In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

Short news

The Canadian company SOL Strategies reaches a historic milestone by obtaining its entry ticket to the prestigious Nasdaq. This listing, scheduled for September 9 under the symbol STKE, marks a major turning point for the Solana ecosystem, increasingly sought after by institutional investors.

At this back-to-school period, major banks are revising their outlook. Faced with a clear slowdown in the American economy, the idea of two to three rate cuts this year is gradually taking hold. Investors, hanging on the Fed’s slightest signals, see in this change of course a potential turning point.

When the largest crypto company becomes a gold prospector: Tether aligns billions and mining ambitions. Ingots, royalties, and stablecoins on the menu, all seasoned with a sovereign fund flavor.

Solana speeds like lightning but stalls below 215 dollars: ETF lurking, record upgrade and flashy meme-coins. Crypto hesitates between a surge and a scheduled slip.

This Friday, September 5, nearly $4.7 billion worth of options on Bitcoin and Ethereum expire, while technical indicators waver and the U.S. economy sends signals of slowdown. This crucial deadline could reshape the spot markets' dynamics.

Russia requires banks to monitor ATM withdrawals for fraud and notify customers, a move that may affect cash-heavy crypto operations.

Crypto crime cases related to digital assets are taking an increasingly worrying turn in Europe. In France, a new kidnapping involving a young Swiss person has just been foiled, recalling previous waves of attacks that had sown panic in the Web3 ecosystem. Seven suspects have been arrested, but many grey areas remain.

The European Central Bank intensifies its communication around the digital euro. Piero Cipollone, board member, presented new arguments in favor of the project to the European Parliament. Will the ECB manage to rally users who are still largely detractors?

Software supply-chain attacks are evolving in a disturbing way as cybercriminals use Ethereum smart contracts to hide malicious code within open-source libraries. Research presented by a security firm ReversingLabs shows that hackers now insert command-and-control instructions within blockchain contracts, complicating detection and closure by defenders. This approach signifies the increased complexity of malware distribution and blockchain becoming a tool of cybercrime.

The ghost of 2017 is haunting speculators again. While some are betting on a comeback of XRP, comparisons with the last bull run are multiplying. However, the current market has little to do with that of yesterday. New dynamics, increased competition, divergent technical signals: does the analogy still hold? Behind the hope of a bullish rebound, a colder reading of the data tells a different story.

Cardano fans are sulking, whales are stirring, and ADA is bouncing back. Yet another crypto farce where the impatience of small holders fattens the big holders.

Trust Wallet has added tokenized U.S. stocks and ETFs, allowing users to trade real-world assets directly from their wallets.

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

While bitcoin and Ethereum take center stage, Solana (SOL) quietly establishes itself as the new asset to watch. Driven by strong technical signals and record interest in derivative markets, the crypto is now assigned a target of $1,000. However, behind this bullish momentum lies a paradox: real activity on the network is collapsing. Between speculative frenzy and on-chain exhaustion, Solana intrigues as much as it questions.

