Cryptocurrency staking is an increasingly popular method to grow digital assets. By locking up cryptos to support the operation of a blockchain network, investors can receive regular rewards. However, in France, these gains are taxed and must be treated with the same rigor as any other type of income. This article will examine the tax implications of staking and unveil strategies to minimize taxes on these earnings.

Finance

Staking cryptocurrencies is becoming increasingly popular among investors looking to profit from their digital assets. By locking up cryptos to support the functioning of a blockchain network, investors receive rewards in return that increase their digital portfolio. However, these rewards are not exempt from tax obligations and must be declared like any other type of income. This article will guide you through the tax implications of staking and provide a detailed procedure for declaring these incomes.

Staking cryptocurrencies is an increasingly popular practice among investors seeking passive income. By locking their digital assets to support the operation of a blockchain network, they can receive regular rewards. However, in France, these incomes are subject to tax, and it is essential to understand the legislation to avoid unpleasant surprises. This article deciphers the tax obligations related to staking, explores recent developments in the finance law, and provides practical advice for optimal tax management.

Cointribune and Huahua team up to reward reading with $HUAHUA tokens! Get involved and earn crypto today.

Staking has become an essential practice for cryptocurrency holders. It allows them to actively participate in validating transactions on blockchain networks. This technique, which involves locking a certain amount of digital currency to support a network's operation, offers attractive rewards. However, to make the most of it, it is imperative to understand how it works, its advantages, as well as the associated strategies and risks. Let's take a look at the benefits of this activity and strategies to maximize the gains it offers.

