While the United States bets on open regulation of stablecoins with the GENIUS Act, China takes a more discreet approach. In Shanghai, a closed-door meeting among regulators reveals a willingness to experiment, without easing control.

Stablecoins

Tether is taking down its posters of abandoned blockchains to better align with crypto stars: while some lament Omni, others are already celebrating on Ethereum and Tron.

"While the dollar plays the tightrope and Trump brandishes his tariffs, Washington unveils a crypto-crutch: stablecoins, a techno remedy or a digital mirage of a wavering empire?"

Stablecoin reserves on Binance hit a record of $31 billion. An "explosion of pending liquidity" according to analysts, which could reignite the flame of altcoins. Is the much-anticipated alt season finally ready to begin?

Under the pretext of stablecoins in Hong Kong, Beijing is moving its pieces. Crypto on the menu, control for dessert? JD and Ant are rolling out the digital carpet, but beware of the invisible strings.

The European Central Bank is embarking on a major technological shift. The Governing Council has just approved two major projects aimed at integrating blockchain technology into the euro transaction settlement system. This is a strategic advancement that marks a turning point in the modernization of the financial infrastructures of the European Union.

While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.

Tokens we thought were safe, a report that strikes, the BIS takes aim at stablecoins. Crypto-mania or toxic bubble? The global finance reassesses its strategies... under high tension.

While Trump rushes headlong to save his stablecoins, Europe is rolling out MiCA and taking the crypto prize. What if, for once, bureaucracy won the race?

Economist Peter Schiff is openly opposing the U.S. government on the future of stablecoins. While Washington relies on these cryptocurrencies to strengthen the dollar, Schiff predicts the opposite. But is he right to be concerned?

American President Donald Trump is urging Congress to promptly pass the GENIUS Act on stablecoins. A race against time is on to make the United States the global leader in digital assets. But does this rush conceal personal interests?

While Trump rakes in millions in home tokens, the Senate blesses stablecoins. New digital dollar or old electoral trick? A deep dive into the American crypto theater.

The American banking giant JP Morgan has just filed a mysterious trademark application called "JPMD" with the U.S. Patent and Trademark Office. This initiative fuels speculation about a potential new stablecoin. But what is this discreet move really hiding?

Treasury Secretary Scott Bessent has just made a shocking prediction: the stablecoin market could soar to $2 trillion within three years. This announcement comes as Bitcoin flirts with its historical highs.

Bank of America is holding off on stablecoins until U.S. lawmakers pass the GENIUS Act. Meanwhile, the bill gains momentum, signaling growing support for clear regulation.

