The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

Finance News

Solana is booming, but CoinShares is backing down: the ETF leaves the stage before entering. The crypto market, meanwhile, is still applauding... Go figure where the real show is.

Arthur Hayes is stirring debate across the crypto market with sharp criticism of Monad, a new layer-1 chain that launched with significant attention and industry backing. His remarks challenge the project’s early momentum and raise broader questions about high-valuation tokens supported by venture capital.

Flash crashes, digital dominos and states lying in wait: the IMF sees tokenization less as a revolution than as an explosive cocktail ready to blow up finance... but hush, it's bubbling.

BitMine is drawing fresh attention as its aggressive buying spree in Ethereum continues. New on-chain activity suggests the company may be preparing another significant purchase, prompting traders to watch whether continued accumulation can steady sentiment in an uneven market. Interestingly, BitMine’s recent purchase activity comes amid broad macro pressures that remain a persistent drag on digital assets.

Amundi launches its first tokenized money market fund, letting investors hold and trade fund units digitally alongside traditional channels.

DeFi is no longer a promise, but a revolution underway. According to Chainlink, it could dominate global finance by 2030—under one condition: regulation. How are institutional funds and stablecoins accelerating this historic adoption? All the answers here.

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

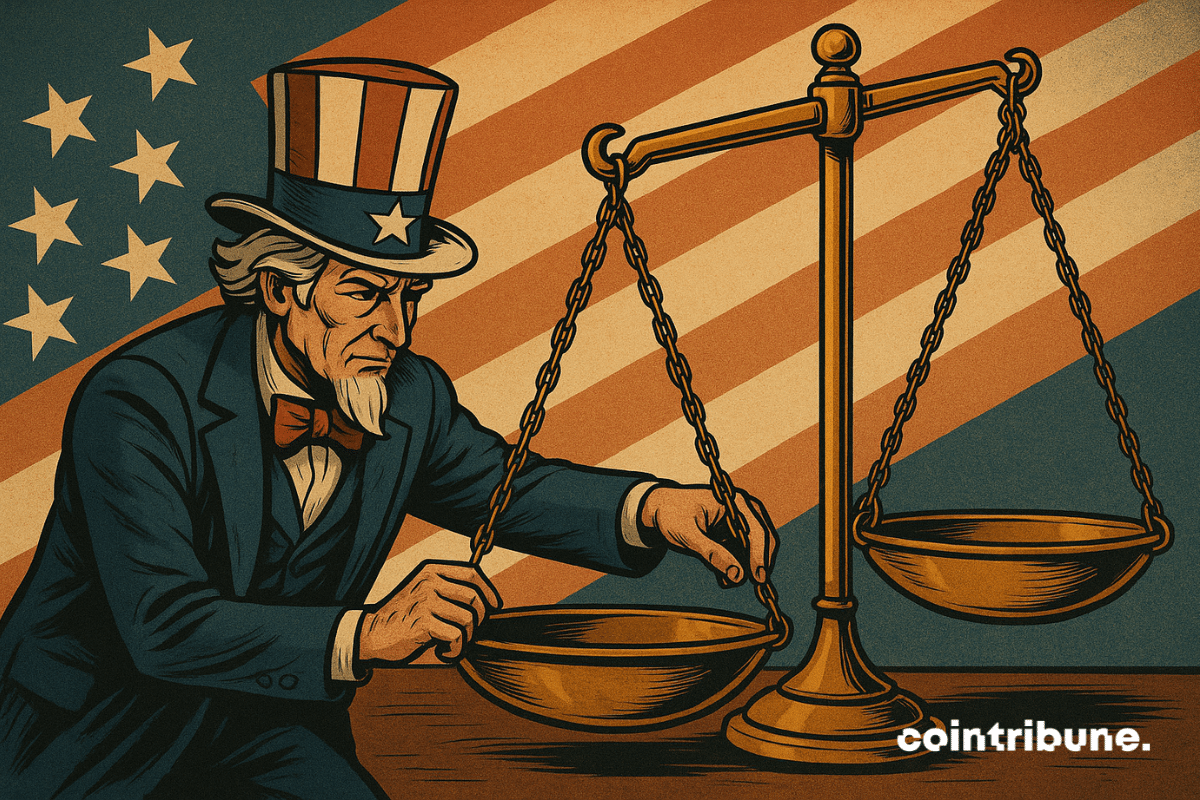

In an economic landscape weakened by persistent inflation and markets still under pressure, the succession at the head of the Federal Reserve becomes a highly strategic issue. The rise of Kevin Hassett, former economic adviser to Donald Trump and close to the crypto world, reshuffles the deck. At the intersection of classical monetary policy and financial innovations, his candidacy intrigues, divides, and could mark a major turning point in the relationship between Washington and the crypto industry.

