Standard Chartered sounds the alarm: crypto treasury companies, built around the accumulation of Bitcoin, Ethereum, and Solana, face a major crisis. The collapse of the mNAV weakens their business models and signals a consolidation phase where only the strongest players will be able to continue growing.

une

U.S. spot Bitcoin exchange-traded funds (ETFs) are flying high at the moment, pulling in investments totaling $2.3 billion over the past week. Following a five-day inflow streak from September 8 to September 12, BTC investment vehicles recorded their best weekly outing in the past three months.

Gemini is moving toward a settlement with the SEC over its years-long Earn case, marking progress in a key dispute while also celebrating its $425M Nasdaq debut.

France threatens to block the MiCA passport for certain crypto companies deemed too lenient. Towards stricter regulation in Europe?

BitMine Immersion, chaired by Tom Lee, has solidified its position as the largest Ethereum treasury holder after its latest accumulation. The firm disclosed on Monday that its combined crypto and cash holdings now stand at $10.8 billion. The company’s aggressive acquisition strategy has pushed its Ethereum balance above 2.15 million ETH, highlighting its determination to dominate long-term blockchain investments.

The US markets celebrated Monday the confirmation of a preliminary agreement between Washington and Beijing regarding the future of TikTok. Oracle, the favorite to acquire the Chinese platform, jumped more than 3% while the S&P 500 crossed the symbolic threshold of 6600 points for the first time.

PayPal plays the magician: a simple link, and hop, your cryptos fly by SMS. But behind the sparkling innovation, who really holds the strings of your digital payments?

The first ETFs exposed to XRP and Dogecoin will be launched this week in the United States. Carried by Rex Shares and Osprey Funds, these products mark an unprecedented regulatory breakthrough for two cryptos long kept away from traditional markets. This milestone broadens the range of assets accessible to investors, beyond bitcoin and Ethereum.

Driven by 638 million dollars in inflows on its ETFs in one week, Ethereum establishes itself as the asset of the moment among institutional investors. However, technical and historical signals call for caution. With 99% of the supply currently in profit and a traditionally bearish September, the market could quickly turn.

Bitcoin wavers, whales sell, Wall Street sulks... and Strategy laughs. The former MicroStrategy continues to fill its vaults, defying volatility and skeptics of a crypto market that is always surprising.

Large Bitcoin holders have resumed selling after a brief price surge, while long-dormant wallets reactivate and ETFs boost demand.

Wednesday, bitcoin is at stake: between the Fed's boost, the 117,000 $ wall and hungry whales, guaranteed suspense for the crypto market star.

The Qubic blockchain is set to make its mark at Token 2049 Singapore, taking place from October 1-2, 2025. This participation represents a decisive milestone for the protocol that claims the title of "fastest blockchain ever certified" with an impressive throughput of 15.5 million transactions per second (TPS) and after a highly publicized demonstration of its UpoW technology on Monero.

Native Markets has won the race to issue and manage Hyperliquid’s dollar stablecoin after securing the USDH ticker following a heated week-long bidding process. The governance contest, which saw top industry players like Paxos and BitGo place bids, has sparked several reactions among many within the crypto industry.

The crypto ecosystem reaches a new milestone with the revolutionary announcement from OKX partnering with Tether to deploy USDT0 on its Layer 2 X Layer network. This major innovation, launched on September 9, 2025, redefines stablecoin interoperability and positions OKX as the essential exchange for the future of decentralized finance.

President Donald Trump has renewed his efforts to remove Federal Reserve Governor Lisa Cook just days before the central bank is expected to deliver its first rate cut in nearly a year. The case has turned into a controversial legal battle that is now overlapping with one of the most significant policy decisions in the US economy. As the administration continues with its appeal, new evidence looms to erode its claims and heightens its political and financial stakes.

