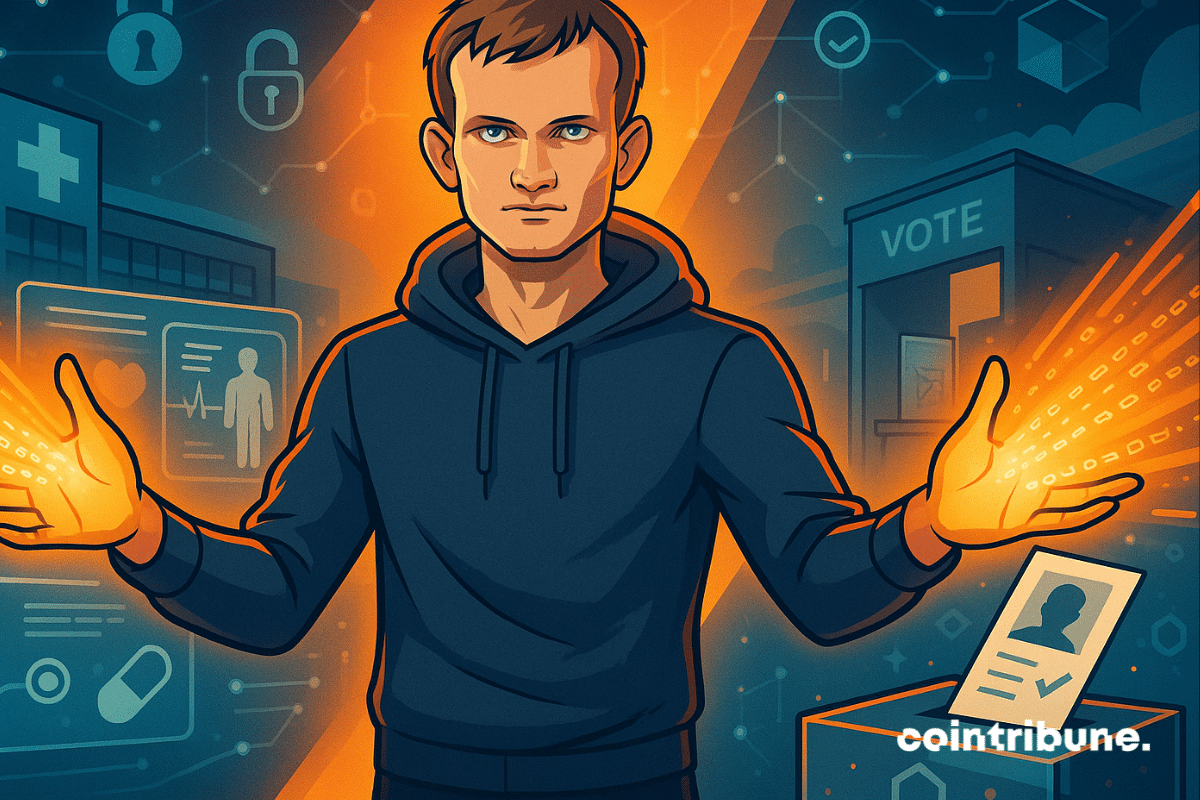

The battle around "Chat Control" goes far beyond a simple technical issue. Behind this controversial law that the European Union is trying to pass is the very definition of digital privacy at stake. Vitalik Buterin, a major figure in crypto, has chosen to oppose it head-on, warning of a project with potentially explosive consequences.

une

While the crypto market goes through a wait-and-see phase, XRP wavers on a critical threshold. Caught between alarming technical signals and persistent regulatory uncertainty, Ripple's asset could suffer a drop of 8 to 10%. A tension zone is setting in, where every indicator could tip market sentiment. For investors, the stake is no longer just the price but the psychological trajectory of an iconic asset.

What if October became Solana's month? Several spot ETFs with staking could be approved by the SEC within two weeks. A decision that could trigger a new institutional momentum and reshape the crypto landscape. But will this regulatory recognition be enough to propel SOL to a status comparable to Bitcoin and Ethereum?

