Bitcoin. A word that resonates, that frightens, that fascinates – and which, on June 9th, has once again shaken all the codes. Skeptics will see it as just another temporary spike. But those who observe the surface trembling sense what is brewing beneath: a tectonic shift of ambition, audacity, and, to be frank, pure instinct. A look back at a surge that saw a millionaire make one of the boldest bets of the year, while the finance world grips its seat.

Theme Bitcoin (BTC)

Saylor dilutes, bitcoins are piling up, and shareholders applaud. MicroStrategy turns the stock market into a mine, without shovel or pickaxe. How far will the captain of the digital treasure go?

Bitcoin just hit hard: a liquidation imbalance of 53,247% has violently overturned the market. In just a few hours, BTC swept away all traders' benchmarks and redefined the battle between bulls and bears. This is not just a price increase; it's a real upheaval.

Michael Saylor says fears over quantum computing breaking Bitcoin are overblown. He believes the network can adapt and tech giants won’t risk their own security.

Bitcoin has never been known for rewarding the obvious. As its price rises to over $105,000, many leveraged traders are taking a surprising position: they are betting heavily on its decline. Behind this seemingly rational behavior may lie a misunderstanding of the deep mechanisms of the crypto market — or worse, a repetition of past mistakes.

Strategy proceeds openly: accumulate bitcoin at any price. However, when the company announces a fundraising of one billion dollars and Michael Saylor subsequently publishes an enigmatic post, the strategy takes on a whole new dimension. Within hours, the markets stir, and speculation resumes. The businessman rekindles the interest of the entire ecosystem and reinforces the idea that Strategy is much more than a tech company: a strong institutional signal in favor of bitcoin.

Bitcoin, freedom or global tracking? When a family buries their cryptos in every corner of the globe, it’s because fortune also attracts handcuffs... but not always thieves.

When Changpeng Zhao, aka CZ, takes to the pen — or rather his keyboard — the crypto ecosystem listens carefully. On June 7, 2025, the former head of Binance struck again with a tweet that was both provocative, ironic, and full of meaning, merging the echoes of Winston Churchill's speeches with his own philosophy of "HODL." The result: a powerful message that encapsulates the mindset of millions of crypto investors around the world.

Solana is shaking, XRP is plummeting, Ethereum is swaying... the whales dance and small investors suffer. The crypto circus continues, without a net, to the rhythm of an increasingly unpredictable market.

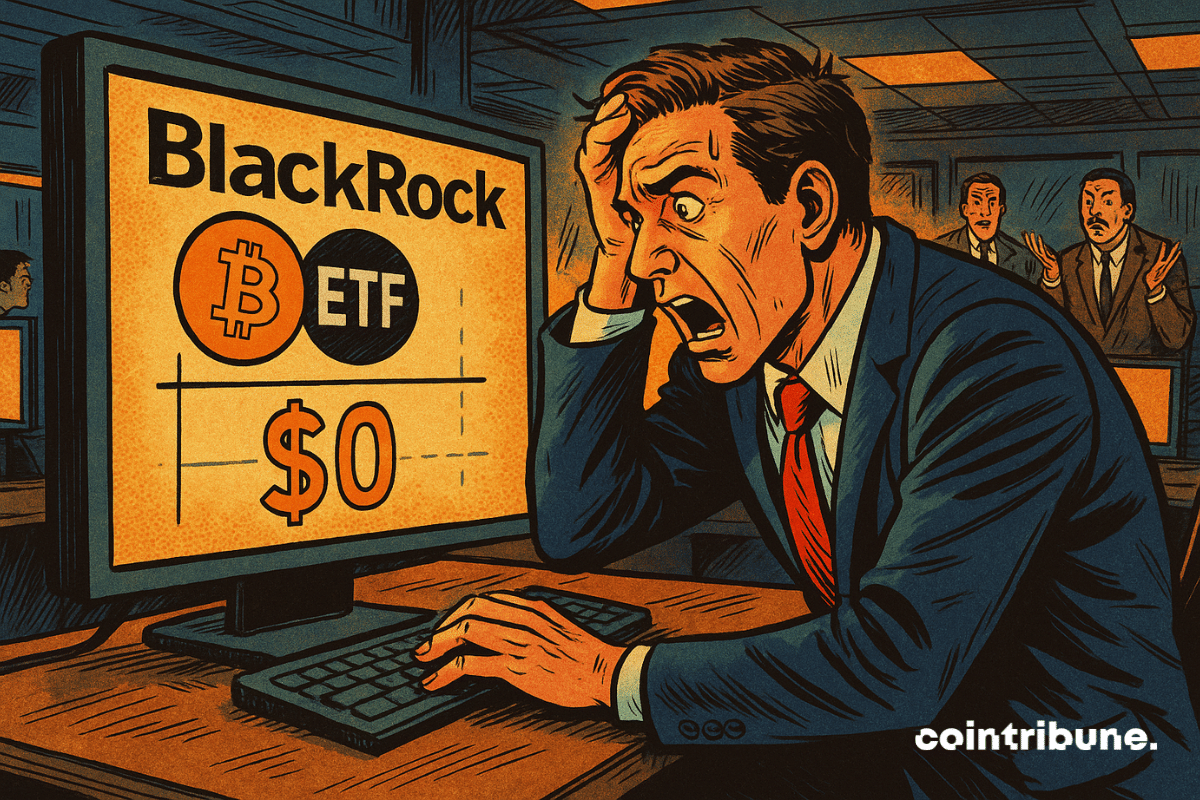

On Thursday, June 6, the asset management giant experienced a record withdrawal of $130.49 million from its Bitcoin spot ETF IBIT, the largest since its launch in January. This shock was enough to drag the entire Bitcoin ETF market into the red for the second consecutive session, raising doubts about the institutional momentum that had been supporting these bitcoin-backed investment vehicles.

