BitMine is drawing fresh attention as its aggressive buying spree in Ethereum continues. New on-chain activity suggests the company may be preparing another significant purchase, prompting traders to watch whether continued accumulation can steady sentiment in an uneven market. Interestingly, BitMine’s recent purchase activity comes amid broad macro pressures that remain a persistent drag on digital assets.

Theme Trading

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

Bitcoin has fallen more than 22% in one month, casting doubt on its momentum. Yet, behind this pullback, several signals point to a possible return to the symbolic threshold of $112,000. While markets are restless, institutional and retail investors watch four key factors likely to revive the bullish trend. In a context of macroeconomic uncertainty and tension in derivative markets, the scenario of a rebound can no longer be ruled out.

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

This November 20 marks an unprecedented turning point in American budget history. Texas has become the first state to officially integrate bitcoin into its public reserves. At a time when fiat currencies are wavering and institutions are seeking solid alternatives, this decision stands as a strong signal. The Lone Star State paves the way for a new form of financial sovereignty, placing the flagship asset at the heart of its long-term economic strategy.

While bitcoin briefly rises above $86,000, a dissonance persists: the US dollar remains strong. This strength, usually unfavorable to risky assets, has not hindered BTC's upward momentum. Is it a real sign of recovery or a mere technical rebound masking underlying weaknesses?

Franklin Templeton launched an XRP-backed ETF on NYSE Arca this Monday. This event marks a significant milestone in integrating altcoins into regulated markets. While attention is focused on Bitcoin ETFs, this initiative signals an expansion of institutional interest. After the litigation between Ripple and the SEC, this launch could pave the way for other cryptos previously sidelined by traditional markets.

While stablecoins worry many central banks, the ECB adopts a surprisingly measured tone. In its latest financial stability review published on November 20, it considers these assets to represent "only a limited risk" to the eurozone. A reassuring position, which the institution justifies by still marginal adoption and an already existing regulatory framework. However, behind this apparent calm, the ECB calls for vigilance given the rapid market evolution and emerging cross-border risks.

Are financial markets getting ahead of the Fed? While traders are heavily betting on a rate cut as soon as December, the Federal Reserve remains cautious and divided. This potential mismatch between anticipation and reality could disrupt macroeconomic balances and weigh heavily on risk assets.

As the crypto market approaches 3 trillion dollars again, bitcoin grabs attention by crossing 86,000 $, driven by an increase of over 3%. This rebound fuels projections of a move towards 88,640 $, but the setup remains fragile. Between immediate resistance zones and hesitant volumes, the bullish scenario remains conditional. Technical signals are accumulating, but only a clear breakthrough of key thresholds could confirm a sustainable recovery.

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

Long considered the spearhead of institutional adoption, Bitcoin ETFs have just experienced one of their worst weeks since their launch. With massive outflows and a tense market, confidence is wavering. Such a situation reminds us that in the crypto universe, nothing is ever fully guaranteed, not even the most solid financial products.

Solana has just recorded 18 consecutive days of positive net inflows on its ETFs, a first in the sector. Launched in early November, these financial products have already attracted over $500 million, triggering significant interest from institutional investors. In a market still overshadowed by the 2022–2023 bear cycle, this dynamic surprises and raises questions about Solana's repositioning in crypto portfolios.

U.S. stocks and crypto tumbled as investor fear surged, with the S&P 500 losing $2 trillion and Bitcoin falling below $85K.

Robert Kiyosaki sold his bitcoins, cashing in 2.25 million dollars. An unexpected decision, while he predicted a BTC at $250,000 by 2026. In a declining market, this withdrawal questions the real drivers of his strategy.

While the crypto industry oscillates between volatility and hopes of a rally, Peter Brandt, a respected figure in technical analysis, cools down the enthusiasm. Unlike the euphoric forecasts of some sector leaders, he believes that bitcoin will not cross $200,000 before the third quarter of 2029. Such a projection questions the solidity of short-term bullish scenarios and invites a reconsideration of the real pace of market cycles.

