ECLD Token's Surge Marks a Milestone for Ethernity Cloud: Analyzing Its Investment Potential

In recent developments within the cryptocurrency market, the ECLD token has experienced a significant surge, capturing the attention of investors and marking a milestone for Ethernity Cloud’s innovative approach to decentralized cloud computing. This rise highlights the token’s growing market presence and sets the stage for a deeper exploration into what makes ECLD a potential game-changer in the cloud computing and decentralized finance (DeFi) sectors.

Cloud computing has become a fundamental aspect of the digital age, allowing people to store data and run applications on the internet instead of their computers. It’s everywhere—from the apps on our phones to the services businesses use daily. However, as much as cloud computing has simplified technology, it also brings challenges, especially around security and privacy.

In this context, Eternity Cloud introduces a significant shift in how we approach cloud computing, focusing on the need for a more secure and private Cloud. At its essence, it uses blockchain’s decentralized nature to tackle some of the most pressing digital issues today: safeguarding data privacy and security, and intellectual property protection. This represents a whole new way of thinking about and interacting with cloud technology—promising a future where users and developers have more control and security over their digital assets. Ethernity Cloud’s approach, centered around the ECLD token, highlights the platform’s innovative potential within the growing decentralized finance (DeFi) space and beyond.

This article examines the investment potential of the ECLD token within the Ethernity Cloud ecosystem, exploring how it fits into the bigger picture of decentralized finance (DeFi). We’ll look into ECLD’s tokenomics, utility, market performance, and how it supports the shift towards decentralized computing.

Overview of ECLD token

The ECLD token is at the heart of the Ethernity Cloud ecosystem, a foundational element that drives both functionality and engagement within its decentralized computing framework. ECLD operates under the principle of scarcity, crucial for its value over time.

ECLD’s utility spans various facets of the Ethernity Cloud platform, serving as the medium for transactions, incentives, and rewards. It facilitates seamless transactions within the ecosystem, enabling users to access and pay for confidential computing services in a decentralized manner. The token also plays a vital role in incentivizing node operators, who are essential to the platform’s infrastructure. By rewarding these operators with ECLD tokens for their contributions. Furthermore, the token fosters active community engagement, allowing token holders to influence Ethernity Cloud’s direction.

Beyond its ecosystem, the ECLD token’s broader significance lies in its contribution to the decentralized finance (DeFi) landscape. By providing a secure and private framework for cloud computing, ECLD enables a range of DeFi applications and services that require confidential data processing capabilities

Utility and Use-cases

The ECLD token embodies a strategic blend of utility, incentive, and potential within the broader context of decentralized computing and finance. Delving deeper, ECLD facilitates all transactions within the Ethernity Cloud platform, streamlining the exchange of services and payments. This function is critical in ensuring that users can access decentralized cloud computing resources with ease and security, characteristic of blockchain technology. The ability to conduct transactions seamlessly within the platform enhances user experience and fortifies the ecosystem’s decentralized nature, eliminating the need for traditional financial intermediaries and thereby reducing associated costs and complexities.

The token’s incentivization of node operators is critical, ensuring network stability and security. This incentivization ensures a continuous commitment to the network’s health, crucial for the platform’s reliability and performance.

The introduction of staking mechanisms for ECLD tokens not only enhances network security through token distribution but also fosters community engagement by providing a means for token holders to earn passive rewards. This strategy aligns with the broader goals of fostering a committed and active user base, which is essential for the platform’s long-term viability.

ECLD’s integration into the DeFi sector exemplifies its adaptability and potential for widespread use. Its application across various DeFi protocols—for instance, as collateral in lending platforms or as a liquidity provision in decentralized exchanges—illustrates the token’s capacity to support innovative financial services. This versatility positions ECLD as a valuable asset within the DeFi ecosystem, facilitating new modes of financial interaction and service provision.

Beyond its broader DeFi functionality, ECLD finds specific uses within the Ethernity Cloud platform, such as enabling access to enhanced data protection services and allowing token holders to participate in governance decisions. These specialized applications reflect ECLD’s role in not just facilitating basic operations but also in enriching user experience and empowering the community to shape the platform’s future. This dual capacity of ECLD underscores its importance in both daily platform functions and in broader strategic development.

Tokenomics and Distribution

The tokenomics and distribution framework of the ECLD token is crafted with an emphasis on ensuring long-term stability, fostering ecosystem growth, and incentivizing meaningful participation among its stakeholders. With a fixed total supply of 1 billion tokens, the model is designed to mitigate inflationary pressures and preserve the token’s value over time. Currently, the ecosystem boasts a circulating supply of 150 million tokens, a figure that reflects active engagement within the network and contributes to its overall market capitalization, which stands at approximately $6.4 million. This valuation points to a growing interest and investment in the platform, underscoring its vitality within the decentralized cloud computing space.