Faced with a colossal budget deficit and persistent Western sanctions, Moscow is ready to cross a historic milestone: issuing sovereign bonds denominated in yuan for the first time. More than a mere financial maneuver, this decision marks a strategic turning point towards a deliberate dedollarization and strengthened monetary integration with the BRICS. By betting on the Chinese currency, Russia aims both to stabilize its public finances and to structure a new circuit for its energy revenues outside Western channels.

The latest PPI figures for September 2025 have just been released, and they are more alarming than expected. With inflation stubbornly high, the Fed finds itself backed into a corner ahead of its December meeting. A crucial decision is brewing: will it cut rates or risk an economic slowdown?

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

Are financial markets getting ahead of the Fed? While traders are heavily betting on a rate cut as soon as December, the Federal Reserve remains cautious and divided. This potential mismatch between anticipation and reality could disrupt macroeconomic balances and weigh heavily on risk assets.

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

U.S. stocks and crypto tumbled as investor fear surged, with the S&P 500 losing $2 trillion and Bitcoin falling below $85K.

Ethereum crashes, BitMine persists: MAVAN, dividend, patriotism... The ultimate crypto pirouette of a giant who prefers to bet big rather than fold to Wall Street.

While bitcoin continues to decline, a signal from the U.S. Federal Reserve briefly reversed sentiment. Within hours, the odds of a rate cut in December nearly doubled, reigniting hopes of monetary support. In a climate of uncertainty, this reversal fuels speculation of a possible rebound. Investors, until now on the defensive, are now watching the Fed as a key factor for crisis exit.

Young investors are increasingly moving their assets to advisors who offer crypto access, making digital assets a key factor in wealth decisions.

November 2025 sees the Fed paralyzed by uncertainty, while Trump multiplies attacks against Powell, calling him a "mental patient." Between frozen rates and presidential insults, the crypto market wavers. Who will emerge victorious from this chaos?

