Unlocking the Value of BLD: An Investor’s Guide to Hidden Gems in Web3

Web3’s landscape is witnessing unprecedented growth with its current market valuation at USD 2.86 billion. And it’s expected to soar to USD 116.51 billion by 2033. As it evolves, the importance of strategic investments becomes increasingly apparent. But investing in web3 goes beyond speculation, it requires a discerning eye to select promising tokens. In this analysis, we zeroed in on BLD, the native token of Agoric, exploring its potential as a hidden gem within the web3 universe.

Investment Lens: Agoric’s Foundation

What is the BLD token?

BLD isn’t just a token; it’s the powerhouse of Agoric’s ecosystem. Functioning as a staking token, it plays a crucial role in supporting governance and decentralization.

What are the main features of Agoric (BLD)?

- Fast: It uses the high-performance Tendermint consensus protocol. This enables fast finality and ensures that chain transactions are quickly confirmed, preventing reversals or changes.

- Predictable: It improves gas economics by removing incentives for gas price manipulation. Thus, promoting a more predictable and user-friendly experience.

The team

Behind every successful project lies an experienced team, and Agoric is no exception. Led by CEO Dean Tribble, the Agoric team brings decades of collective experience in smart contracts and secure computing. Their extensive background predates the era of cryptocurrencies, providing a unique perspective that has significantly shaped the Agoric platform Their deep-rooted understanding of market dynamics and emerging technologies positions BLD as more than just a token but a proof of collaborative efforts shaping the decentralized future.

Technology supporting BLD

Agoric’s Hardened JavaScript smart contract platform stands out, making blockchain programming accessible to over 17 million JavaScript developers worldwide. Built on the Cosmos-SDK, Agoric bridges the gap between traditional programming and blockchain development. Thus, offering a unique proposition for DeFi innovation. BLD operates on a Proof-of-Stake consensus mechanism to ensure security, efficiency, and scalability.

The Cosmos ecosystem

BLD’s integration into the Cosmos ecosystem enhances its demand dynamics. The ability to seamlessly interact with other blockchain networks within Cosmos creates a broader scope for applications and use cases. Agoric’s strategic positioning is noteworthy for investors seeking interoperability.

BLD’s value proposition

BLD is a key player in Agoric’s ecosystem, ensuring security through staking while offering multifaceted utility. Its scarcity, tied to staking, introduces a unique economic dynamic. This may be appealing to investors who value limited supply.

The stability provided by BLD’s sister token, IST, pegged to the US dollar, enhances its attractiveness to investors seeking a balance between potential returns and risk mitigation.

Additionally, BLD’s role in DeFi innovation and its potential to catalyze a crypto-economic standard library makes it a compelling investment in the dynamic Web3 landscape.

Backed by industry investors

Agoric enjoys strong support from diverse investors, including MetaStable, Polychain, Pantera Capital, CoinFund, and HashKey, all esteemed for their strategic investments in blockchain projects. This backing not only provides financial stability but also signifies confidence from established entities in Agoric’s vision and potential.

Security measure

Security is crucial in the blockchain and DeFi space, and Agoric recognizes this by implementing advanced measures to strengthen BLD against potential threats:

- Decentralization: Distributing governance and staking for enhanced resilience.

- Smart contract audits: Regular checks to identify and address vulnerabilities.

- Community involvement: Engaging the community in governance processes to promote collective vigilance.

- Cosmos ecosystem integration: Tapping into a broader range of security measures through integration with interconnected blockchains.

Moreover, Agoric’s commitment to ongoing technological advancements is instrumental. Its regular updates, protocol upgrades, and adaptive features show a dynamic approach to addressing challenges and capitalizing on opportunities within the Web3 sphere.

Risks associated with BLD

While the potential for growth with BLD is evident, it’s crucial to acknowledge the associated risks. The decentralized nature of the crypto space inherently carries risks, and investors should consider the following:

- Market volatility: BLD, like many cryptocurrencies, is subject to price volatility influenced by market dynamics. Sudden price fluctuations can impact investor sentiment and pose challenges for those seeking stable returns.

