Venture Capital Returns to Crypto: Q3 Hits $4.65B Amid Growing Confidence

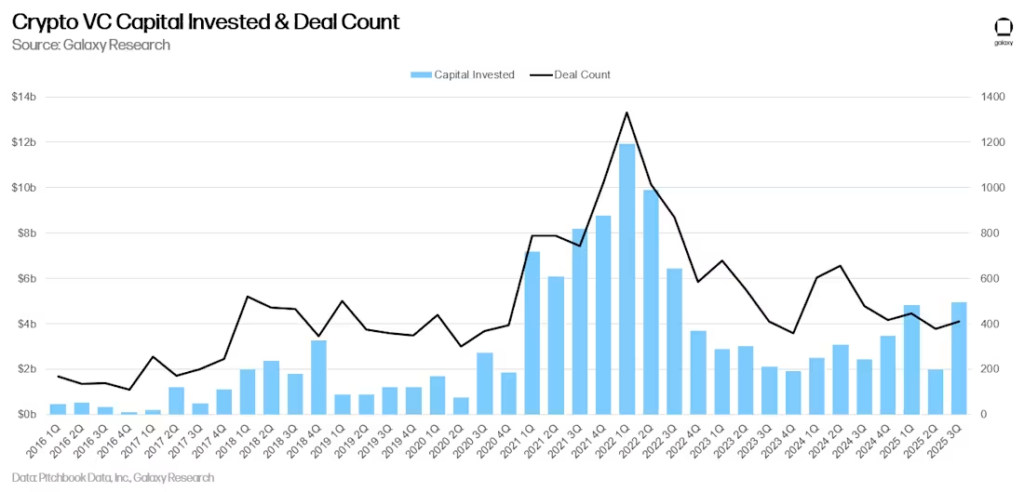

After a prolonged slowdown, investment in crypto-focused startups rebounded sharply in the third quarter, reaching $4.65 billion. This marks one of the strongest bursts of venture capital activity since the downturn triggered by FTX’s collapse in late 2022. Investor confidence, which had fallen during that period, appears to be recovering as firms return to backing new crypto ventures at levels not seen in recent years.

In brief

- Investment in crypto startups rebounded sharply in the third quarter, reaching 4.65 billion dollars, one of the strongest periods since the FTX collapse.

- Funding grew 290% from the previous quarter across 415 deals, with a mix of early-stage projects and large rounds driving growth.

- However, venture capital has not kept pace with soaring crypto prices.

Q3 2025 Sees Strong Crypto Venture Activity

In the third quarter of 2025, investment in crypto ventures surged 290% from the previous quarter, spread across 415 deals. The increase reflected both a significant rise in total funding and a slight uptick in the number of investments. Alex Thorn, head of research at Galaxy Digital, highlighted the strong quarter-on-quarter growth in a recent report. By comparison, the first quarter of 2025 saw $4.8 billion in funding, making Q3 one of the strongest periods for the sector.

This growth was accompanied by ongoing activity across a range of areas, including stablecoins, artificial intelligence, blockchain infrastructure, and trading platforms. Early-stage projects also continued to receive steady support, particularly at the initial funding stage. Overall, these patterns suggest that venture engagement in crypto remains solid, even if it has not returned to the frenzied levels seen during the 2021–2022 bull run.

Amid this surge, a small number of large deals accounted for a significant portion of the funding. Seven deals alone represented about half of the total capital. Among the largest rounds were $1 billion for Revolut, $500 million for Kraken, $250 million for Erebor, $146 million for Treasury, and $135 million for Fnality. Companies founded in 2018 received most of the total capital, while those launched in 2024 saw the highest number of deals.

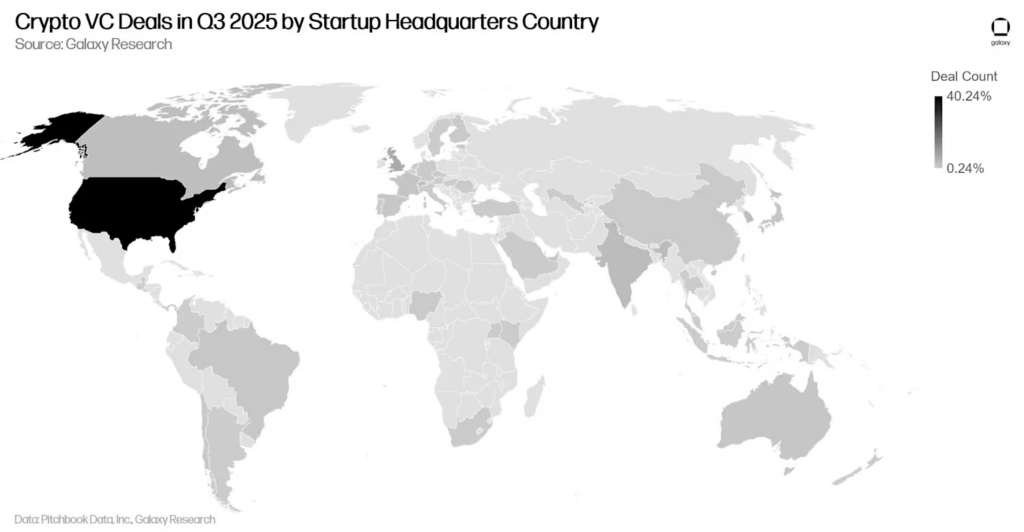

U.S. Dominance and Regional Breakdown

The United States continued to lead the sector, both in terms of capital and deal volume. Here is how the global distribution breaks down:

- U.S.-based companies captured 47% of all funding and accounted for 40% of completed deals, maintaining their dominant position in the crypto venture space.

- The United Kingdom followed, receiving 28% of total investment and completing 6.8% of all deals.

- Singapore and the Netherlands drew smaller portions of capital, at 3.8% and 3.3%, respectively, while deal counts in Singapore reached 7.3%, and Hong Kong accounted for 3.6% of transactions.

Regarding the U.S.’s future leadership in crypto, Thorn noted, “We expect U.S. dominance to increase, particularly now that the GENIUS Act is law and especially if Congress can pass a crypto market structure bill, which would further entice traditional U.S. financial services firms to enter the space in earnest.”

Challenges Impacting Crypto VC Funding

Meanwhile, venture capital activity has not kept pace with rising crypto prices. Bitcoin, for instance, hit a record $126,000 in October, yet funding growth has lagged behind. Thorn noted that during previous bull cycles in 2017 and 2021, venture capital activity tended to move closely with token price gains—a connection that has weakened over the past two years.

Thorn pointed out that “the venture stagnation is due to a number of factors, such as waning interest in previously hot crypto VC sectors like gaming, NFTs, and Web3; competition from AI startups for investment capital; and higher interest rates, which disincentivize venture allocators broadly.”

On developments affecting venture capital, the report pointed out that spot exchange-traded products (ETPs) and digital asset treasury companies may be diverting capital away from early-stage crypto ventures. Large U.S. investors are increasingly seeking exposure through spot Bitcoin or Ethereum ETPs instead of funding startups directly. If this trend continues, Thorn noted that more investment could flow to ETPs, potentially limiting funding for areas like decentralized finance and Web3.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.