El Salvador marked the fourth anniversary of its Bitcoin Law with a symbolic purchase of 21 BTC, just as analysts warned that September 8 often proves unfavorable for the cryptocurrency.

Theme Bitcoin (BTC)

The Trump family is back in the spotlight after their wealth coffers grew following American Bitcoin's (ABTC) debut and World Liberty Financial's (WLFI) price surge. However, both DeFi projects linked to the family have since faced a market correction of over double digits.

Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

Bitcoin, does it take away or does it enrich? For Michael Saylor, it inflates the wallet: $7.37 billion gained despite a market drop. Proof that faith pays off.

Since 2011, Satoshi Nakamoto has disappeared, leaving behind an unresolved enigma. However, some believe that the threat of quantum computing could force his return. This is the somewhat crazy but fascinating thesis of Joseph Chalom, co-CEO of SharpLink Gaming

The calm was short-lived. Indeed, the crypto market is plunging back into fear, according to the Crypto Fear & Greed Index, which dropped to 44 after several weeks of stability. This psychological signal is not isolated, as it accompanies a clear shift in investment flows, leaving the most volatile altcoins to refocus on the heavyweights of the sector, bitcoin and Ethereum.

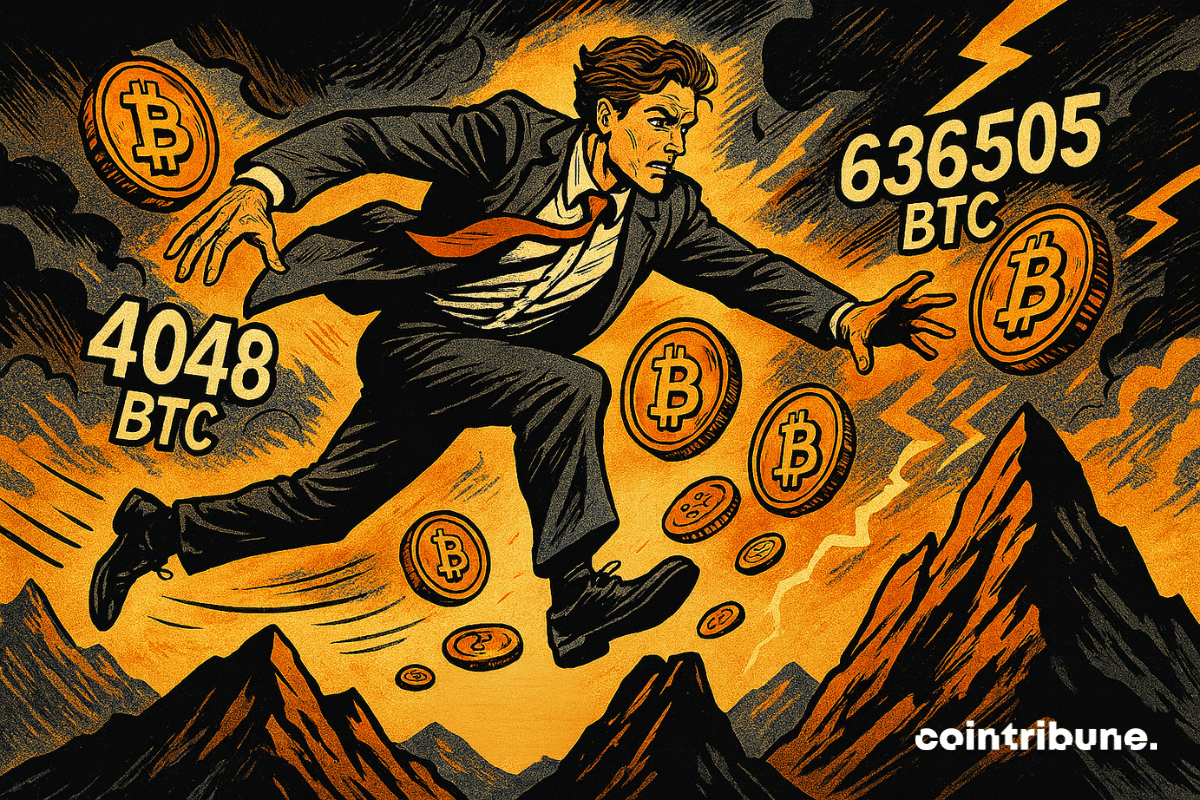

The disappearance of a few thousand bitcoins from a balance sheet is enough to fuel controversies. This weekend, the issuer of USDT found itself at the center of a media whirlwind: did it secretly sell its BTC? Some saw a strategic shift there. However, behind the seemingly worrying figures, another reality emerges, much more nuanced, and above all, revealing the discreet movements of a giant in crypto finance.