- Regulatory Uncertainties: The evolving regulatory environment surrounding cryptocurrencies presents both challenges and opportunities for BLD. Compliance with international regulatory standards, particularly in major markets like the US, EU, and Asia, is critical for its widespread adoption and operational stability. Regulatory shifts can significantly influence investor sentiment, either positively or negatively. Agoric’s proactive stance in navigating these regulations, balancing the decentralized nature of BLD with necessary compliance, is key. Investors should remain aware that the regulatory landscape is a crucial factor in their investment strategy, affecting everything from market accessibility to the long-term viability of BLD.

- Technological vulnerabilities: Despite robust security measures, no technology is entirely immune to vulnerabilities. Agoric’s commitment to security and the experienced team’s proactive approach to mitigating risks provide a balanced outlook for investors.

- External threats: External factors, such as cyber-attacks, fraud, or adverse geopolitical events, can impact the cryptocurrency market, including BLD. However, BLD has demonstrated resilience against external threats so far.

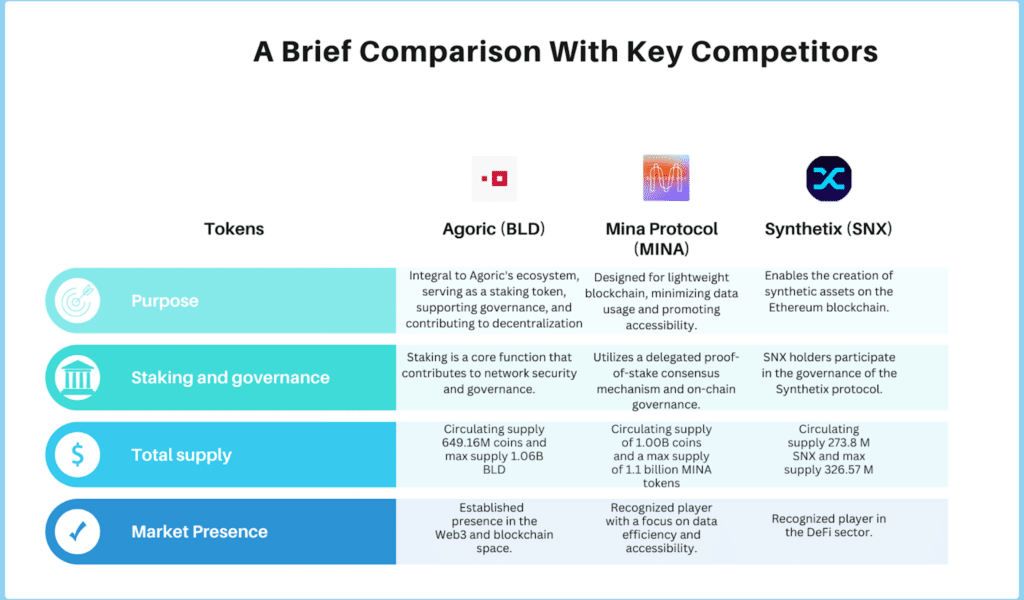

Comparative analysis

Agoric stands out amidst competitors with its emphasis on JavaScript smart contracts, a distinctive feature in a landscape dominated by various programming languages. While some competitors may excel in specific domains, Agoric’s emphasis on usability and composability sets it apart. Thus, presenting a unique value proposition for investors seeking portfolio diversification.

Adoption trends and partnerships

Examining current adoption trends, Agoric has witnessed a surge in momentum. Recent integrations, including collaborations with BitGo and Pine Street Labs, reflect growing recognition and adoption.

Agoric has also partnered with other prominent entities across various domains such as, KREAd, QuickWork, and Calypso to further enhance Agoric’s ecosystem and credibility.