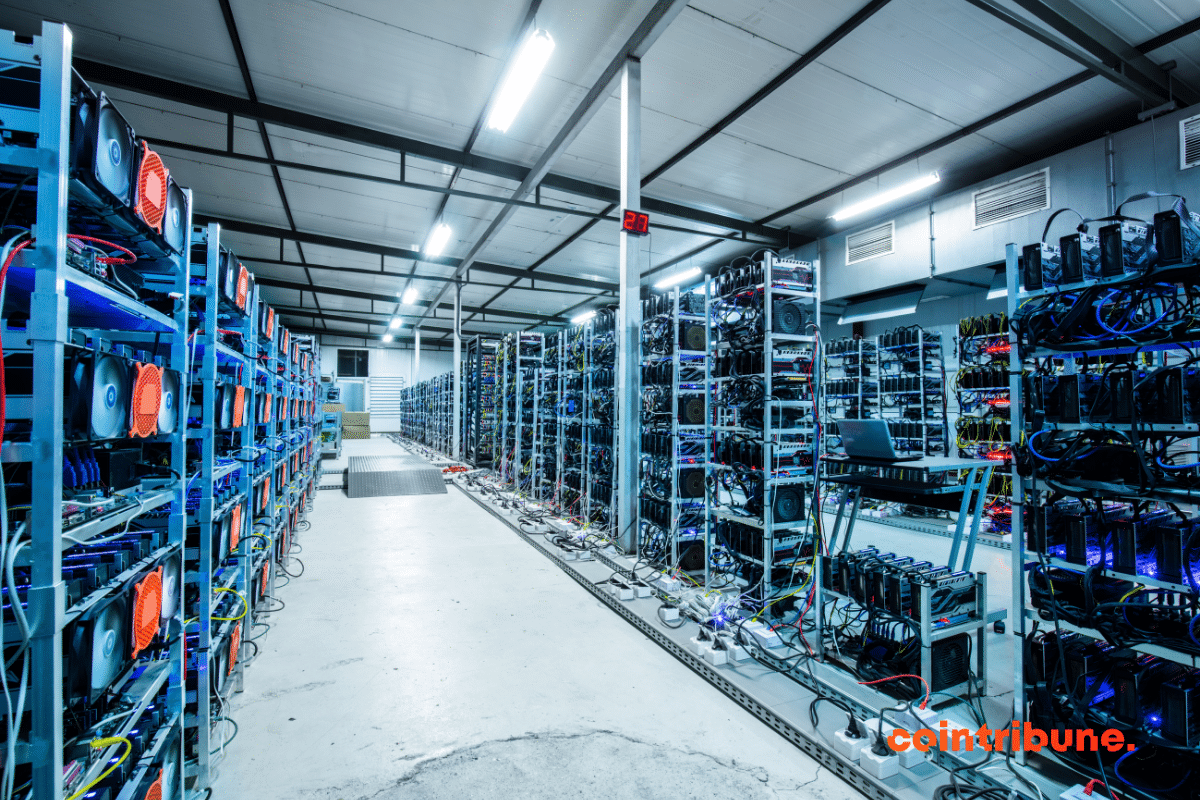

In the world of cryptocurrencies, staking and mining are two key strategies for increasing one's digital assets. While mining relies on computational power to secure the network and validate transactions, staking involves holding funds in a cryptocurrency to support the integrity of the network. This article compares these two methods in detail, exploring their techniques, profitability, and associated risks. Whether you're a seasoned investor or a newcomer to the crypto industry, understanding the nuances between staking and mining will allow you to optimize your investments and navigate the crypto ecosystem with confidence.

Cryptocurrency staking has become a popular practice for those looking to profit from their digital assets. It involves locking cryptocurrencies to support the operation and security of a blockchain network and allows for the generation of passive income. This article is designed to guide beginners through the fundamentals of staking. It explains how it works, the steps to get started, strategies to maximize gains, and pitfalls to avoid.

Making money in the crypto universe isn’t just about trading or mining. There are other ways to generate income, notably staking. Staking allows holders of cryptocurrencies whose blockchain uses the proof of stake (PoS) mechanism to earn money. If you want to grow your money while being environmentally friendly, crypto staking is ideal. Follow along in this article to fully grasp its functioning, its advantages, and the potential profits of this very interesting activity.

Trading in financial markets is a complex and dynamic activity, requiring not only a deep understanding of the markets but also access to the right tools. In this rapidly evolving environment where information and trends change swiftly, having the best trading tools is a must to remain competitive and effective.

Technical analysis is a fundamental component of trading, allowing investors to navigate the financial markets insightfully. It is based on studying price movements and trading volumes to predict future trends. This article aims to demystify technical analysis by explaining its basic principles, essential tools and indicators, how to read and…

Fundamental analysis plays a crucial role in cryptocurrency trading, offering investors insight into the intrinsic value and long-term potential of digital assets. In a market characterized by volatility and constant innovation, mastering this analytical approach distinguishes solid investment opportunities from high risks. This article aims to demystify fundamental analysis in crypto trading by addressing its basic principles, key indicators to watch, strategies for effective analysis, and common pitfalls to avoid, thus providing a practical guide for investors aspiring to navigate successfully in this complex universe.

Trading in financial markets is an activity that requires not only discipline but also a deep understanding of various analysis methods. Whether one is interested in stocks, forex, or other instruments, effective analysis is key to success in often unpredictable financial markets. For traders, whether novice or seasoned, grasping the…

Do you dream of winning a PS5? Cointribune, in partnership with Rayn, is launching a contest that could help you fulfill your wish. This contest is part of the Read to Earn program, an initiative that rewards curiosity and learning about blockchain and cryptocurrencies.

L’avènement des security tokens marque une évolution significative dans le monde de la finance numérique, offrant une nouvelle façon de représenter les actifs financiers sur la blockchain. Ces tokens, qui allient les avantages de la technologie blockchain à la conformité réglementaire, sont en train de transformer les méthodes traditionnelles de financement et d’investissement. Toutefois, le processus de création et de gestion d’un security token est complexe et nécessite une compréhension approfondie de plusieurs aspects clés. Cet article se propose de détailler les étapes cruciales de ce processus, de la conception initiale à la gestion post-lancement, offrant ainsi un guide pratique pour les entreprises qui envisagent d’entrer dans cet espace innovant.

Security tokens are emerging as a major innovation in the world of digital finance. By merging blockchain technology with the demands of traditional financial markets, they offer a new perspective on investment and asset tokenization. However, this advancement is not without challenges, particularly in terms of regulatory compliance and technological integration. Let's explore the specifics of these assets.

Security tokens are transforming the landscape of digital finance, introducing a new and regulated dimension to the world of cryptocurrencies. Anchored in blockchain technology, these tokens stand out for their ability to represent real financial assets while offering increased security and transparency. However, their integration into the financial market poses significant challenges, particularly in terms of regulation and investor understanding. This article aims to demystify the concept of security tokens by exploring their functionality, the regulatory frameworks governing them, as well as the advantages and risks they present to investors.