Bitcoin mining difficulty touched a new all-time high as the crypto market descended into volatility following the latest US job data. After hitting an all-time high (ATH) in August, market commentators projected that the difficulty of Bitcoin mining would decrease. However, the mining difficulty has steadily increased as the month progressed, with large players dominating the space.

Quantum computer and Bitcoin. Here is a hot series that is not about to fade, especially after IBM's latest experiment.

Reports from the U.S. labor market sent shockwaves through the financial markets, prompting risk assets like Bitcoin to experience sharp price swings. With job data for August coming in lower than expected, predictable alarms erupted regarding a looming recession, which could drive fresh appetite towards risk assets.

Solana speeds like lightning but stalls below 215 dollars: ETF lurking, record upgrade and flashy meme-coins. Crypto hesitates between a surge and a scheduled slip.

This Friday, September 5, nearly $4.7 billion worth of options on Bitcoin and Ethereum expire, while technical indicators waver and the U.S. economy sends signals of slowdown. This crucial deadline could reshape the spot markets' dynamics.

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

Analysts say Bitcoin could fall below $100K before recovering, with key levels and market trends guiding the outlook.

Is bitcoin approaching a decisive turning point? As signs of fatigue accumulate, a new analysis rekindles the specter of an imminent bearish cycle. According to a fractal modeling aligned with historical four-year cycles, October could mark the beginning of a deep correction. After the euphoria of the highs, the market enters a phase of uncertainty where every technical signal is scrutinized. This scenario, increasingly discussed among analysts, calls into question the strength of the current upward trend.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

September, long synonymous with a downturn for bitcoin, seems to be losing its curse. This historically unfavorable month for risky assets is starting, for the third consecutive year, a contrary dynamic. Supported by a flexible macroeconomic context and structuring institutional flows, the market is giving signs of maturity. The queen of cryptos no longer suffers the calendar: she redefines it.

Despite the recent bitcoin correction, the institutional rush on bitcoin continues to strengthen.

In August, bitcoin miners generated revenues close to 1.65 billion dollars, a level almost identical to that of July. This maintenance reflects an impressive resilience of the sector, despite a context marked by rising costs and energy pressure. But behind this apparent stability lie structural vulnerabilities that raise questions: can the current mining model really hold in the long term?

Bitcoin’s recent 12% pullback has drawn attention, but on-chain data indicates that this correction is a normal phase in the market. Analysts say the decline is within historical patterns and reflects a healthy reset rather than the end of the ongoing bull cycle.

Since the beginning of September, bitcoin (BTC) and Ethereum (ETH) have captured the attention of a crypto market suspended between hope and concern. While Wall Street falters, the two leaders show intriguing resilience. Yet, behind this apparent calm, technical indicators reveal growing tension. Between contradictory signals and increasingly polarized forecasts, traders are preparing for volatility that could make September a decisive month for the market's future.

While bitcoin melts and shareholders groan, Michael Saylor continues his XXL crypto shopping spree: diluted shares, questionable dividends, and a dream of joining the S&P 500. What a financial farce!

The debt is making headlines again on both sides of the Atlantic. Bitcoin is ready to soar if the Fed and the ECB were to bring back the printing press.

What if the next crypto cycle was not only bullish but a historic turning point? At the WAIB Summit 2025, several experts stated that a single cycle could be enough to increase crypto users from 659 million in December 2024 to 5 billion users within ten years. A global adoption underway, driven not only by speculation but by the rise of concrete use cases, the maturity of blockchain technologies, and renewed interest from individuals as well as institutions.

As September begins, crypto traders approach the market cautiously, with Bitcoin, Ethereum, and XRP showing varied performance.

Ethereum plays the tightrope walker: programmed drop, then theatrical rise. September trembles, October rejoices. Crypto traders? They might applaud... after getting trapped.

Bitcoin wavers below 109,000 dollars, caught between macroeconomic uncertainty and unfavorable technical signals. While investors scrutinize upcoming indicators likely to guide US monetary policy, the pressure intensifies. Institutional capital outflows, tensions in derivatives products, and weakened sentiment indicators increase distrust. The market freezes in anticipation, exposed to latent volatility.

Ethereum takes the prize for the big players, Bitcoin clings to its throne. A duel of numbers, egos and billions: who will emerge victorious from this digital waltz?