The distribution of ECLD tokens is strategically aligned with the ecosystem’s objectives, ensuring that different segments of the community are appropriately incentivized. This includes allocations for the founding team and advisors, recognizing their integral role in the project’s inception and ongoing development. Additionally, a significant portion of the token supply is dedicated to community rewards, designed to encourage participation in governance, staking, and other activities that bolster network security and contribute to the platform’s evolution.

Investments in ecosystem development are another critical component of ECLD’s economic model. Funds earmarked for this purpose aim to drive the platform’s expansion, underwriting new projects, technological advancements, and partnerships that enhance the utility and reach of Ethernity Cloud. Such strategic reinvestment is essential for maintaining the platform’s competitive edge in the rapidly evolving landscape of decentralized technologies.

Liquidity is a primary concern in ECLD’s tokenomics, with specific allocations intended to ensure the token’s availability and trade ability across exchanges. This approach not only facilitates market access for a broader range of participants but also aids in stabilizing the token’s price by mitigating potential liquidity crunches.

Trust among the community and potential investors is built through transparency in the distribution and allocation of ECLD tokens. By openly sharing details about the token supply, its distribution strategy, and usage plans, Ethernity Cloud aligns itself with best practices in governance and ethical conduct within the blockchain space.

Market Performance Analysis

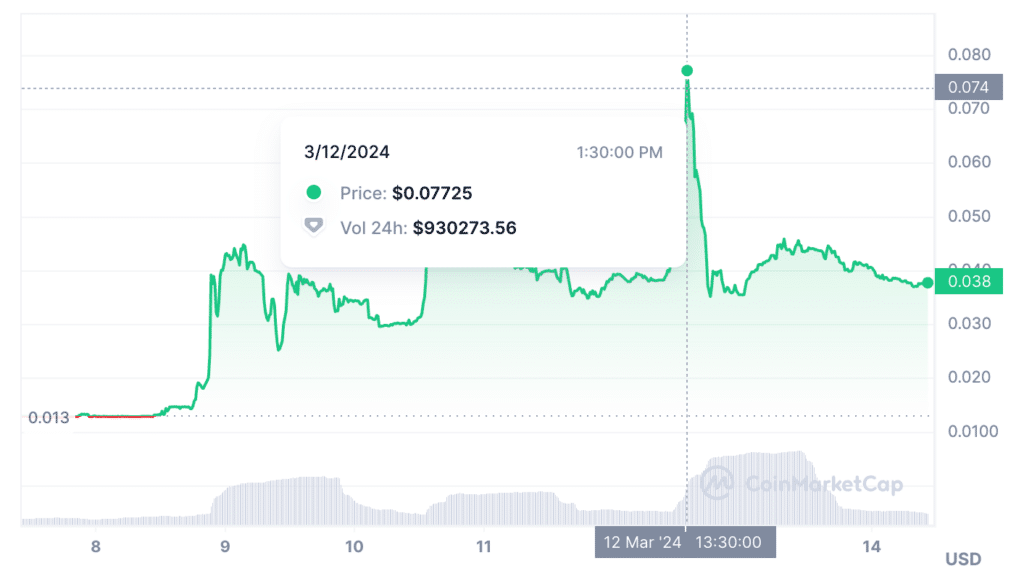

The market performance of the ECLD token showcases a dynamic and promising trajectory. Its journey to an all-time high of $0.0767 on March 12, 2024, from a considerably lower valuation of $0.0103, illustrates not just the token’s volatility but also its capacity for rapid growth. This growth is a testament to the market’s confidence in Ethernity Cloud’s technological advancements and its innovative approach to decentralized cloud computing.

The volatility observed with ECLD, while indicative of the potential for swift value increases, also underscores the inherent risks and speculative nature of the cryptocurrency market. Investors and market watchers are drawn to such tokens that demonstrate quick gains, reflecting the broader market’s appetite for innovative blockchain solutions that promise enhanced privacy and security in digital interactions.

Highlighting the recent achievement, ECLD secured the #1 spot as the top gainer on CoinMarketCap, emphasizing its growing value and potential within the DeFi landscape. This milestone is not only about the token’s market performance but also acknowledges the robust technology and innovative approach of Ethernity Cloud.

A key factor that indicates the potential for a high value in the future is the depth of utility that the token possesses. A token that is deeply integrated into its platform’s functionality and offers a wide range of uses has a stronger foundation, suggesting that its current market performance could just be the beginning of its value appreciation. The token’s performance, backed by robust technology and a vibrant community, positions it as a compelling asset for investors interested in the evolving field of decentralized finance and cloud computing.

Conclusion

In wrapping up, ECLD represents the qualities of an emerging token within the evolving digital landscape, seamlessly fitting the narrative of a ‘hidden gem. Its utility, governance model, and integration into the DeFi ecosystem highlight Ethernity Cloud’s forward-thinking approach. As the sector continues to mature, ECLD’s potential for impact suggests it’s an area worthy of closer examination by those interested in combining blockchain technology, cloud computing, and investment opportunities in the crypto space.

As with any investment, especially in the rapidly evolving crypto market, conducting thorough research and considering a wide range of factors before making investment decisions is crucial.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more