Bitcoin is increasingly moving from private portfolios to public balance sheets. A new report from River indicates that governments are no longer passive observers of the market. Today, 23 countries hold BTC in some capacity, marking a meaningful expansion of state-level participation.

China

Gold and silver closed 2025 at record highs, and that rally has accelerated into early 2026. A combination of strong demand, constrained supply, and rising political uncertainty is driving investors toward precious metals. New concerns about central bank independence have further intensified buying pressure.

While Beijing is making its e-yuan grow, Washington debates whether cryptos can offer rewards. What if the real danger is not what we think?

Reports of a renewed crackdown on Bitcoin mining in China’s Xinjiang region triggered concern across crypto markets this week. Early claims warned of severe hashrate losses and widespread shutdowns. Mining data reviewed after the initial reaction suggests, however, that the impact was brief and far smaller than first reported.

After one of the steepest selloffs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.

Bitcoin collapses, Trump threatens, Beijing counterattacks, and cryptos suffer: meanwhile, Dogecoin still seeks a way out of the crisis. Should we laugh or buy?

China announces that it is giving up some of its privileges at the WTO. This move, described as "major" by the organization's director-general, Ngozi Okonjo-Iweala, reshuffles the cards of global trade. Made by Li Qiang himself, this decision marks a strategic shift for Beijing authorities, long accused of unfairly benefiting from multilateral rules.

AnchorX and BDACS have launched AxCNH and KRW1, stablecoins pegged to the offshore Chinese yuan and South Korean won, aiming to streamline cross-border payments and expand digital currency adoption.

Promised for 2026, the digital euro is already causing waves: Lagarde sees sovereignty, Navarrete calls it a useless gadget, and banks fear a digital bank run.

Chinese firms may face restrictions on stablecoin activity, affecting their role in the city’s digital asset market.

PetroChina is exploring the use of yuan-backed stablecoins for cross-border oil trade as Hong Kong rolls out a new licensing framework, while China weighs regulatory clarity for digital assets in international settlements.

China is reportedly weighing whether to authorize yuan-backed stablecoins. It would be a major reversal of its restrictive crypto stance. According to Reuters, sources familiar with the matter say the State Council will review a roadmap later this month that could open the door to stablecoin issuance tied directly to the Chinese yuan.

Faced with a wave of critical maturities on $4,000 billion of debt, Beijing launched an unprecedented monetary response. In August, the People's Bank of China injected $1,400 billion to avoid the suffocation of its bond market. More than an emergency measure, this intervention marks a strategic turning point in managing Chinese financial flows. In a context of global tensions, this technical gesture speaks volumes about Beijing's determination to maintain control over its economic cycle.

While the trade war intensifies, Beijing and Moscow show their determination. In July, their exchanges jumped to $19.14 billion, an annual record that contrasts with the gloom of the first half of the year. This rebound occurs as Donald Trump threatens China with new tariffs, after sanctioning India for its Russian oil purchases.

E-commerce giant JD.com is getting ready to enter the stablecoin race as Hong Kong’s regulatory regime for digital currencies officially kicks off. The company has registered two potential stablecoin-linked entities, Jcoin and Joycoin, through its fintech arm JD Coinlink Technology, just days before the city’s new framework takes effect.

At Shanghai, China unveiled a major proposal: to create a global organization dedicated to the governance of artificial intelligence. In a speech with geopolitical undertones, Beijing denounces "fragmented" international regulation and aims to position itself as a strategic alternative to the United States. By betting on openness and dialogue with countries in the Global South, this initiative marks a step in China's ambition to shape technological innovation, as well as the norms that will govern its use on a global scale.

