2026 will mark a historic turning point: real world assets (RWAs) tokenized are establishing themselves as the new standard for global payments. Programmable stablecoins, digitalized government bonds, and massive adoption by banks — this financial revolution is already redefining liquidity and transactions. Ready to understand how these assets are transforming the economy?

Trading Exchange RSS

Could bitcoin's four-year cycle be living its last moments? This is the unexpected hypothesis put forward by Grayscale in a report published on Monday. According to the asset manager, the crypto king could break free from its historical mechanics as early as 2026, reaching new heights well before the usual deadline. This major challenge to a pillar of crypto analysis sparks as much hope as questions in a rapidly changing market.

BitMine buys $70M of Ethereum in 3 days. Supercycle coming? Discover all the details of this massive operation.

An arithmetic bug, billions of tokens, a hurried hacker… and Yearn retrieving $2.4M in commando mode. In the crypto jungle, treasure hunts are intensifying.

Goldman Sachs has agreed to acquire Innovator Capital for $2B, bringing new ETF and crypto-linked products, with the deal set to close in 2026.

Kalshi is pushing prediction markets further into the crypto space as global demand accelerates. Rising interest in event-based trading has prompted the platform to tokenize event contracts on Solana, giving users more in sensitive markets. Analysts say this shift could position Kalshi to challenge competitors and keep pace with the industry’s rapid growth.

Changpeng Zhao and his investment company YZi Labs come out swinging against the management of CEA Industries, accused of letting the BNC stock price collapse by more than 90%. This offensive marks a turning point for the future of this treasury company dedicated to BNB. Will shareholders follow CZ in this battle to regain control?

Vanguard, asset management giant, has just shaken up the market by opening its doors to crypto ETFs for its 50 million clients. A decision that could cause Bitcoin to explode and redefine institutional investment. Why this turnaround, and what will be the consequences?

After a month of massive disengagement, crypto investment products record a spectacular comeback. In a single week, crypto ETPs attract 1.07 billion dollars, breaking a series of four consecutive weeks of outflows totaling 5.5 billion $. This renewed interest marks an unexpected turning point in a highly uncertain monetary context, where markets scrutinize Fed signals.

Bitcoin is collapsing, miners are coughing, and some flee to AI: when digital gold turns into an electric burden under maximum stress!

