While dApps are looking gloomy, DeFi is gorging on billions. Decline in clicks, increase in liquidity... traders are deserting, but capital has never been so loyal.

News

The governor of the Bank of France speaks out. François Villeroy de Galhau demands transferring the supervision of cryptocurrencies to ESMA, based in Paris. Dollar-backed stablecoins particularly worry French authorities. Will Europe be able to impose its own vision against the American giants in the sector?

Bitcoin has just crossed 126,000 dollars, but the market remains surprisingly quiet. This ascent without frenzy, rare in a universe where spectacular rises often precede violent drops, intrigues analysts. Unlike usual cycles, the apparent calm of the metrics fuels both confidence and curiosity. Should we see in this the beginnings of a new paradigm for the flagship crypto asset?

BlackRock’s spot Bitcoin exchange-traded fund (IBIT) has surpassed 800,000 BTC in assets under management, following an eight-day inflow streak that brought in over $4 billion. The milestone marks a significant step in institutional adoption of Bitcoin, coming less than two years after the fund’s launch in January 2024.

Robert Kiyosaki warned of a weakening U.S. dollar and urged investors to protect their wealth by shifting to gold, silver, and cryptocurrencies.

The SEC is preparing to introduce an “innovation exemption” that would give companies more flexibility to develop digital assets and emerging technologies. SEC Chair Paul Atkins said the proposal could be formalized as soon as the end of this quarter, despite challenges caused by the ongoing government shutdown.

YZi Labs announced a $1B fund to support developers building projects on the BNB Chain, aiming to foster innovation and growth.

The Ethereum Foundation takes a new step by launching the Privacy Cluster, a team entirely dedicated to network privacy. A strategic initiative that responds to the growing concerns about digital surveillance and the increasing need to protect user data.

The minutes of the Fed published on October 8 confirm an expected but delicate monetary shift. While the rate cut is now underway, the extent of the move by the end of the year still divides the committee. In a context of slowing employment, contained inflation, and government paralysis, this shift weighs heavily on market expectations. For crypto investors, sensitive to monetary policy signals, every Fed hesitation becomes a factor of volatility.

MetaMask, more playful than ever, bets on political and sports predictions. Polymarket joins the wallet… but France remains on the regulatory sidelines.

On the BNB Chain, a few days were enough to turn modest bets into lightning-fast fortunes. Driven by meme coins launched in a chain and propelled by social virality, a new speculative wave is shaking the ecosystem. Between dizzying returns and community excitement, the episode reveals both the excesses and the attractiveness of a network that has become the favorite playground of traders.

While bitcoin reaches a new all-time high at $126,000, the prevailing sentiment is that the market is already inaccessible. However, contrary to this impression, recent data paint a very different picture. According to Cosmo Jiang, partner at Pantera Capital, over 60% of investors still have no exposure to cryptos. This revealing figure reminds us that the majority of the adoption potential is yet to come.

"All that glitters is not gold." This 17th-century proverb applies wonderfully to flashy innovations. For several years, Artificial Intelligence (AI) has been presented to us as a revolution comparable to electricity or the Internet. But is it really a revolution? Or rather a spectacular optimization of what already exists? As we know it, AI revolutionizes nothing. It merely oils the gears of an already established system and mainly fits within the continuity of a centralized paradigm. At the same time, another technology, much less publicized but much more radical, pursues its trajectory: Bitcoin and decentralization. Unlike AI, Bitcoin does not just improve existing systems. It questions them, and sometimes even makes them obsolete. The true revolution today, the only one, is Bitcoin. Because it does not make the old world faster, it builds a new one.

10 billion dollars in Ethereum are waiting to be sold as validators massively leave the network. Details here!

The memecoin $TRUMP, in free fall by 90%, is betting everything on a record fundraising of 200 million dollars to avoid collapse. Between hopes of a rebound and risks of failure, can this crypto poker move save the token linked to Donald Trump? #Trump #memecoin #crypto

BlackRock’s iShares Bitcoin ETF has quickly grown to nearly $100 billion, surpassing longtime funds and fueling strong investor interest in Bitcoin.

