After several years of hostility towards Bitcoin, Taiwan may soon reconsider its viewpoint given its precarious geopolitical situation.

Theme Bitcoin (BTC)

Altcoins beat Bitcoin in April! In this article, find out why this trend will shake up the crypto market.

When crypto plays leapfrog with the quantum computer, BlackRock warns about Bitcoin, while future hackers are already rubbing their hands together.

Solana is establishing itself in the crypto world by significantly surpassing all other L1 and L2 blockchains in network revenue. This success is based on several key factors that enhance its attractiveness and relevance. Is Solana about to dethrone Bitcoin and become the world's leading blockchain?

Bitcoin is nearing $104,000, but the enthusiasm of retail investors is collapsing. Google searches and downloads of trading apps have reached an unprecedented low. This contrast reveals a worrying paradox: where have the retail investors gone in this historic bull cycle?

In 2025, companies are establishing themselves as the main buyers of bitcoin, surpassing individuals and ETFs. This strategic shift places BTC, designed for decentralization, in the hands of centralized actors. Can the crypto queen still embody a popular alternative in the face of this growing concentration?

The BIS reveals that $600 billion in crypto circulated in 2024, primarily for speculation, not for real use. Details here!

Tether has just acquired nearly half a billion dollars in bitcoin as part of a major strategic operation. This transaction prepares the launch of Twenty One, a new Bitcoin treasury company set to enter Nasdaq through a SPAC merger. A maneuver that could redefine the standards of institutional crypto management.

Arizona Governor Katie Hobbs vetoed two crypto-related bills due to concerns over market volatility while approving a law to regulate crypto ATMs, setting limits on transactions and requiring fraud protections.

While whales stash their digital gold, the small ones struggle. Bitcoin evaporates, ETFs confine it, and the promise of a decentralized crypto takes an oligarchic turn.

In a crypto market where volatility is the norm, Bitcoin has just reached an unexpected milestone. It is now less unstable than the S&P 500 and the Nasdaq. This discreet yet significant shift, revealed by Galaxy Digital, challenges a decade of perception of an asset deemed too risky for traditional portfolios. More than just a technical indicator, this signal could mark a lasting status change for the first cryptocurrency.

The American deficit is set to explode by 2.5 trillion dollars. This Republican fiscal bomb could paradoxically become the fuel for a historic rally for bitcoin in the face of the inevitable devaluation of the dollar.

Bitcoin accelerates and moves back above $100,000: find our complete analysis and the current technical outlook for BTC.

While Wall Street soars amid easing tensions between Washington and Beijing, Bitcoin has dropped below $102,400 on May 12. An unexpected decline that contrasts with the prevailing optimism and institutional momentum of recent weeks. Why hasn't BTC benefited from the market euphoria? With just hours before the release of the U.S. CPI, investors are questioning whether this is simply profit-taking or an early sign of deeper macroeconomic stress.

Bitcoin surpasses $105,000 and some investors are already thinking about selling. However, according to a recognized expert, there is no clear signal justifying this. A key indicator shows that bulls are still in the game. Here’s how to interpret this signal… and avoid giving in to panic.

In the span of a few hours, the crypto market was hit by a brief correction. While bitcoin seemed firmly established above $100,000, a sudden reversal changed the trend, sweeping away the bullish momentum. Over $700 million in positions were liquidated, which brought BTC below $101,000. This rapid and unexpected drop destabilized investors, once again confirming the vulnerability of a market where confidence can shift in an instant.

The U.S. and China agree to pause tariffs for 90 days, boosting crypto market optimism with Bitcoin and others seeing strong gains.

Michael Saylor strikes again. The head of Strategy has just purchased an additional 13,390 bitcoins for $1.34 billion, reinforcing his dominance in the institutional market. What's the next step? Raising $84 billion to continue his buying frenzy. A strategy that fascinates as much as it worries financial experts.

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.

