Trump, crowned president of mental mining, dreams of a bitcoin empire while Beijing prepares its tokens... A crypto-crusade to follow between tweets, stablecoins, and the digital yuan under surveillance.

Trading Exchange RSS

Is Bitcoin losing ground where it was supposed to triumph? Cathie Wood, CEO of ARK Invest and a leading figure in crypto investment, has just lowered her most ambitious target for BTC. The reason is the rise of stablecoins in emerging economies, where they are establishing themselves as a new store of value. A strong strategic adjustment that questions the real role Bitcoin will play against these dollar-backed alternatives.

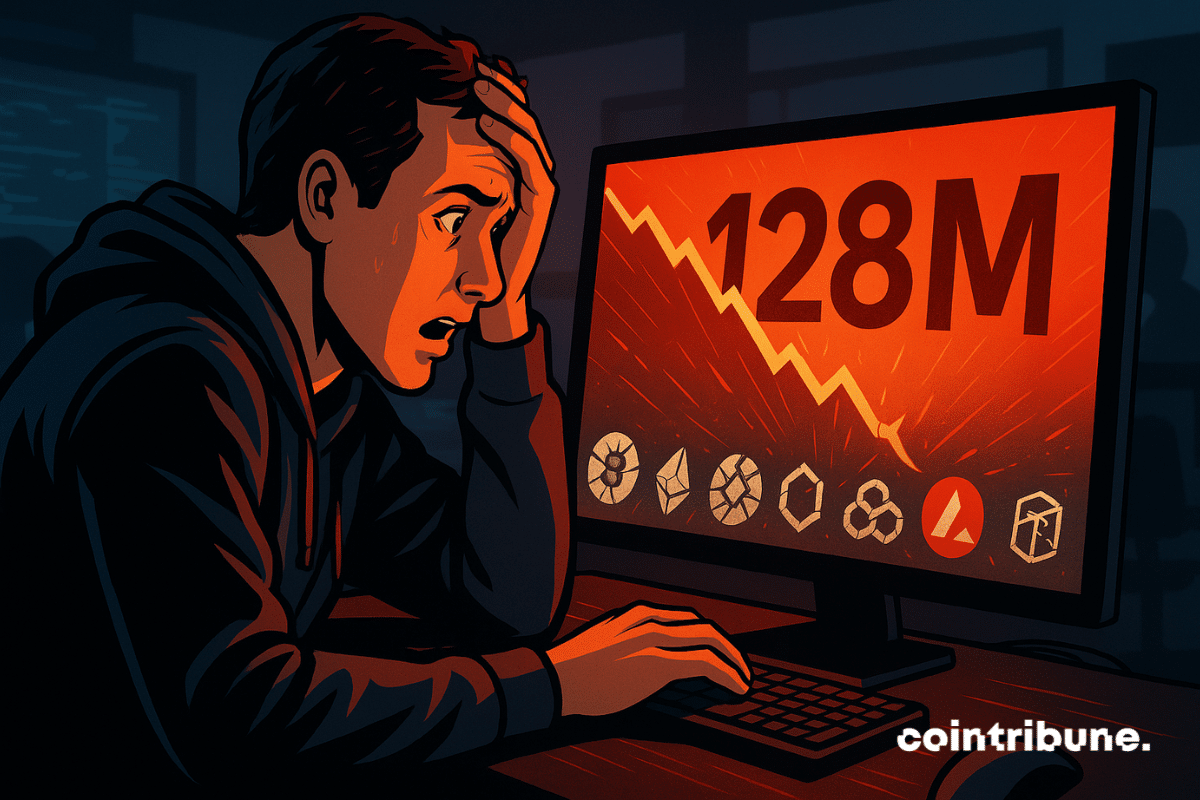

Balancer has just published its preliminary report on the attack that shook the DeFi protocol on November 3. A technical flaw in the V2 pools allowed hackers to siphon 128 million dollars across seven different blockchains. But the real bill is much higher: the total value locked (TVL) collapsed by 58% in just two days. How could a protocol audited eleven times fall victim to such a debacle?

What if the role of store of value promised to bitcoin in emerging economies was slipping away? This is a hypothesis that Cathie Wood, founder and CEO of ARK Invest, now seems to take seriously. Known for her strong convictions about the potential of bitcoin, the investor now lowers her most optimistic scenario, citing an unexpected dynamic: the meteoric rise of stablecoins as an alternative to BTC in certain regions of the world.

Elon Musk hits the jackpot if Tesla sells more robots than cars... Shareholders celebrate, investors worry. Who really controls AI: man or fantasy?

The boundary between crypto and politics is becoming clearer. By now allowing the legal purchase of firearms with USDC, Circle brings the issue of financial neutrality to the forefront. This decision, praised by some and contested by others, reveals tensions between the promise of decentralization and institutional realities, while reigniting the debate on what crypto can or cannot allow within a legal framework.

Kalshi and Polymarket record a sharp drop in probabilities in favor of Donald Trump, as the Supreme Court examines the legality of his tariff powers. This turnaround highlights two dynamics: the possible rollback of presidential authority over foreign trade, and the growing role of decentralized platforms as sensors of political anticipation. A case where constitutional law, economic strategy, and technology intersect under the watchful eyes of judges... and investors.

