Faced with a wave of critical maturities on $4,000 billion of debt, Beijing launched an unprecedented monetary response. In August, the People's Bank of China injected $1,400 billion to avoid the suffocation of its bond market. More than an emergency measure, this intervention marks a strategic turning point in managing Chinese financial flows. In a context of global tensions, this technical gesture speaks volumes about Beijing's determination to maintain control over its economic cycle.

Home » Archives for Luc Jose Adjinacou » Page 4

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

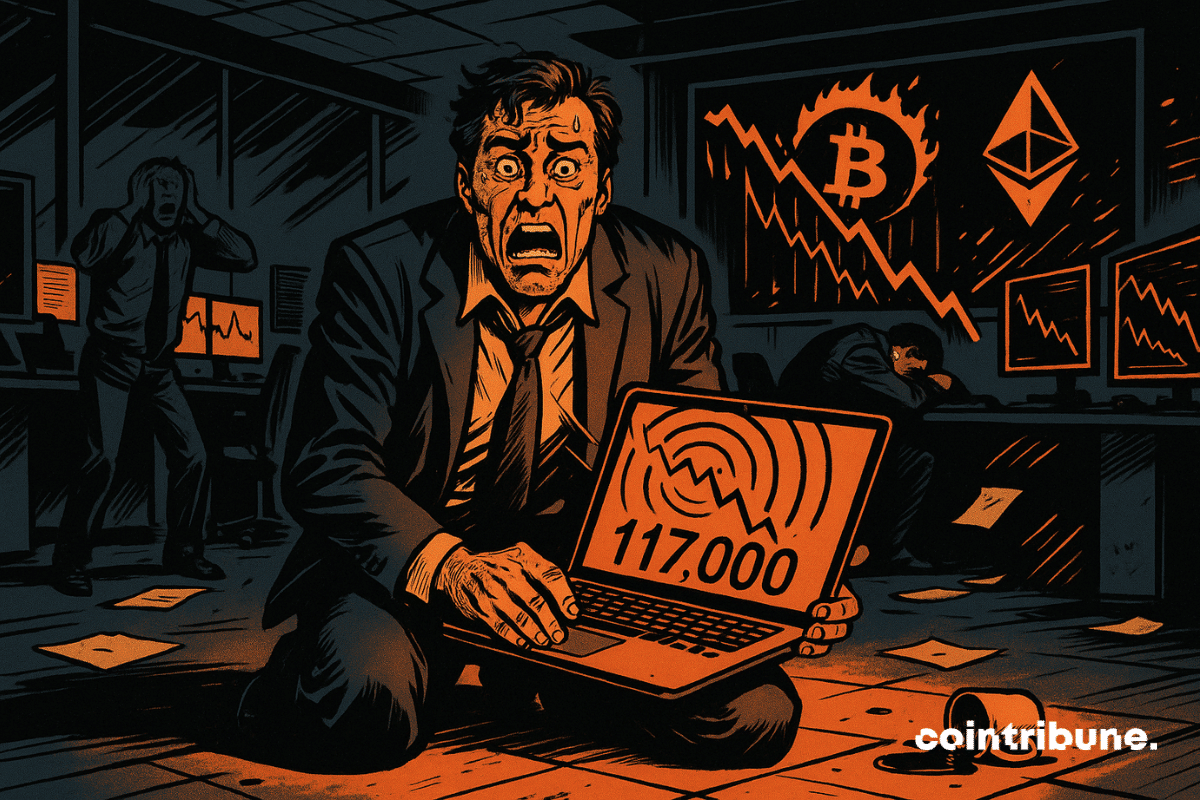

Bitcoin dropped by 7% in a few days, just after reaching an all-time high above $124,000. Simple pause or the start of a reversal? While the market questions the strength of the bullish cycle, some on-chain indicators send a completely different signal. Behind the volatility, some well-known indicators among seasoned investors outline a possible bottom, often a precursor to a rebound.

While the crypto market evolves in a climate of macroeconomic uncertainty, a major operation has just redefined the balances. In one week, BitMine Immersion Technologies acquired 1.7 billion dollars in Ethereum, crossing the symbolic threshold of 1% of the total circulating supply.

