Crypto: Institutional funds experiencing lots of outflows

Institutional funds specializing in cryptocurrencies continue to face capital outflows for the fifth consecutive week, according to the latest report from CoinShares. With a withdrawal of $32 million last week, the total outflows now amount to $232 million. Despite a decrease compared to previous weeks, institutional investors remain cautious towards cryptos. Let’s explore the reasons behind this trend.

The outflow trend persists

As the cryptocurrency market experiences a stagnant phase, with Bitcoin struggling to surpass the $30,000 mark, investors are displaying a negative sentiment.

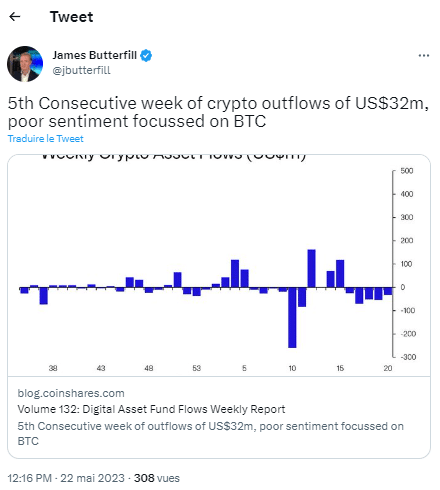

According to a recent CoinShares report on crypto asset fund flows, crypto-focused investment funds have recorded a series of capital outflows for the fifth consecutive week.

Between May 15th and May 19th, these funds witnessed a capital outflow of $32 million. Bringing the total to $232 million. Despite a slight decrease compared to previous weeks, this trend still evokes a certain reluctance among institutional investors, according to James Butterfill, Head of Research at CoinShares.

Exchange volumes have also declined, reaching $900 million for the week, representing a 40% decrease compared to the year’s average. This trend has also been observed on centralized exchange platforms. Where volumes hit their lowest level since late 2020, amounting to $20 billion for the week.

This trend persists, with Bitcoin funds experiencing the highest number of outflows, totaling $33 million. In comparison, Ethereum funds saw smaller outflows, with only $1 million.

Investor geographic preferences

Regarding the geographic distribution of fund outflows, Germany takes the lead with $24 million, accounting for 73% of the total. Institutional funds based in Switzerland also recorded outflows amounting to $3.3 million.

These coincided with the approval of European legislation on cryptocurrencies, MiCA. Additionally, US funds recorded an outflow of $5.5 million, while Canada, a crypto supporter, saw an inflow of $2.2 million.

During the five-week period from April 21st to May 19th, the price of Bitcoin experienced a decline of approximately 4.8%. It is now stabilized at $26,842. Currently, at the time of writing, the price of BTC stands at $27,309, according to data provided by CoinMarketCap.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.