Ilya Lichtenstein, involved in the theft of approximately 119,756 BTC on Bitfinex, says he was released from prison earlier than expected thanks to the First Step Act, a law passed under Donald Trump. He spent just over a year behind bars, although he had been sentenced to five years.

News

BitMine stock jumped 14% after an announcement described as "spectacular" by its chairman, Tom Lee. Indeed, the company is seeking shareholder approval to significantly increase the number of authorized shares. This strategic move comes as BitMine strengthens its position on Ethereum, of which it holds 3.41% of the circulating supply. In a market where crypto treasuries are growing, this initiative marks a key step for one of the largest institutional holders of ETH.

Aave Labs founder Stani Kulechov has suggested sharing revenue from outside the protocol with token holders amid ongoing governance debates.

Crypto markets are showing a notable shift, with major altcoins recording solid gains. Bitcoin’s share of the overall market has weakened and is now nearing 59%. Capital rotation toward higher-beta assets has followed, renewing discussion around a potential altcoin-led phase.

There are days when the crypto market looks less like a stock exchange and more like a playground. On Friday, memecoins reignited the traders' cheeks: in 24 hours, the sector regained about 3 billion dollars in capitalization. So, meme season or just a spark? The answer rarely fits in a single number. It is rather hidden in a mix of attention, leverage, and timing.

While bitcoin remains above $89,000 at the start of 2026, many analysts claim that whales are beginning a powerful accumulation movement. A signal perceived by some as the prelude to a new bull run. However, behind this optimistic reading, on-chain data tells a very different story. Far from a massive return of large holders, the current market dynamic seems driven by other actors, much more discreet… and probably more decisive for what comes next.

In crypto, good resolutions never last: barely January has started, wallets are already siphoned, insiders suspected, and MetaMask emails clicking where it hurts...

For the first time in over 400 days, a major technical support for XRP has broken. Under pressure below 2 dollars, Ripple's crypto operates in a critical zone. The market is holding its breath, as the bullish structure falters, and what follows depends on the next moves.

Bitcoin is at a decisive turning point in 2026, between the risk of a major correction and the potential for a historic rally. What are the price levels to watch to anticipate its next moves? Between critical supports, psychological resistances and divergent expert opinions... Here are the thresholds that will tip BTC this year.

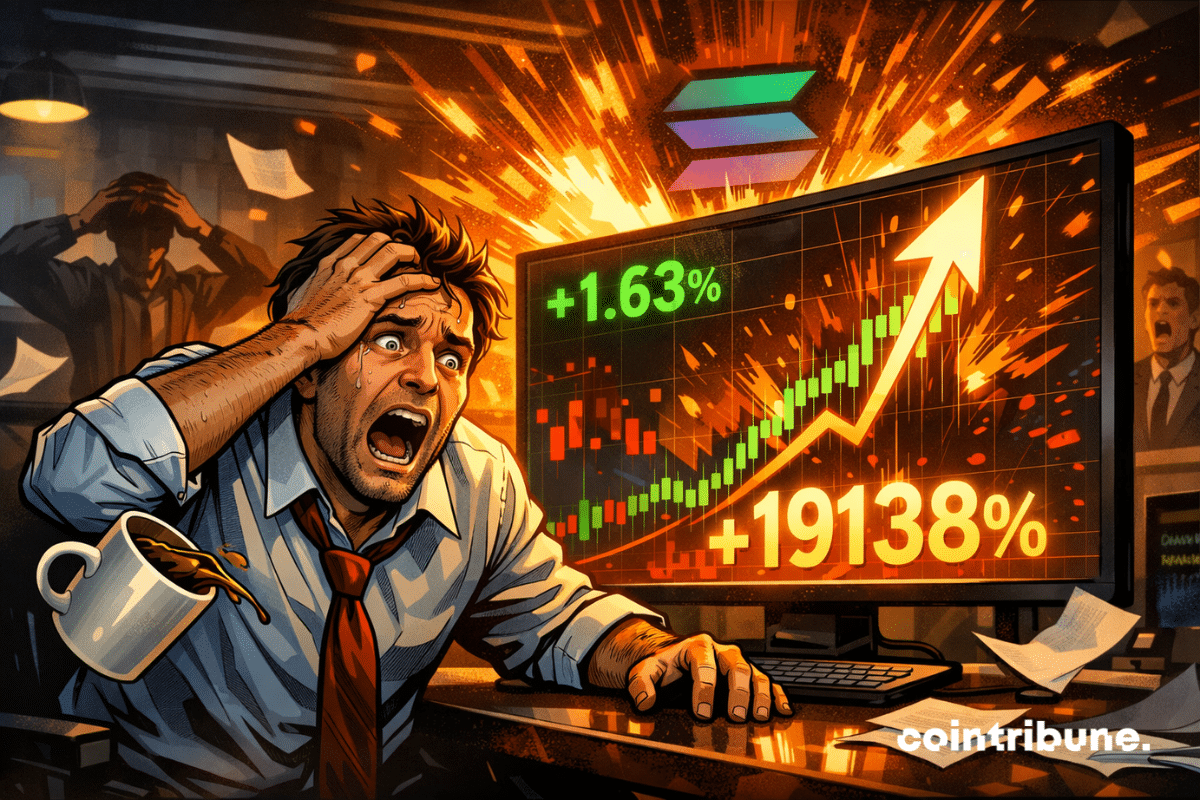

Despite a 46% drop in three months, Solana tops the crypto trends at the start of this year, according to Santiment data. This accumulation is supported by large wallets, while the majority of investors remain hesitant after an unstable 2025. Such a discreet but structured movement calls for attention. Is it a simple opportunistic bet or an early reversal signal?