Cryptocurrency trading relies heavily on the interpretation of signals. These signals, key indicators for buying and selling decisions, play a crucial role in any trader's strategy. However, understanding them and using them effectively is not always straightforward. Certain strategies and tricks can help you decipher these signals. This article discusses the different types of trading signals, strategies for using them to your advantage and common mistakes to avoid for optimal interpretation.

Trading, with its fluctuations and uncertainties, calls for rigorous risk management to ensure the sustainability and profitability of investments. Faced with a volatile and unpredictable market, understanding and mastering the different types of risk is important for protecting capital and maximizing gains. This article sets out the strategies for effective risk management in trading.

Trading, a complex and constantly evolving activity, requires a deep understanding of taxation, particularly in France where tax rules are diverse. For traders, whether they operate in stocks, cryptocurrencies, or other digital assets, mastering the tax aspects is crucial to maximizing returns and minimizing risks. This article sheds light on the current tax rules for traders, from amateurs to professionals, and offers strategic advice for optimized tax management.

Trading, whether it involves stocks, cryptocurrencies like Bitcoin, or other assets, requires not only a sound investment strategy but also a deep understanding of tax obligations. In France, declaring trading income can be complex, with specific rules and significant tax implications. This article aims to clarify this process by providing detailed information on the different categories of trading income, the important steps for compliant declaration, tax optimization methods, and the pitfalls to avoid for effective and error-free tax management.

The rise of cryptocurrencies has transformed the financial landscape, introducing new tax challenges for investors. Among these is the flat tax on cryptocurrency gains. This uniform tax changes the way crypto gains are taxed, affecting investment strategies and tax planning. Investors need to adapt to this reality to optimize their returns while remaining compliant with crypto trading tax requirements. This article details what the flat tax is, its application to cryptocurrencies, its implications for investors, and provides strategies for effectively managing tax obligations in this context.

Les masternodes attirent l’attention des investisseurs pour leur potentiel de revenus et leur rôle important dans les réseaux blockchain. Ces nœuds qui soutiennent le fonctionnement des cryptomonnaies offrent une combinaison unique d’avantages financiers et de participation active au réseau. Cependant, ils comportent également des risques liés à la volatilité du marché des cryptomonnaies et aux exigences techniques. Cet article explore en détail les avantages et les risques associés aux masternodes, et fournit des stratégies concrètes pour maximiser les bénéfices potentiels.

Blockchain, renowned for its disruptive innovations, presents a new facet with the concept of Read to Earn. This initiative merges technology and content consumption, offering a novel dynamic in the digital world. Instead of being mere consumers, readers become active users, rewarded for their engagement and curiosity. This article reveals the multiple advantages of Read to Earn in blockchain and highlights its potential to enrich both readers and content creators while enhancing the intrinsic value of the blockchain ecosystem.

In the world of cryptocurrencies, new methods for acquiring assets are emerging regularly. Among them, the Read to Earn concept stands out for its innovative and accessible approach. Instead of mining or investing, why not earn cryptos simply by consuming content? This is the enticing promise of Read to Earn. If the idea of combining learning with financial gains appeals to you, this article is for you. It reveals how to turn your reading time into a potential source of income in the world of cryptocurrencies.

In the digital world, engagement models are constantly evolving. The concepts of Read to Earn and Learn to Earn are drawing attention for their innovative approach to content consumption and education. But what is the real distinction between these two models? Why are they relevant in today’s landscape? This article aims to demystify these terms, highlighting their characteristics, advantages, and implications.

In the digital age, where content is king, a new trend is shaking up the landscape: the Read to Earn model. Instead of being mere consumers, readers become active participants, earning tangible rewards for their engagement. This shift, though subtle, redefines the interaction between creators and consumers, establishing a synergy where everyone finds their reward. This article unveils the specifics of Read to Earn, highlighting how it works and the opportunities it offers.