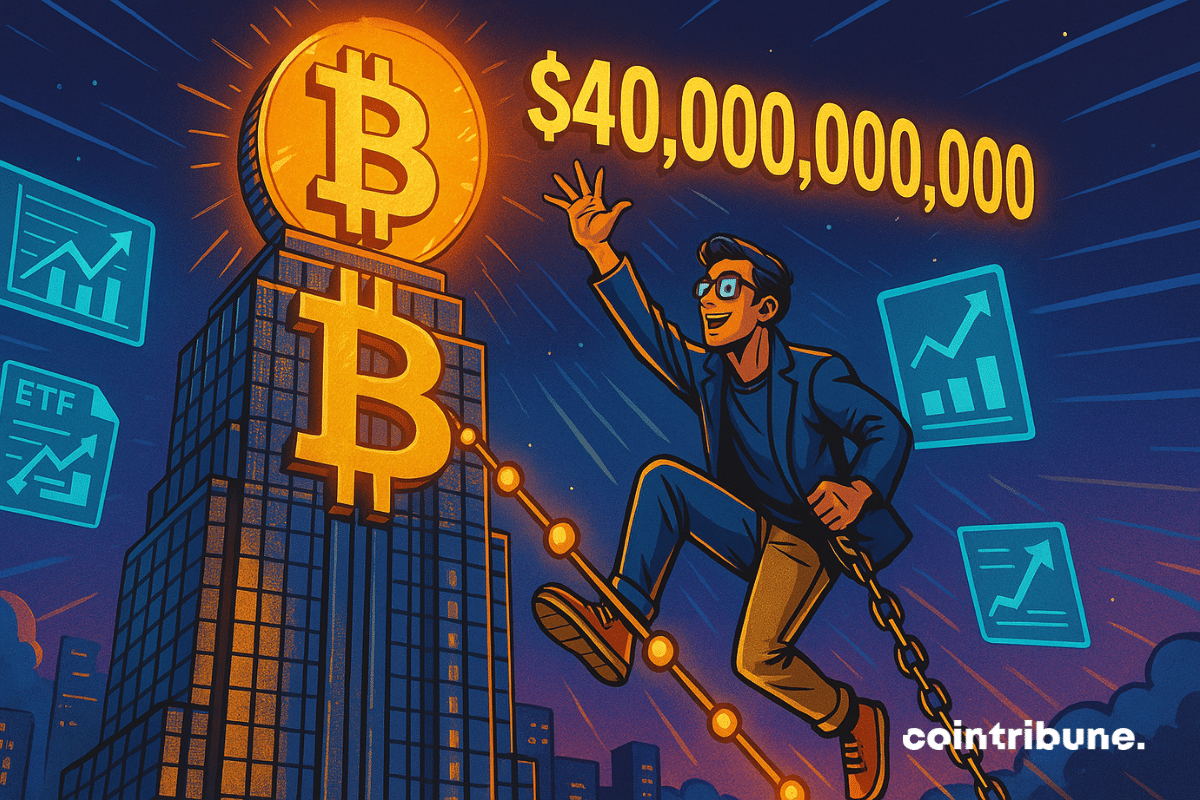

As financial markets waver under the weight of monetary tensions and macroeconomic uncertainties, Bitcoin ETFs have reached a historic milestone with $40 billion in cumulative inflows. This symbolic threshold represents much more than just a record. It confirms the integration of Bitcoin into regulated portfolios and reveals a profound transformation in crypto investment. From now on, Bitcoin is establishing itself as a durable component of institutional financial architecture.

A Japanese company has just dethroned an entire country in the race for bitcoin. By surpassing El Salvador, Metaplanet transforms an ambition into a statement of power. Behind this meteoric rise, a radical vision of the global monetary future is emerging. Are we on the brink of a new era where companies dictate the rules?

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

Under the guise of progress, Paris is rolling out the red carpet for crypto lombard credit... but the banks couldn't care less, and Bercy is already pulling out the calculator to tax the bold.

While panic looms over small investors, the whales are resurfacing at Binance, depositing their digital gold, and patiently waiting for the storm to pass.

As Ethereum cheerfully crosses the $2,600 mark this week, a thrill runs through the crypto community. Behind this skyrocketing rise of 37% lies a rare technical signal: maintaining the price above the realized price of $1,900. An indicator that, combined with the Petra update, paints an unprecedented bullish scenario. But why does this symbolic threshold electrify the experts? A deep dive into the insides of a boiling market.

When New Hampshire chose to integrate bitcoin into its reserves, the initiative resonated little beyond its borders. But today, the echo has become global with Taiwan studying the same strategy, considering allocating 2.5 billion dollars to it. A strong signal of a possible global monetary shift.

After a long dry spell, altcoins are finally showing signs of awakening. Ethereum has just surged more than 32% in a week, reviving hopes for a true "altseason." As Bitcoin's dominance reaches 65% of the total market capitalization, many analysts see it as a precursor to an imminent shift.

The prestigious investment bank Goldman Sachs is increasingly strengthening its position in the crypto ecosystem. With a $1.4 billion stake in BlackRock's Bitcoin ETF, it now stands as the largest institutional holder of this financial product. What does this massive investment reveal about the future ambitions of the banking giant?

The European Union is ending anonymity in crypto transactions. Starting July 1, 2027, any transfer exceeding €1,000 will be required to reveal the precise identity of the sender and the recipient. According to Paschal Donohoe, president of the Eurogroup, these new anti-money laundering rules (AMLR) clearly place blockchain and digital assets under the direct oversight of European authorities. For crypto enthusiasts, this measure represents both a necessary revolution and a painful betrayal.

Bitcoin is still struggling to reach the symbolic target of $150,000, despite a recent rebound to $104,000 recorded on May 8th. Michael Saylor, founder of MicroStrategy and a staunch advocate of Bitcoin, has clearly identified the culprits behind this slowdown: opportunistic investors, whom he labels as tourists or weak hands, who exit the market at the slightest sign of quick gains.