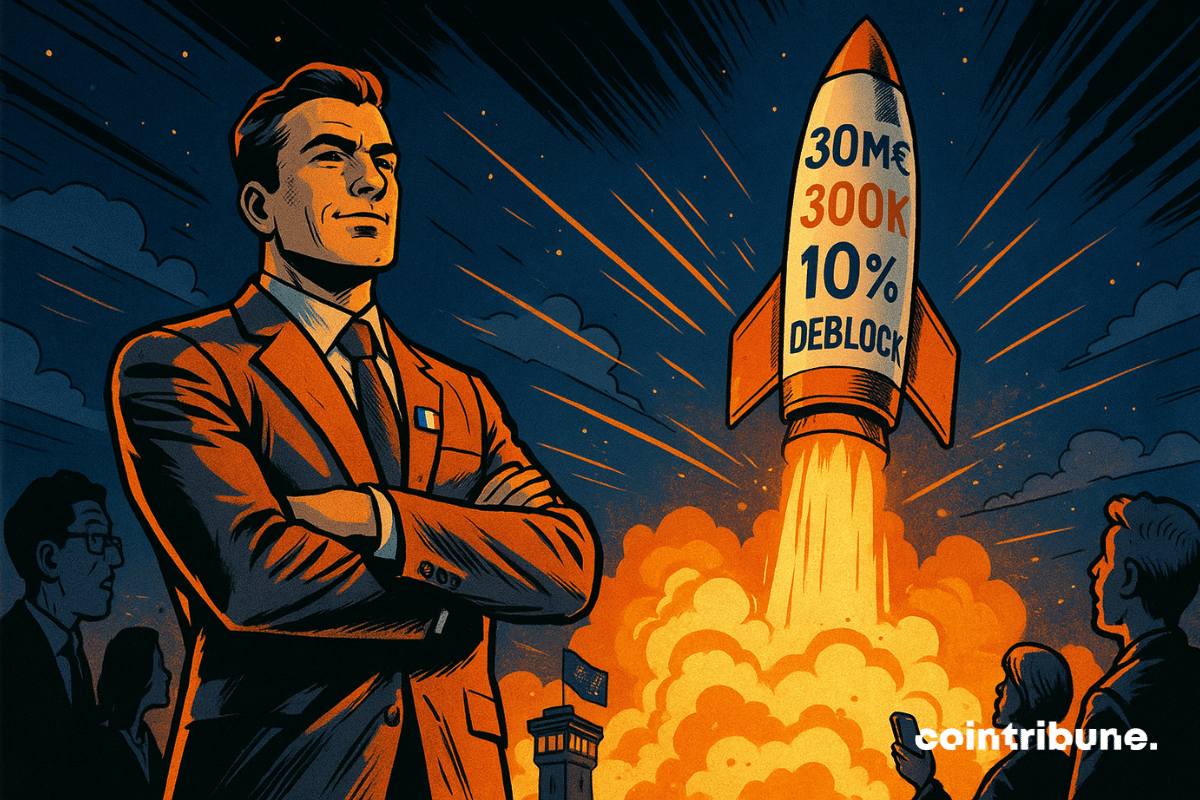

While the ECB dreams of a well-behaved digital euro, a French crypto startup is spending £30 million to hack the bank... but with the regulator's approval. Hats off.

While markets watch every macroeconomic signal to anticipate Fed movements, a major indicator just defied forecasts. The United States trade deficit fell by nearly 24% in one month. In a global context of high tension, between renegotiated tariff agreements and disrupted supply chains, this unexpected decline raises strategic issues. It could also influence capital flows, reshape economic balances, and strengthen interest in decentralized assets like bitcoin.

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.

Mastercard and Polygon make crypto transfers easier by replacing long wallet addresses with short, verified usernames for safer, simpler transactions.

Aave announces a new savings app offering up to 9% APY, real-time interest tracking, and higher yields than traditional banks.

A site fades away, a token collapses: DappRadar takes its bow, leaving its DAO stranded and the crypto market searching for a new GPS for its scattered data.

A wave of panic is blowing over crypto ETPs. In the space of one week, over $2 billion has been withdrawn from these financial products, marking their largest outflow since February. This is a strong signal for an institutional market plagued by doubt, amid economic uncertainties and monetary tensions. As traditional markets waver, investors are reassessing their exposure to cryptos. This situation could mark a turning point in the strategy of major holders.

A few days before Thanksgiving, Washington and Beijing are preparing to conclude a decisive agreement on rare earths, these vital materials for the technology industry, defense, and crypto mining. In a tense geopolitical climate, this compromise could defuse a crisis with heavy consequences for global supply chains. Faced with the threat of US customs sanctions and Chinese export restrictions, this agreement marks a strategic turning point, but nothing is decided yet.

The Real-World Asset (RWA) tokenization market is experiencing exponential growth, rising from $85 million in 2020 to $24 billion in June 2025, a 308-fold increase in three years according to the latest reports from RedStone, Gauntlet, and RWA.xyz. In this context of radical transformation of financial markets, Stobox and REAL Finance have signed a Memorandum of Understanding (MoU) to explore new technical and commercial synergies between regulated tokenization platforms and emerging blockchain networks.

After BitMine, SharpLink plays the crypto rentier: a safe filled with Ethereum, dividends pouring... and a strategy that would make many central banks envious.

Tokyo throws 17 trillion yen, dreams of AI everywhere… but its hotels close due to a lack of workers. What if Japan also programmed a robot to hire?