Bitcoin’s rally is showing signs of fatigue after a sharp sell-off pushed prices under $109,000. Long-term holders have realized billions in profits while exchange-traded fund inflows slow, raising concerns that the market may be entering a cooling phase similar to past cycle tops.

SWIFT explores blockchain for its interbank messaging system, aiming to improve efficiency, security, and regulatory compliance.

Leading blockchain analytics platform is set to test the heights of artificial intelligence in cryptocurrency by unveiling a mobile agent designed to make trading more interactive. The crypto intelligence firm aims to simplify on-chain trading by introducing a natural conversation feature.

Has Trump found the cure for plummeting cryptos? WLFI buys back its tokens burned with the financial blowtorch. A hastily botched operation or a finely tuned strategy? To be seen.

What if stablecoins, meant to embody stability, became a threat to global financial balance? In a recent report, Moody’s Ratings warns against their growing adoption, especially in emerging countries. These assets, now used far beyond traditional crypto circles, could weaken central banks' control, erode bank deposits, and cause systemic shocks.

The PCE inflation figures for the month of August, published this Friday, September 27, confirm apparent stability, with progress as expected. A key indicator for the Federal Reserve, the PCE remains above the target, while American consumption continues to surprise with its strength. In a context of monetary tension, these data maintain uncertainty about the future trajectory of interest rates.

BlackRock has filed for a new Bitcoin Premium Income ETF designed to generate yield through a covered-call strategy, expanding its crypto offerings.

The U.S. exchange-traded product (ETP) market for digital assets is taking another step forward. With regulators broadening the framework for crypto funds, XRP has now been included in a Nasdaq-listed multi-asset spot crypto ETF, giving investors easier access to a wider set of cryptocurrencies.

xAI takes OpenAI to court, alleging that former employees shared confidential AI technology, giving OpenAI access to proprietary information.

Vanguard, bastion of financial conservatism, is preparing to take an unexpected step towards cryptos. The asset management giant is considering opening access to crypto ETFs on its brokerage platform. If this development materializes, it would mark a major strategic turning point and strengthen the anchoring of these assets in the institutional financial landscape.

From reactive to proactive. OpenAI changes the paradigm with ChatGPT Pulse, an AI that no longer waits for your questions but anticipates your needs. Instead of waiting for your questions, the AI works in the background to prepare personalized daily updates. For crypto enthusiasts, this means receiving daily signals and insights even before opening their trading platforms.

Decentralized finance is about to reach a new milestone. Aave, a leading crypto lending protocol, is preparing to launch its V4 update by the end of 2025. After crossing the symbolic mark of 50 billion dollars in net deposits, the ecosystem is ready for a major transformation. But what will this new version concretely bring?

While Aster is leading, Bitwise plays its joker: an ETF on a declining crypto. Should you bet on HYPE... or on the high hopes of financiers?

The People’s Bank of China (PBOC) has just inaugurated an international center dedicated to the digital yuan in Shanghai. A strong signal: Beijing wants to impose its e-CNY as a pivot of a new global monetary order. Can this initiative really challenge the dollar’s hegemony and compete with stablecoins dominated by the greenback?

A brand new DEX, a former Binance boss behind the scenes, billions pouring in... Aster propels crypto into a frantic dance between hype, incentives, and suspicious concentration.

Solana records a historic high: 71.8 million SOL are engaged in futures contracts. This peak in open interest could suggest a rise in strength. However, the crypto drops 18% in one week, marking one of the worst market performances. This discrepancy between bullish speculation and price collapse raises questions: is the market fueled by excessive leverage?

Vitalik Buterin considers the Fusaka upgrade and its PeerDAS technology as a decisive turning point for the future of Ethereum. By revolutionizing blockchain data management, this innovation could well solve the complex equation between scalability and decentralization.

Bitcoin briefly plunged below $109,000, recording a three-week low. Hours before the expiration of $22 billion in options scheduled for this Friday, pressure is mounting among investors. In a context of increased volatility and macroeconomic uncertainties, positions are being urgently readjusted. The crypto market is entering a decisive sequence where each level crossed could amplify upcoming movements.