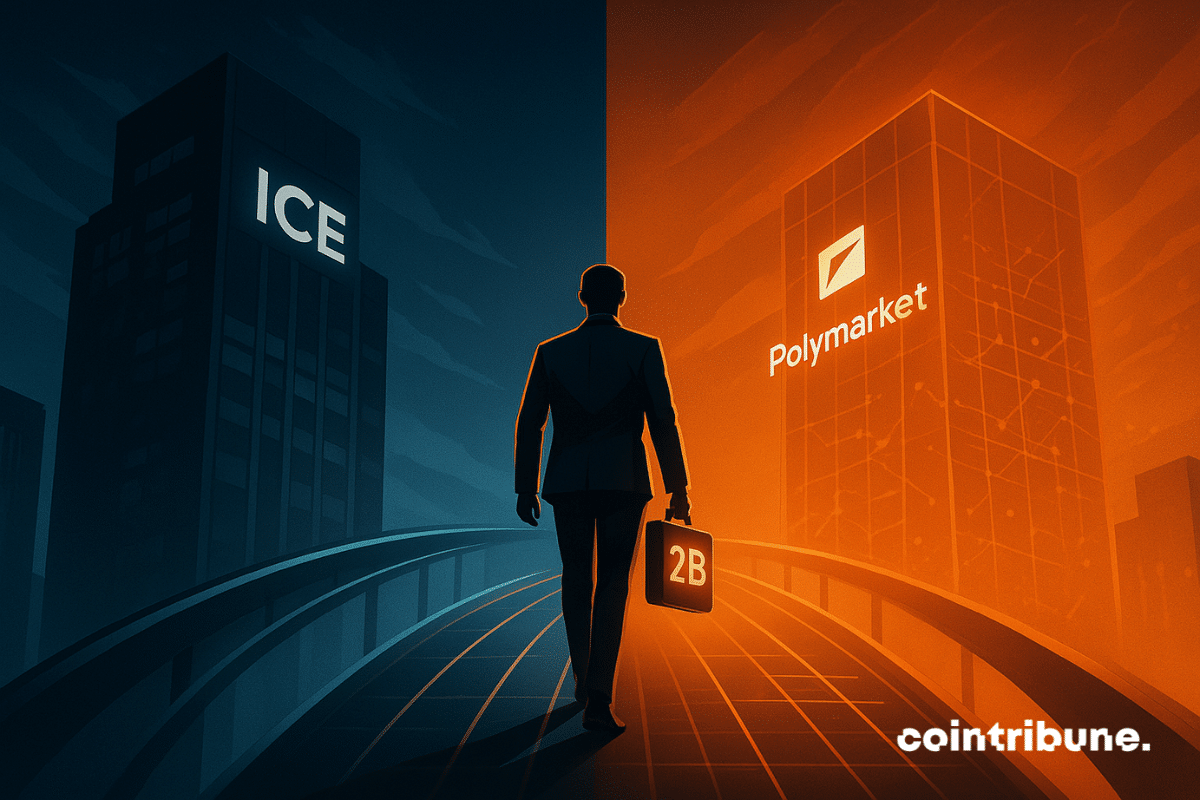

Prediction markets have received a major vote of confidence after Intercontinental Exchange (ICE)—the operator of the New York Stock Exchange—announced a $2 billion strategic investment in Polymarket. The deal values the platform at roughly $8 billion, marking a stunning turnaround for a company that faced regulatory fire just three years ago.

ASTER, the 300x leverage DEX token, shakes Binance in 2025! The mega whales massively accumulate this ultra-volatile crypto project, but behind the rapid rise lie huge risks. Should you jump into the arena? #Crypto #Aster #Binance

Bitcoin and gold are both hitting record highs, with analysts projecting Bitcoin could reach $644K after its next halving as gold continues to surge.

Despite a correction of more than 4% after a historic peak at $126,219, bitcoin maintains a solid bullish momentum, supported by robust institutional fundamentals. Massive flows to ETFs and renewed Wall Street confidence paint the picture of a maturing market. From Citibank to JPMorgan, the giants of American finance now anticipate a rise to $150,000 by December.

Bitcoin is soaring to $125,000 and disappearing from platforms: 114,000 coins flown away, investors in cold panic. Rush for digital gold or just a gimmick?

BNB has just shaken up the crypto market hierarchy. By surpassing XRP, Binance's native token settles in third place worldwide, just behind Bitcoin and Ethereum. This rapid progression intrigues as much as it impresses. While the figures confirm a strong momentum, this rise raises questions about its legitimacy and sustainability.

Ethereum is no longer just the infrastructure for smart contracts. It becomes a strategic lever in corporate balance sheets. This week, as ETH surpassed 4,700 dollars, SharpLink Gaming approaches one billion dollars in latent gains. Thanks to a methodical accumulation started in June, the company transforms its treasury into a value creation tool, drawing market attention.

The end of the year looks very promising for bitcoin. Even the major American banks are very optimistic.

While currencies wobble and the economy coughs, gold climbs, bitcoin soars... and investors applaud hoping not to jump with the monetary parachute.

Kraken recently completed a major acquisition of Breakout, making it the first major crypto exchange to enter proprietary trading. This strategic move represents a significant shift in how crypto traders can access capital, offering funded accounts with substantial leverage without risking personal funds once the evaluation phase has been successfully completed.

Bitcoin (BTC) has once again surpassed its previous records, climbing to new heights above $126,000. Unlike earlier speculative rallies, analysts say this surge reflects a stronger market structure and increasing institutional participation. More so, on-chain and ETF data suggest that Bitcoin may be entering a more stable phase of growth.

Spot trading activity across crypto exchanges slowed in September, hitting its weakest level in months, even as institutional demand for Bitcoin surged through exchange-traded funds. The contrasting trends highlight a shift in market behavior, with speculative trading losing momentum while long-term investment flows gaining strength.

On September 3, 2025, the United States Securities and Exchange Commission (SEC) released the Post-Quantum Financial Infrastructure Framework (PQFIF). This strategic document, submitted to the U.S. Crypto Assets Task Force, officially designates Naoris Protocol as the reference model for the financial sector’s transition to post-quantum cryptography. This recognition places the protocol at the center of U.S. regulatory priorities in cybersecurity, at a time when the rise of quantum computers poses an existential threat to the protection of digital assets.

MetaMask launches a crypto program with token rewards. A key strategy before a flagship event! Details here.