Public debts: A risk for the markets?

The United States government is struggling to find a solution to the debt ceiling. As a result, the markets are holding their breath and fearing default. In our previous article, we discussed the role of long cycles in monetary policy. In this context, French debt is also a cause for concern. The presented stability plan already appears optimistic. It is evident that difficulties in managing public debts would have dramatic consequences for the markets and the global economy. Let’s take a closer look.

The United States facing the risk of default

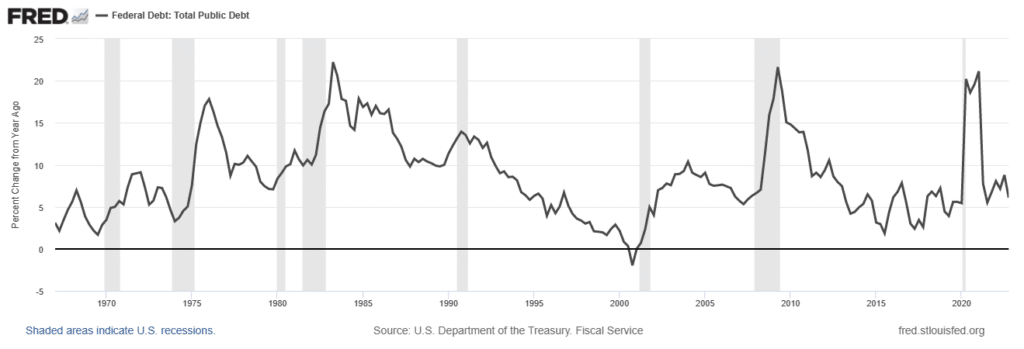

In the first quarter of 2023, the public debt of the United States reached nearly $31.419 trillion. Moreover, this record level of public debt is also accompanied by a departure from the traditional economic balance of the United States. The United States has been intensifying its expansionary public sector policy in recent years, and this is not without risks.

However, the debt ceiling is set at $31.4 trillion. This ceiling has been exceeded since January, but it was accompanied by “extraordinary measures.” Treasury Secretary Janet Yellen has warned that in the absence of an agreement, a default may have to be considered by June 1, 2023. It should be noted that the exponential growth of U.S. debt does not bode well for long-term budget stability. The public debt stands at over 123% of GDP at the end of 2022. This ratio was only 30% of GDP in 1981 and 55% of GDP in 2001.

The cost of insuring U.S. debt has also skyrocketed. Joe Biden rejects budget cuts proposed by Republicans when they refuse to raise the debt ceiling. This ceiling, which has been raised nearly 80 times in the past 40 years, is obviously surpassed when debt grows at an exponential pace.

Potentially dramatic consequences

There is nothing more sensitive in finance than the instability of public debts. Indeed, Citigroup and J.P. Morgan have already scheduled meetings in anticipation of a possible default. As a result, significant volatility in bond prices would create great uncertainty in many operations and derivative products, which are largely insured by bonds.

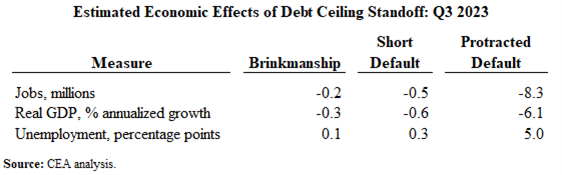

Furthermore, the White House is being very cautious and states that a “getting close to a breach of the U.S. debt ceiling could cause significant disruptions to financial markets.” In the case of a “protracted default,” the recession could result in a considerable contraction of -6.1% of GDP. This would lead to the loss of over 8 million jobs and a 5-point increase in unemployment. This would be equivalent to the most severe recession since the great crisis of 2008.

Moreover, the global consequences would also be dramatic. Moody’s analysts predict a 20% drop in financial markets in the event of a “protracted default.” GDP would contract by nearly 4%. This is significant. It should be noted that over $500 billion of U.S. debt is traded daily on the markets.

France: An overly optimistic “stability program”?

The situation in the United States, which poses a risk of credit rating downgrade (even without default), is not without parallels with the situation in France.

The trajectory of French public finances

Ministry of Public Finances has revealed its “stability program” until 2027. Deemed too optimistic by many economists, it aims to reduce the deficit to below 3% of GDP and stabilize the level of debt. Nevertheless, the debt service is expected to reach €70 billion in 2027. It is simply the government’s largest expense… What will be the impact of rising interest rates on the trajectory of public finances? What will be the consequences for financial stability in France?

The French credit rating depends closely on the government’s ability to reassure investors. In fact, Fitch Ratings (which, however, does not represent investors) downgraded France’s rating to “AA-”. Therefore, it is quite common to set trajectories that are rarely achieved. The Ministry also reveals a very gradual decrease in the public deficit. The deficit is projected to be 2.7% in 2027.

