Polygon sacrifices 30% of its team to dominate crypto payments. We give you all the details in this article.

Stablecoins

U.S. lawmakers have put a major crypto market structure bill on hold after strong pushback from Coinbase. Fresh criticism from the exchange’s chief executive raised doubts about whether the proposal could move forward without changes. As a result, Senate Banking Committee members delayed a planned markup while reassessing industry and regulatory concerns tied to the draft.

What if the next threat to traditional banks did not come from an economic crisis, but from a simple innovation in stablecoins? Brian Moynihan, CEO of Bank of America, warns that the rise of yield-bearing stablecoins could trigger a massive outflow of bank deposits, thus disrupting the balance of the American financial system. This worrying scenario for traditional institutions could see their role as lenders severely affected by this new form of digital competition.

A new piece is added to the crypto puzzle: World Liberty Financial, supported by Trump’s entourage, wants to turn the stablecoin USD1 into the locomotive of decentralized finance.

A new advertising campaign tied to crypto policy has stirred debate in Washington as lawmakers prepare to review a major market structure bill. Ads airing on Fox News urge viewers to pressure senators to support legislation that excludes decentralized finance provisions. The timing of the campaign coincides with key Senate activity on crypto regulation.

Rising global sanctions and increased state involvement drove illicit cryptocurrency activity to record levels in 2025. Data indicates that sanctioned entities were the primary source of these flows, even though illegal use continued to account for only a small portion of total crypto transactions. Analysts describe the shift as a response to mounting geopolitical pressure rather than a breakdown in compliance.

JPMorgan plays the bankers of the future: its JPM Coin infiltrates Canton, the blockchain of the big players. It smells like crypto fragrance on Wall Street, with more control than utopia.

At Visa, it's no longer a toss-up with crypto: 91 million later, the card becomes the new favorite toy of decentralized financiers. To be continued…

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

While stablecoins have gained more than $100 billion in 2025 to peak at $307 billion according to DefiLlama, India is taking the opposite direction. The Indian central bank (RBI) states that only a sovereign digital currency guarantees monetary stability. In a global landscape where CBDCs struggle to impose themselves, New Delhi erects the e-rupee as a bulwark against the privatization of money.

Stablecoins continue to gain a stronger foothold across global crypto markets. This growth now appears not only in supply figures but also in transaction activity across blockchains. In Europe, momentum is building around euro-linked tokens, while USDC continues to expand across multiple networks. Recent data points to a shift toward transaction-driven expansion rather than passive issuance.

The Bitcoin Queen hangs up. Exhausted but clear-headed, Lummis leaves a void. Regulators, traders, and crypto lobbyists wonder: who will now whisper in the ears of senators?

Coinbase Institutional sees in 2026 much more than a simple market rebound: a strategic shift. In a 70-page report published in mid-December, the platform anticipates a deep integration of cryptos at the heart of global finance. While this year has been marked by volatility and persistent regulatory uncertainties, Coinbase is betting on a new emerging phase where regulation, institutional adoption, and new uses will sustainably reshape the crypto landscape.

Six years after launching its own private blockchain, JPMorgan Chase is radically changing strategy. The bank has just transferred its digital deposit token, the JPM Coin, to Base, Coinbase's public network. A major turning point for an institution that until now had exclusively relied on its closed ecosystem Kinexys.

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

The world's largest crypto exchange platform strengthens its ties with the Trump family. Binance has massively integrated USD1, the stablecoin from World Liberty Financial, into its infrastructure. A rapprochement that comes just weeks after the presidential pardon granted to its founder.

The UK is moving quickly to strengthen its position in digital finance as part of its 2026 growth plan. Pound-pegged stablecoins are now the central play in a regulatory push to keep the country competitive as Europe develops new rules. Clear timelines, new testing routes, and pressure from nearby markets are pushing the region toward a more structured stablecoin system.

Circle, the issuer of the famous USDC, takes a decisive step by developing USDCx, a stablecoin designed to offer banking privacy to companies and institutions. Developed in partnership with Aleo, this project answers a growing demand: how to benefit from blockchain without exposing transactions to the public?

The crypto market is booming: Polygon activates an update that could transform the entire ecosystem. All the details in this article!

The United States takes a decisive step in integrating cryptos into the traditional financial system. Caroline Pham, acting chair of the CFTC, has just authorized the use of bitcoin, Ethereum, and USDC as collateral in the U.S. derivatives markets. A decision that could well redefine the rules of the game.

