Solana’s core development team is preparing to significantly raise the network's computational capacity with a new proposal. The Solana compute unit limit increase aims to meet the growing demands of high-performance decentralized applications (dApps).

Trading Exchange RSS

It’s been a full year since spot Ethereum ETFs went live in the U.S., and the market is celebrating with a strong streak of inflows and bullish sentiment. Despite being overshadowed by Bitcoin ETFs, these funds have quietly carved out a substantial presence.

New record for BlackRock: its Ethereum ETF climbs to $10 billion in 251 days. All the details in this article!

On July 24, nearly a billion dollars in leveraged positions were liquidated within a few hours, triggering a wave of sales on derivative platforms. XRP, Dogecoin, Ethereum, and Solana all plummeted, caught up in an overheating mechanism fueled by massive speculative bets. A dark day that reminds us how volatility remains the rule, not the exception, in the crypto universe.

MicroStrategy continues to surprise. While most companies adjust their cash reserves with cautious investments, the firm led by Michael Saylor continues to forge a radically different path. Staying true to its "Bitcoin first" strategy, MicroStrategy has just announced a $2 billion fundraising, primarily intended for the purchase of new BTC. This is not just a financial operation: it is a manifesto. Behind this decision lies an ideological confrontation between two visions of the monetary world. And MicroStrategy, once again, chooses its side unambiguously.

Faced with the persistent uncertainties of traditional markets, cryptocurrencies are establishing themselves as a strategic refuge. In 2025, flows into these assets reached an unprecedented threshold: 60 billion dollars injected since January, according to JPMorgan. This astonishing 50% increase since May confirms an unprecedented institutional dynamic. Such a turning point redefines the balance of capital and illustrates the increasing normalization of cryptocurrencies in the financial universe.

For several sessions, the bitcoin market has been showing signs of increasing tension. An unusual accumulation of liquidity above the price and a rapid increase in its dominance are reigniting speculation. In the shadows of the charts, short sellers and eager buyers are engaged in a tactical duel. For several technical analysts, the stage is set: a massive short squeeze now seems inevitable.

Ethereum wavers between past profits and the cold sweats of summer: an explosive cocktail mixing variable rates, rapid predictions, and a DeFi that grits its teeth.

In response to the increase in customs duties decreed by Donald Trump, 30% on European imports starting August 1st, Brussels is deploying heavy artillery. The Commission has approved a counter-tariff attack of 93 billion euros, targeting strategic American sectors. An economic escalation is unfolding between two major blocs, against a backdrop of political tensions and fragile global trade.

China remains indifferent to threats and is getting rid of American debt. Bitcoin is lurking.

Chris Larsen, co-founder of Ripple, moves 175 million dollars worth of XRP at a high price. Could this massive movement signify a strategic dumping? Discover the implications of this action on the crypto market and the risks for investors.

JPMorgan Chase is reportedly exploring a new lending product that would allow clients to borrow against their crypto holdings. According to sources cited by the Financial Times, the U.S. banking giant is in internal discussions to launch crypto-collateralized loans, potentially as early as next year. The plan would let clients use cryptocurrencies such as Bitcoin, Ethereum, or even crypto-focused ETFs as collateral in exchange for cash or credit. While still in its exploratory phase, the product would be JPMorgan’s clearest signal yet that it is taking crypto seriously.

Bitcoin’s rally is starting to cool, and eyes are now turning to altcoins. With volumes soaring, Binance is right in the thick of it.

Cryptocurrency adoption has witnessed remarkable growth in 2025, with individuals and even large institutions pivoting towards digital asset ownership. Interestingly, data shows that the recent wave of crypto embrace is largely driven by digital payment and artificial intelligence.

Mara Holdings, one of the largest publicly traded Bitcoin mining firms, has released a bold financing plan: the company aims to raise up to $1 billion through a debt sale to support its Bitcoin acquisition strategy and operational needs.

Ethereum’s next major protocol upgrade, Fusaka, is scheduled for launch in early November. Developers aim to boost scalability and network resilience while trimming unnecessary features.

Altcoins suddenly plunge after a frenzied rally. Ethereum and XRP drop, but Bitcoin remains calm. Temporary correction or the beginning of a real reversal in crypto? Suspense.

Andrew Keys, co-founder of Ethereum-focused investment firm The Ether Machine, has reignited the ETH vs BTC debate. During his media rounds, Keys emphasized that Ethereum has significantly outperformed Bitcoin in returns over the last decade.

While Bayrou struggles with the budget, Occitanie is mining convictions: France's local regions are flirting with crypto, and it could very well earn them more than a Livret A.

Brussels holds its breath. As August 1st approaches, the trade dispute with Washington slides into strategic confrontation. In the face of the threat of a 30% surcharge on European imports, Paris and Berlin demand a firm response. Their goal: to push the EU to activate, for the first time, the anti-coercion instrument.