Young investors are increasingly moving their assets to advisors who offer crypto access, making digital assets a key factor in wealth decisions.

Ether (ETH) dropped nearly 30% in one month, breaking the symbolic $3,000 threshold. This brutal setback endangers the finances of an entire segment of the crypto ecosystem. Behind the curve, companies exposed to ETH see a year of gains evaporate.

Bitcoin has just reached 86,000 dollars, a pivotal threshold that places the asset at the heart of an area referred to as "max pain" by several analysts. In a climate of monetary tension, this drop fuels fears of an imminent institutional capitulation.

Little known outside Japan, Metaplanet now intends to play in the big leagues. With an aggressive bitcoin accumulation strategy, this Tokyo-listed company is about to raise 135 million dollars to further strengthen its treasury in BTC. A bold initiative that confirms the growing place of bitcoin in the financial strategies of listed companies, and further fuels the parallel with Strategy.

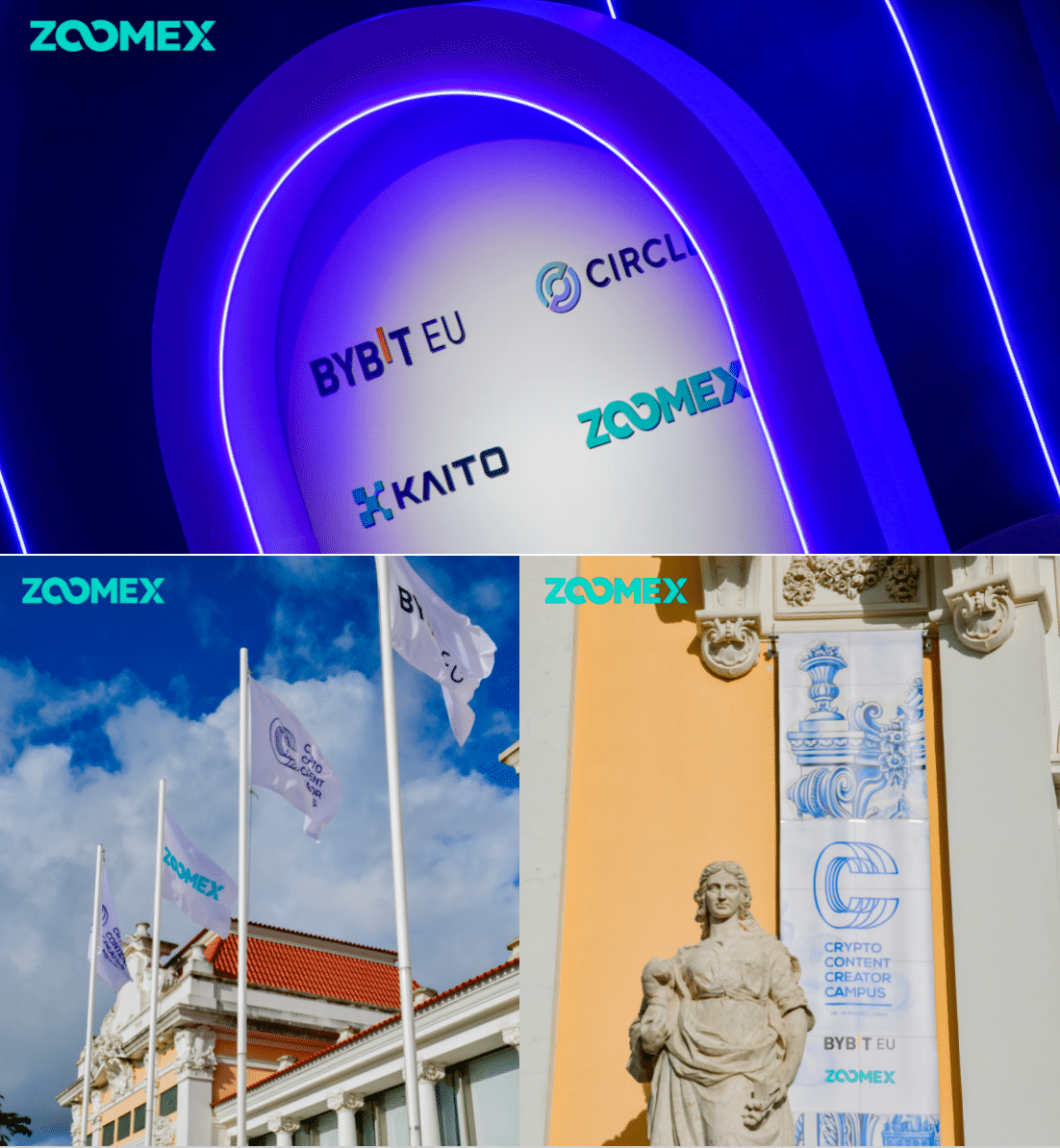

Lisbon, Portugal, November 16, 2025 — Global digital asset trading platform Zoomex, as the diamond sponsor of CCCC Lisbon 2025, made a successful appearance at the two-day crypto event. With its core strengths of “simple and user-friendly, secure and transparent, user-first,” Zoomex stood out as one of the most prominent trading platforms at this European crypto gathering.

Behind the apparent rise of XRP, the technical signals turn red. While Ripple's crypto shows a sustained price, the on-chain data reveal a worrying fragility: a large share of recent investors are at a loss, exposing the market to potentially explosive selling pressure.

While traditional markets are wavering in anticipation of Nvidia's results, bitcoin surprises by rebounding 4% on Tuesday. In a tense atmosphere, the crypto escapes the declining US stock indices and intrigues investors. Is this surge a sign of a new bullish momentum or merely a speculative spike? The timing, on the eve of a key verdict on AI, makes this move all the more strategic.