Facing a tense economic context and persistently high rates, some companies are revising their cash management strategies. The latest is the Chinese company Jiuzi Holdings. Listed on Nasdaq but little known to the general public, the Chinese company has just authorized an investment of up to 1 billion dollars in cryptocurrencies. This is an unexpected shift for an actor outside Web3, who is now betting on Bitcoin.

Nine major European banks join forces for a simple and ambitious bet: a euro stablecoin, tailored for MiCA, designed from the start for on-chain uses. The consortium includes ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. First issuance targeted: second half of 2026.

When cryptos become mirages, scammers become experts: 100 million stolen, 23 countries affected, 5 crooks arrested. And meanwhile, Bitcoin looks elsewhere, impassive.

The tokenization of real assets (RWA - Real World Assets) represents one of the most promising sectors of the crypto ecosystem in 2025-2026. The integration of recognized assets on the blockchain through RWAs constitutes a significant innovation that is a central narrative of the 2024-2025 crypto season. In this dynamic context, Real Finance (REAL) positions itself as a major player by developing a complete infrastructure to facilitate the integration of real-world assets into the Web3 ecosystem.

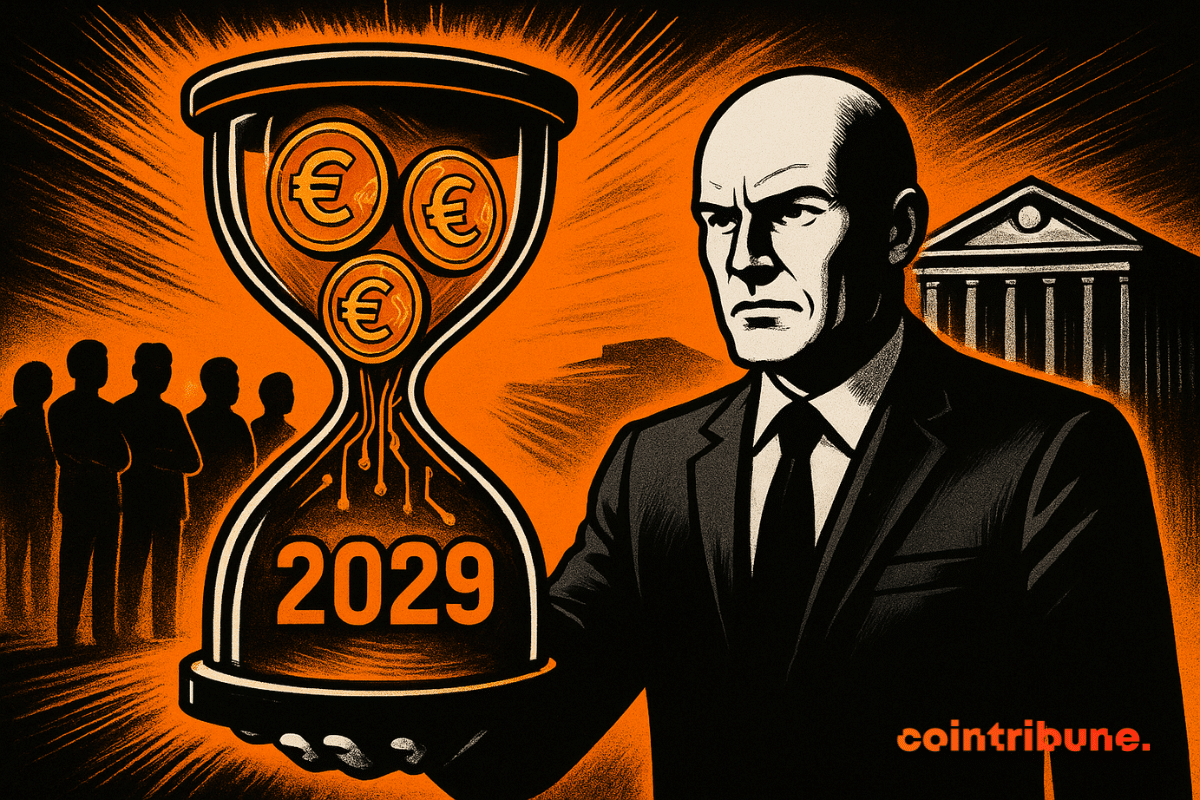

Europe’s digital euro may not be ready for mainstream use in the near or medium term, according to ECB Executive Board member Piero Cipollone. Despite recent progress in discussions and political negotiations, Cipollone noted that mid-2029 remains the most realistic timeframe for a launch, as key technical decisions are still pending.

