There are now several arguments suggesting that the upcoming cycles may behave differently. This is notably the case by recently reaching an ATH before the halving event.

Bitcoin

The rise of cryptocurrencies has opened new avenues in the investment world, notably through Bitcoin ETFs. These funds, which replicate Bitcoin's performance while being traded on traditional exchanges, represent a fascinating fusion between digital finance and conventional investment. For investors eager to enter the cryptocurrency universe without the complexities of directly managing these assets, Bitcoin ETFs present an attractive solution. This article provides a comprehensive guide on buying Bitcoin ETFs, covering the platforms where to find them, the key steps to acquire them, and the pitfalls to avoid for a successful investment.

In the financial investment world, the rise of cryptocurrencies, particularly Bitcoin, has captured the attention of investors. Simultaneously, Bitcoin ETFs (Exchange-Traded Funds) have emerged as an attractive option for those looking to invest in this sector without the complexities of directly managing cryptocurrencies. However, a question remains: Is it possible to include these ETFs in a Equity Savings Plan.)? This article explores the rules governing investments in an Equity Savings Plan, examines the compatibility of Bitcoin ETFs with these rules, and proposes alternatives for investors.

In 2024, it's not just electricity rates that are rising. Banking fees are also experiencing a significant increase. Can Bitcoin, whose initial ambition is to be a peer-to-peer electronic cash solution, become a serious alternative to increasingly expensive banking services?

Dans le monde financier actuel, les ETF Bitcoin représentent une innovation majeure, offrant aux investisseurs une nouvelle manière d’accéder au marché des cryptomonnaies. Ces fonds négociés en bourse combinent la facilité d’investissement des actions traditionnelles avec l’exposition dynamique au bitcoin. Cependant, le choix du bon ETF Bitcoin peut se révéler complexe, compte tenu de la diversité des options disponibles et des spécificités de chacune. Cet article vise à éclairer les investisseurs sur les principaux critères pour sélectionner un ETF Bitcoin adapté et présentera une analyse détaillée des meilleurs ETF disponibles sur le marché.

The famous economic analyst Noah Smith recently wrote an exciting article about bitcoin. He mentions the recent approval of ETFs by the SEC and the secret interests of certain bitcoiners. His thesis is striking: there would be an increasingly powerful Bitcoin lobby that would act in the shadows to create monetary chaos in the world.

Experiencing the loss of your Bitcoin account is one of the most frightening nightmares for a cryptocurrency investor. However, in the face of this perplexing situation, there are effective strategies you can deploy to fully recover your data and protect your assets. Whether it's a connectivity issue, the loss of your private keys or passwords, or even if you have been the target of phishing or hacking attacks, don’t panic. Follow the Bitcoin security tips that we will detail in this guide. They will provide you with pragmatic solutions to safely regain access to your valuable bitcoins.

With the rapid evolution of the crypto industry, the security of digital assets has become a major concern for holders of Bitcoin and other crypto assets. Soft Wallets have become essential tools for storing and managing your digital currency. However, with the number of options available in the crypto market, selecting a Soft Wallet is not that simple. Discover our complete guide to digital wallets for cryptocurrencies.

The security of digital assets is a major concern for investors. That’s why many Bitcoin holders choose to use a hardware wallet, or hard wallet, to store their cryptos with peace of mind. Discover our review of the most popular and effective hard wallets for securing your bitcoins, ethers, and other cryptocurrencies, along with their features, advantages, and disadvantages.