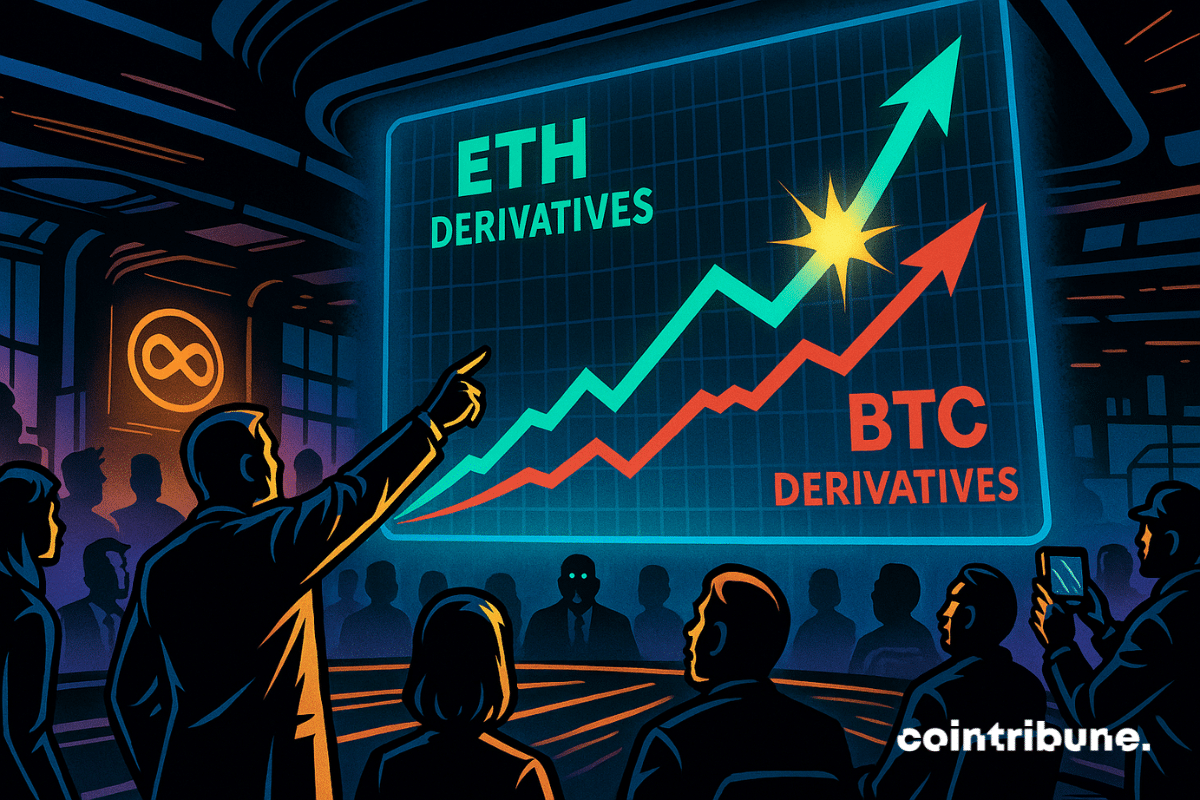

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

The news may seem trivial at first glance, but it marks a strategic turning point for Sony. After conquering trade shows worldwide with PlayStation, the group now wants to leave its mark on a rapidly evolving sector: crypto payments. Behind the scenes, Sony Bank is accelerating, preparing a regulatory offensive, and laying the foundations for a future stablecoin, an initiative that could transform the way millions of players consume their digital content.

Bitcoin has just crossed a critical threshold by falling below $84,000, plunging investors into uncertainty. This week promises to be decisive for the 2025 year-end closing: rebound or collapse? Analysis of key levels, macroeconomic risks, and opportunities to seize before year-end.

Strategy launches a giant dollar reserve to support its Bitcoin bet. Discover all the details in this article.

David Sacks, a key figure in crypto and Trump advisor, calls the New York Times accusations a pure "nothing burger." Between threats of lawsuits, sharp denials and political stakes, this clash reveals much more than a simple media dispute.

A hacker, a forgotten division, and nine million vanished... The arithmetic falters, the vaults empty, and Yearn's coders mourn their yETH. Crypto drama or bad comedy?

The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

China has just made a big move: the central bank is further tightening its crackdown on crypto and stablecoins, calling them a major threat. Why this radical decision? What impacts for the global market and investors?

Billy Markus, creator of Dogecoin, has just torn apart the manipulation accusations that bloom after every crypto crash. His sarcastic message on X is timely: the market just lost 200 billion dollars in 24 hours. Who to blame this time?

TON and Telegram launch an AI that pays geeks to work without them knowing. Durov continues to challenge certainties with his GPUs... and his frankness.

Crypto faced a tough November, losing $127M to hacks and attacks, with DeFi platforms hit hardest and $45M recovered.

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

When bricks soar, young people bet on the virtual: crypto becomes their plan B... Or their programmed ruin? A risky bet from a disillusioned and downgraded generation.

What if Ethereum was worth much more than the market thinks? According to a study conducted by CryptoQuant, 9 valuation models out of 12 estimate that ETH is currently largely undervalued. For Ki Young Ju, CEO of the platform, these analyses reveal a significant gap between the current price of Ether and its real theoretical value. This finding rekindles the debate on how cryptos should be valued.

Bitcoin ends this year on a familiar note. Down more than 36% from its annual highs, the asset eerily replicates the movements of the 2022 bear market. This correlation alarms analysts as crypto ETFs register positive inflows again. Between the return of institutional capital and memories of a previous crash, the market oscillates between concern and hopes of a rebound.

Bitcoin stumbled into the new month after a sharp weekend drop erased days of calm trading and reignited market-wide fear. Prices plunged without warning on Sunday, triggering heavy liquidations and closing out the asset’s weakest November in years. Traders now question whether the fall signals deeper trouble or a reset that clears the way for a rebound.

Self-custody and financial privacy have returned to the forefront of the U.S. crypto conversation after SEC Commissioner Hester Peirce reaffirmed them as core individual rights. Her remarks come amid regulatory uncertainty, rising ETF adoption, and renewed debate over Bitcoin’s founding principles.

Heavy withdrawals hit BlackRock’s flagship Bitcoin ETF in November, but company executives say the activity reflects normal market behavior, not a shift in long-term sentiment. Momentum from earlier in the year continues to guide the firm’s outlook, supported by the strong demand that once pushed IBIT toward a major milestone.

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

Strategy, the Bitcoin giant will only relinquish its precious reserves under one condition, which one? A condition that may reveal dark days ahead for BTC.