Vitalik Buterin warns that closed systems in healthcare, finance, and governance threaten trust and urges open, verifiable, and privacy-focused technology.

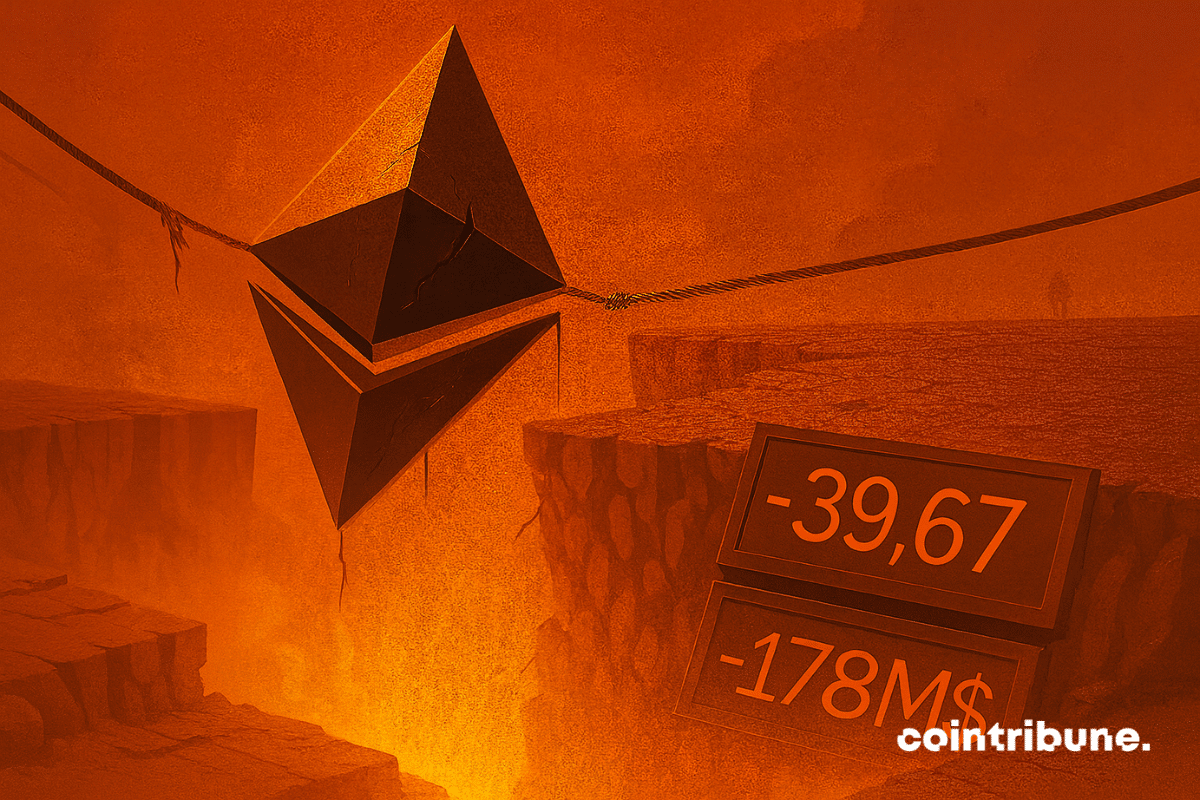

Ethereum falls below $4,000. Liquidations, ETFs outflows, but record accumulation behind the scenes. Complete analysis of the reversal.

Cryptocurrency activity is growing worldwide, led by the Asia-Pacific region, with Latin America and Africa also seeing notable increases.

After losing its top position to Tron in March, Ethereum has surged back to reclaim its place as the leading network for USDT, with its supply reaching $80 billion. Although both networks maintained high supply levels of roughly $75–$80 billion for most of the year, this reversal signals a key shift in infrastructure preferences.