How to manage your bitcoins at retirement? Is it better to simply sell your BTC, or to use them as collateral with a bank and live on credit?

Switzerland, once a discreet safe haven, is preparing to empty its crypto pockets to 74 countries... Enough to make digital anonymity enthusiasts hiding in the Alps tremble!

As traditional finance giants struggle to reinvent their reserve strategy, a Japanese company is stepping off the beaten path. Metaplanet, boldly dubbed "the Japanese strategy," is no longer just flirting with bitcoin. It is now entering an economic war with a clear ambition: to own 100,000 BTC by the end of 2026. This is no longer just a bet; it is a manifesto.

Musk plays the cartomancers 2.0: crypto bets on X, algorithms as a crystal ball, and the press relegated to the status of folkloric prediction.

On June 5, BlackRock did nothing. Not a dollar, not a movement, not even a shiver. Its Bitcoin ETF, IBIT, which until now had been a war machine for incoming capital, remained frozen. And this is not trivial. In a market where immobility is often more concerning than panic, this inaction is worth much more than just a simple zero. While others are bleeding, BlackRock stands still. And in this gesture, there may be more strategy than lethargy.

Under pressure in the face of an uncertain economy, markets are watching every move of the Federal Reserve. Far from being limited to traditional assets, its decisions now strongly influence the crypto market. As a potential surprise rate cut approaches, bitcoin is holding its breath. Such a monetary signal could propel the first cryptocurrency to new heights, fueling expectations of a historic rally.

The global digital landscape is witnessing the emergence of an invisible yet formidable predator: Crocodilus, a malware for Android with voracious ambitions. Detected for the first time in March 2025, it quickly mutated, transitioning from a simple regional test to a planetary offensive. And it’s not your vacation photos that interest it, but rather your money — especially that which you thought was safe in your crypto wallets.

There are stories that one buries with lawsuits, maximum security prisons, and forgotten headlines. Then there is bitcoin, this red thread that one never really cuts. In June 2025, a transaction of 300 BTC, equivalent to 31 million dollars, lands in the wallet of Ross Ulbricht, creator of Silk Road, the legendary black market of the darknet. The catch? This windfall comes from a wallet linked to AlphaBay, its notoriously infamous successor. The past has not said its last word. It returns... in encrypted form.

Nearly 4 billion dollars in options for Bitcoin and Ethereum are set to expire this Friday, June 6, drawing the attention of a pressured market. With predominantly bullish positions and prices below critical thresholds, this expiration could trigger a wave of volatility. In a tense geopolitical climate, traders and institutional investors are proceeding cautiously, aware that even the slightest price movement could reshuffle the deck in the very short term.

Retired NBA star Scottie Pippen is encouraging everyone to learn about Bitcoin. Experts and recent data show the cryptocurrency’s growing strength and possible price gains ahead.

When Musk threatens space and Trump cuts the funding, it's crypto that takes a hit. A duel of egos, billions vanished and bewildered investors... Who really benefits from the chaos?

In the crypto ecosystem, few announcements redefine the fundamentals. Yet, Cane Island Digital reveals that more than a third of mined bitcoins are permanently lost. Far from being just a statistic, this reality disrupts the understanding of actual supply, increases the asset's scarcity, and questions current valuation models. This silent phenomenon, often overlooked, raises critical issues: how to value an asset whose growing portion is evaporating? And how far could this gradual disappearance reshape the monetary landscape of bitcoin?

An unknown geek, armed with rented hash, snags $330,000 in bitcoin. Technical coincidence, bluffing move, or a silent revolution under the bits of solo mining?

Uber's announcement to accept bitcoin and other cryptocurrencies as payment methods marks a strategic turning point. More than just a simple technological addition, it is a strong signal. The mobility giant aims to root itself in the emerging digital economy. At a time when cryptocurrencies are gaining traction in daily usage, Uber does not want to just ride the wave, but to help shape it. This choice raises a fundamental question: what role will technological giants play in the evolution of global payment systems?

Are bosses becoming miners? While MicroStrategy inspires, others dive into Bitcoin... but if it crashes, will they need to sell the desks or just the chairs?

Once again, James Wynn is making headlines — and not for the right reasons. This crypto trader, known for his excessive risk-taking, has just lost 25 million dollars in a partial liquidation of his latest Bitcoin position. It's yet another drop in a long series of bets that are as spectacular as they are self-destructive. Should this be viewed as boldness or a form of programmed financial suicide?

When a former dealer offers bitcoin to the Czech Justice, the minister says thank you... before falling. Morality: it's better to trace donations before ending up in the newspapers.

While the volatility of Bitcoin continues to turn heads, some players choose not to observe — but to act. The Blockchain Group has just doubled down: 60 million euros injected into 624 BTC, boosting its reserves to 1,471 units. A calculated maneuver that goes beyond mere speculative placement. Here’s why.

JPMorgan, long hesitant about cryptocurrencies, marks a major turning point in the banking sector. The American bank announces the integration of Bitcoin ETFs as loan collateral, a decisive step towards the adoption of these assets. As regulation takes shape and institutional investor interest grows, this evolution could redefine the relationship between traditional finance and blockchain. This change signals a new era for financial products, placing cryptocurrencies at the heart of mainstream banking services.

A struggling Spanish coffee chain abandons its cup to embrace digital gold. Salvador Martí, the boss of Vanadi Coffee, wants to transform his business into a pure Bitcoin machine. But will this bold strategy actually save the company from bankruptcy?

"." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0.png 1200w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0.png">

"." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0.png 1200w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/06/Black-Dollar-0.png">