Bitcoin’s short-term risk metrics have slipped into extreme territory, reviving debate over whether the market is nearing another major bottom. A widely followed measure, the short-term Sharpe Ratio, has dropped to around -38.38—a level seen only a handful of times in Bitcoin’s history. Analysts tracking on-chain and statistical data say similar readings have previously aligned with long-term buying opportunities.

une

After the closure of Garantex, Russia did not lose its channels for circumventing sanctions. It multiplied them. Five new crypto platforms have taken over, according to an alarming report from Elliptic.

Ethereum is putting an old crypto promise back at the center of the game. Not the marketing promise. The political promise. The one that says a public network should not depend on the mood of an intermediary, a blacklist, or a "we'll see later." Vitalik Buterin just reignited this cypherpunk thread with a simple, almost brutal message: Ethereum "going hard." Behind the phrase, there is a very concrete technical choice: FOCIL, for Fork Choice Enforced Inclusion Lists, announced as the flagship on the consensus side of the upcoming Hegota upgrade, expected in the second half of 2026.

The big fish are emptying their pockets on Binance. The whale ratio soars to 0.64. Meanwhile, small holders watch their altcoins sink. Nice!

The post-election rally in the US was short-lived. Less than a year after the November 2024 presidential election, the crypto market has erased almost all the gains accumulated in its wake. Driven by a spectacular surge in altcoins, the sector peaked in October 2025 before sharply giving up ground. Since this peak, capitalization has fallen by about 40%, ending a bullish momentum that seemed firmly established. The electoral cycle ultimately did not fulfill its promises.

Wall Street has just experienced one of its worst weeks with $8.3 billion in stocks sold in only seven days. A massive capital flight that raises questions: is this a sign of an imminent crisis or a historic opportunity for Bitcoin and cryptos?

Donald Trump raises tariffs to 15%. The decision, announced in a tense electoral atmosphere, revives the American protectionist line and puts trade policy back at the center of the economic debate. Traditional markets reacted. Cryptos, however, remained stable. This contrast raises questions about the real sensitivity of the crypto market to political and trade shocks.

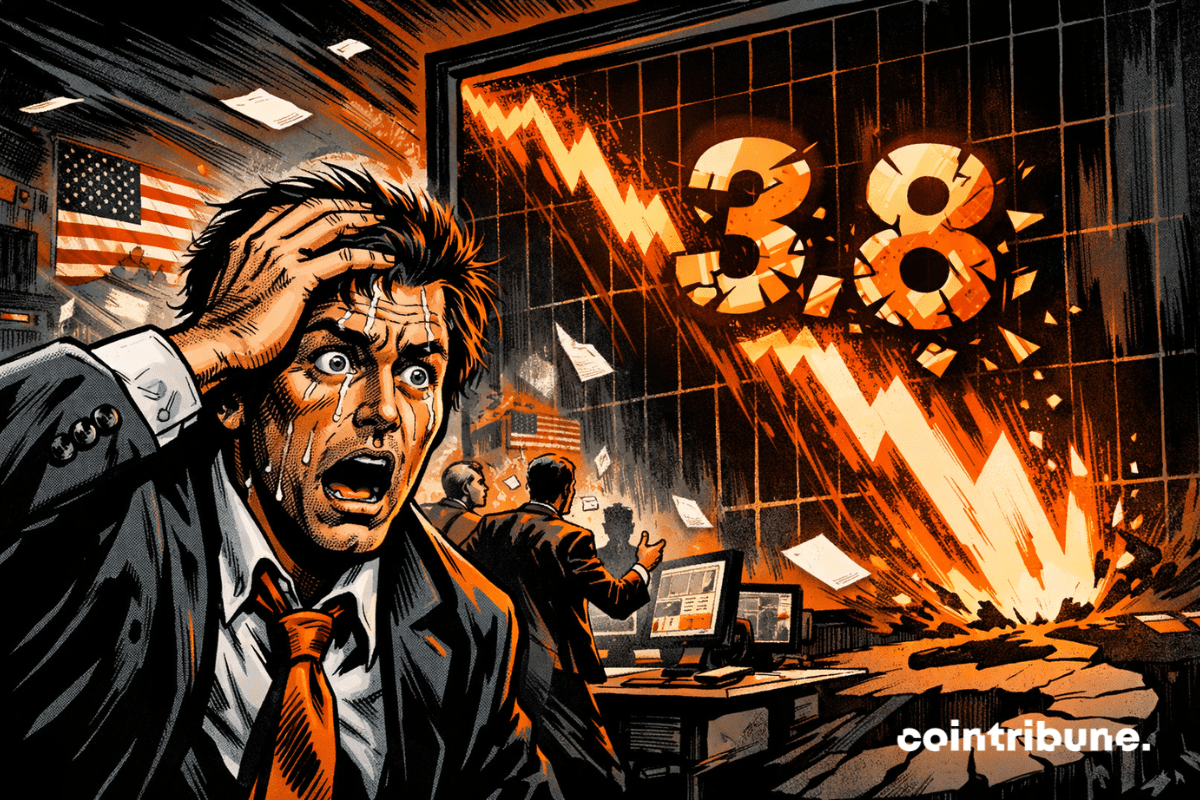

US spot Bitcoin ETFs have seen a fifth consecutive week of net outflows. In total, nearly 3.8 billion dollars have left these investment vehicles since mid-January. Institutional investors are tightening ranks, but for how long?

