While cryptos are in turmoil, Elon Musk moves 133 million in bitcoin without a word: secret plan, space whim or just portfolio management? Mystery at the top.

Finance News

In the midst of budget paralysis, the US public debt reaches 38 trillion dollars, a historic record. This threshold, revealed by the Treasury, raises questions about the budget trajectory of the United States, as monetary policy remains under pressure and crypto regulation remains unclear.

Hyperliquid Strategies is taking a major step to strengthen its presence in the decentralized finance (DeFi) ecosystem. The firm plans to raise up to $1 billion to expand its holdings of the Hyperliquid (HYPE) token, which powers the world’s largest decentralized derivatives platform.

CZ, former CEO of Binance, criticizes Peter Schiff's tokenized gold project by calling it a crypto asset based on trust rather than proof. According to him, tokenization does not make gold truly on-chain and introduces dependence on intermediaries. This remark reignites the debate between two visions: Bitcoin's verifiable transparency and the traditional value of now-digitized gold.

For the first time since the start of the conflict in Ukraine, Washington and Brussels are coordinating a series of major economic sanctions against Russia. Directly targeting the energy sector, these measures aim at Rosneft, Lukoil and gas exports. The objective is to dry up the revenues that fuel the Kremlin's war effort. This financial offensive marks a strategic turning point, with immediate consequences on the markets and expected repercussions on the Russian economy, already weakened by three years of international pressure.

Revolut, the well-groomed neobank, joins the European crypto dance with the MiCA license in pocket… and a stablecoin behind the scenes? A revolution in a tie that already irritates the old players.

While gold crashes like a soufflé, bitcoin heavyweights enter ETFs. Golden savings melt, crypto heats up... Who stole the cash box?

In one day, gold lost 2.1 trillion dollars, more than half of the crypto market capitalization, causing a real financial earthquake. While Bitcoin briefly took advantage of this drop to cross $104,000, its rise was quickly stopped by sales from major holders. In the end, the yellow metal falters, but the queen cryptocurrency still struggles to establish itself as a real safe haven compared to gold.

The US Department of Labor will publish inflation data on Friday despite the government shutdown. An unusual decision five days before the Fed's crucial interest rate decision. Crypto investors are holding their breath.

The real-world asset tokenization (RWA) market is exploding in 2025, surpassing $25 billion in on-chain assets. But while most platforms sacrifice security, trust, or decentralization to move fast, Real Finance arrives with a radically different approach: solving the RWA trilemma. Comparative analysis of an infrastructure that could redefine industry standards.

The United States government shutdown is nearing its fourth week, putting pressure on lawmakers to resolve the funding impasse while also addressing key issues in the digital assets sector. As the Senate prepares for another vote to reopen the government, Democratic senators are moving forward with plans to meet crypto executives to discuss the stalled market structure bill.

40 million outflows from Bitcoin ETFs in one day. Should we worry about the momentum of crypto funds? Complete analysis in this article!

In the Sino-American escalation, a subtle lever takes on an explosive dimension: rare earths. Essential in advanced technologies, these materials become the silent weapon of a strategic duel where industrial sovereignty and monetary confrontation intertwine.

RWA Market Nears $35B Milestone as Tokenized Treasuries and Institutional Adoption Accelerate Growth

The tokenized real-world asset (RWA) market continues its strong momentum, edging close to the $35 billion milestone as institutional products, Treasuries, and gold-backed tokens drive on-chain adoption. Recent data from rwa.xyz shows the total RWA value reaching $34.14 billion, marking a 10.58% rise over the past 30 days and signaling growing investor confidence in blockchain-based real-world exposure.

When others flee, Saylor whistles the purchase: a teaser, a chart, and there goes bitcoin ready to inflate its treasure. Strategy or poker?

While the crypto market was going through a period of marked instability, a statement from Donald Trump was enough to reverse the trend. By announcing a meeting with Chinese President Xi Jinping on October 31, during the APEC summit in Seoul, the American president triggered an immediate rebound in major cryptos. In a tense climate between the United States and China, this announcement was seen as a sign of easing, briefly rekindling investor optimism.

The cryptocurrency market extended its turnaround throughout three consecutive quarters into Q3 2025, propelling total capitalization to levels last observed in late 2021. According to CoinGecko, the sector added $563.6 billion in Q3, representing a 16.4% increase and bringing the industry to approximately $4.0 trillion.

When Solana releases a war engine called Ultra v3, it’s not the crypto traders who complain, but the competitors who cough. Fees falling, precision skyrocketing.

Robinhood unleashes heavy artillery: US stocks on Arbitrum, tokenized ETFs… The platform is betting everything on crypto, but Brussels and Vilnius might well bring it down.

The tokenization of securities divides the giants of finance: Nasdaq wants to revolutionize Wall Street, but Ondo Finance cries out for lack of transparency. Who is right? Dive into this battle that could redefine the future of crypto and your investments. The outcome will surprise you.

Gold enters the 24/7 era. Driven by the record rally of the yellow metal, tokens backed by gold have just exceeded 1 billion dollars in daily volume. This milestone establishes tokenized gold as a trading and hedging tool, more agile than traditional ETFs.