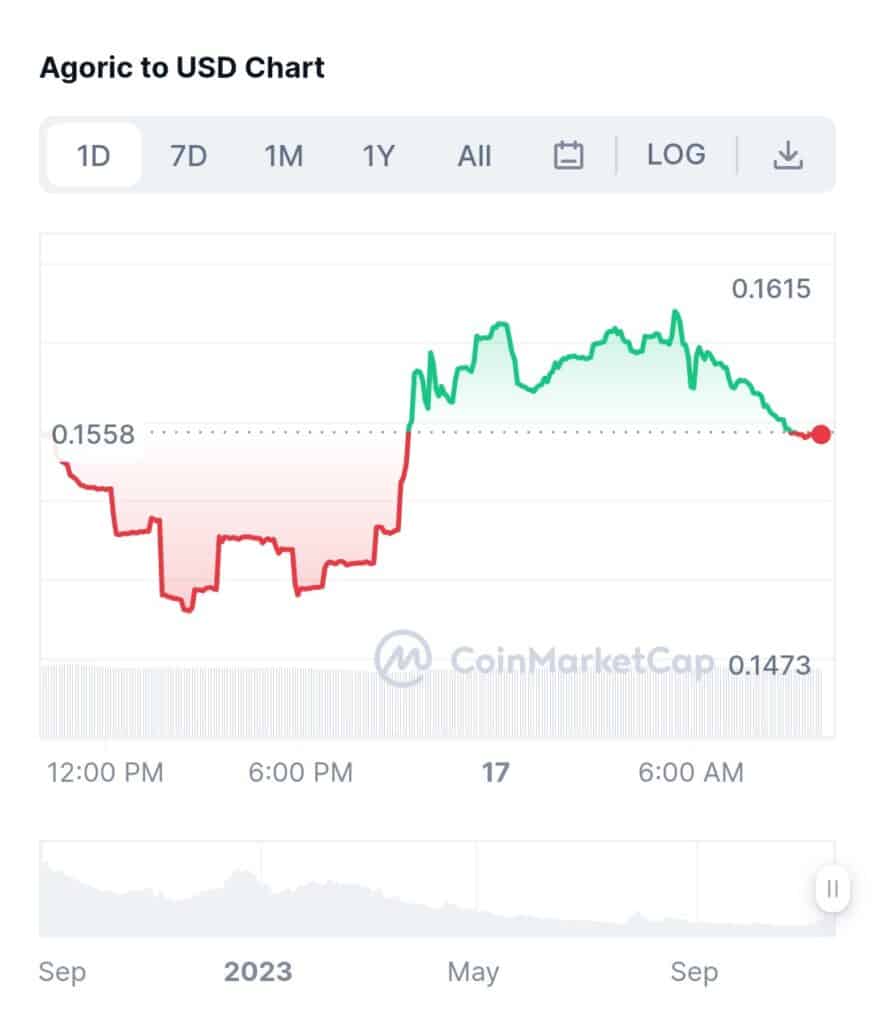

Agoric (BLD) price and market sentiment

As of the time of writing, Agoric is priced at $0.16, boasting a market cap of $103,390,251 and a 24-hour trading volume reaching $369,930, reflecting a 3.76% increase in the past 24 hours. Notably, Agoric has a maximum supply of 1000 million tokens.

BLD’s performance over the last 90 days is captured in the table below:

From CoinMarketCap, we can see that:

Coincodex’s current forecast suggests a potential -7.23% dip in Agoric’s price, projecting it to reach $0.148955 by November 22, 2023. This prediction aligns with the current Neutral sentiment, as indicated by a Fear & Greed Index score of 63 (Greed).

Over the last 30 days, Agoric experienced 17 out of 30 (57%) green days, exhibiting a 22.20% price volatility during this period. More data from Coincodex revealed the following:

Agoric BLD price predictions (2023-2030)

Based on data from Coincodex, which incorporated historical price movements and BTC halving cycles, Agoric’s projected price is expected as follows:

| Year | Estimated yearly low | Potential high | Potential gain |

| 2024 | $0.139778 | $0.368092 | |

| 2025 | $0.311681 | $1.253412 | 703.70% |

| 2030 | $0.895655 | $1.133653 | 626.91% |

These projections offer insights into potential future scenarios, but it’s crucial to approach such forecasts with a degree of caution, considering the inherent uncertainties in the crypto market.

Projected adoption and future growth

Looking ahead, Agoric’s roadmap and projected adoption scenarios paint an optimistic picture. The integration of BLD and IST into Pine Street Labs’ walletOS product signifies a move towards simplifying transactions for developers.

Such advancements hint at a future where Agoric becomes a preferred platform for decentralized applications and financial innovations. Investors eyeing long-term growth potential may find these adoption scenarios compelling.

Conclusion

BLD emerges as a compelling and potentially undervalued opportunity in the dynamic Web3 space. The multifaceted role it plays within Agoric’s ecosystem, coupled with its integration into the broader Cosmos framework, positions BLD as a key player in the evolving blockchain landscape.

Note that investing in cryptocurrencies involves risks as they’re highly volatile. Therefore, do thorough research, consider your risk tolerance, and, if needed, consult with a financial advisor before making investment decisions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more