Ethereum shows a rebound of more than 50% in less than two weeks. Find our complete analysis and the current technical perspectives for ETH.

Finance News

The BIS reveals that $600 billion in crypto circulated in 2024, primarily for speculation, not for real use. Details here!

On May 13, 2025, in Riyadh, Donald Trump signed a strategic partnership with Saudi Arabia valued at 600 billion dollars. Beyond the amount, it is the nature of the alliance, encompassing defense, tech, and energy, that is striking. As Washington strengthens its foothold in the Middle East and Riyadh accelerates its post-oil transformation, this agreement redefines the power dynamics between two powers seeking global influence.

American inflation defied all doomsday predictions in April, falling to 2.3% despite the implementation of massive tariffs by the Trump administration. This unexpected decline raises a troubling question: what if analysts had exaggerated the impact of protectionist measures? Are fears of an inflationary spiral overstated?

Bitcoin accelerates and moves back above $100,000: find our complete analysis and the current technical outlook for BTC.

Ethereum, powered by the Pectra update, is surprising. In just five days, the crypto ETH jumps by 42%. It surpasses Coca-Cola and Alibaba in market capitalization. This meteoric rise shakes traditional markets. Today, the time is no longer for the anonymous ambitions of established values. It is about the emergence of a decentralized network that is redefining the financial hierarchy.

