Tokenized gold hits $3.9B with gold-based tokens XAUT and PAXG leading the market while stablecoin supply continues to grow.

Finance News

What if the real economic threat was neither inflation nor rates, but a global liquidity collapse? This is the alert issued by Robert Kiyosaki, author of the bestseller Rich Dad, Poor Dad. In a series of messages on X, he claims that markets are wavering not because of fragile fundamentals, but because the world is severely lacking cash. A shortage that, according to him, could trigger a new wave of money printing with unpredictable consequences.

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.

BlackRock’s BUIDL Token Gains Institutional Traction as Binance Expands Support

Markets hate unpredictability. Yet, within a few days, their certainties collapsed. The probability of a rate cut by the Fed in December, previously the majority view, is now below 50%. This abrupt change of direction has revived tensions across all asset classes. In the crypto ecosystem, already severely tested by a corrective phase, this resurgence of uncertainty acts as a catalyst for volatility.

China: the economy slows and signals turn red. What impact on the crypto market if the world's second-largest economy falters?

While the SEC digests its shutdown, Grayscale speeds towards Wall Street. An IPO? Yes, but under tight control. Crypto enters the stock market... and not democracy.

A muted end to 2025 may be laying the groundwork for a stronger crypto breakout in 2026. Bitwise chief investment officer Matt Hougan says the absence of a late-year rally strengthens his view that next year will bring the next major upswing for digital assets.

The restart of the US government reopens the way for crypto regulation and ETFs. A decisive turning point or just a stay of execution for the market?

XStocks has reached $10 billion in just four months, drawing over 45,000 token holders and highlighting the rapid rise of tokenized stocks.

Big corporate holders of Bitcoin are entering a more competitive phase as new entrants add crypto to their balance sheets. While activity remained steady in October, shifting buying patterns eroded the dominance of long-standing leaders, bringing greater attention to new corporate holders of Bitcoin and major altcoins.

Visa is taking another major step in digital payments with a new pilot program that allows U.S. businesses to send stablecoin payouts directly to crypto wallets. Announced at the Web Summit in Lisbon, the initiative connects traditional bank accounts to blockchain-based transfers, aiming to speed up cross-border payments and support the expanding freelance economy.

DBS and J.P. Morgan are working together to enable seamless tokenized deposits between banks while exploring interoperability across blockchain platforms.

She dreamed of being a queen, handled bitcoins by the thousands... and ended up on the London judicial throne! Dive into the crypto universe where scammers aim high, very high.

After more than 40 days of paralysis, Washington is beginning to emerge from the crisis. On Monday evening, the Senate voted on a temporary funding law aimed at reopening federal agencies, including the SEC, essential to the crypto ecosystem. If the House approves the text this Wednesday, the government could resume its activities by the end of the week. This outcome is closely watched by the markets, as several key cases for the blockchain industry are awaiting revival.

Bitcoin was supposed to take off after the US budget chaos. Result? ETFs on strike, Solana showing off... and investors biting their nails, eyes fixed on December.

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

While the United States struggles to align on crypto regulation, the Senate breaks the deadlock. The Agriculture Committee has just unveiled an ambitious bill aimed at clarifying the roles of regulators, CFTC and SEC, and laying the foundations for a coherent legal framework. Led by Senators Boozman and Booker, the text also addresses key concepts such as DeFi, DAOs, and blockchain. This is a first step towards more readable regulation.

Progress toward ending the U.S. government shutdown is driving market optimism with crypto gains and renewed ETF hopes.

While some flee the crypto ship, Saylor fills up on bitcoins. And if the stubborn captain was right? Guaranteed plunge into Strategy's digital vaults.

When bitcoin falters, Saylor blazes: 397 BTC more, 641,205 in stock... The man who confuses corporate strategy with a collection of digital coins still does not intend to ease off.

By promising $2,000 per American, funded by tariffs, Donald Trump shakes up budgetary rules. Without waiting for legal approval, risky assets, led by crypto, are already anticipating the impact of such an injection. This political move, resembling a unilateral stimulus, triggers as much hope as doubt, between populist drift and speculative catalyst.

A prolonged U.S. government shutdown has created a rare information void just as financial markets seek clarity. Investors are awaiting the Federal Reserve’s next rate decision with limited insight, while lawmakers continue advancing cryptocurrency legislation despite widespread staffing delays.

Growing attention to the long-delayed Fort Knox audit has reignited debate between gold and Bitcoin. Binance founder Changpeng Zhao (CZ) has once again joined the discussion, questioning gold’s verifiability while responding to long-time critic Peter Schiff. Rising interest in tokenized gold and continued market uncertainty have added fresh momentum to the conversation.

