Metaplanet continues its Bitcoin purchases and intrigues investors facing a pressured market. More details in this article!

Theme Bitcoin (BTC)

Bitcoin plunges into the abyss, but BlackRock acts as savior with its ETF, displaying record volumes. Coincidence or strategy? Investors cling, hoping for an unlikely recovery.

Strategy reported a $12.6 billion Q4 loss as Bitcoin prices fell sharply, marking one of the largest quarterly losses for a U.S. public company.

While Bitcoin collapses below $65,000, Binance surprises the market by investing $233 million in 3,600 BTC. A bold decision that divides experts: some see it as a strong signal of confidence, while others believe the disappearance of Bitcoin would make the world better. Between opportunity and risk, how should investors react?

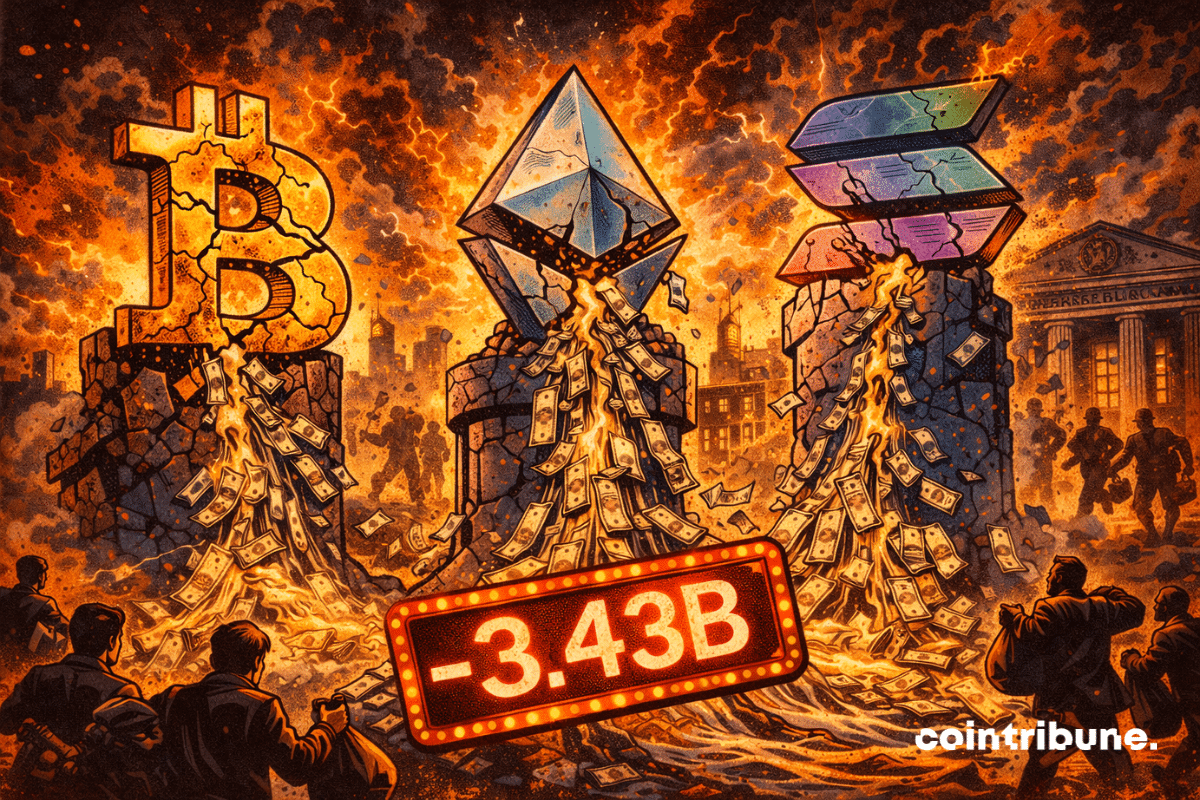

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

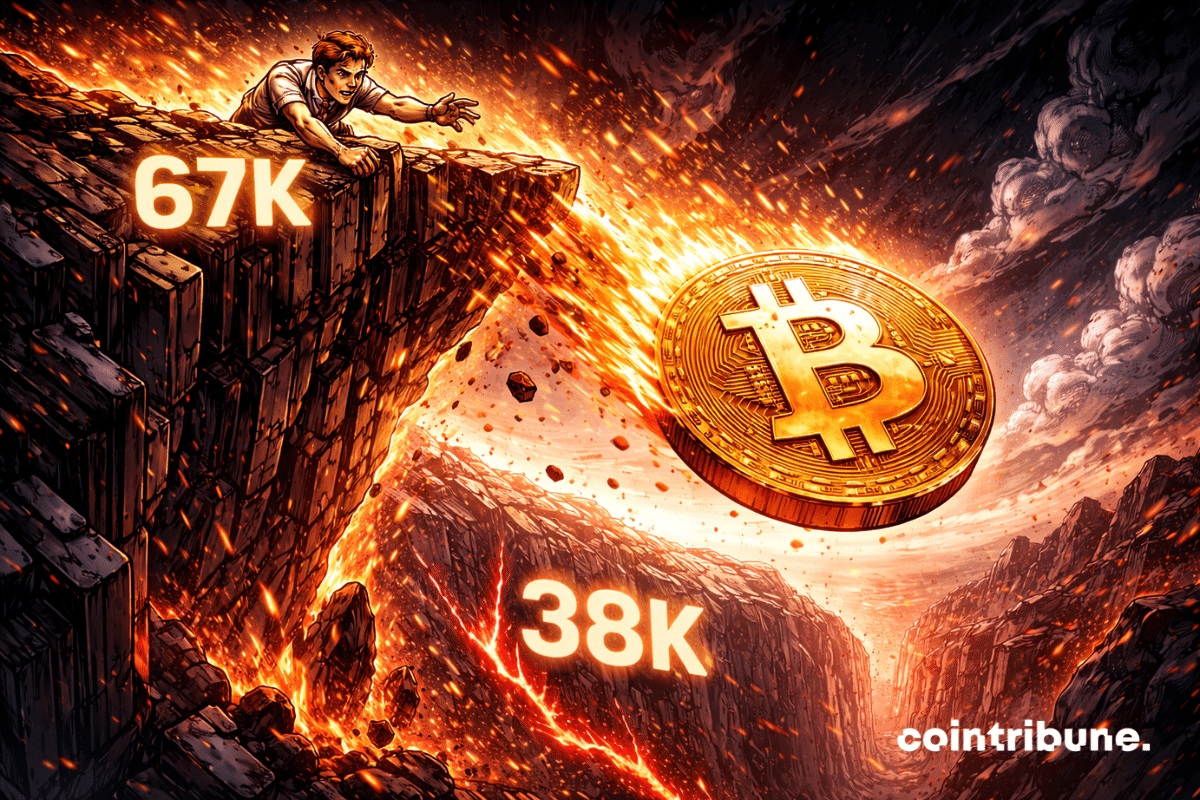

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40% decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

Bitcoin’s price remains under strain as selling pressure continues to weigh on the market. The OG coin fell to an intraday low of $72,945 in the previous session as market pullback continues across risk assets. While retail traders have largely maintained bullish positions, institutional investors have begun to retreat. Current data points to a growing divide between these two groups, raising questions about where Bitcoin may head next.

Bitcoin is sliding, ETFs are fleeing, Binance is coughing, traders are tensing up. And we were told that cryptos were rock solid...

Markets may be mispricing how sharply U.S. interest rates could fall if Kevin Warsh becomes the next chair of the Federal Reserve. A new forecast points to rapid and sizable rate cuts—an outcome that could weaken the dollar and reignite risk assets, including Bitcoin.

In 2026, family offices massively bet on AI, leaving crypto behind. With 89% of them having no exposure to digital assets, the gap widens. Why such an imbalance? What are the risks and opportunities for investors?

It fell back below $74,000 on February 2, Bitcoin suddenly erases gains recorded since Trump’s 2024 election. This sharp decline occurs in a climate of widespread distrust towards risky assets, as selling pressure intensifies. After a peak close to $126,000 reached at the end of 2025, the market now questions the strength of the bullish cycle and leaves doubt over the continuation of the movement.

Bitcoin exchange-traded funds finally stopped the bleeding on Monday with $562 million in fresh inflows, after four consecutive days of massive outflows. But will this breath of fresh air be enough to reverse the trend in a crypto market still under pressure?

