Ethereum (ETH) Imminent Drop? December 20, 2023 Crypto Analysis

The Ethereum price finished the second week of December on a negative note, recording a drop of 6% and seems to continue its bearish movement. Let’s examine together the future outlook for the ETH price.

The Ethereum (ETH) Situation

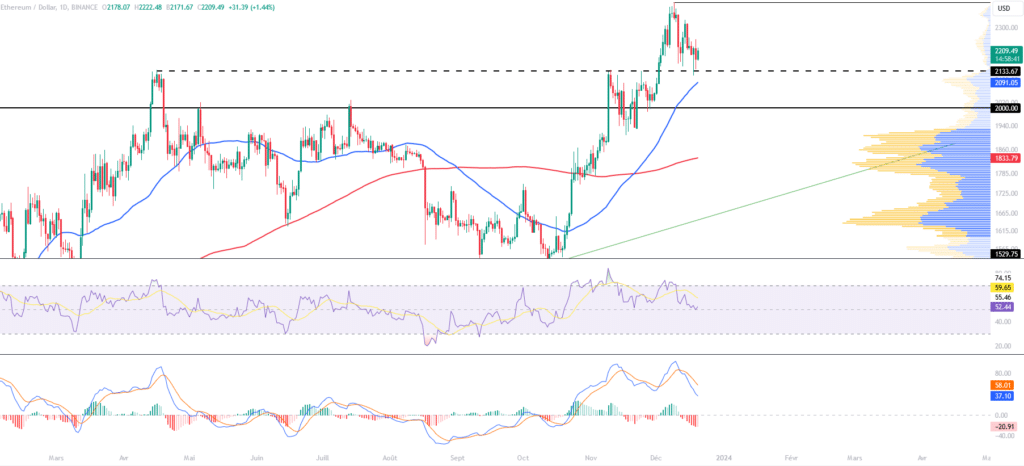

After reaching a new yearly high at $2,400 at the beginning of the month, the Ethereum price suffered a decline approaching -10%. Ethereum tried to recover at the $2,140 level. It is worth noting that this last level was the former peak, taken into account since the start of the year 2023. Currently, ETH appears to be consolidating and building pressure, forming a small descending wedge.

This morning, Ethereum is trading around $2,200. It is above its 50 and 200-day moving averages, which continue to trend upwards, thus supporting the bullish trend in the medium and long term for Ethereum. On the oscilloscope side, indicators still point to a bullish momentum. However, a daily divergence is intensifying. This suggests a period of consolidation or correction that should not be overlooked.

The current technical analysis has been carried out in collaboration with Elie FT, an enthusiastic investor and trader in the cryptocurrency market. He is currently a trainer at Family Trading, a community of thousands of proprietary traders active since 2017. You’ll find Live sessions, educational content, and support around financial markets in a professional and warm atmosphere.

Focus on Derivatives (ETHUSDT)

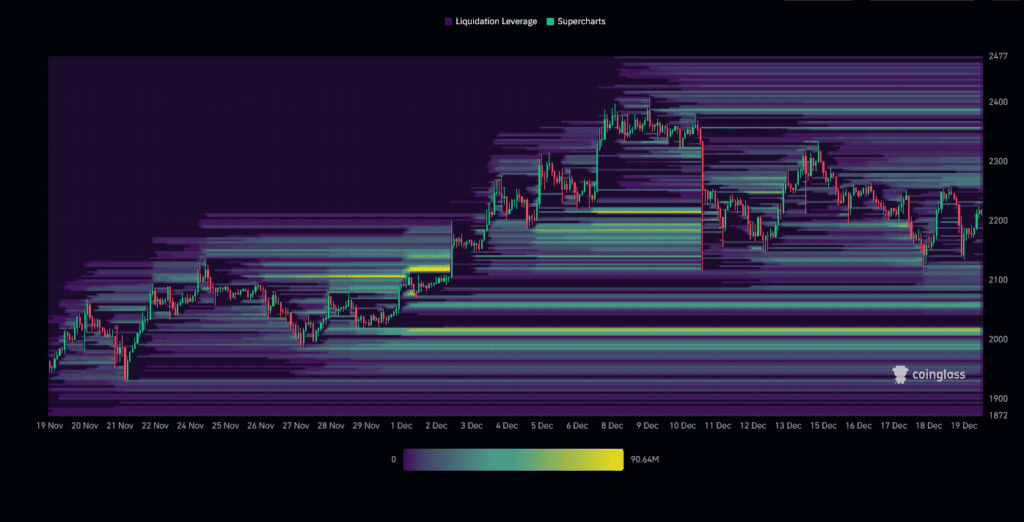

After failing to breach $2,400, Ethereum’s open interest dropped by approximately 19%. This represents nearly $960 million less in positions on ETH contracts. This decline was accompanied by significant liquidations on the buyers’ side. Consequently, these elements demonstrate a reduction in trader engagement in the market, suggesting an opportunity to reevaluate one’s strategy. Since then, ETH’s open interest has been stagnant, suggesting that traders are still lacking conviction regarding the token’s future performance.

The Ethereum liquidation heat map reveals that, as of today, the most significant liquidation zone is slightly above $2,000. Indeed, this level has sparked considerable interest among traders since the end of November. As the market approaches these levels, it might trigger a large number of orders, which, naturally, could increase the volatility of the cryptocurrency. Consequently, this zone must be attractive for investors.

Hypotheses for the Ethereum (ETH) Price

If the Ethereum price maintains above $2,140, we could anticipate a bullish continuation up to the level of $2,300. The next resistance to consider, if the upward movement continues, would be the threshold of $2,400 or even $2,500. At this stage, it would represent an increase close to +16%.

If the Ethereum price does not hold above $2,140, we could consider a pullback to $2,000 or even $1,900. The next support to consider, if the bearish movement continues, would be around the $1,800 levels. At this stage, it would represent a decline close to -15%.

Conclusion

After failing at $2,400, Ethereum is tending to make up for its loss. As such, increased support from buyers is necessary to strengthen the hypothesis of a bullish continuation. Otherwise, the bearish movement may continue. Consequently, it is imperative to closely monitor the price reaction at different key levels to confirm or disprove the current hypotheses. Beware of potential “fake outs” and “market squeezes” in each situation. Moreover, let’s not forget that these scenarios are based purely on technical analysis. The course of cryptocurrencies can change more or less quickly, according to other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more