Toncoin reshaping the crypto market: analysis of April 11, 2024

After consolidating for several months, the price of Toncoin has discovered a new range. Let’s examine together the future prospects for TON.

Status of Toncoin (TON)

After reaching a low of around $1 during the summer of 2023, Toncoin garnered buying interest, bringing it just below its all-time high of around $3. From this level, the cryptocurrency began a consolidation phase, forming a symmetrical triangle for over four months. It is worth noting that this pattern created a significant value area. It wasn’t until the end of February 2024 that Toncoin broke out of this zone upward, propelling it towards new historic highs.

At present, one Toncoin is worth $7.5. Within the span of seven weeks, TON has recorded a rise of 258%, while the overall cryptocurrency market has recently lost momentum. Toncoin, therefore, rebounded on its 50 and 200-day moving averages, confirming the notion that TON’s medium and long-term trend is bullish. On the side of the cryptocurrency’s momentum, it is unsurprising to see an upward revision, as indicated by oscillators and the price of Toncoin itself. Although this strengthens the market, it is important to note that this could also signal a period of overbuying that might result in a downward correction.

The current technical analysis was conducted in collaboration with Elie FT, an investor and trader passionate about the cryptocurrency market. Today a trainer at Family Trading, a community of thousands of independent traders active since 2017. You will find Live sessions, educational content, and mutual aid around financial markets in a professional and warm atmosphere.

Focus on derivatives (TONUSDT)

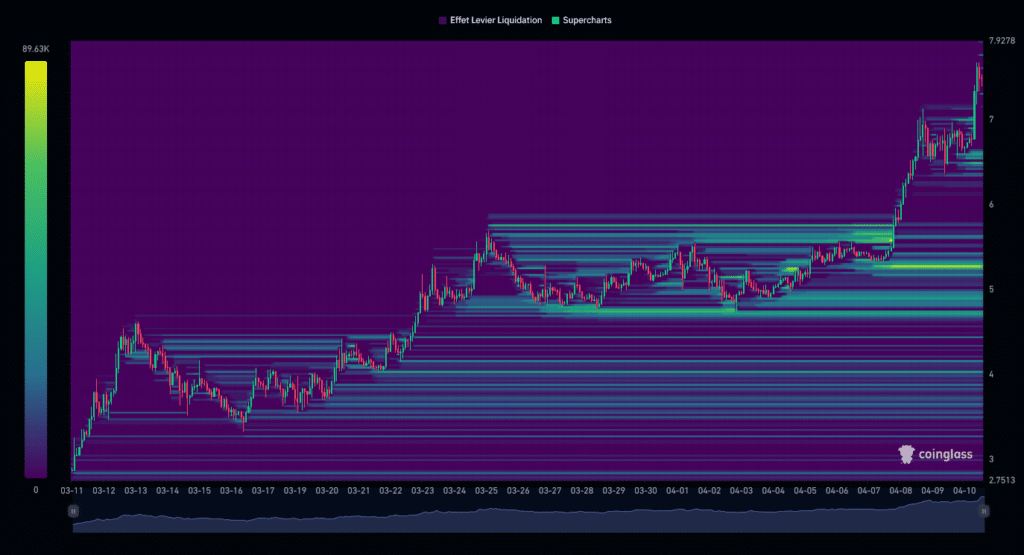

The open interest on the TON/USDT contracts has evolved in parallel with its price, which is on an upward trend. Indeed, since April 1st, the open interest for Toncoin contracts has experienced an increase of more than 75%. This growth was marked by short position liquidations during bullish periods and long position liquidations during bearish periods, all within a context of a generally positive funding rate. This suggests that investor interest in TON/USDT perpetual contracts is predominantly focused on buying.

The heat map of TON/USDT liquidations over the last month shows that the liquidation zone around $5.4 has generated a notable buying interest for the cryptocurrency. Currently, the most significant liquidation zones are located below the current price of TON, with the nearest zone identified around $6.5. Lower down, the $5.2 area also deserves mention. The price approaching these levels could massively trigger orders, thus increasing the risk of a period of heightened volatility for Toncoin. These zones are therefore crucial points of interest for investors.

Assumptions for Toncoin’s price (TON)

- If the TON price maintains above $5, we could anticipate a bullish continuation up to the $8 or even $8.5 level. The next resistance to consider, if the upward movement continues, would be the psychological threshold of $10. At that stage, it would represent an increase of more than +40%.

- If the TON price fails to hold above $5, we could contemplate a return to $4 or even $3.5. The next support to consider, if the bearish movement continues, would be around $2.7. At that stage, it would represent a decrease of nearly -64%.

Conclusion

Toncoin has demonstrated remarkable resilience and a sustained bullish trend since the summer of 2023, exceeding expectations in recent weeks despite a less favorable dynamic in the overall cryptocurrency market. This ascending trajectory, supported by various indicators, confirms the strength and long-term growth potential of TON. However, investors should remain cautious of overbuying signals that could precede a correction. Therefore, it will be crucial to carefully observe the price’s reaction to the various key levels to confirm or deny the current assumptions. It is also important to stay alert to potential “fake outs” and market “squeezes” in each scenario. Finally, let’s remember that these analyses are based solely on technical criteria, and the price of cryptocurrencies can also evolve quickly due to other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more