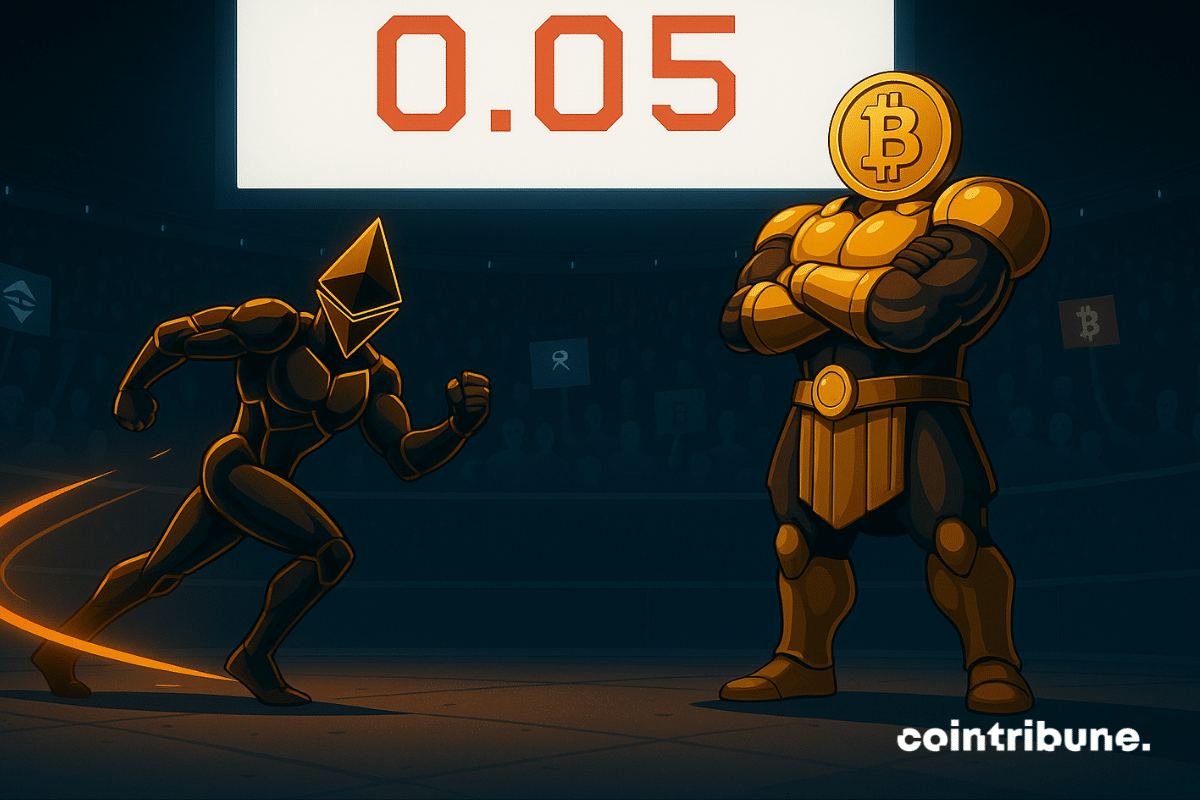

Ethereum’s ETH/BTC ratio remains under 0.05 as the cryptocurrency navigates price swings, investor activity, and market trends.

According to the latest on-chain data, 92% of the bitcoin supply is now in profit. A figure that attests to the strength of the market... but also marks a potentially delicate turning point. Historically, this level has preceded both rallies and sharp corrections. As euphoria gains ground, several indicators suggest the market could waver.

Capital Group’s crypto investment appears to have paid off, according to recent reports, with its $1 billion Bitcoin-related stock surging by over 400%. The American asset management firm entered the Bitcoin treasury market a few years ago, following significant investments in Metaplanet and Strategy.

The crypto scene has once again proven that no protocol, no matter how popular, is completely safe. The Shibarium bridge, a strategic gateway between the Layer 2 of the same name and Ethereum, was the target of a swift flash loan attack that siphoned the equivalent of 2.4 million dollars. Behind this move, a maneuver both technical and psychological demonstrating the persistent flaws of decentralized security.

European regulators are targeting $17.5 billion of cat bonds held in UCITS funds. ESMA considers these securities, exposed to natural disasters, too complex and risky for retail investors. If the European Commission follows this recommendation, a wave of forced sales could shake an already strained market.

At Pump.fun, yesterday's chaos becomes today's eldorado: a memecoin inflated with billions, crazy promises, and regulators grimacing at the show.

While the crypto market stalls, Arthur Hayes tempers the prevailing impatience. The cofounder of BitMEX believes that criticisms directed at bitcoin ignore a fundamental lever: global monetary policy. In a recent interview, he suggests that continued money printing by central banks could extend the crypto bull cycle until 2026. This macroeconomic analysis contrasts with the widespread pessimism and invites investors to reassess their benchmarks.

Ethereum envisions itself as a digital ghost: invisible transactions, secret votes… and regulators seeing red. The blockchain is preparing its revolution, between Big Brother and crypto utopia.

As the war in Ukraine enters a critical phase, Donald Trump throws a wrench in the diplomatic pond. The American president stated that no new sanctions against Moscow would be taken as long as NATO countries continue to buy Russian oil. This statement exposes the persistent fractures within the Alliance and revives the question of its strategic coherence towards Russia.