The U.S. government is going through the longest shutdown in its history with 36 days of blockage. This unprecedented situation directly threatens the adoption of crucial cryptocurrency legislation. The results of the midterm elections further complicate negotiations.

Bitcoin remains below $105K as heavy selling keeps the market under pressure while traders watch the upcoming U.S. tariff ruling.

US digital asset ETFs came under pressure this week as institutional traders shifted to a more cautious stance. Bitcoin and Ether products recorded sharp outflows, while Solana funds continued to draw steady interest. Activity suggested uneven sentiment across major crypto assets as markets reacted to recent volatility.

Google hides its spy in your dashboard: Gemini, a talkative, geolocated, multitasking AI that guides you... and maybe watches you. Soon a driving license for robots?

Robinhood delivered another strong quarter, posting sharp gains in revenue and profit as crypto activity surged. Markets pulled back slightly after hours, but the company’s year-to-date rally remains among the strongest in publicly traded fintech and crypto-adjacent firms.

Senators continue work on the crypto market structure bill and are set to discuss key details with David Sacks.

Prediction markets are about to disrupt crypto finance, and Gemini has just made the move. Between disruptive innovation, tense regulation, and Ethereum’s key role, this revolution could redefine investment. Analysis of the stakes and opportunities not to be missed.

Europe has just dealt a decisive blow against one of the largest crypto scams ever dismantled. Over 600 million euros embezzled through fake investment platforms, nine arrests in three countries, and an operation conducted swiftly under Eurojust's coordination. This cross-border crackdown unveils the alarming scale of criminal networks exploiting blockchain to launder funds out of sight. A case that confirms the urgency of a judicial response commensurate with the crypto challenges.

Michael Saylor's aggressive Bitcoin accumulation strategy — could it survive the next bear market? Crypto analyst Willy Woo offers reassuring answers, supported by numbers. But a longer-term risk remains.

The drop of bitcoin below 100,000 dollars has revived tensions in the market, shaking a symbolic threshold for investors. Behind this technical retreat are more complex signals. While some fear a lasting bearish trend, several influential voices in the sector see it as a transitional phase, carrying potential for a rebound. Between behavioral analysis and macroeconomic dynamics, this correction could mark much more than a simple temporary adjustment.

When Kim Jong-un becomes HR at Upwork, GitHub hosts viruses, and AI disguises thieves… the crypto sphere realizes its worst nightmares are already among us.

As the crypto market holds its breath, a note from 10x Research reignites the debate. Ethereum is now a good candidate for shorting. According to the firm, betting against ETH could provide effective coverage against the institutional rise of bitcoin. This strategic reading shakes up the hierarchy between the two main assets in the sector.

A new European Commission plan to expand the powers of the European Securities and Markets Authority (ESMA) has stirred debate across the continent. The proposal aims to tighten regulatory consistency across crypto and financial markets. However, critics warn that the move could slow innovation and reduce agility within Europe’s growing fintech sector.

Forward Industries’ board approved a $1 billion share buyback program, highlighting its position as the largest corporate Solana treasury amid market pressures.

Shocking ranking in crypto: XRP climbs to the top of altcoins against Dogecoin and Solana. More details in this article.

Ripple’s US dollar–pegged stablecoin, RLUSD, has rapidly climbed the ranks to become one of the top ten stablecoins by market capitalization. Less than a year after its December 2024 launch, RLUSD has surpassed the $1 billion mark—a milestone that reflects growing confidence in Ripple’s expanding digital asset ecosystem.

Sequans, bitcoin's friend just yesterday, quietly dumps 970 tokens: tactic or panic? Meanwhile, crypto markets are tying themselves in knots with their wallet.

The cryptocurrency market is experiencing a turbulent start to the quarter. While Bitcoin falters under the weight of massive capital outflows, Solana surprises by attracting an unprecedented institutional influx. A striking contrast that illustrates a possible turning point in the crypto market balance

Michael Saylor continues his obsession with bitcoin. His company Strategy has just filed a request for an IPO of a share denominated in euros, specially designed to raise funds and acquire even more BTC. Will this initiative be enough to revive a buying momentum that is showing signs of weakening?

Ethereum has just reached a spectacular milestone in scalability. On November 4, 2025, the network recorded a record throughput of 3,453 transactions per second, shattering its usual performance. Vitalik Buterin, co-founder of the blockchain, was quick to praise this major advance. But does this technical feat finally signal the end of the congestion problems that have long hampered the network?

Sam Bankman-Fried, former fallen crypto icon, plays his last card before the justice system. Sentenced to 25 years in prison for fraud, the former CEO of FTX is contesting his trial before a federal appeals court in New York. His defense argues that the company was not insolvent and that clients could have been reimbursed if time had not run out. A strategic appeal that could disrupt the legal reading of the collapse of one of the largest crypto empires.

Richard Teng, CEO of Binance, breaks the silence: facing rumors of collusion with Donald Trump’s USD1 stablecoin, he firmly denies them. Between presidential pardons and crypto stakes, this case reveals the behind-the-scenes of a tense sector. Is the truth finally unveiled?

Bitcoin has just fallen back below $100,000, reviving doubts about the strength of its upward trend. Behind this symbolic threshold lies a weakened market, caught between weakening demand and macroeconomic tensions. For CryptoQuant, the threat is clear. If this support does not hold, BTC could plunge to $72,000 within two months. A scenario that worries, as technical and fundamental signals turn red.