Growing interest in Ethereum’s long-term outlook has pushed validator queues higher for both entry and exit. Recent data indicate that roughly 1.5 million validators are waiting to join the staking system, while approximately 2.45 million ETH are in the exit queue. These conditions mark a busy period for participants who choose native staking over liquid staking alternatives.

Italy supports the European Central Bank's (ECB) digital euro project but sets its conditions. Italian banks, while welcoming this digital sovereignty initiative, request a financial effort spread over time. Facing heavy investments, the Italian banking sector wants to avoid a budget shock. Will this stance resonate with other European countries?

When JPMorgan flirts with Ethereum without ever slipping the ring on its finger... 102 million slipped into Bitmine, it's discreet, clever, and above all very, very crypto-compatible.

Polymarket is regaining momentum after a long cooldown period as trading activity climbs again. User participation is also on the rise, with renewed interest from both crypto-native and mainstream audiences. Recent data shows the platform nearing the trading volumes last seen during the peak activity surrounding the 2024 U.S. elections.

A steady shift toward digital assets is underway across the hedge fund sector, as an increasing number of managers incorporate crypto positions. Rising market activity and clearer signals from U.S. policymakers have been key drivers of this trend. In fact, recent survey data indicate a broad transition that is gradually pulling crypto further into mainstream finance.

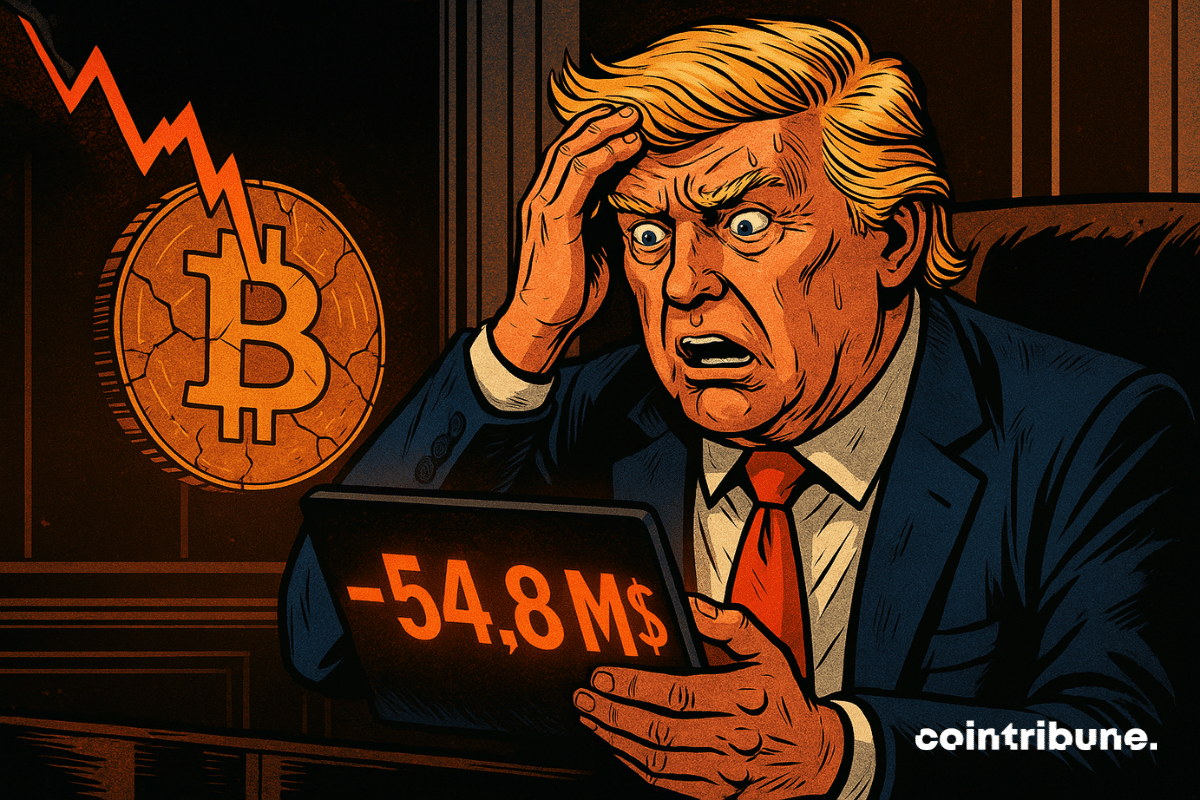

Trump believed he held the key to the crypto kingdom… Result? A stock market bloodbath, billions lost, and a truth stinging more than his tweets: crypto does not forgive.