Bitcoin flirts with 114,000 dollars, but behind this stability, some analysts are sounding the alarm. A new market reading, based on Elliott Wave theory, announces a peak at 140,000 dollars by the end of this year… followed by a sharp decline in 2026. As euphoria spreads among investors, this projection invites looking beyond the short term.

News

While financial markets collapse under the threat of new announcements related to the trade war orchestrated by Donald Trump, the crypto market takes everyone by surprise. Indeed, XRP and Ethereum are bouncing back sharply, breaking with an established bearish trend. Are these assets in the process of sustainably detaching from classic macroeconomic dynamics? In a context of tariff tensions and increased volatility, the crypto market's reaction raises questions about its ability to play a strategic alternative role.

Pump.fun collapses, memecoins are shaky. In July, the star crypto platform lost 80% of its revenue. Traders fleeing, fierce competition, saturated market: find out why memecoin euphoria may be coming to an end. Complete analysis and key figures.

While bitcoin oscillates around critical thresholds, between selling pressures and bullish technical signals, investors wonder: simple market breathing or prelude to a new surge towards 75,000 dollars

The Paris stock market rises by 0.76% as the Fed could ease its policy in response to the American economic slowdown.

Panic on the crypto planet: panicked whales, small holders bleeding. And Binance picking up BTC like it's raining. Bitcoin itself looks grim…

Saudi Arabia, Russia and their partners within OPEC+ announce a coordinated increase in oil production of 547,000 barrels per day. A strategic decision that disrupts the fragile balance of the global market and could reignite geopolitical tensions, as the standoff between Washington and Moscow intensifies.

Bitcoin is seeing renewed interest as large holders add to their positions, with market sentiment shifting toward optimism.

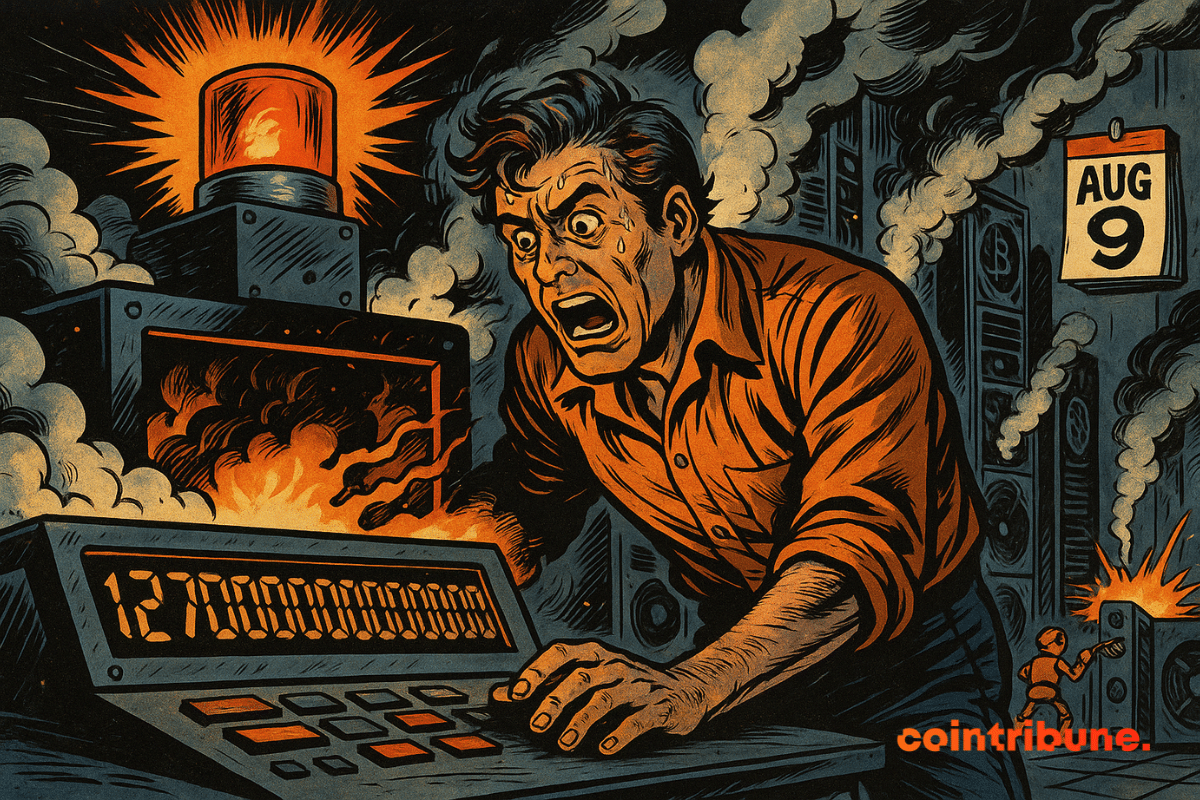

Blockchain intelligence firm Arkham has disclosed that 127,426 BTC, worth nearly $14.5 billion today, was quietly stolen from Chinese mining pool LuBian in late 2020. The heist, which had remained hidden from the public for almost four years, now ranks among the largest crypto thefts in history by current valuation.