While cryptos wreak havoc in pockets and ideas, Francophone Africa plays a digital card... but wouldn’t this revolution have a little hint of the euro?

France is taking a major step in modernizing its financial markets with the launch of the Lightning Stock Exchange (Lise), a fully tokenized equity platform designed for small and medium-sized enterprises (SMEs). Backed by leading French banks and armed with a new regulatory license, Lise aims to bring blockchain efficiency to traditional stock listings and reshape how companies go public.

Solana is experiencing a marked correction phase after the break of a key support, in a market context dominated by Bitcoin's decline. Discover the technical outlook for the future evolution of SOL.

The dollar, the cornerstone of the global financial system, once again finds itself at the heart of a geopolitical controversy. Donald Trump accuses the BRICS of wanting to undermine its supremacy. In response, the Kremlin firmly denies any intention of destabilization, stating that the alliance does not target any foreign currency. Behind this tense exchange, one question remains: are the BRICS quietly working to reshape the global monetary order, or is this an alarmist reading of the ambitions of this emerging bloc?

Prediction platform Polymarket is broadening its reach into traditional finance with a new feature that lets users bet on stock and index movements. The move highlights the platform’s growing ambition to connect crypto-native speculation with mainstream financial markets, as investor interest in event-based trading continues to accelerate.

The Hong Kong subsidiary of one of the largest Chinese banks has just made history by tokenizing a colossal fund on the Binance blockchain. A bold initiative that comes in a highly tense regulatory context.

While the market is bleeding, Bitget releases a report: crypto investors still want to load up. 2025, a year of gains... or shocks?

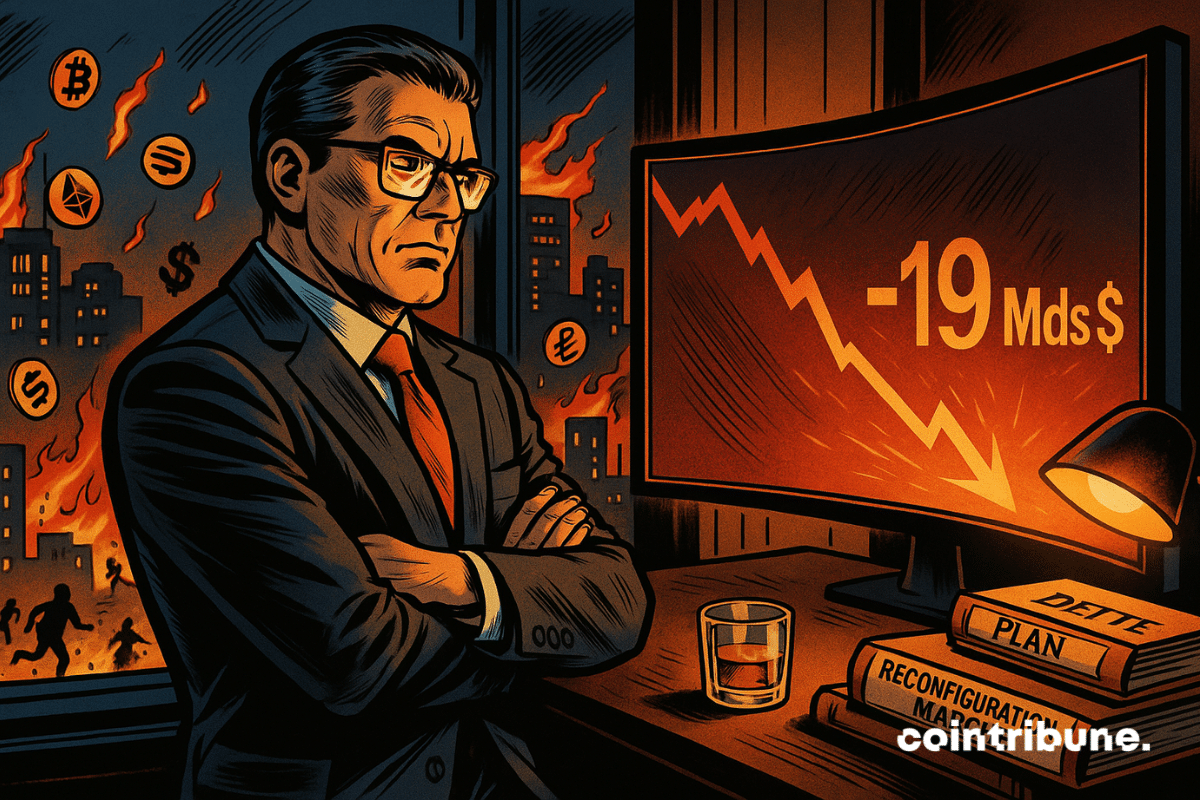

Last Friday, the crypto market experienced a brutal reversal, with nearly 19 billion dollars of open interest wiped out in a few hours. A correction of such magnitude, even in an ecosystem accustomed to volatility, immediately caught analysts’ attention and revived fears of an uncontrolled collapse. However, behind this spectacular drop, the first analyses reveal a very different scenario, that of a planned deleveraging rather than a generalized panic.

After one of the steepest selloffs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.