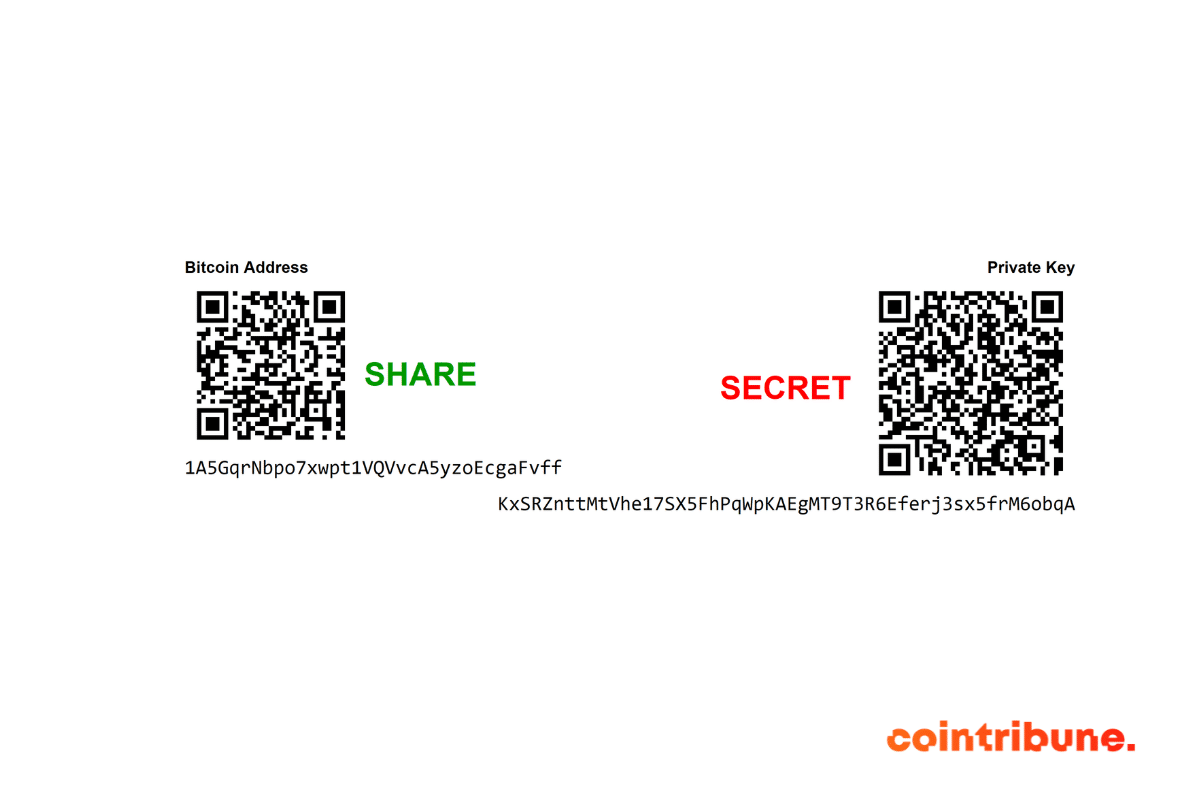

The concept of a key frequently appears in the cryptocurrency world due to its crucial role in managing a crypto wallet. Indeed, a person truly owns bitcoins only when they are the sole holder of their private keys. Therefore, you must keep it secure if you possess one. In this article, we invite you to dive into the fascinating world of Bitcoin private keys and their secure management. Our journey will include understanding fundamental concepts, various types of wallets available, and optimal storage methods. From a broader perspective, we will also provide essential Bitcoin security tips to effectively protect your valuable digital assets. Dans le cadre de cet article, nous vous invitons à une plongée au cœur du monde fascinant des clés privées Bitcoin et de leur gestion sécurisée. Notre parcours inclura la compréhension des concepts fondamentaux, les divers types de portefeuilles disponibles, ainsi que les méthodes optimales de stockage. Dans une perspective plus large, nous vous fournirons également des conseils sécurité Bitcoin [Insérer lien Page mère Conseils Sécurité Bitcoin] essentiels pour protéger efficacement vos précieux actifs numériques.

In the world of cryptocurrencies, the Cypherpunk movement is often mentioned when discussing the origins of Bitcoin (BTC). But why? What role did it play in the creation of the pioneer of cryptocurrencies? And, most importantly, what does it entail exactly? Let's explore some answers together.

You’re hearing about Bitcoin (BTC) more and more often, and you’ve even invested into it, but you haven’t yet dived into the bowels of the network. Well, today, you have an opportunity to take the plunge by following along with the steps needed to deploy your very own node on…

Having already talked about good practices managing email addresses and crypto exchanges, it’s time to move on! The long term storage of your bitcoins and other cryptocurrencies on the exchange platform where you bought them is high on the list of bad practices for managing your crypto legacy. As ergonomic…

If you’ve been informing yourself about Bitcoin mining, you’ve certainly heard of Bitcoin Core. The open source software was first released in 2009 by Satoshi Nakamoto, the creator of BTC, under the name ‘Bitcoin Qt’. According to data collected in 2016, almost 90% of miners used the Bitcoin Core client…

Online gambling first hit the scene at the end of the 1990s. Since then, things have changed a lot and now you can even play at an online casino with Bitcoin. There are more and more platforms out there that offer games with BTC. In order to get up to…

More and more people are looking to get their hands on some bitcoin (BTC). Some of these people believe that it is possible to get bitcoin for free. Unfortunately, this type of reasoning provides fertile ground for scammers who wish to take advantage of the greed of some to…

The purpose of this guide is to introduce you to the different options available when you want to sell BTC. This includes selling your bitcoin back into your traditional bank account, Paypal or another means of fiat money. If you decide to sell your Bitcoin online, you can do so…

Bitcoin is the flagship and pioneering cryptocurrency in this emerging crypto age. No other cryptocurrency can boast the same market cap or fame that Bitcoin has acquired. Since 2008, Bitcoin has aimed to facilitate international capital exchanges without intermediaries, allowing for faster and more secure transactions thanks to its blockchain…

Created by Satoshi Nakamoto, Bitcoin is the most famous cryptocurrency in the world, and also the most valuable. It has established itself as a precursor of virtual currency because it forms part of the very first generation. Bitcoins are created and managed by a community of internet users who…