Bitcoin falters in November 2025: between technical drops, investor withdrawals, and macroeconomic tensions, the crypto defies its historical trends. Why does this "cautious calm" hide major risks? Exclusive analysis of the 5 signals to watch to anticipate the next wave of volatility.

Theme Bitcoin (BTC)

Tom Lee, an iconic figure of crypto optimism, just unveiled a projection that is a bombshell in the ecosystem. According to him, Bitcoin could reach between 1.6 and 2 million dollars by 2030. But that's not all: he even mentions a 3 million scenario. How does he justify such ambition?

Facing a debt considered "unsustainable", the Tesla CEO warns: the United States is heading towards a budget wall. In a discussion with Joe Rogan, he denounces an economic trajectory that has become, in his view, "dead end". For some, this looming crisis could propel bitcoin to new heights. The asset, historically linked to distrust of the dollar, could strengthen thanks to this announced crisis.

In seven days, the asset's realized capitalization jumped by 8 billion dollars, marking a spike in on-chain activity rarely seen outside periods of extreme tension. This indicator, which measures investments actually committed, suggests a possible bullish return. Yet, despite this structural effervescence, the spot price of bitcoin remains frozen. A dissonance arises between internal network movement and the inertia of external flows.

Bitcoin and Ethereum are subject to massive withdrawals of several billion dollars from exchanges, a rare phenomenon that intrigues investors. While gold collapses, these cryptos resist. Is it a sign of a historic rebound or mere caution? Dive into the on-chain data analysis and trends that could change everything.

Trump shakes hands with Xi, crypto traders hold their breath. Historic agreement, systematic mistrust: the tariff truce amuses the stock market, but Bitcoin still sulks.

While the small fry are stirring, crypto whales quietly pile up BTC on Binance... What if the real maneuvers are unfolding in the silence of order books?

Musk, the man who sleeps less than an Ethereum server, attacks WhatsApp with X Chat, encrypted messaging Bitcoin-style. Advertisers and GAFAM, hide your hooks, it's going to encrypt hard!

Bitcoin just experienced a red October, a first since 2018. November, historically a bullish month for BTC, could it change everything? Between hoped-for rebound and risks of decline, here is what experts predict and strategies to adopt to not miss the movement.

Seventeen years after the publication of the white paper by Satoshi Nakamoto, bitcoin is no longer a niche bet. It is a global asset worth 2 trillion dollars. Yet, on this October 31, the market turns the page on a thwarted "Uptober." October closes in red for the first time since 2018. A signal to be read carefully, without melodrama.

The Basel Committee's rules on cryptocurrencies could change the game in 2026. Between bank adoption of stablecoins and crypto integration, a financial revolution is underway. Are banks ready to take the leap? The answer could change everything for your investments.

In October, the Bitcoin market confirmed its vitality despite a sharp price correction. Spot volume exceeded 300 billion dollars, a sign of a return to "cash" trading and a reduction in leverage usage. According to CryptoQuant, this dynamic reflects a healthier market, capable of withstanding volatility without a sudden collapse. In short, despite the drop in BTC, investors, whether retail or institutional, show renewed confidence in the spot market, marking a structural evolution of the market towards greater stability.