The term bear market is used by crypto investors to refer to a market where most stocks are declining in value, as opposed to the term bull market, which stands for a market on the rise. A bear market has its distinct characteristics and is important to understand if you…

A bull market is a market in which prices are rising or are expected to rise. The word is widely used by crypto investors in contrast to the term bear market, a market where most stocks are declining in value. Usually, it’s quite easy to profit in a …

An atomic swap is a peer-to-peer exchange that allows two users to exchange digital assets without going through an exchange, centralised or not. How does it work? While the core principles of an atomic swap are relatively easy to grasp, the whole thing is a bit harder to get…

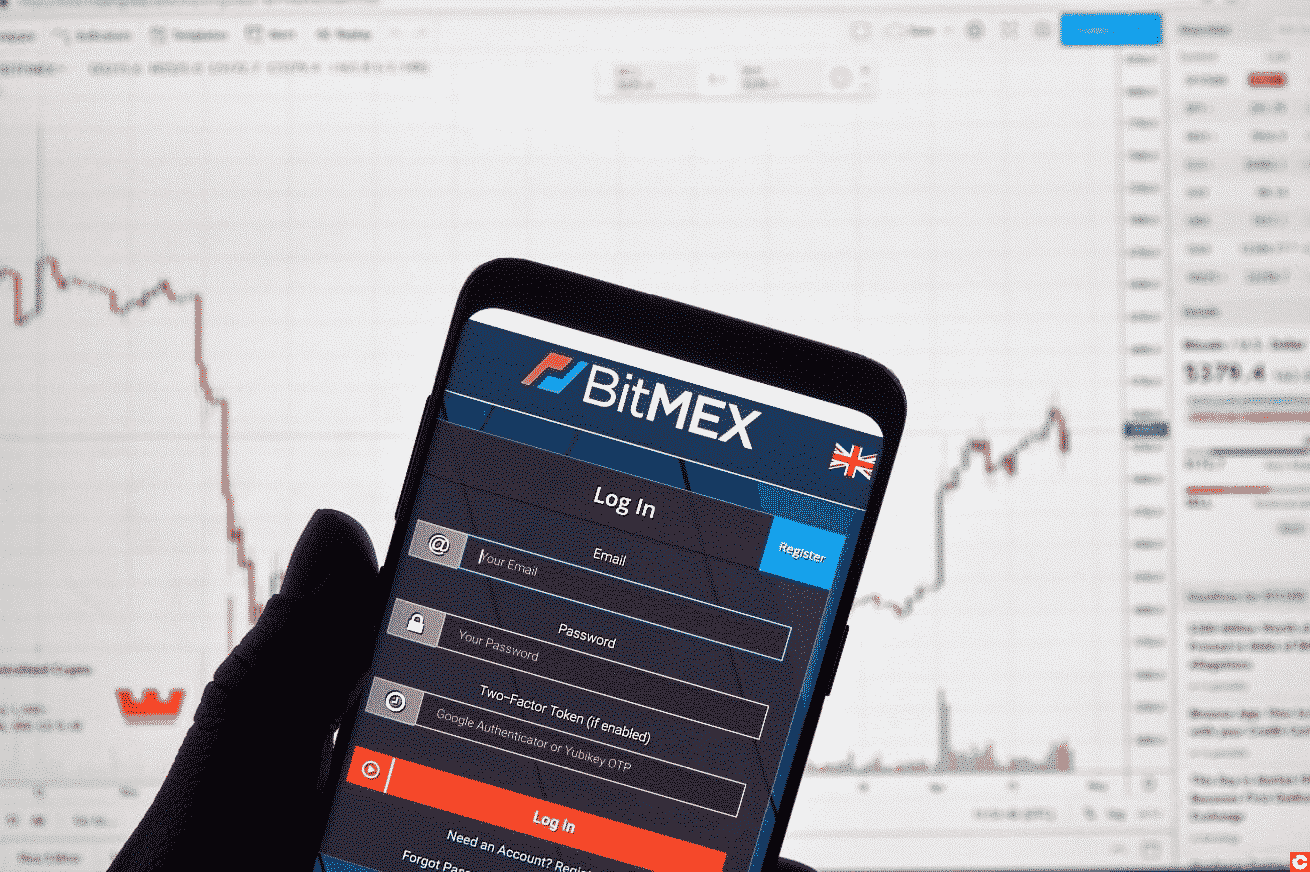

For the uninitiated, taking your first steps on the BitMEX exchange can seem complicated. The interface is uninviting and, let’s face it, intimidating. But by getting to know this platform and with a little help registering, it quickly becomes much more accessible. In this comprehensive guide to creating a BitMEX…