Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?

Archive 2025

Trump accelerates in crypto: raising $3 billion for bitcoin. Amid scandals and strategy, the Trump saga in blockchain continues to shake Washington.

X, formerly Twitter, soon to be a bank, wallet, and exchange? Musk is betting big with X Money, the "crazy ambition" to dethrone banks… stay tuned!

As Bitcoin flirts with new highs and the crypto market once again dresses in green, an anomaly strikes hard: XRP, usually in the spotlight, is experiencing an unexpected collapse in its flows. Far from the excitement energizing ADA, SOL, or even SUI, Ripple seems to be going its own way... and not in a good direction. A look back at a reshuffling that could redefine the priorities of institutional investors.

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

In a crypto ecosystem where every move is scrutinized by investors, the sudden rise of XRP on the regulatory scene is intriguing. In just a few days, the likelihood of approval for a spot ETF backed by this asset has jumped to 83%, according to Polymarket. This figure, far from trivial, crystallizes a strategic turning point in the battle between the crypto industry and the SEC. More than just a speculative signal, it embodies a possible shift towards long-awaited institutional legitimization.

Bitcoin is flirting with 110,000 dollars, but intriguing whales are playing their own game. Who will win: the impatient or the strategists? Discover this secret battle where the future of BTC is at stake!

How long will Japan be able to absorb the surge in borrowing rates without resorting to printing money?

A crypto revolution is underway: Binance allows live trading through its social platform. Details in this article!

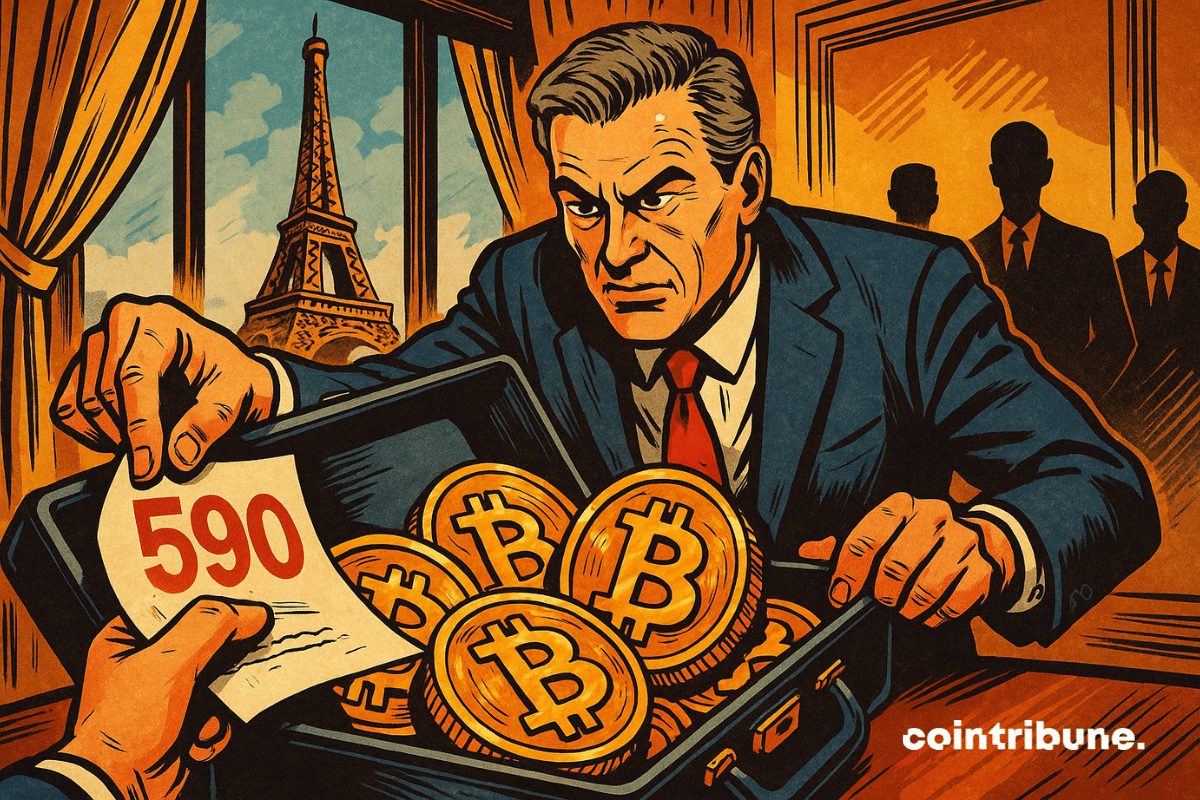

The wind is blowing strong in the crypto market, and Blockchain Group has just poured digital oil into it. The French company listed in Paris has raised no less than 72 million dollars to acquire nearly 590 new Bitcoins. A bold, frontal move, and especially unprecedented in France. While others talk about diversification, Blockchain is buying the future at face value.