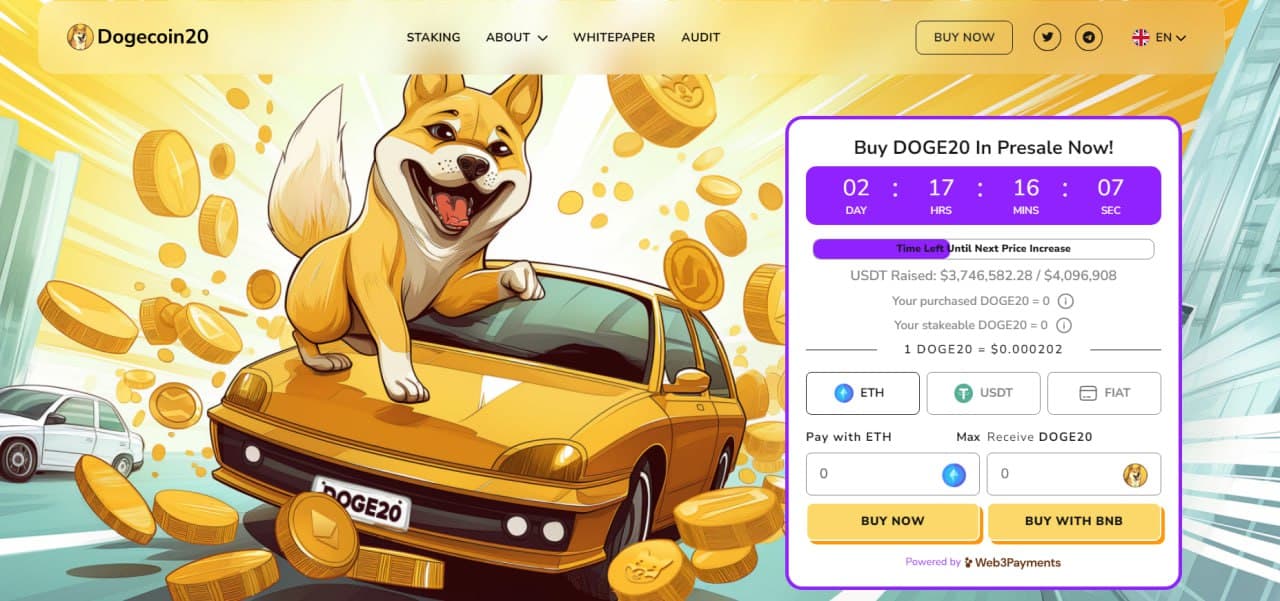

Meme coins have been ruling the crypto scene lately, and there are plenty of surprises for investors. Dogecoin is nearing the $1 milestone crypto enthusiasts are cheering for. According to CoinMarketCap, its current value is $0.1856, and it has increased by 119% during the last 30 days. It is expected that its value will keep increasing in the following period. Meanwhile, Dogecoin20 keeps raising one million after another, heading quickly towards the $11 milestone. Check out why these cryptos attract so much attention!

Finance News

The SEC's approval of Bitcoin ETFs could unlock things in Asia. It is rumored that Hong Kong will give the green light before June.

As the wind of the resumption of its upward momentum continues to make people happy, there is already interesting news about bitcoin (BTC). According to some experts, we are heading straight towards a supply shortage of the flagship crypto. A possibility that would not be without consequences for the broader crypto market.

Discover how financial turbulence is shaking the FED, engulfed by record losses of $114.3 billion.

After hitting a low point at $3,050, Ethereum recorded a 20% increase. Let's examine together the future prospects for ETH.

Significant influx into Bitcoin Spot ETFs, a sign of increasing adoption by institutional investors. Details in this article.

Bitcoin had reached a new price record of over $73,000 a few days ago. After disappointing investors with a sharp correction towards $65,000, the flagship cryptocurrency once again hit the $71,000 mark. Here, in this article, are the reasons that could justify such a strong comeback.

The public deficit of France could exceed the European limit in 2024. The economic stability of this powerhouse is being tested.

After registering a decrease of more than 10%, Bitcoin rebounded and regained the $70,000. Let's analyze together the future prospects for the price of BTC.

Bitcoin (BTC) has been in a gloomy trend for the past few days. However, investors seem to be holding onto their position regarding the leading cryptocurrency. A trend that could change as Bitcoin regains strength.

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic challenges. Here is a summary of the most impactful news of the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

The future of Bitcoin hanging in the balance: investors are closely watching critical levels, fearing an imminent plunge.

Massive outflows at Grayscale: Bitcoin under pressure, market on alert.

The US Department of Justice (DOJ) has launched a major antitrust offensive against Apple. According to the DOJ, the rules of the tech giant's App Store restrain competition and stifle innovation, especially in the crypto sector, arbitrarily penalizing developers in favor of Apple's monopoly.

The main Indian opposition party alleges that the Modi government has "paralyzed" it by freezing bank accounts. Bitcoin fixes this.

The SEC is taking a very close look at the Ethereum foundation and appears determined to categorize it as a "security," which would jeopardize ETF hopes.

Bitcoin, the undisputed crypto king, has retreated from its recent highs, sparking questions about the market’s direction. Analysts speculate that investor greed could drive these fluctuations, with short-term gains taking precedence over long-term stability.

After rallying up to $200, Solana then underwent a corrective phase of about 20%. Let's examine the upcoming prospects for the SOL price.

The decision of the Federal Reserve regarding the interest rate cut was particularly anticipated. The Fed defies the predictions of some analysts by keeping them at their current level. A prudent choice that could change as the inflation of the US economy slows to 2%.

According to the latest information, Bitcoin (BTC) has dropped again in the past few hours after recently reaching a milestone it had never achieved before. Bitcoin Spot ETFs, celebrated for their notable performances since their launch, are partly responsible for this.

After reaching the $4,000 threshold, Ethereum has entered a corrective phase of 25%. Let’s examine the future outlook for ETH together. Situation of Ethereum (ETH) After marking a high at $4,100, the price of Ethereum has begun a downward movement, countering its last bullish phase active since $2,100. Indeed, the…

As the crypto market experiences a plunge, investors who have been actively positioned in ether are cashing out their gains. In this context, a trend towards selling is being observed among several large investors. This dynamic is fueling speculation about the prospects of the crypto.

Is this already the end of the recent bullish crypto market? The question is worth considering given the trend of asset liquidation now observed among many investors. A dynamic that is linked to the increased market volatility.

The precarious financial situation of the AMF highlighted by a scathing report from the Cour des Comptes.

The Grayscale GBTC ETF is once again weighing on Bitcoin with capital outflows of several hundred million dollars.

Italian: """

In recent developments within the cryptocurrency market, the ECLD token has experienced a significant surge, capturing the attention of investors and marking a milestone for Ethernity Cloud's innovative approach to decentralized cloud computing. This rise highlights the token's growing market presence and sets the stage for a deeper exploration into what makes ECLD a potential game-changer in the cloud computing and decentralized finance (DeFi) sectors.

Chinese finance starts 2024 on fragile footing, with an uneven recovery despite efforts deployed!

The success of Bitcoin ETFs is driving Standard Chartered Bank to raise its price forecasts for the end of the year.

Here is a summary of the most impactful news from the past week surrounding Bitcoin, Ethereum, Solana, etc., a journey into the heart of the innovations and debates that have animated the cryptocurrency sector in recent days.