The debate is growing on social media and in crypto circles: what if autonomous artificial intelligences discovered the interest of bitcoin by themselves? This hypothesis, long relegated to the realm of science fiction, is gaining ground among experts. An unprecedented race could begin between humans and machines to control a resource that has become strategic.

Trading Exchange RSS

Memecoins have faced heavy selling pressure over the past month, reinforcing the view among many traders that the sector’s best days are over. Social media sentiment has turned sharply negative, and market participants are increasingly writing off meme tokens as a failed trend. However, crypto analytics firm Santiment argues that such widespread pessimism may signal a potential reversal rather than a permanent decline.

Bitcoin struggles to stay above $70K as ETFs face significant outflows, reflecting cautious investor sentiment and ongoing market volatility.

Mrinank Sharma, who led the Safeguards Research Team at Anthropic, has stepped down less than a year after the unit was formally launched. His departure has sparked debate across the tech community—not only because of his senior role, but because of the tone of his resignation letter. In it, Sharma warned that “the world is in peril,” pointing to a series of overlapping crises unfolding at once. Many readers interpreted the message as a broader caution about the rapid development of advanced AI systems.

Vitalik Buterin calls for a change of course for prediction markets, which he sees trapped in a short-term speculative logic. According to him, these platforms could become much more than betting tools: real instruments for hedging economic risk. This position comes as these markets gain influence in the crypto ecosystem and beyond.

The lady who manages billions says: AI will break everything, prices will collapse. Central bankers are in the dark. Her solution? Bitcoin, obviously.

A key valuation indicator today places bitcoin at an unprecedented level since March 2023, a period when BTC traded around 20,000 dollars. After several months of correction following its last all-time high, the market shows a reading rarely seen during the cycle. This configuration, based on on-chain data, raises questions about the real state of the market and the position of bitcoin in its current phase.

For years, Bitcoin has been sold as an escape route. A rare asset, outside central banks, supposed to shine when the rest trembles. Except that in 2026, the soundtrack changes: at the slightest twitch in tech, Bitcoin coughs too. And that is more than a market detail. It is an open identity crisis.

Donald Trump's empire continues to expand its footprint in the crypto universe. Trump Media has just filed two new exchange-traded funds focused on major cryptocurrencies with the SEC: a Bitcoin-Ether ETF and a Cronos ETF. This offensive comes as the market goes through a period of marked turbulence.

Bitcoin drops 28% in one month, short positions explode, and investors doubt. Yet, Anthony Pompliano remains convinced: this phase is only a prelude to a historic rise. Why does he see a unique opportunity in this volatility?

A 24-year-old man defrauded nearly 1 million dollars by promising incredible returns in crypto and today he risks 375 years in prison. How did he trap his victims? The chilling story.

Crypto use within human trafficking networks is rising, according to new data from Chainalysis. Yet the firm argues that blockchain’s open ledger may also expose those same networks to investigators. A recent report shows a sharp increase in crypto flows tied to suspected trafficking operations, many of which operate across Southeast Asia. Analysts believe transaction visibility could give law enforcement a tactical edge.

Friday the 13th, lucky day? Bitcoin flirts with its record driven by inflation. The Fed does not move. Truflation already knew. Atmosphere.

As Bitcoin and Ethereum lost ground in Web3 casinos, stablecoins have established themselves as the new currency. Driven by their stability, speed, and massive adoption, they are redefining player habits and the economic structure of online gaming platforms.

The French subsidiary of the cryptocurrency exchange platform Binance confirmed on Thursday that one of its employees was the victim of a burglary at his home. Law enforcement arrested three suspects. This case is part of an unprecedented wave of attacks targeting the crypto sector in France.

In Washington, the regulatory future of cryptos may be decided in the coming months. Amid market volatility, the CLARITY Act stands as a pivotal text for the American crypto industry. Treasury Secretary Scott Bessent advocates for its rapid adoption, believing that legislative clarification could soothe investor sentiment. Behind this tight schedule lies a major political stake: securing the crypto framework before the 2026 electoral balances reshuffle the cards.

Within a few sessions, bitcoin has plunged back into a turbulence zone rarely seen since previous major crashes. On-chain data reveals $2.3 billion in realized losses over seven days, a shock that ranks this episode among the most violent in its recent history. This wave of capitulation follows a brutal correction of BTC, falling heavily after its peak above $126,000.

Bitcoin nears $66,500, and short positions reach unprecedented highs since 2024. Could this extreme pessimism, often a sign of a reversal, trigger a rapid rebound?

The session tastes more like a "breather" than a victory. Yes, Aster, Hyperliquid, and Hedera jumped, and yes, the total crypto market capitalization timidly goes back into the green. But this rebound looks more like a market catching its breath after bad macro news than a real regime change.

A massive expiration shakes the crypto markets this Friday. Nearly 3 billion dollars worth of Bitcoin and Ethereum options mature on Deribit at 8:00 UTC. Traders remain cautious after last week's liquidation shock.

Bitcoin has just erased its hard-earned gains after last week's crash. The world’s leading cryptocurrency falls back towards $65,000, a collateral victim of a panic that hits the tech sector hard. Even precious metals are not spared.

Central bank digital currencies (CBDCs) are moving closer to reality across much of the world. Policymakers often present them as faster and more efficient tools for payments and cross-border transfers. Yet billionaire investor and founder of Bridgewater Associates, Ray Dalio, argues that control remains at stake with such systems.