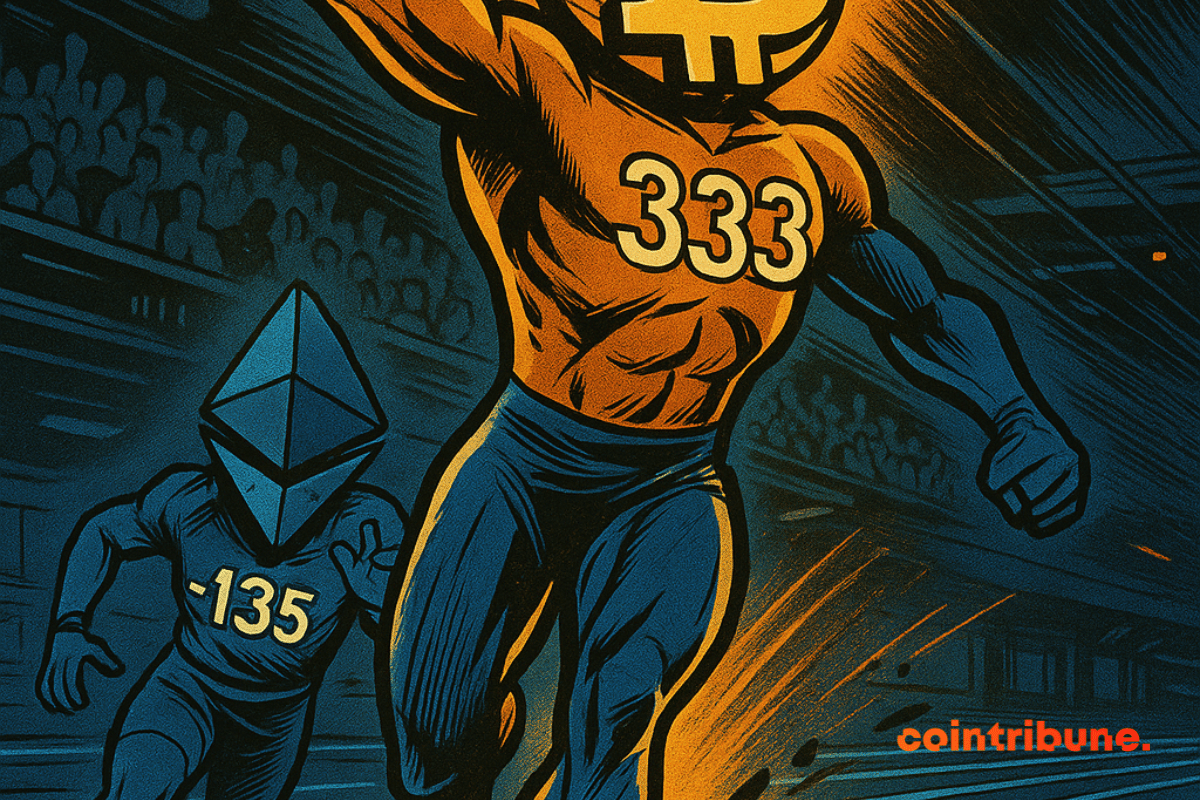

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

Two weeks before a crucial Federal Reserve meeting, the governor, expected to succeed Jerome Powell in 2026, stood out with an unambiguous statement. He wants a rate cut as early as September. In an interview with CNBC, he said the US economy requires an immediate adjustment, breaking with the caution shown by other monetary officials.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

Despite the recent bitcoin correction, the institutional rush on bitcoin continues to strengthen.

After the January explosion, interest in memecoins sees a more measured return. Google searches indicate persistent curiosity, but less euphoric, reflecting a new caution among investors. Without the usual noise from social networks and Crypto Twitter, this crypto dynamic could mark an evolution towards a more mature market approach.

In August, bitcoin miners generated revenues close to 1.65 billion dollars, a level almost identical to that of July. This maintenance reflects an impressive resilience of the sector, despite a context marked by rising costs and energy pressure. But behind this apparent stability lie structural vulnerabilities that raise questions: can the current mining model really hold in the long term?

Gemini has officially filed for its IPO, a step that could bring the decade-old platform to Nasdaq under the ticker symbol GEMI.

Bitcoin’s recent 12% pullback has drawn attention, but on-chain data indicates that this correction is a normal phase in the market. Analysts say the decline is within historical patterns and reflects a healthy reset rather than the end of the ongoing bull cycle.

Despite a major update to version 23 of its protocol, Pi Network struggles to spark market enthusiasm. In a sector where every innovation is scrutinized to revive bullish momentum, the announcement of technical advances inspired by Stellar Protocol 23 and the integration of new functionalities were not enough to boost its token price. This dissonance between technological progress and stock market inertia raises questions about the project's ability to convert its evolutions into real value.

While American universities are investing heavily in artificial intelligence, from the University of Georgia to the University of Michigan, a national survey reveals a surprising reality. American citizens, far from embracing this revolution, show growing distrust towards the integration of AI on campuses.

Since the beginning of September, bitcoin (BTC) and Ethereum (ETH) have captured the attention of a crypto market suspended between hope and concern. While Wall Street falters, the two leaders show intriguing resilience. Yet, behind this apparent calm, technical indicators reveal growing tension. Between contradictory signals and increasingly polarized forecasts, traders are preparing for volatility that could make September a decisive month for the market's future.