Bitcoin continues to fascinate, surprise, challenge expectations, and test the psychological limits of the market. Just a stone's throw from the symbolic threshold of $100,000, the leading cryptocurrency records a historic weekly close, solidifying its position in a context of increased volatility. This figure, more than ever at the center of discussions, raises questions: is it merely a milestone or a true market catalyst?

Home » Archives for Luc Jose Adjinacou » Page 61

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

In a changing world where alliances redefine global balances, Saudi Arabia's attitude towards the BRICS is intriguing. Invited to join this strategic group of emerging powers, the kingdom opts for a wait-and-see strategy. This choice is not insignificant. It reflects deep issues that combine geopolitics, economics, and regional rivalries, at a time when the BRICS are seeking to expand and increase their influence.

In a context of booming financial markets, where every macroeconomic event can redefine the balance, the upcoming week is set to be crucial for cryptocurrencies. Investors' attention is focused on key indicators such as the PCE price index, the minutes of the U.S. Federal Reserve (FOMC), and the revision of U.S. GDP. Meanwhile, the imminent expiration of over 10 billion dollars in Bitcoin and Ethereum options is expected to add to the prevailing volatility. These dynamics, which intertwine economic uncertainty and crypto issues, could significantly shape the financial landscape.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

A wave of panic is sweeping across the crypto market. While Bitcoin was nearing highs close to $100,000, it experienced a sharp drop below $96,000 this Sunday, November 24, 2024. This event, accompanied by massive liquidations of over $500 million, shakes investor confidence and raises questions about the underlying dynamics of the market.

In a volatile market context, where regulations and competition are increasingly present, Binance, one of the largest cryptocurrency exchange platforms, has reached a new high. In November 2024, it recorded an influx of 8.73 billion dollars in assets, bringing the total value of its holdings to 154.9 billion dollars. This performance highlights a positive momentum for Binance, but also a strategic shift that could redefine expectations regarding crypto platforms.

The currency market is experiencing particularly marked turbulence in recent days, as the dollar continues to show spectacular strength against the euro. To the point that some analysts anticipate a critical threshold: parity between the two currencies. This dynamic, which represents a two-year peak, raises concerns among economists, businesses, and investors, with potential repercussions on the European and global economy.

The crypto market is buzzing with Avalanche (AVAX) establishing itself as one of the best-performing assets in recent weeks. With its value doubling in record time, AVAX has captured the attention of investors while also rekindling speculation about a potential prolonged rally. As the Avalanche platform continues to strengthen its ecosystem, could this price surge signal a lasting change, or indicate imminent overheating?

Since Elon Musk acquired Twitter, renamed X, the billionaire has made efficiency a mantra, even at the expense of disrupting the traditional structures of the company. His recent revelation of having reduced the workforce by 80% illustrates his unconventional vision of management and leadership. Thus, while this decision is shocking in its magnitude, it also opens the debate on the viability of such a model.

Bitcoin is once again defying predictions and flirting with the symbolic threshold of $100,000. As the financial world watches this historic moment, VanEck, a renowned investment manager, is projecting an ambitious target of $180,000 for the most famous of cryptocurrencies. This forecast is based on a booming market dynamic, supported by favorable regulatory signals and increasing institutional demand. But what should investors prepare for in a market characterized by opportunities, but also risks of overheating?

The world of cryptocurrencies is in constant upheaval, but certain developments draw particular attention due to their scale and implications. Indeed, open interest in futures contracts on Ethereum has just crossed an unprecedented threshold, surpassing 20 billion dollars. This record is indicative of a renewed interest in the asset, as well as a bullish movement that redefines the short-term outlook for one of the most influential cryptocurrencies.

