Avalanche (AVAX): Rally Begins? November 29, 2023 Crypto Analysis

Avalanche hit a new yearly high by reaching $24. Let’s explore the upcoming prospects for the AVAX price.

Avalanche (AVAX) Situation

While the Avalanche price has been declining for over a year, AVAX recently marked a new yearly ATH (All-Time High). This occurred after a rebound from its lowest level ever recorded since 2021, registering a rise of more than 180% in just over a month. This latest surge naturally came to counter the bearish structure AVAX had followed since summer 2022. Besides technical factors, this increase could have been fueled by news related to Alibaba or JP Morgan, undoubtedly perceived as positive by investors.

Today, the AVAX price is trading around $21. It is noticeable that it has not truly crossed its last peak. Thus, this still leaves the possibility of a continuation of its downward trend. However, the 50-day and 200-day moving averages confirm the idea of a possible ongoing shift to an upward trend. Indeed, they are now crossed and trending upward, below the current price of Avalanche. As for oscillators, they show a persistent bullish momentum, although the emergence of some signs of weakness may legitimately cause fear among investors.

The current technical analysis was conducted in collaboration with Elie FT, a passionate investor and trader in the cryptocurrency market. Now a trainer at Family Trading, a community of thousands of individual traders active since 2017. There you will find Live sessions, educational content, and mutual assistance regarding financial markets in a professional and warm atmosphere.

Focus on Derivatives (AVAXUSDT)

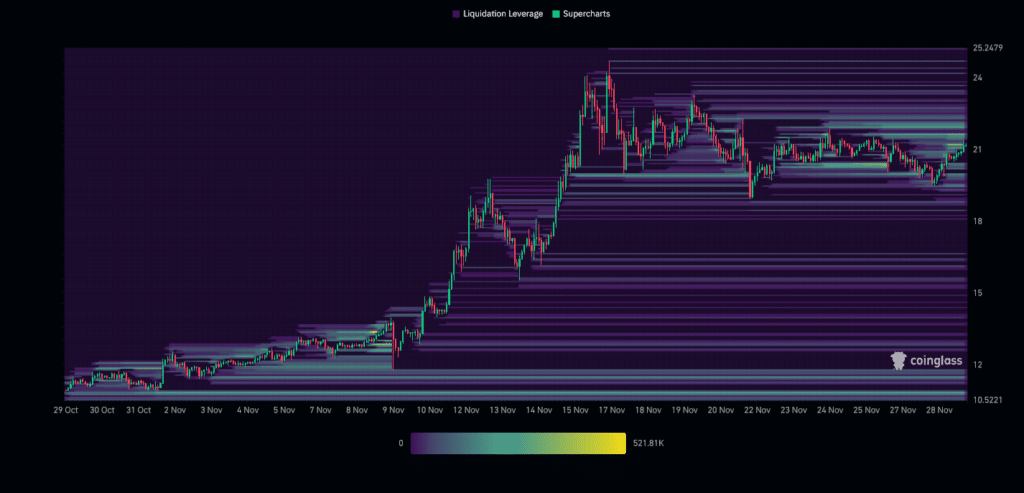

The open interest in AVAX has risen alongside its price. It increased by nearly +272% since the beginning of October. Thus, an addition of positions (Long and short) close to +$158 million can be noted. This reflects an increase in trader participation, particularly on the buyers’ side. As for liquidations, they are not really significant. The distribution occurs on both the buyers’ and sellers’ sides, in a bullish context.

The AVAX liquidations heat map is not particularly revealing, suggesting cautious trading activity. However, it’s important to note that the most relevant and closest liquidation zone to the current price is around the $21-22 mark. As the market approaches this level, it could trigger a large number of orders, which naturally could increase the volatility of the cryptocurrency. Consequently, these zones are potentially attractive for investors.

The Hypotheses for Avalanche (AVAX) Price

If the AVAX price manages to return and maintain above $23, a bullish continuation up to the $30 level could be anticipated. The next resistance to consider, if the upward movement continues, would be between $38 and $40. At this point, that would represent a rise close to +90%.

If the AVAX price fails to cross and maintain above $23, a fallback to the $16-15 range may be considered. The next level to consider, if the bearish movement continues, would be around the $13 and $12 marks. At this stage, that would represent a decrease close to -43%.

Conclusion

Avalanche has undergone a significant rise countering its bearish structure. From a technical standpoint, this suggests the possibility of a trend reversal to the upside. However, a corrective phase is not out of the question. In such a scenario, it will be important to closely observe the price reaction on the various identifiable levels to confirm or refute the different hypotheses made. Beware of potential “fake outs” and market squeezes in each situation. Moreover, let’s not forget that these scenarios are based solely on technical analysis. Cryptocurrency prices can evolve more or less quickly, according to other, more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more