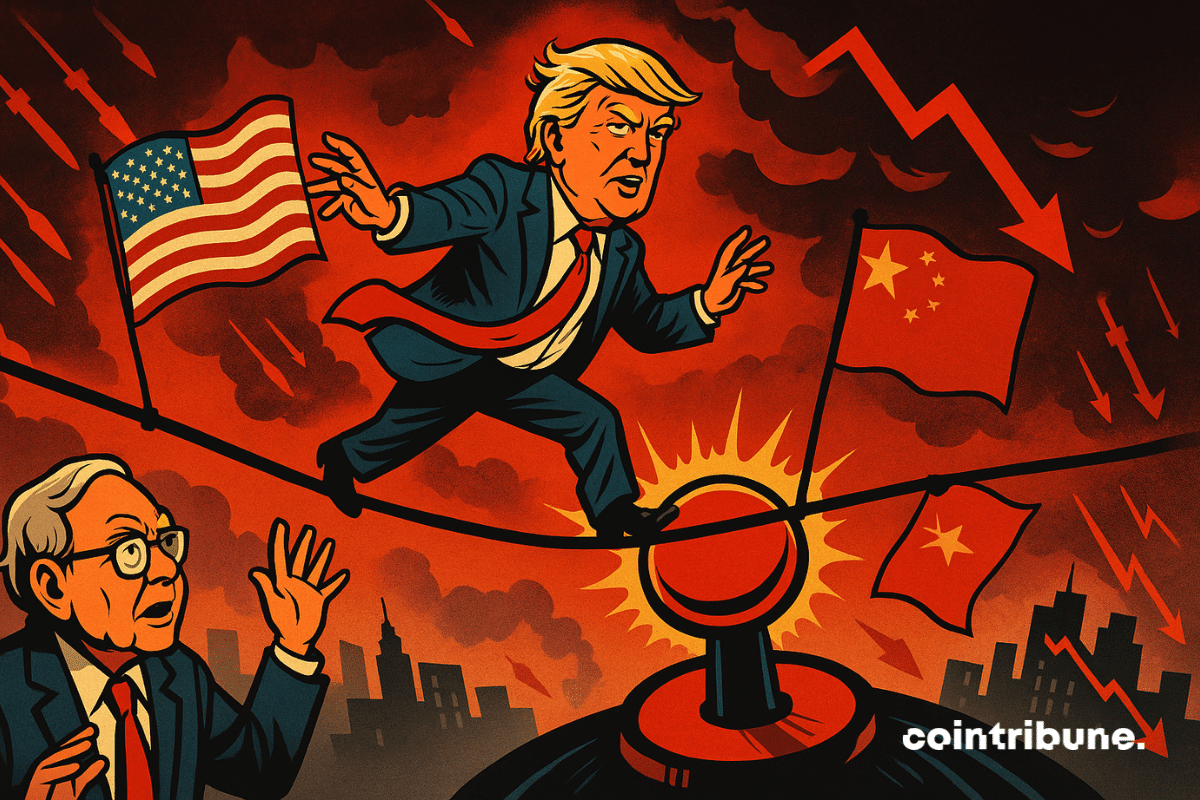

The U.S. and China agree to pause tariffs for 90 days, boosting crypto market optimism with Bitcoin and others seeing strong gains.

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

In a world where geopolitical fault lines are shifting rapidly, Saudi Arabia plays a delicate tune between two rival blocs. Solicited by the BRICS but still closely tied to the United States, Riyadh is biding its time, suspending its official membership despite signals of openness. While Beijing lures with its economic promises and Washington threatens with tariffs, the kingdom is preserving its options. Does this tactical ambiguity mask a pre-established strategic direction or is it preparing for a major rebalancing on the global chessboard?

As the Russo-Ukrainian war drags into its fourth year, a possible meeting between Volodymyr Zelensky and Vladimir Putin in Istanbul could reshape the dynamics. For the first time in months, Kyiv is open to the idea of direct talks. Zelensky announced this Sunday, May 11, that he would await Putin on Thursday, May 15, in Istanbul. However, Ukraine sets a firm condition: no exchanges will take place without a total ceasefire, which is demanded from this Monday. This is a significant requirement in a conflict where every diplomatic gesture is closely scrutinized.

Chinese economy: prices are sinking, the people are saving, Beijing is patching things up, dishes are changing. The dragon is coughing, but still plays the mystery card to avoid being roasted.

As the conflict in Ukraine reaches a critical juncture, Kyiv and its Western allies are proposing a comprehensive, unconditional ceasefire for 30 days. Supported by Washington and major European capitals, this initiative aims to create a pathway for negotiations. However, beyond the call for a truce, one question looms: will Moscow see this as a genuine hand extended or a tactical maneuver concealing a strategic advantage for Ukraine? The answer could reshape the balance of power diplomatically.

Refounding or not, the Ethereum Foundation continues to support the ecosystem: millions distributed, subsidized crypto-tech, Vitalik in quantum mode, and pampered developers. Who said austerity?

With Pectra, Ethereum promises the future but stacks ETH with the big players: decentralization or private club? The small stakers, on the other hand, count their crumbs on the blockchain.

Morgan Stanley estimates that bitcoin is now significant enough to be considered an international reserve currency.

