The Bitcoin Giant MARA Takes Over 64% of Exaion, EDF Subsidiary

MARA Holdings has just formalized a major acquisition, a 64% stake in Exaion, an EDF subsidiary specializing in IT infrastructure and artificial intelligence. A strategic move that confirms the transition of Bitcoin miners toward more stable activities, such as AI and cloud computing.

In Brief

- MARA completes the acquisition of 64% of Exaion, an EDF subsidiary specializing in IT infrastructure and AI.

- A redesigned governance with Xavier Niel and Fred Thiel on the board to accelerate MARA’s transition to AI.

- MARA’s acquisition of Exaion reduces dependence on bitcoin and positions MARA as a key player in data centers and cloud computing.

MARA Takes Over Exaion, EDF’s AI Subsidiary

The announcement came on February 20, 2026. MARA Holdings has finalized the acquisition of 64% of Exaion, after obtaining the necessary regulatory approvals. This operation, initiated in August 2025 with EDF Pulse Ventures, allows MARA to establish a strong presence in Europe and diversify its activities beyond Bitcoin mining.

The Exaion board of directors will now include three representatives from MARA, three from EDF Pulse Ventures, and one from NJJ Capital, Xavier Niel’s investment vehicle. Fred Thiel, CEO of MARA, and Xavier Niel will also sit on the board, further strengthening the synergy among the partners.

This acquisition fits a clear strategy. Indeed, the goal is to reduce dependence on bitcoin, whose margins shrink with increased mining difficulty. By betting on Exaion, MARA positions itself in a growing market, that of data centers and AI. This is done by benefiting from EDF’s expertise in energy and infrastructure.

Bitcoin Miners Turn to AI

MARA’s transition to AI and data centers represents both an opportunity and a risk. On one hand, this diversification could stabilize revenues and attract new capital, particularly through strong partnerships with EDF and NJJ. On the other, transition costs and increased competition in data centers could weigh on profitability.

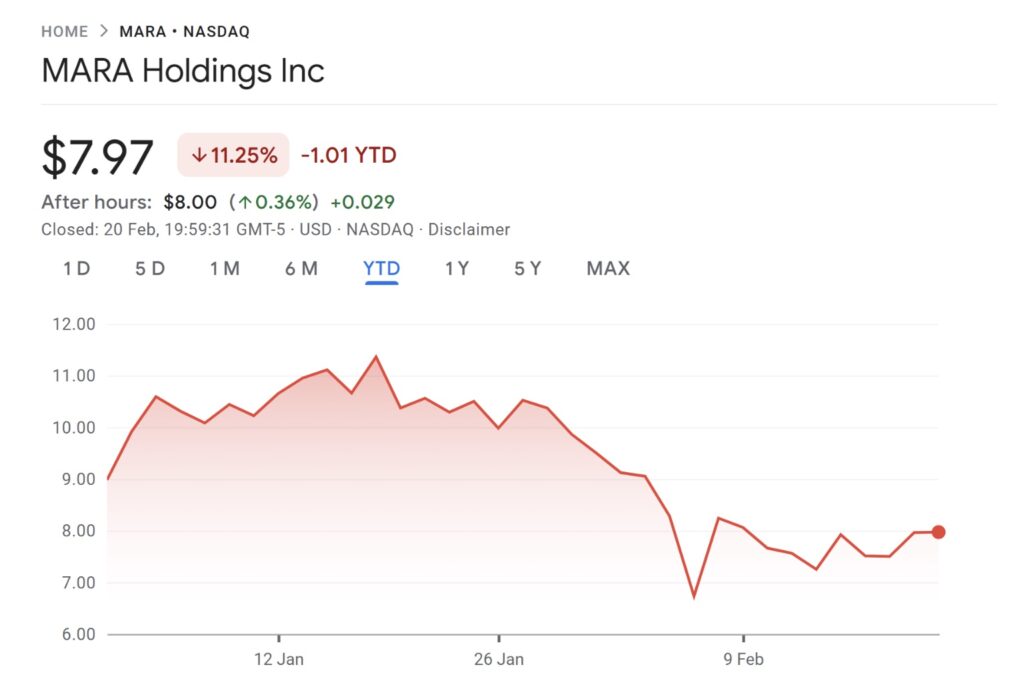

MARA’s stock price, down 12% year over year, reflects these uncertainties. However, the outlook remains interesting. If the Exaion integration strategy pays off, MARA could become a key player in AI, with more stable dividends and increased valuation.

On a larger scale, this transition questions the future of Bitcoin mining. Players who manage to diversify will survive, while those remaining dependent on pure mining might disappear. A revolution is underway, and its consequences on the crypto market will be major.

With the acquisition of Exaion, MARA proves that the future of Bitcoin miners lies with AI and data centers. A bold strategy, but necessary in the face of shrinking BTC margins. This transition could well redefine the industry, between opportunities and challenges. What if Bitcoin mining was just one chapter in their story?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.