"He who does not move does not feel his chains." Rosa Luxembourg’s phrase resonates strangely in the digital age. Digital currency today reveals invisible chains that many still do not perceive. Cash quietly disappears, replaced by a recorded, analyzed, and continuously interpreted world. Every transaction becomes data, and every data a lever of control. Privacy is no longer a moral luxury, but a political fault line. Institutions defend transparency as a condition of stability. Freedom advocates see privacy as a fundamental guarantee. This tension reshapes our relationship to power, trust, and individual autonomy. The central question is no longer just about technology, but about what we accept to reveal in order to exist. This text explores the existential battle of monetary privacy: protecting human dignity when everything becomes traceable.

The GENIUS Act brings long-awaited clarity to U.S. stablecoins but deepens the regulatory divide with Europe, creating fragmented liquidity pools and raising concerns about cross-border stability and settlement friction.

The International Monetary Fund steps out of its usual reserve and publishes a detailed guide on stablecoins. As the market exceeds 300 billion dollars, the institution believes that regulation alone will not be enough. What strategy does it really advocate?

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

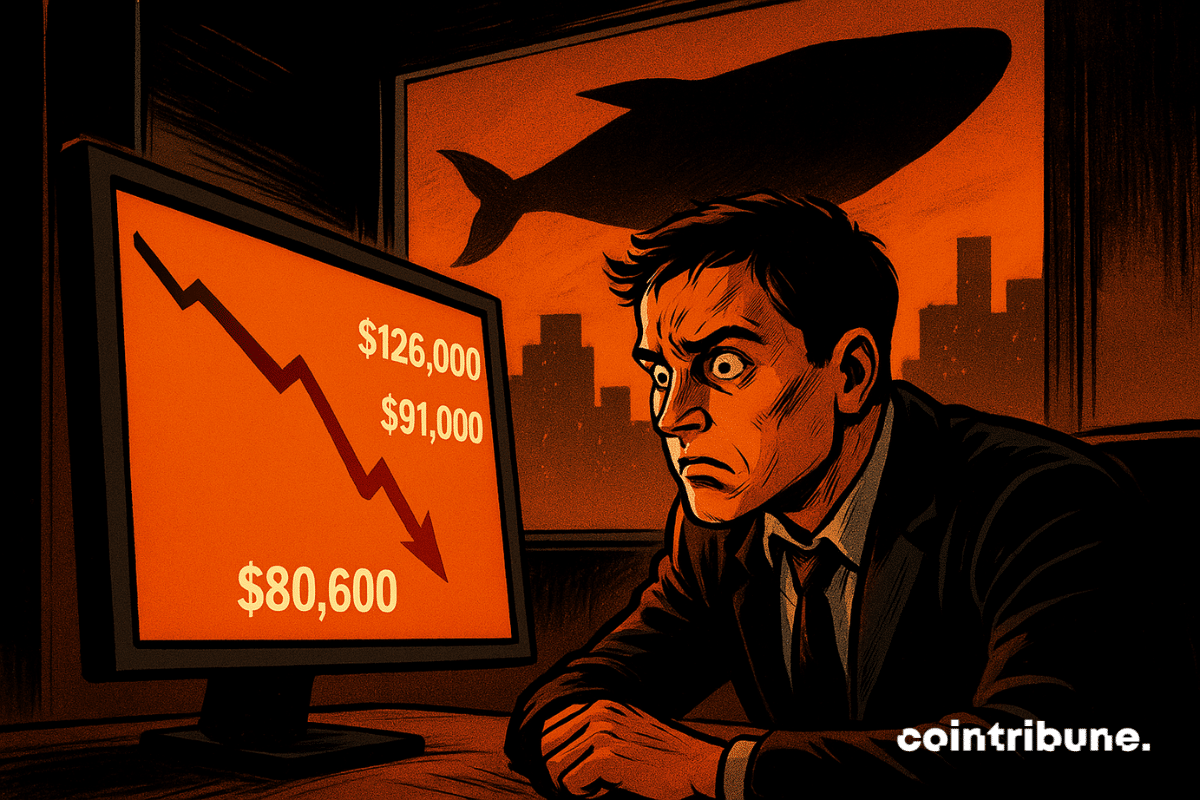

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

QCAD has become Canada’s first fully compliant CAD stablecoin, offering stable value, faster payments, and greater access to digital financial services.

While stablecoins worry many central banks, the ECB adopts a surprisingly measured tone. In its latest financial stability review published on November 20, it considers these assets to represent "only a limited risk" to the eurozone. A reassuring position, which the institution justifies by still marginal adoption and an already existing regulatory framework. However, behind this apparent calm, the ECB calls for vigilance given the rapid market evolution and emerging cross-border risks.

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Cash App is preparing one of its biggest updates yet as parent company Block sets a timeline to add stablecoin operations to the platform. New tools for both Bitcoin and digital dollar payments are being prepared for rollout, with early 2026 cited as the target window. Essentially, Block is pushing to expand access to digital payments while keeping Bitcoin at the center of its ecosystem.