By setting a deadline of about ten days to decide between a diplomatic agreement and military action, Donald Trump has placed Iran back at the center of a high international tension sequence. The American president stated he is considering a limited military strike to pressure Tehran on its nuclear program, even as discussions are ongoing. Between strategic pressure, naval deployment, and a tight timetable, Washington and Iran are now advancing on a particularly fragile diplomatic line.

MARA makes a big move by taking control of 64% of Exaion, EDF's technological gem. A strategic acquisition marking the end of traditional Bitcoin mining and the start of an era dominated by artificial intelligence (AI).

While the price of Bitcoin seems to stagnate, the Lightning Network is breaking usage records: 5.22 million transactions and over 1 billion dollars transferred, a sign of growing adoption and an ecosystem ready for the future.

While the crypto exchanges sector is going through a consolidation phase accelerated by MiCA regulation, Kraken positions itself as one of the strongest players in the European market. Dorian Vincileoni, Head of Regional Growth for Western Europe and the Baltic countries at Kraken, shares his vision on market evolution, platform strategic priorities, and the challenges of building a sustainable crypto infrastructure. Interview.

Bitcoin has only two outcomes according to Michael Saylor, either $0 or 1 million $. A radical prediction that shakes the crypto market. Between total collapse and financial revolution, which scenario will happen according to you?

While the cryptocurrency market undergoes a phase of decline marked by strong risk aversion, Tether's USDT shows an opposite dynamic. The stablecoin records record adoption, driven by practical uses such as savings, payments, and cross-border transfers, confirming its central role in crypto ecosystem liquidity and stability.

Washington opens a new explosive trade front. After being overruled by the Supreme Court on his use of emergency powers, Donald Trump immediately announced a 10% global tariff on imports. This decision renews trade tensions at a time when markets remain particularly sensitive to political shocks. Between institutional confrontation, alternative legal strategy, and increased volatility risk, this episode could have effects far beyond U.S. borders.

After absorbing 230,000 BTC from a massive wave of sales, the largest wallets have triggered a "V" shaped accumulation that reshuffles the market cards. In an environment marked by high volatility and significant flows to exchange platforms, this strategic turnaround intrigues. Rapid rebuilding of reserves, large movements towards Binance: on-chain signals suggest a possible shift in the balance between supply and demand.

The threshold of 50% of ETH "in staking" announced by Santiment looks like a reassuring milestone, almost triumphant. But it triggers a controversy: does this figure really measure active staking or only accumulated deposits? The difference is not trivial, as it changes the reading of supply, network security, and market sentiment.

The Clarity Act could change everything for crypto, and Brad Garlinghouse bets 90% on its adoption in April 2026. A regulation that would finally clarify the status of digital assets, reduce legal uncertainties, and pave the way for a new era for Ripple and stablecoins.

Nearly $4 billion has left Bitcoin ETFs in five weeks. Indeed, investment vehicles meant to embody Bitcoin's institutional anchoring are going through a phase of sustained withdrawals. After months of record inflows, the mechanism reverses and raises questions. Is this a mere tactical adjustment or a deeper change in investors' perception regarding indirect exposure to the flagship asset?

Quantum scares, bitcoin falls. But devs work, seed phrases save, and 1.7 million BTC sleep. The real question lies elsewhere.

One can see a Bitcoin pullback as a diagnosis… or as a mirror. Brian Armstrong, CEO of Coinbase, clearly chooses the second option: according to him, the recent drop looks more like a collective nervous breakdown than an engine failure. The network is not damaged. It is the emotions that make the noise.

On April 15 and 16, 2026, the Carrousel du Louvre will host the Paris Blockchain Week, an event that has become in a few editions the must-attend meeting where traditional finance and digital assets stop observing each other and finally start to dialogue. Far from crypto conferences focused on speculation and community narratives, PBW 2026 embodies a paradigm shift: financial institutions are no longer spectators, they become actors of the blockchain infrastructure. Analysis of an event that materializes the maturity of a sector.

Stablecoins reach $141 billion of illicit activities in 2025. A record that reignites the debate on global crypto regulation!

While the bitcoin price struggles to regain its peaks, the network itself shows robust health. The mining difficulty has just recorded its largest increase since 2021, a paradox worth examining.

Bitcoin network activity has fallen nearly 50% since 2021, revealing a sharp drop in on-chain engagement even as market caps climbed.

Ethereum is about to reach a decisive milestone with Glamsterdam, a major update planned for 2026 aimed at deeply transforming the performance, security, and user experience of the network. Between increased scalability, smart wallets, and preparation for the post-quantum era, this evolution could redefine the future of the Ethereum blockchain.

Bitcoin staggers, but institutional capital does not disengage. While crypto has erased nearly 50% from its peaks, US spot ETFs still show $53 billion in cumulative net inflows. A striking contrast with the atmosphere of distrust dominating the market. Behind the recent withdrawals, the figures tell a deeper dynamic: that of a financial instrument that has far exceeded initial projections and is reshaping institutions’ relationship with bitcoin.

Bitcoin plunges and extreme fear dominates the market. However, institutions are quietly accumulating. Should you buy now?

Bitcoin enters a zone of strategic turbulence. Behind the apparent price stabilization, the derivatives market sends a clear signal: professional investors strengthen their defensive positions. The options structure suggests that a return to 60,000 dollars becomes a credible scenario. At the same time, institutional flows contract and US Bitcoin ETFs record net outflows. Between tactical repositioning and capital caution, the market balance is shifting.

The United States Supreme Court has just struck hard. In a rare decision, it declared illegal the international tariffs imposed by Donald Trump, removing a trade tool he wielded as a geopolitical weapon. A judicial slap that could reshuffle the cards of his economic policy. But how far will this confrontation between the White House and the judiciary go?