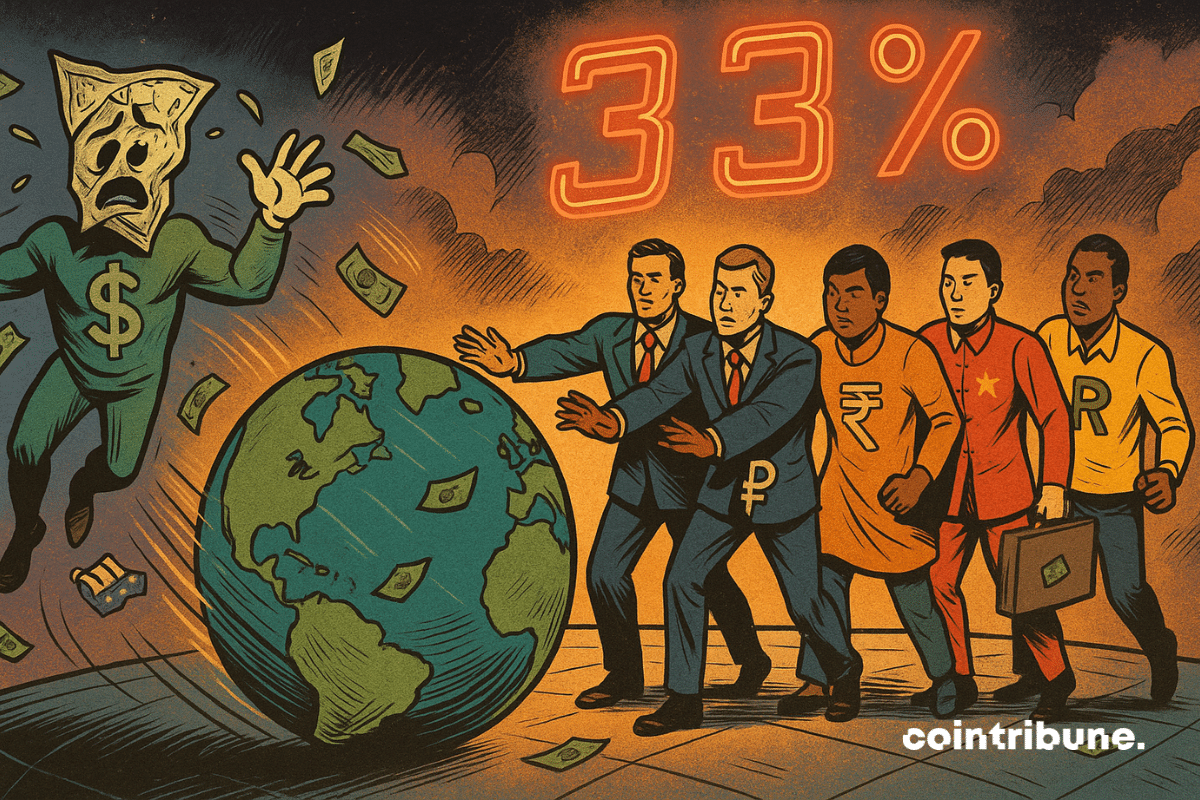

The global monetary architecture is shaking on its foundations. By reducing the share of the dollar in their exchanges to 33%, the BRICS are signaling a historic break. Their trade now largely relies on their own currencies. Behind this shift lies a deliberate strategy to fragment a system dominated by the greenback. This is no longer an intention; it is a movement underway. And it is reshaping the balances of a financial order that has until now been under the influence of Washington.

The realization of gains from large cryptocurrency wallets occurs at a time of growing dominance of BTC, increasing interest from institutional capital, and a price pattern similar to what preceded the rally in early November when Donald Trump won the presidential election in the United States. Despite the strengthening of BTC's narrative as a store of value, Trump himself tests the resilience of bitcoin, as the Republican insists on his tariff war while pressuring the Federal Reserve (Fed).

The stock market reacts positively to the Fed's decision to keep interest rates unchanged. Discover the key figures in this article!

After its correction, SUI displays very encouraging technical signals. Find our complete analysis and the current technical outlook.

A stunning crypto operation on the memecoin Melania brings in $99.6 million for 24 traders. Spotlight on this case that intrigues investors!

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

While the Sino-American trade war seemed frozen in an endless game of retaliation, an unexpected gesture has rekindled hope: Beijing agrees to official talks with Washington. A first in months. This meeting, much more than a simple diplomatic exchange, crystallizes the deep tensions shaking global trade and the economy of the two giants.

XRP consolidates after a significant increase. Find our complete analysis and current technical outlook.

eToro will raise $500 million and targets a $4 billion valuation. We tell you everything about this IPO that is shaking up the crypto sector.

Bitcoin takes a pause after a bullish surge: find our comprehensive analysis and the current technical outlook for BTC.

2025 marks a turning point for Real-World Assets (RWA) in decentralized finance. Long regarded as the missing link between the real economy and Web3, RWAs are finally gaining momentum thanks to blockchain infrastructures designed for the concrete use cases of trade financing. Among the pioneers of this convergence are Credefi and XDC Network, who are announcing a strategic alliance to democratize access to tokenized credit for European SMEs, with real guarantees, stable returns, and end-to-end regulatory compliance.