December Fed minutes highlight risks of cash strains in money markets and steps officials may take to keep funding smooth.

Bitmine and Fundstrat head of research Tom Lee rehashed debates across crypto markets after forecasting a sharp rise in Ethereum’s price. Speaking at Binance Blockchain Week, Lee stated that Ether could reach $62,000 in the coming months as blockchain adoption enters a new phase. His remarks also reaffirmed his long-held bullish view on Bitcoin.

While Beijing is making its e-yuan grow, Washington debates whether cryptos can offer rewards. What if the real danger is not what we think?

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

While the market coughs, Tether, on the other hand, is gobbling up bitcoin… A frenzy of crypto-purchasing that intrigues, worries, and could well shake more than one stablecoin in a business suit.

Shiba Inu (SHIB) is under renewed pressure as its market position weakens. Once ranked among the top 15 cryptocurrencies, SHIB now sits near the lower end of the top 40 by market capitalization. Recent price movement and fading interest have raised questions about whether the token can recover in the next market cycle.

Crypto veteran and BitMEX co-founder Arthur Hayes has adjusted his portfolio, selling a significant amount of Ether and reallocating funds into decentralized finance projects. The move comes as Ethereum faces weak price momentum while network activity continues to grow steadily. Hayes’ actions have drawn mixed reactions across the crypto community, particularly as DeFi tokens remain under pressure.

The current stability of bitcoin may conceal a sudden reversal. While the asset opened 2026 at $87,500, rarely combined technical signals, bullish divergence of the RSI, extreme compression of Bollinger bands, indicate an imminent volatility surge. Several analysts mention a possible rebound. However, attention also focuses on another breaking point: the announced end of the four-year cycle, a historic pillar of crypto strategies, now challenged by influential market voices.

In 2026, the crypto universe will change its face. Binance announces a historic shift driven by different factors. All the details here!

A simple technical incident was enough to paralyze a large part of the crypto ecosystem. In November 2025, an outage at Cloudflare took offline Coinbase, BitMEX, Blockchain.com, Ledger, and many others. Within hours, the promise of Web3 resilience clashed with a brutal reality. Behind the smart contracts, the infrastructure remains vulnerable. Dependent on centralized Web2 services, many so-called decentralized projects expose a critical flaw. Vitalik Buterin sees this as a warning sign and a call to action.

Trust Wallet suspends its Chrome extension after a $7 million hack. Why is this crucial update postponed? What are the risks for users? Analysis of vulnerabilities, impacts, and urgent measures to protect your crypto assets in 2026.

While stablecoins have gained more than $100 billion in 2025 to peak at $307 billion according to DefiLlama, India is taking the opposite direction. The Indian central bank (RBI) states that only a sovereign digital currency guarantees monetary stability. In a global landscape where CBDCs struggle to impose themselves, New Delhi erects the e-rupee as a bulwark against the privatization of money.

While the market remains struggling, another transformation, more discreet but decisive, is taking shape. In this new year, bitcoin will no longer seek to charm traders. It will integrate, step by step, into the real economy. If the price falls, usage, however, progresses. A pivotal year is opening, where the price drop contrasts with the silent rise of payment technologies. BTC no longer waits for the next bull run to exist: it finally becomes a daily tool.

Is bitcoin climbing? Or plunging? Between juicy injections, cautious politicians and Harvard funds, 2026 promises a well-spiced crypto saga... with guaranteed suspense on the regulation front!

In 2025, the crypto market reminded its ruthless nature. While bitcoin briefly crossed 126,000 dollars, a brutal correction wiped out several major fortunes in the sector. Even the most influential figures were not spared, losing billions in a few weeks. From Michael Saylor to CZ, the year left behind a fractured landscape dominated by losses.

In January 2026, the US Senate could pass a historic law on cryptos, redefining their regulation. This text, awaited for months, would clarify the legal framework for Bitcoin and digital assets. What impacts for investors and the market? Here are the stakes and opportunities to seize.

Will bitcoin reach $150,000 in 2026? Polymarket bettors give it only a 27% chance, defying optimistic forecasts by analysts. Between economic uncertainties and institutional hopes, discover why this year promises to be a controversial turning point for the crypto queen.

Warren Buffett turns a page in history. This December 31, 2025 marks the end of his reign at the head of Berkshire Hathaway, after more than 60 years of exemplary management. An iconic figure of the markets, "the Oracle of Omaha" embodied a vision of investing based on discipline, duration, and consistency. His departure is not just a change of leadership, but a strong signal addressed to the global markets, at a time when an emblematic era of American capitalism is closing.

Solana shakes up the crypto market with a massive liquidation in just one hour. All details in this article.

Russia is moving to impose tougher penalties on illegal cryptocurrency mining after officials reported low compliance with new registration rules. A draft bill from the Justice Ministry proposes fines, forced labor, and prison terms for miners operating outside the law. Officials say the measures are intended to bring a rapidly expanding sector under state oversight and into the tax system.