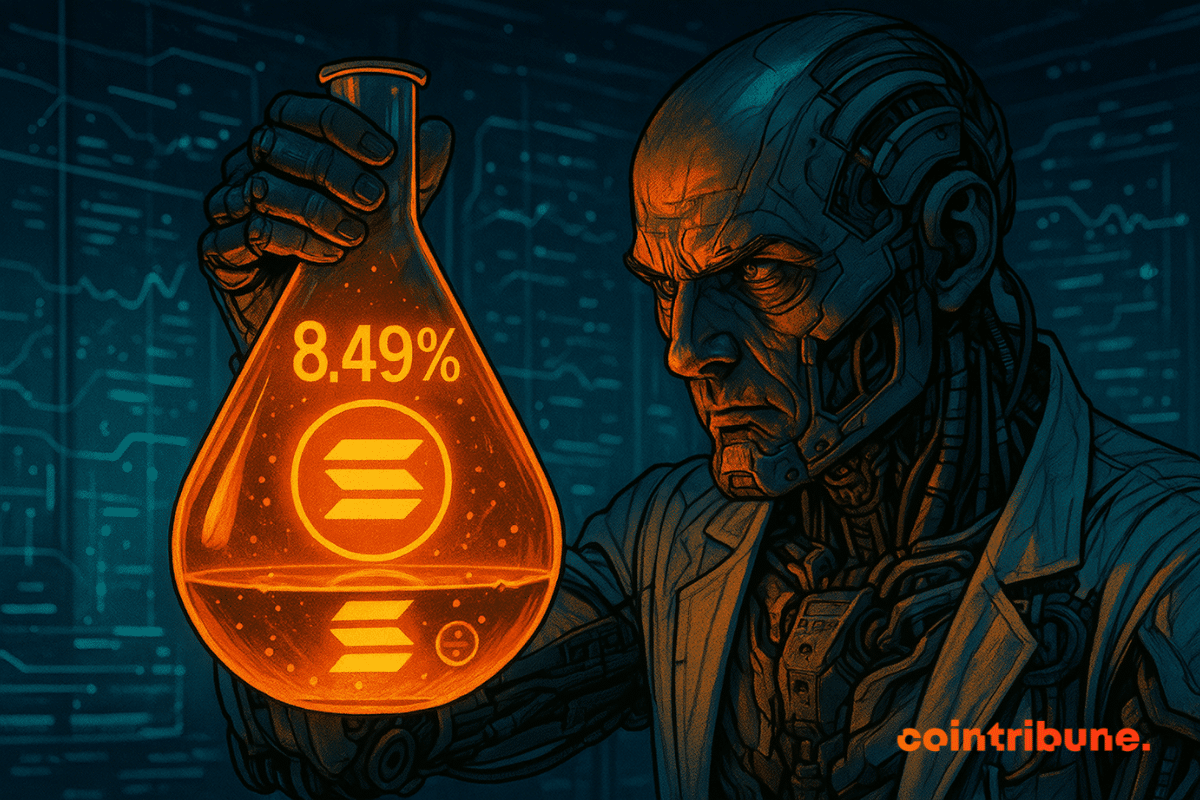

Solana shines, MoonPay joins the dance of liquid staking with a yield of 8.49%. But behind the simplicity, there is fierce competition and colossal stakes for crypto.

Every token unlock by Ripple rekindles tensions surrounding XRP. On August 1st, one billion tokens will be released from escrow, according to a well-established monthly schedule. Predictable yet always scrutinized, this movement fuels speculation about a potential market impact, as XRP attempts to breach a crucial technical threshold. In an ever-nervous crypto climate, Ripple's strategy raises as many questions as it reassures.

The Trump administration unveiled its plan to make the United States the "global capital" of AI. This strategy removes environmental constraints and diversity policies that governed the sector. But does this race for technological supremacy not hide deeper geopolitical stakes?

Imagine the Louvre Carousel filled with computers, post-its, and high-fives among coders: that’s how the RaiseHack finals took place on July 8-9, in parallel with the RAISE Summit, the main European gathering dedicated to AI. The 2025 edition truly earned its title of the world’s largest AI hackathon: over 6,000 developers registered across all Tracks, a record certified by the organizing foundation.

Tensions are rising within the Cardano community as a major delegated representative, known simply as “Whale”, has launched a critique of founder Charles Hoskinson and Input Output Global, accusing them of wasting millions in ADA on underdelivered promises. Whale, who reportedly controls around 6 million ADA worth of delegated voting power, declared a blanket rejection of all future proposals from IOG.

In a crypto market plagued by uncertainty, XRP surprises. While Bitcoin wavers and Ethereum experiences sharp fluctuations, Ripple's asset aligns bullish technical signals. Long burdened by its legal troubles, the crypto is now shaping a unique market structure, blending support stability with order book density. This atypical trajectory intrigues analysts and traders. XRP could well be gearing up for a powerful return to levels previously thought unreachable.

In just 13 days, Ethereum ETFs have captured over $4 billion. A record influx shaking up the crypto market and attracting finance giants. Discover why Ethereum could soon dominate the digital asset landscape.

Polymarket wants to launch its own stablecoin. The crypto prediction platform, which currently uses USDC for all its transactions, is considering creating its own stable currency to capture the revenues currently received by Circle. Two options are on the table: a sharing agreement with Circle or an in-house stablecoin.

When Bitcoin flirts with unprecedented highs, the spotlight once again shines on the crypto universe. This spectacular rebound, fueled by ETFs and growing institutional adoption, coincides with the emergence of another phenomenon: the tokenization of real-world assets (Real World Assets or RWA). These hybrid instruments, halfway between traditional finance and Web3, attract a new wave of investors seeking stability and diversification.

The SEC seems finally ready to take a decisive step. Several Bitcoin and Ethereum ETF issuers have just filed modifications to include in-kind redemptions. A key step for these products, which could thus gain in attractiveness and tax efficiency. This long-awaited regulatory breakthrough would radically transform the attractiveness of these financial products.