Bitcoin and the broader crypto market posted modest gains over the past 24 hours, even as fresh U.S. labor data complicated expectations for near-term rate cuts. January’s jobs report showed that hiring remained firm, but growth across several sectors appeared restrained. Markets had hoped for weaker data to strengthen the case for monetary easing. Instead, traders were left facing mixed signals.

The European Parliament has taken a decisive step in the development of the digital euro, endorsing a resolution that confirms its strategic importance for monetary sovereignty and the future of payments in Europe.

Did bitcoin really hit the bottom at $60,000? Michael Terpin, CEO of Transform Ventures, warns of a new drop to $40,000 before a sustainable recovery. Between historical cycles and market fragility, his analysis divides experts.

The crypto market sends contradictory signals. Indeed, investor sentiment has just reached a historic low, reflecting a strong distrust towards bitcoin. At the same time, some data from Binance indicate a slowdown in selling pressure. This discrepancy between market psychology and real flows raises a central question: are we witnessing a simple technical lull or the beginnings of a lasting rebalancing?

Bitcoin is going through a critical phase, but CryptoQuant encourages investors to stay calm. We tell you more in this article.

Crypto ETFs were supposed to mark the definitive entry of institutional investors into the ecosystem. A few months later, the reality is more mixed. While the market tries to identify a bottom, a clear gap is widening between bitcoin and Ethereum. The latest figures show that ETH ETF holders find themselves in a significantly more exposed position than their counterparts invested in Bitcoin ETFs. An imbalance that raises questions about the relative strength of the two assets during this correction phase.

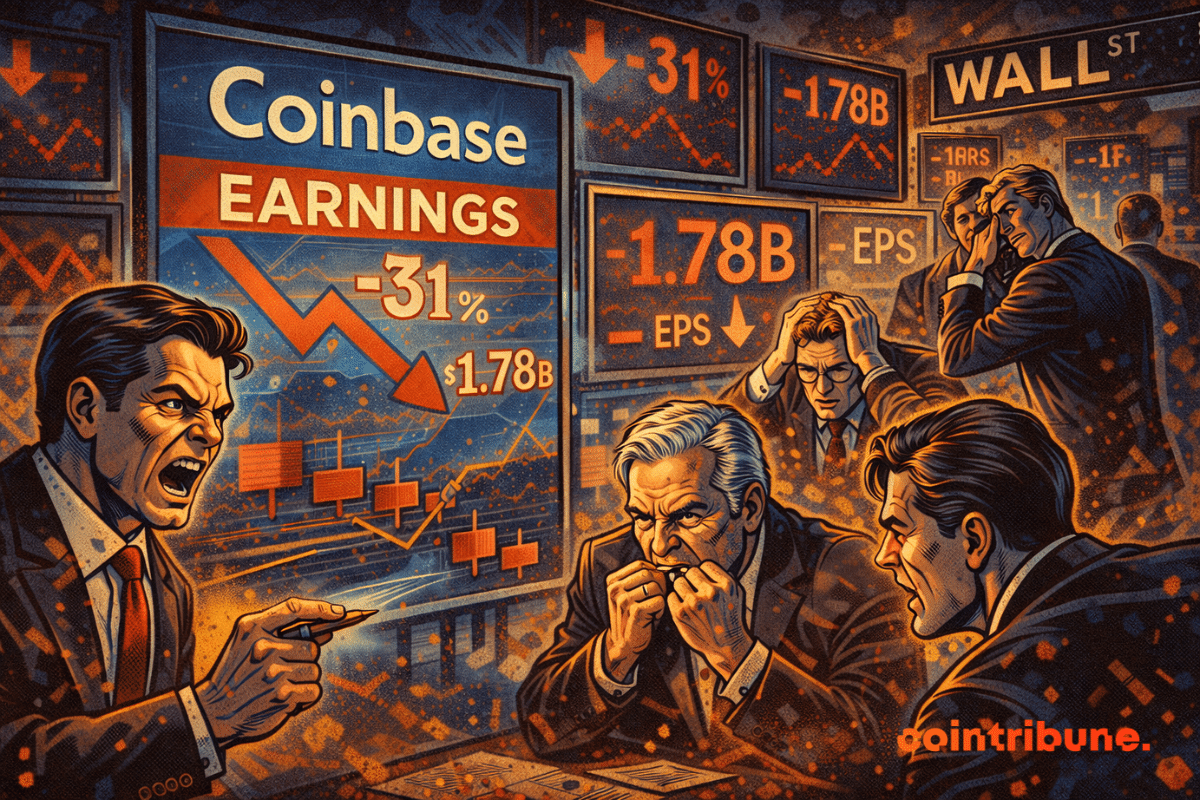

Coinbase loses 667 million. Yet, its subscribers are booming. Its stablecoins generate revenue. So do its loans. So? It's the trading that coughs. And Washington that sleeps in.

The boundary between traditional and decentralized finance continues to erode. This time, it is BlackRock that is shifting the lines. The global asset management giant has connected its tokenized fund BUIDL, backed by US Treasury bonds, to the Uniswap infrastructure. An initiative that goes beyond simple technological experimentation, as it materializes the entry of a major institutional player onto the operational rails of DeFi.