Nearly ten years after its spectacular collapse, Mt. Gox resurfaces. Indeed, the former Japanese bitcoin giant suddenly moved over 10,000 BTC, worth $953 million, after eight months of silence. This massive transfer rekindles fears of a large-scale liquidation. Worse still, creditors, already battered, will have to wait until 2026 to hope for reimbursement. Enough to revive tensions around the oldest scandal in crypto history.

A wave of panic is blowing over crypto ETPs. In the space of one week, over $2 billion has been withdrawn from these financial products, marking their largest outflow since February. This is a strong signal for an institutional market plagued by doubt, amid economic uncertainties and monetary tensions. As traditional markets waver, investors are reassessing their exposure to cryptos. This situation could mark a turning point in the strategy of major holders.

After BitMine, SharpLink plays the crypto rentier: a safe filled with Ethereum, dividends pouring... and a strategy that would make many central banks envious.

As tension rises in the market, Bitcoin is about to cross a critical technical threshold: the "death cross." This signal, feared by traders, occurs at a pivotal moment, at the intersection of a 25% correction and an uncertain macroeconomic climate. While some see it as a classic bearish indicator, others recall it coincided with market lows. In this context, certainties waver, and each candlestick becomes a test for investor morale.

At each ETF launch, the crypto market anticipates a price jump. For XRP, backed by the new XRPC fund from Canary Capital, the expected effect did not occur. Despite solid opening volume, the price remained frozen before dropping by 7%. A striking contrast with previous surges triggered by similar announcements. Why hasn’t XRP, despite being in the spotlight, benefited from this institutional momentum?

While the crypto market seeks a new balance, an analysis by Glassnode reveals a major strategic divergence: bitcoin holders hold, Ethereum holders mobilize. Beyond community rivalries, these data reveal two opposing visions of crypto value. One is based on reserve, the other on use. This behavioral gap, often neglected, could well redefine the power balance within a rapidly evolving ecosystem.

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.