Bitcoin lost 7.5% after nearly touching $123,250, briefly reviving fears of a lasting correction. However, some analysts see an ideal configuration, described as a "perfect bottom." For them, this technical pullback would be less a sign of weakness than a strategic springboard announcing a major rebound.

In a universe dominated by digital abstraction, the sudden disappearance of the statue of Satoshi Nakamoto in Lugano resonates as a symbolic shock. Erected during the Plan B Forum in homage to the decentralized spirit of bitcoin, the work was torn down, vandalized, then recovered in pieces by the lakeside. This artistic manifesto, having become a target, crystallizes the tensions around the crypto imagination. A reward in bitcoin was promised, a sign that the case goes beyond simple vandalism: it calls into question the integrity of symbols in a faceless culture.

Sharplink has just made a big move on Ethereum with $54 million in purchases. Discover the behind-the-scenes of this strategic operation, its implications on the crypto market and the signals it sends to institutional investors.

Bitcoin miners generated $1.66 billion in July, a record since the 2024 halving. Profitability, difficulty, projections: the mining economy is undergoing major changes. Discover the key figures, trends to watch, and what August holds.

Trump dreams of a crypto eldorado, the CFTC sprints, the SEC follows… but behind the speeches, who really regulates this digital rush westward? Regulatory suspense guaranteed.

Spot crypto exchange-traded funds (ETFs) are currently on a smooth sail, posting strong inflow records week-on-week. Although these investment products struggled during the early parts of the year following the broader market drop, their performances have picked up in this quarter—particularly in the U.S. market

While the price of bitcoin is holding steady, its mining difficulty is climbing sky-high: a technical record that may hide more gold than speculation…

U.S. stocks suffered a blow on August 1, losing $1.1 trillion in value after President Donald Trump reportedly fired the head of the Bureau of Labor Statistics, Erika McEntarfer. The decision came hours after a disappointing July jobs report.

The SEC unveils the "Project Crypto" and disrupts the regulatory landscape. Coinbase and Bitget applaud a reform deemed historic. Legal ICOs, auto-custody, digital sovereignty: discover why this initiative could reposition the United States at the heart of global blockchain innovation.

The European Union takes a new decisive step in the regulation of artificial intelligence. After laying the groundwork in February, Brussels today activates the second part of its AI Act, directly targeting general-purpose models like ChatGPT. A regulatory offensive that divides sector players.

In an already tense crypto market, XRP is drawing attention for the wrong reasons. Several technical and on-chain indicators are turning red, signaling growing selling pressure and marked investor disengagement. The decline in leverage exposure, combined with significant outflows, fuels the risk of key support breaks. If the momentum does not reverse quickly, crypto could enter a more pronounced correction phase, revealing increasing vulnerability to market uncertainties.

In the span of a few hours, Arthur Hayes, the former CEO of BitMEX, sold more than 13 million dollars in crypto, while the market evolves in a consolidation phase. The operation intrigues as much as it worries, due to its scale, but especially because of its timing. This move, far from trivial, could signal a global change of course.

As distrust settles in the crypto ecosystem, Pi Network fuels tensions with a controversial decision: a voluntary token lockup in exchange for a mining bonus that can rise up to 200%. In a context of free-falling prices and lethargic liquidity, the initiative provokes the outrage of a community already tested by technical delays and the lack of use cases.

The already fragile balance of the global economy has just taken another hit. On August 1st, Donald Trump signed a decree imposing heavy tariffs on seventy countries, with enforcement scheduled for August 7th. This announcement immediately shook financial markets, amplifying tensions against a backdrop of global instability. Behind this trade offensive lies a clear protectionist strategy, with potentially massive consequences for international trade, diplomatic relations, and the economic trajectory in the coming months.

Tether reaches a historic milestone by surpassing South Korea in Treasury bonds. Crypto no longer just exists; it now asserts itself in the most strategic economic spheres.

As each bitcoin becomes rarer, Strategy aims to concentrate an unprecedented share. Michael Saylor, its co-founder, mentions the possibility of holding up to 7% of the global bitcoin supply, or nearly 1.5 million BTC. With already more than 3% in reserve, the company no longer just invests: it builds a financial model focused on the strategic accumulation of the asset. A trajectory that redefines corporate treasury codes in the era of digital currencies.

The Federal Reserve Board is confronting fresh turmoil as Adriana D. Kugler resigns during a critical period of political tension. Her departure comes as former President Donald Trump steps up efforts to influence the central bank’s operations.

Shiba Inu just turned five, and the celebration comes with more than birthday candles. The meme coin is flashing bullish signals across on-chain data, burn metrics, and trading charts, suggesting a breakout may be close.

The payment world is shifting. Between crypto expansion and offensive strategy, Visa is redefining the rules of a game that has become global.

Ethereum changes course. Justin Drake unveils a lean roadmap to face the quantum era: radical cryptography, 1 million TPS, full resilience. An ambitious technical plan that could redefine the foundations of the entire crypto ecosystem.

The Japanese firm Metaplanet is stepping up. It plans to issue up to 3.7 billion dollars of shares to finance a massive BTC accumulation strategy. A bold approach, directly inspired by the Strategy model (ex-MicroStrategy), which establishes bitcoin as a central pillar of its financial doctrine.