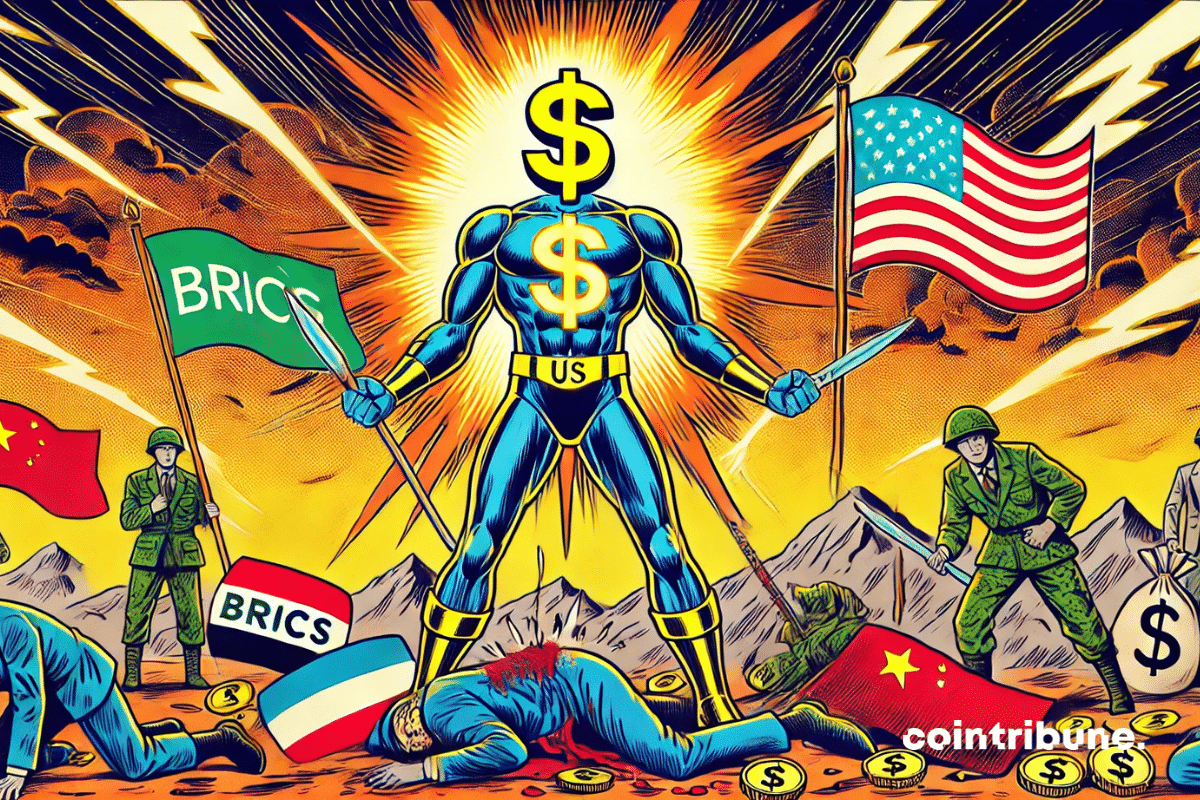

As the world closely watches the BRICS efforts to reshape the global economic order, a new trend seems to undermine their ambitions. Foreign banks, far from aligning with the alliance's de-dollarization agenda, are instead bolstering their reserves in US dollars. This development, in a context where the local currencies of the BRICS are collapsing, raises further questions about the future of economic multipolarity and the resilience of the global financial system.

Despite the uncertainties surrounding the global context, the French economy surprises with its ability to maintain a precarious balance. While the projected zero growth for the end of the year could have heralded dark days, several indicators suggest an unexpected resilience. However, this picture is neither black nor rosy, according to the words of the Governor of the Bank of France, François Villeroy de Galhau.

In a context where financial markets are adapting to the rise of cryptocurrencies, a new milestone was reached on November 21, 2024. With a record volume of $70 billion, Bitcoin spot ETFs and crypto stocks like those of MicroStrategy and Coinbase have captured unprecedented attention. This spike in activity reflects the rapid evolution of investor interest, as well as the unique dynamics that are redefining the contours of the crypto-financial ecosystem.

The world of cryptocurrencies is about to reach a landmark stage: Bitcoin is approaching the symbolic threshold of 100,000 dollars. This event triggers contrasting expectations, between euphoria among investors and caution among analysts. On the brink of this new phase, several questions arise: will this record mark a decisive turn towards a new era of massive adoption, or will it precede a brutal market correction?