out through unusual accumulation activity. This surge, supported by significant volumes, reactivates speculation about a possible lasting rebound.

The Trump family is back in the spotlight after their wealth coffers grew following American Bitcoin's (ABTC) debut and World Liberty Financial's (WLFI) price surge. However, both DeFi projects linked to the family have since faced a market correction of over double digits.

Ethereum’s revenue fell sharply in August, even as its price and institutional interest continued to rise.

Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

As artificial intelligence radically transforms the job market and particularly threatens several positions, OpenAI launches an ambitious counter-offensive. The parent company of ChatGPT is developing a job platform specialized in AI, positioned as a direct competitor to LinkedIn.

Since 2011, Satoshi Nakamoto has disappeared, leaving behind an unresolved enigma. However, some believe that the threat of quantum computing could force his return. This is the somewhat crazy but fascinating thesis of Joseph Chalom, co-CEO of SharpLink Gaming

The calm was short-lived. Indeed, the crypto market is plunging back into fear, according to the Crypto Fear & Greed Index, which dropped to 44 after several weeks of stability. This psychological signal is not isolated, as it accompanies a clear shift in investment flows, leaving the most volatile altcoins to refocus on the heavyweights of the sector, bitcoin and Ethereum.

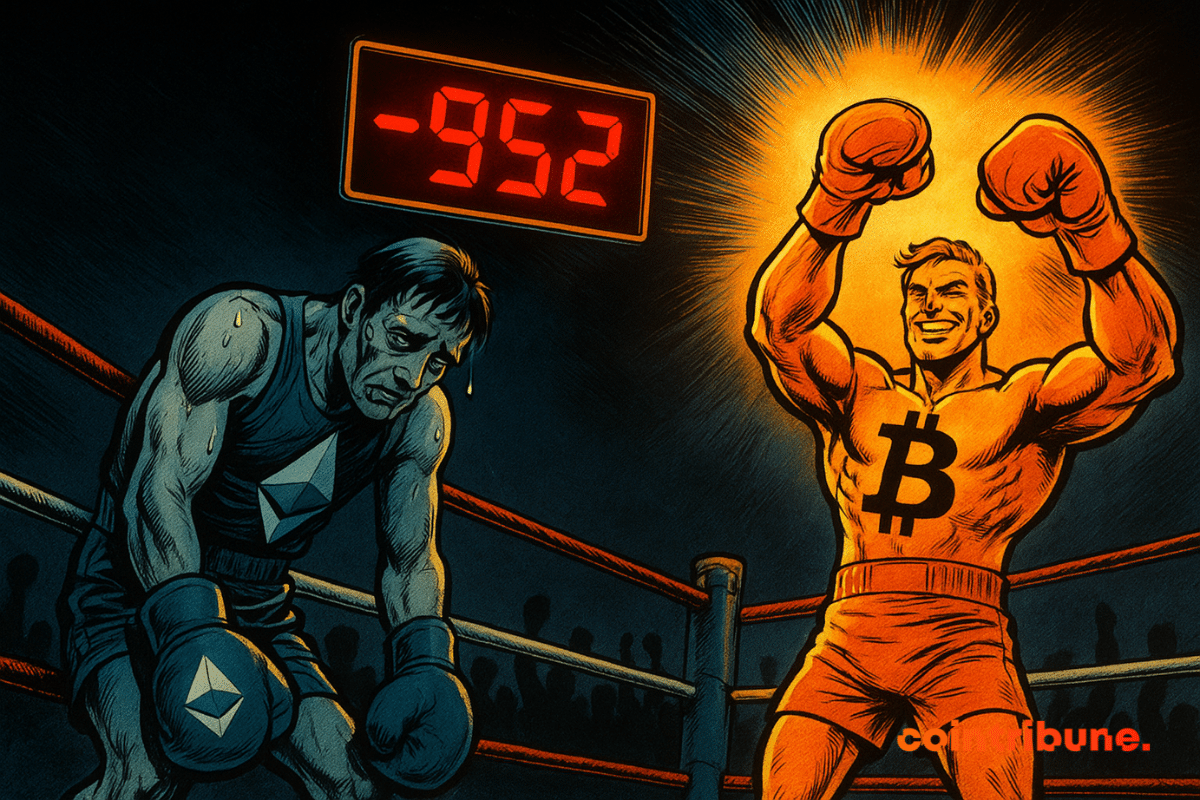

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.

Since its creation, Ethereum (ETH) has continually surprised the markets. But the latest indicator marks an unprecedented milestone. For the first time, Ethereum's exchange balance has turned negative: in other words, more ETH leave trading platforms than enter. This rare phenomenon could be the fuel for a surge towards $7,000, according to several analysts.

American crude is losing ground. This week, the Indian Oil Corporation (IOC), India’s leading public refiner, turned its back on shipments from the United States to refocus on the Middle East and West Africa. This logistical rebalancing, seemingly technical, reflects a strategic shift: the rise of energy alliances within the BRICS, the decline of the dollar in oil trade, and the assertion of a new economic order.

Bitcoin mining difficulty touched a new all-time high as the crypto market descended into volatility following the latest US job data. After hitting an all-time high (ATH) in August, market commentators projected that the difficulty of Bitcoin mining would decrease. However, the mining difficulty has steadily increased as the month progressed, with large players dominating the space.