While mining profitability erodes and hashprice declines, the Bitcoin network records an unprecedented power rebound. On August 18, the hashrate climbed to 966 EH/s, nearing a historic peak, despite nearly zero transaction fees and growing economic pressure on mining companies. This striking contrast between economic tension and technical robustness raises questions: how does the mining ecosystem manage to maintain, or even strengthen, its security in such an unfavorable context?

After weeks of bullish euphoria, the crypto market violently corrected, revealing an underlying tension ignored for too long. In just 24 hours, over 500 million dollars of long positions were liquidated, dragging down bitcoin, Ethereum, and XRP in their fall. This brutal wave revealed the fragility of a market fueled by leverage, where technical indicators, sidelined by optimism, suddenly regain all their importance. A return to reality is necessary for investors.

While the wait around Pi Network drags on, a discreet statement from a moderator reignites hopes. Millions of users are still waiting to access their mined tokens, but a second migration to the mainnet could change the game. This signal, although unofficial, comes amid growing frustration. If it materializes, it would mark a strategic turning point for a project still locked in its mainnet, far from the promises of a truly accessible blockchain.

Within 24 hours, new wallets have acquired nearly 280 million dollars in Ethereum, while the asset trades just below its yearly highs. This sudden accumulation, spotted by on-chain analysts, raises questions: are we witnessing a simple strategic accumulation phase or the precursor signal of a larger bullish movement?

What if bitcoin exploded to $280,000 by the end of 2025? This is not just another rumor, but the projection of a respected trading veteran in traditional circles. Peter Brandt, a prominent figure in financial markets for over 40 years, supports a chart model that is making a big noise in the crypto sphere. Built on the analysis of historical cycles, this scenario anticipates a new peak for bitcoin… well beyond current expectations. A forecast that reignites debates as a key market moment approaches.

Nearly 94% of XRP investors are now in the green, a level rarely reached in crypto history. Driven by a surge up to $3.11, the fourth largest crypto by market capitalization triggers as much euphoria as concern. Indeed, previous instances where XRP reached such profitability were followed by sharp corrections, in 2018 as in 2021. This time, is it a new bull cycle... or a precursor sign of a brutal reversal?

The crypto market is coming out of its lethargy: the open interest on Bitcoin futures has just exceeded $82.4 billion, an unprecedented level since speculative euphoria phases. While BTC's price remains stable, derivatives are experiencing a clear resurgence in activity. This dynamic, driven by institutional investors and rising leverage, could mark a turning point. Rising futures, options in frenzy: signals are multiplying, and the market seems to be preparing for a new cycle.

In a global climate under high tension, an unexpected name emerges in the bets related to the Nobel Peace Prize: Donald Trump. Indeed, favored on the Polymarket and Kalshi platforms, the American president outstrips several historical figures. This breakthrough, driven by geopolitical dynamics and relayed in crypto circles, triggers as much speculation as questions. Simple reflection of a strategic enthusiasm or indication of an international repositioning?

Could XRP initiate a decisive turning point? A rarely observed technical signal attracts analysts' attention: Bollinger Bands draw a setup favorable to a trend reversal. While the market remains volatile and volumes decline, the asset shows signs of resilience above a critical threshold. Enough to revive the interest of seasoned investors, on the lookout for a strategic entry point. Is this movement the prelude to a new bullish cycle or just a simple technical rebound?

XRP, long held back by its judicial battle with the SEC, returns to the forefront. While institutional investors quietly strengthen their positions, a series of massive liquidations shakes the market. Between unstable technical signals and behind-the-scenes accumulation strategies, crypto is going through a zone of high instability. Should this be seen as a simple correction or the beginning of a strategic repositioning?

While the majority anticipated a Fed rate cut in September, a key indicator casts doubt. The latest Producer Price Index (PPI) release rekindles inflation fears and cools hopes for monetary easing. This subtle but meaningful reversal reshuffles the deck in a context where Fed policy dictates the rhythm of risky assets, and more than ever, that of the crypto market.

Less than 48 hours after hovering near a peak at 124,000 dollars, bitcoin falls below 117,000 while ether drops to 4,400. This brutal but seemingly classic correction exposed a weak link in the ecosystem: publicly traded companies exposed to cryptos. Thus, this segment long supported by bullish euphoria takes the reversal full on. The market, meanwhile, reminds that it never rewards excess for long.