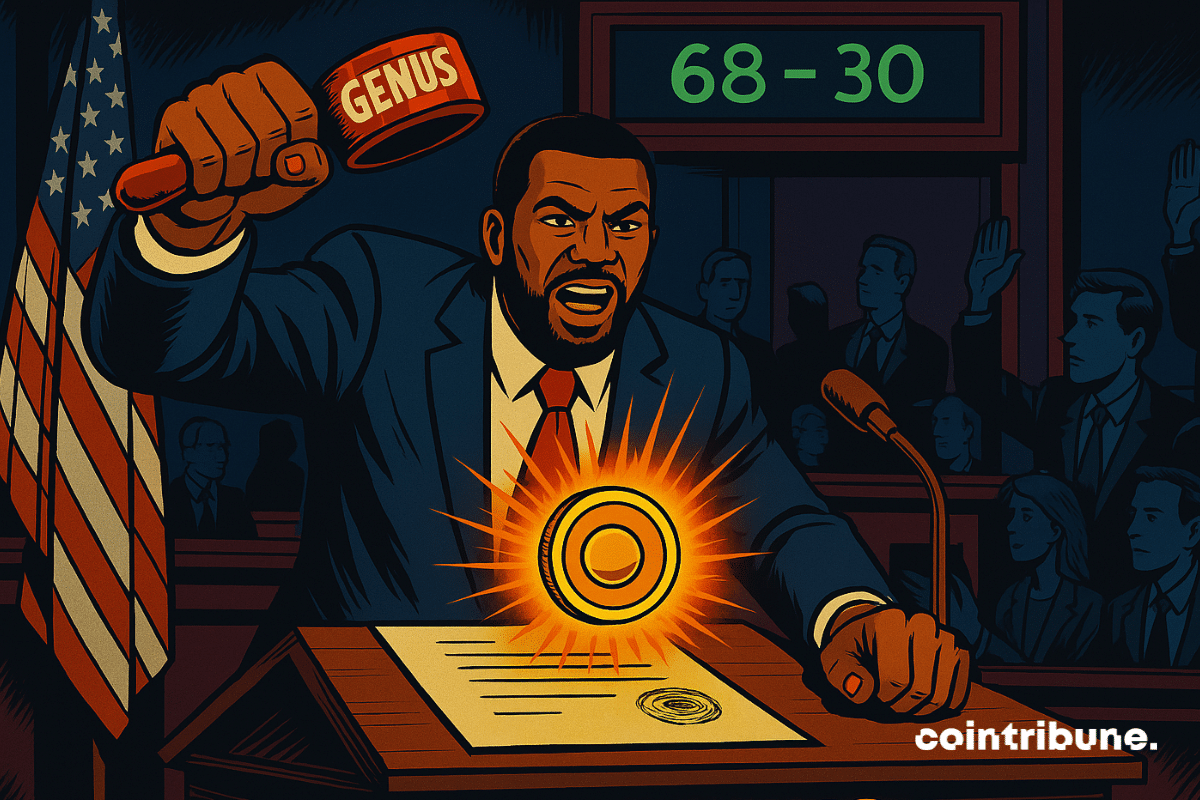

The regulation of stablecoins in the United States has just reached a historic milestone. The U.S. Senate voted 68 to 30 to advance the GENIUS Act, paving the way for a plenary session debate. Does this advancement finally mark the birth of a federal regulatory framework for dollar-backed cryptocurrencies?

The United States is preparing to regulate stablecoins. A key vote on the GENIUS Act could transform the crypto industry forever.

No need for an IPO for Tether: while others seek funding, USDT prints its way. A cryptocurrency that breathes loud, very loud... but always behind closed doors.

Circle makes a brilliant debut on Wall Street with a raise of $1.1 billion, well beyond expectations. A strong signal as the United States sharpens its legal framework on stablecoins and repositions crypto in their monetary arsenal.

Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

The traditional banking sector is making a historic shift towards stable cryptocurrencies. Discussions between Stripe and financial institutions reveal a massive interest in this technology. But will widespread adoption depend solely on the goodwill of regulators?

"Ledger sorts its Visa crypto card in the USA with Bitcoin cashback. Discover all the details in this article."

Not seen Trump, but his pro-bitcoin envoys proclaimed in Vegas: America wants to mine, regulate, and dominate the crypto-world, while Beijing tightens the screws.

Tether, the issuer of the USDT stablecoin, has just reached a historic milestone by surpassing Germany in the holdings of U.S. Treasury bonds. With over 120 billion dollars invested, the company now ranks as the 19th largest holder in the world, surpassing several nations.

In a crypto environment marked by volatility, stablecoins are emerging as the preferred safe haven for venture capital investors. Despite geopolitical tensions and market fluctuations, these digital currencies pegged to traditional currencies are garnering increasing attention. Why does this particular segment generate so much enthusiasm among the most discerning financiers?

The BIS and the Fed unveil an innovative toolkit for tokenization. Discover all the details in this article!

The BIS reveals that $600 billion in crypto circulated in 2024, primarily for speculation, not for real use. Details here!

The U.S. Senate rejected the GENIUS Act bill yesterday, which aimed to regulate stablecoins. With a vote of 48 against 49, far from the 60 votes needed, this bipartisan legislation faced unexpected opposition from Democrats, jeopardizing the regulatory future of dollar-backed cryptos. But what are the real reasons behind this legislative failure?

The crypto greenback is waging its war: while rivals battle in plain sight, USD1 climbs the rankings, propelled by the Trumps and boosted by billions.

And what if the dollar was no longer the only compass for stablecoins? Around the world, a tide is forming: governments, regulators, and companies want alternatives. Between monetary sovereignty and geopolitical ambitions, crypto is taking an unexpected turn.