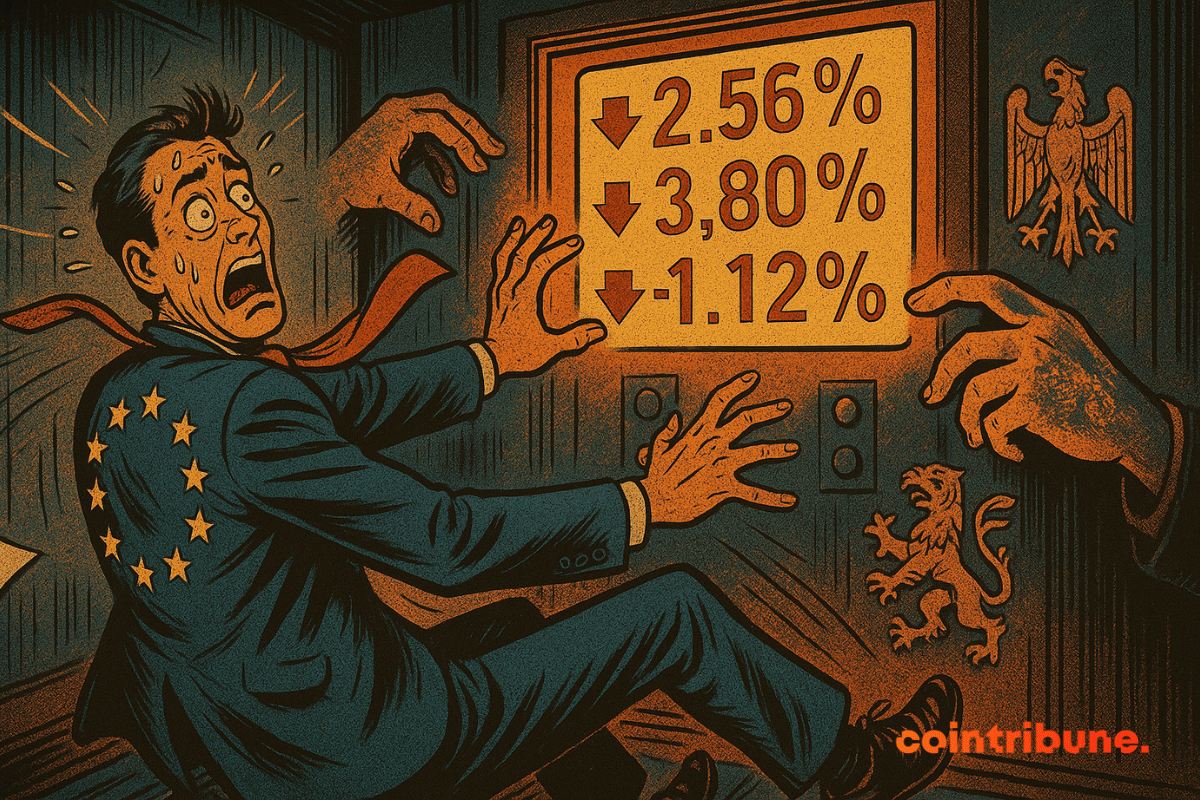

European markets began the week without a clear direction, caught between two major uncertainties: the upcoming decisions of central banks and fears of a global trade tightening. On Monday, May 5, the main financial markets show clear caution, illustrated by slightly declining indices and low trading volumes. Indeed, investors are anxiously awaiting the next announcements from the Fed and the Bank of England, in an environment where every monetary or diplomatic signal can shift the trend.

In an article published this morning on Cointribune, we reported information that BNP Paribas had partnered with Pi Network to facilitate SEPA transfers in cryptocurrency. After thorough checks, this information turned out to be false.

And if a trade war could lead to a nuclear confrontation? The hypothesis seems extreme, until it is put forward by Warren Buffett. Indeed, during the annual meeting of Berkshire Hathaway, the investor warned that Donald Trump's economic policies, perceived as aggressive, could fuel global tensions with uncontrollable consequences. An unusual stance, heavy with implications, in an international context already weakened by growing rivalries.