Debt is also projected to slightly increase as growth stabilizes around +1.4%. However, this program seems quite optimistic in a context of uncertainty and expenditure (war, low growth rate, massive investments planned in various areas…).

The problem of long-term public debt

It is very rare in history for excessive public debt not to end in inflation, war, or default. It is natural that such amounts, manipulated by a minority of politicians, present significant economic risks. The problem of long-term public debt needs to be analyzed from two aspects: financing and growth.

One of the main issue arises when financial markets, as well as the central bank due to inflation, are no longer capable of directly or indirectly financing the budget.

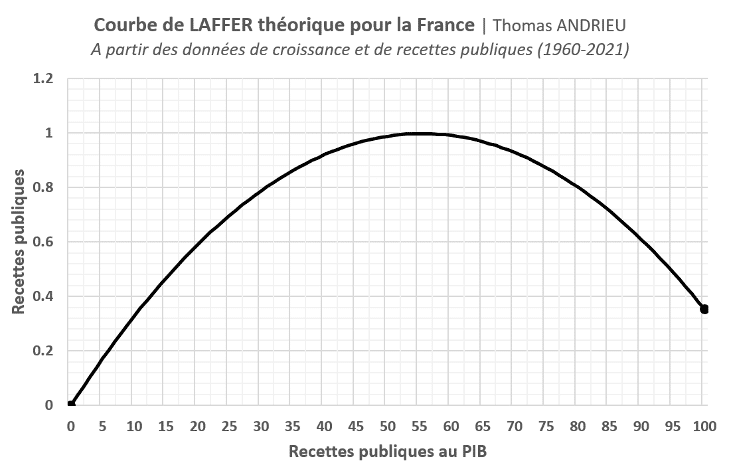

The other concern is caused by the state’s inability to manage political crises, social disorganization, and its inability to collect taxes. The famous saying “too much tax kills tax” refers in economics to the Laffer Curve. If the state becomes too “burdensome” in the economy, any new tax will reduce activity, which will reduce revenues and the quality of public services. This threshold can be estimated around 55% of GDP in terms of tax burden for France. But it is clear that the state’s ability to collect taxes gradually becomes weaker as the state extends its economic power.

And if inflation saved the state?

The only way to smoothly reduce public debt is to historically:

- Have a growth rate higher than the increase in debt and/or the short-term interest rate

- Have a sufficiently high interest rate (zero or positive real rate) to incentivize the state to balance its budget in the long term.

This last condition may seem contradictory; however, the decrease in the debt ratio has been accompanied in recent centuries by an increase in interest rates.

States only react under constraints. Even though inflation may reduce debt in the medium term, it always ends up having a neutral effect in the long term. The increase in interest rates with stable inflation leads to a long-term deterioration of the state budget, which cancels out the debt reduction effects in the short term. It is evident that only real incentives (an actual increase in the real interest rate) should be present for debt reduction to be political rather than mechanical.

What are the consequences for gold and cryptocurrencies?

We have seen that public debt is one of the major reasons for the financialization of economies. There is a close and statistically strong link between public debt, money supply, and financial markets. A risk of default or increased volatility in the public credit rating could cause a significant drop in financial markets. The impact would first be most significant on the banking system, but it would also affect the financing capabilities of most companies. The resulting drop in financial markets would not be negligible.

Considering the sensitivity of Bitcoin (BTC) to liquidity, there is a possibility of a significant downside risk for the cryptocurrency. However, we have seen in recent weeks that banking crises have favored Bitcoin. While a short-term bearish effect is conceivable, it is also likely to strengthen the legitimacy of the market in the long term. It is also futile to point out that increased volatility in the US credit rating would lead to a fall in the US dollar. This increased volatility would therefore benefit the price of Bitcoin.

As for gold, it would certainly benefit from a recession. However, the long-term impact would be more uncertain. Only entering a sustained deflationary period could be a bearish factor for the yellow metal. But this scenario is effectively ruled out in a context of funding tensions.

In conclusion

In short, the United States government could default on its payment obligations within a few weeks. This default would not be due to a lack of financing but to political gridlock. Raising the debt ceiling becomes a source of tension as the debt increase becomes structural and unprecedented. This may just be the beginning of a long period of tension surrounding public debts.

With or without default, the solvency of the government could be affected. Furthermore, the impact of a payment default, as discussed so far, would likely have a moderate effect on the economy. However, the risk of escalation is significant. Several analysts, including the White House, anticipate a severe recession in the event of a “protracted default.” The consequences for the global economy and the financial system would be significant. It is within this framework that this structural risk leads us to question the fragilities of the economy.

France also shows structural difficulties that could amplify in the long term. Inflation may benefit states in the short term for deleveraging, but its positive effects are already diminishing as interest rates rise. On the contrary, we could witness states’ inability to manage their creditworthiness. Certain safe-haven assets could benefit from this.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.