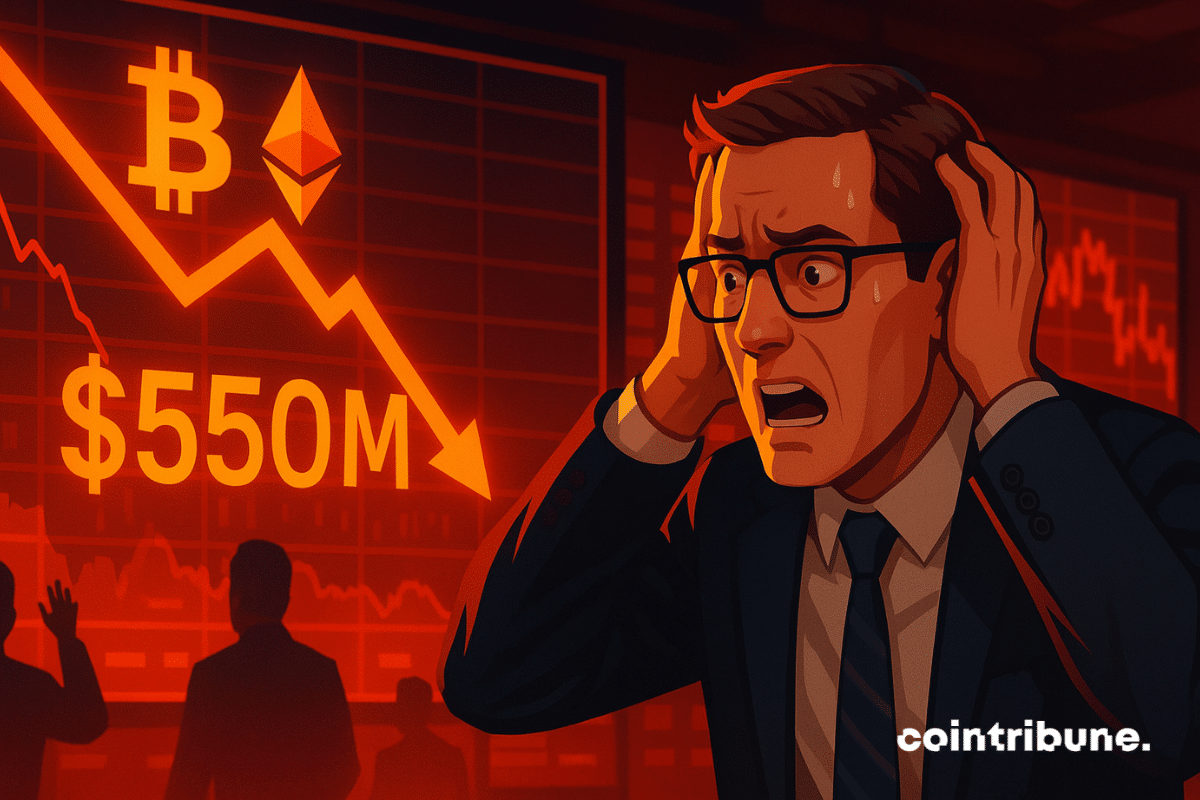

Bitcoin has once again shaken the market—dropping over 10% in just a few hours, dragging Ethereum and the entire market into a whirlwind of panic. Traders held their breath, and the age-old question echoed loudly once again:

In 2025, crypto breaks all records: entrepreneurs become billionaires in a few months thanks to spectacular fundraising and bold secondary sales. But behind these express fortunes hide major risks and burning questions. Who will withstand the test of time? Dive into the behind-the-scenes of this digital gold rush.

The crypto market, already known for its volatility, has just experienced another major shock. In just 24 hours, over $1.1 billion has been liquidated, revealing the ecosystem's fragility against increasingly influential macroeconomic forces. The fluctuations of bitcoin and altcoins have not escaped investors' attention, who saw their positions swept away by this wave of liquidations, increasing the risks associated with this uncertain market.

Michael Saylor sees bitcoin soaring to the skies, Wall Street is converting... What if the crypto guru was still right despite geopolitical turbulence?

Rising debt levels and growing concerns over financial stability are driving investors toward crypto and gold as safe-haven assets. BlackRock CEO Larry Fink described this shift as a response to mounting fears about government debt and the declining value of money.

For nearly ten years, the last week of October has been known to offer bitcoin a bullish surge, to the point of being nicknamed the "golden week." But this year, despite a promising Uptober month, the momentum is slowing down. The king of cryptos defies expectations, sowing doubt among investors accustomed to now weakened seasonal patterns.

While the European Union is preparing to fully deploy the MiCA regulation by the end of the year, Germany voices a dissenting opinion. The main opposition party, the AfD, has just submitted a shock motion to the Bundestag. It demands that bitcoin be recognized as a strategic reserve asset, distinct from other cryptos. This unexpected position questions the uniformity of the European regulatory framework and could pave the way for a revision of the institutional treatment of bitcoin within member states.

Bitcoin and Ethereum ETFs suffered massive withdrawals on Wednesday, October 29, totaling more than 550 million dollars in a single day. Fidelity, BlackRock, and ARK Invest are among the victims of this wave of redemptions that reflects a sharp change in sentiment. But is this a simple correction or the prelude to a deeper movement?

Gold has just suffered a staggering 10% drop in 6 days, a rare collapse that has occurred only 10 times in 45 years. Meanwhile, Bitcoin resists and shows surprising stability. Should this be seen as a warning sign? Are traditional safe-haven assets losing their crown?

Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions in it. Should we worry when banks applaud tokens they do not control?

What if the future of monetary reserves no longer relied on gold or fiat currencies, but on bitcoin? In France, a bill supported by the UDR party plans to create a national reserve of 420,000 BTC. A groundbreaking initiative which, although driven by a minority parliamentary group, challenges the foundations of monetary sovereignty. At a time when states are groping with cryptos, this project revives a major strategic debate.

Japan has entered a new phase of digital finance with the launch of its first yen-backed stablecoin, JPYC. Developed by Tokyo-based fintech firm JPYC, the token aims to bring the stability of traditional finance into the expanding digital asset market—offering Japanese consumers and businesses a secure bridge between fiat and blockchain-based payments.

A historic turning point could unfold in just a few days. Geoffrey Kendrick, crypto head at Standard Chartered, suggests that one favorable week would suffice for bitcoin to never fall below $100,000 again. In a note released this Monday, October 27, he states that if current macroeconomic and geopolitical dynamics hold, the six-figure threshold could become a new durable floor for the market. This projection, if confirmed, would redefine the benchmarks of the entire industry.

A drop in inflation figures, and here come the traders again. Bitcoin rejoices, ETPs swell. Who said the crypto market lived only on rumors?

A discreet but historic shift has occurred in central bank reserves. For the first time in nearly 30 years, gold surpasses U.S. Treasury bonds. This adjustment, far from trivial, reflects a growing loss of confidence in U.S. sovereign debt. Behind this choice, central banks are reshaping their priorities, betting on the timeless strength of the yellow metal. This signal, almost unnoticed, could redefine the foundations of the global monetary system.

The message is brief and the signal clear. The "Orange Dot Day" blinked again, then the confirmation came: 390 more BTC. Strategy Inc thus strengthens its treasury beyond 640,800 BTC, while the market approaches 115,000 dollars. The sequence speaks for itself and sets a climate of methodical anticipation.

Bitcoin entered the week on a strong note, climbing toward $113,000 as traders positioned for further gains ahead of a critical U.S. Federal Reserve meeting. With market sentiment buoyed by expectations of an imminent rate cut, optimism spread across crypto markets, reinforcing Bitcoin’s short-term uptrend.

Bitcoin’s market structure is showing signs of strain as long-term holders begin moving their coins, leading to a decline in illiquid supply. New data from Glassnode reveal that around 62,000 BTC—worth nearly $7 billion—have left long-term, inactive wallets since mid-October, marking the first major drawdown in the second half of 2025.