BitRiver founder Igor Runets is under house arrest as the company struggles with debt and operational challenges.

Tether launches an open-source system for bitcoin mining, marking a major breakthrough in the global crypto infrastructure.

Balaji Srinivasan claims that Western governments will eventually launch massive asset seizure campaigns. This will happen as a sovereign debt crisis approaches. He foresees a time when the State will seek new means since the bill is increasing and the option "carry on as before" is closing. This alert, published via X according to multiple press reprises, quickly circulated in the crypto ecosystem.

While volatility establishes itself as a new norm, the recent drop in bitcoin goes beyond a simple technical correction. It reflects a brutal disengagement of institutional capital and a questioning of crypto market dynamics. Between ETF panic and rarely observed undervaluation signals, the crypto leader finds itself at a critical crossroads.

While the market digests a wave of massive liquidations, bitcoin and Ethereum register an unexpected rebound. In a still tense climate, this recovery intrigues as much as it divides. The contrast between extreme volatility and price increase reignites debates about the market's real solidity. After a week marked by instability, signals are blurred and positions are opposed.

Trump finally places his pawn at the Fed: Kevin Warsh. Monetary hawk, he promises discipline and rigor… While Wall Street and crypto collectively hold their breath.

While bitcoin briefly fell below $75,000, Michael Saylor did not hesitate to strengthen his positions. The Executive Chairman of Strategy invested $75.3 million to acquire an additional 855 BTC. A strategic choice, made official via the SEC, that fits into an uninterrupted accumulation policy since 2020. In a tense market, this move confirms the long-term vision of a key player on the crypto scene.

Panic among crypto traders: capital is evaporating, the Fed is frowning, and even bitcoin is coughing. A chill wind is blowing across the blockchain world.

Bitcoin sharply dropped this weekend, and the clearest signal does not come from the spot market. It comes from derivatives. The drop of over 10% between a peak at $84,177 and a low at $75,947 opened a rare gap on CME futures contracts, with a price difference exceeding 8% at reopening. It's the fourth largest gap since the launch of Bitcoin futures in 2017.

Bitcoin extends its losing streak to four months as the market struggles, but analysts remain cautiously hopeful for a rebound in February.

The IBIT ETF records historic losses after Bitcoin's drop. We provide all the details in this article.

The Bitcoin network is faltering in the face of the American winter. In January, an extreme cold wave paralyzed part of the territory of the United States, causing a sharp slowdown in mining activity. As the United States now concentrates a large share of the global hashrate, this episode highlights the sector's dependence on local energy infrastructures. The sudden drop in production raises questions about the network's real ability to withstand climate shocks and the limits of a model nonetheless considered resilient.

What if Epstein’s ghost also haunted bitcoin? Explosive emails link the man to the "founders" of crypto. Elite networks, hidden money, and guaranteed mystery.

Bitcoin is faltering, and warning signals are multiplying. As hopes for a recovery fade, the market seems to be returning to the bearish patterns of previous cycles. Key technical thresholds have broken, reviving projections of a return below $50,000. This scenario, long considered extreme, is gaining ground among analysts and seasoned traders. The prospect of a prolonged bearish phase is no longer a mere hypothesis but is becoming a concrete risk for investors still exposed.

Tether, the world’s apex stablecoin issuer, reported a sharp decline in profit in 2025 while continuing to expand its holdings of U.S. government debt. New financial data shows a clear shift toward capital preservation and liquidity as global demand for stablecoins rises. Despite weaker earnings, asset growth remained strong throughout the year. The results confirm Tether’s continued importance to global crypto market activity.

Crypto investment products suffered steep losses on Thursday as a broad sell-off swept through global markets. The total crypto market value fell roughly 6%, prompting one of the largest single-day fund outflows of the year. Bitcoin and Ether investment products bore the brunt of the decline as investors moved decisively to reduce risk.

Investors are turning away from Bitcoin, driving strong demand for gold and silver. JPMorgan highlights potential gold prices of $8,500 as metals attract new inflows.

For the first time, the United States targets crypto platforms linked to Iran, triggering a shockwave in the markets and a geopolitical escalation. Bitcoin free fall, Middle East tensions, and tightened regulation: what are the risks for investors and global stability?