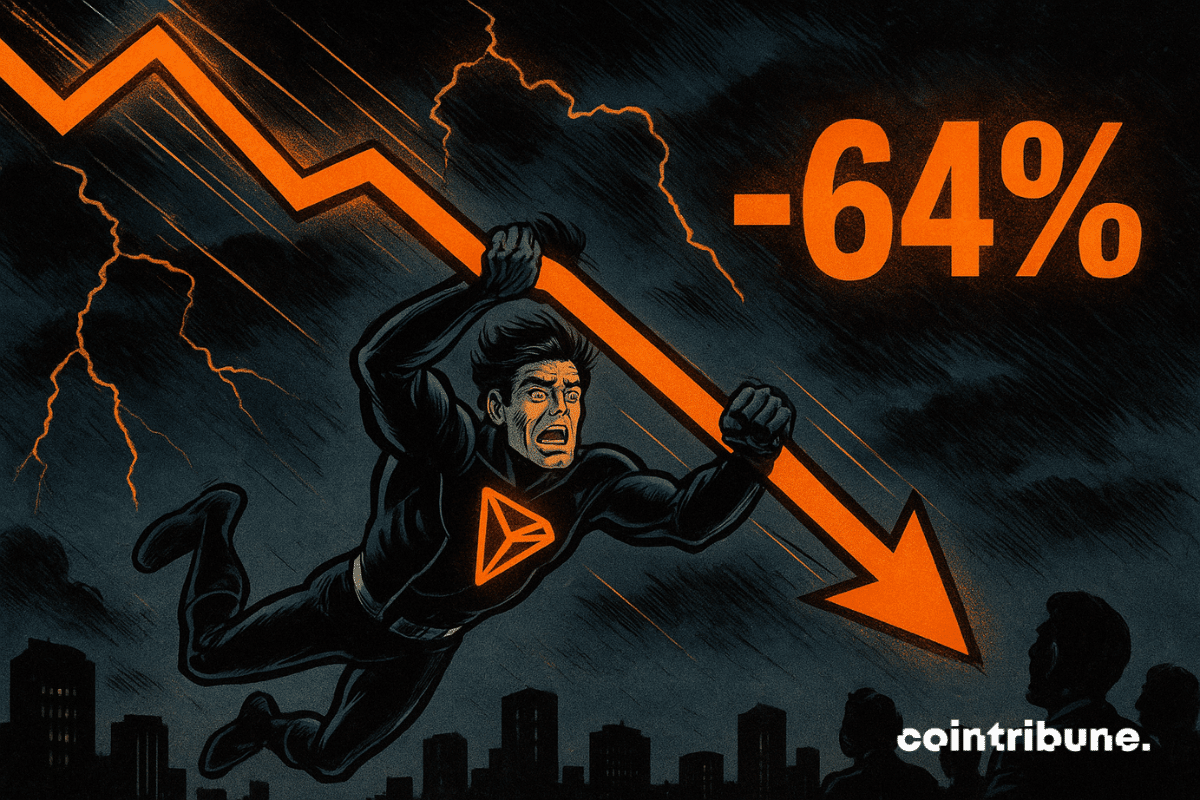

Tron’s decision to lower transaction fees has quickly reduced the daily revenue earned by its block producers. Within 10 days of the fee change, revenue dropped sharply, according to recent on-chain data.

OpenAI wants more than a partnership: under the guise of AI and philanthropy, the company sharpens its independence from Microsoft. Throne preserved or future masked rivalry?

This Wednesday, September 17, the US central bank is expected to cut its key interest rate by 25 basis points. A decision already priced in by the markets, but far from trivial, as inflation remains above target and employment slows down. Behind this monetary shift, investors are looking for a signal. Temporary shock or catalyst for a new cycle? From bitcoin to gold, through Wall Street, all assets are watching Jerome Powell’s verdict.

Ethereum shines in the crypto sky, but its brains struggle to make ends meet. Jackpot for the blockchain, crumbs for the coders: find the error, or the irony of the century.

On September 13, Binance Coin (BNB) crossed a symbolic threshold by briefly surpassing the market capitalization of the Swiss bank UBS. Such an event illustrates the rising power of cryptos against traditional financial institutions. Changpeng Zhao, co-founder of Binance, immediately reacted, calling on banks to "adopt BNB". As the crypto reaches a new all-time high, this statement revives the debate about the integration of native tokens in banking strategies in the era of decentralized finance.