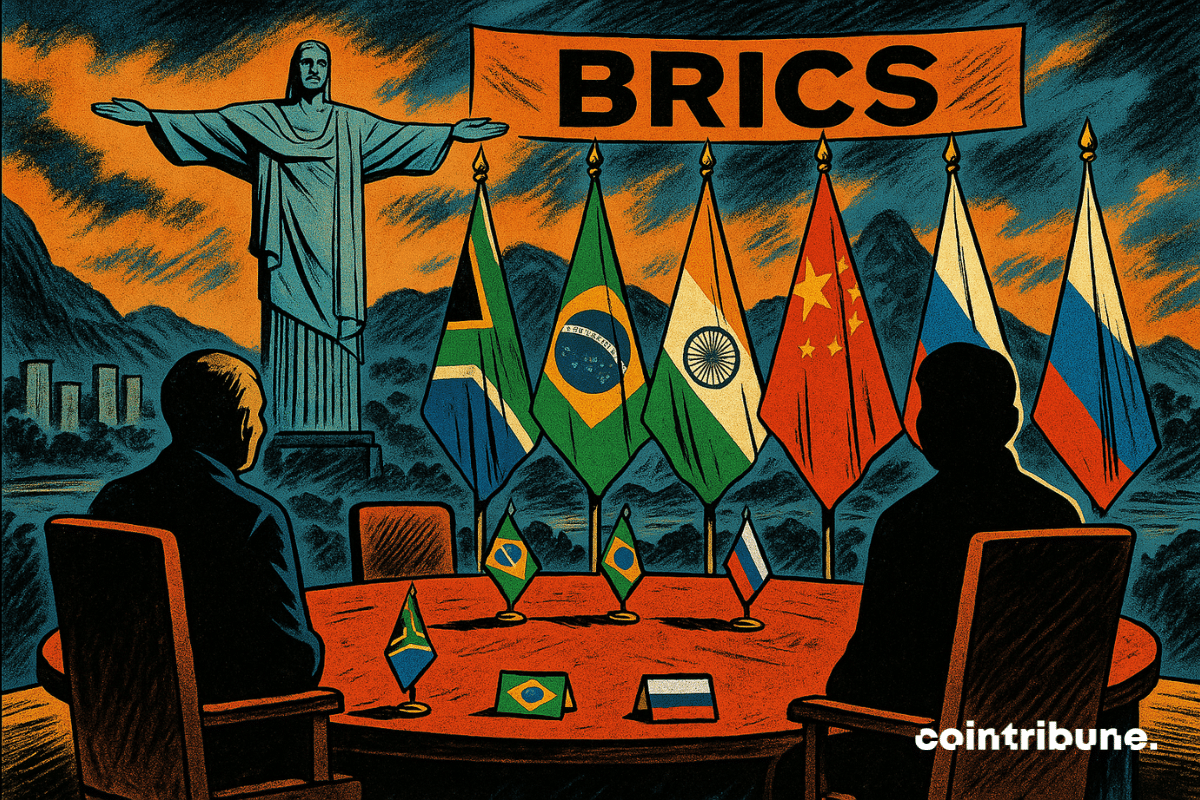

Rio is set to host a high-stakes BRICS summit, marked by two historic absences: Xi Jinping and Vladimir Putin. The Chinese president is withdrawing for the first time since 2013, while his Russian counterpart remains in the Kremlin, targeted by an arrest warrant from the ICC. At a time when the bloc wants to assert itself against the dollar and strengthen its influence, these withdrawals weaken the group's unity and raise doubts about its geopolitical trajectory.

The economic center of gravity is shifting towards the South, and both Beijing and Moscow want to dictate the pace. Ahead of the BRICS summit in Rio, Vladimir Putin and Xi Jinping are unveiling an unprecedented initiative: a joint investment platform dedicated to global South countries. Designed as a lever of influence and emancipation from circuits dominated by the West, this announcement marks a key step in the construction of an alternative financial order led by emerging powers.

Symbol of a Sino-American tug-of-war, TikTok once again crystallizes the tensions between digital sovereignty and trade war. With 170 million users in the United States, the ByteDance application is facing a third deadline extended by Donald Trump. By extending the deadline for the sale, the president is reviving an explosive file where geopolitical pressure, technological stakes, and legal battles are intertwined. TikTok remains at the heart of a strategic struggle, at the crossroads of economic interests and national security concerns.

While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

In the turmoil of global commercial reconfigurations, Beijing is advancing its pawns. China announces the complete removal of tariffs on exports from 53 African countries, expanding preferential access to its market. Behind this gesture lies a targeted diplomatic offensive as Washington, under the leadership of Donald Trump, reactivates protectionist levers against the continent. Africa, long peripheral in geo-economic arbitration, is becoming the epicenter of a clash of influences where industrial ambitions, strategic alliances, and narratives of sovereignty intersect.

In an economic context where every trade tension weighs on global markets, Washington has chosen firmness. On June 11, Howard Lutnick, Secretary of Commerce, ruled out any reduction in tariffs imposed on China. An unambiguous announcement, despite an agreement announced as "concluded" by both capitals. This tariff status quo reinforces uncertainty about global supply chains and sends a clear signal: the time is not for easing, even amid diplomatic dialogue.

As Washington and Beijing reopen a diplomatic channel in London, tensions over rare earths and semiconductors threaten the global balance. In the face of the Chinese delegation, Washington demonstrates its firmness. Donald Trump, true to his style, sets the tone: "China is not easy." Behind this statement lies a reality: neither side seems willing to yield on such strategic and explosive issues.

Beijing is picking Uncle Sam's pockets, offloading its Treasury bonds, and whispering to the global economy: "I love you... me neither."

The U.S. and China agree to pause tariffs for 90 days, boosting crypto market optimism with Bitcoin and others seeing strong gains.

China hoped to restore its economic reputation through conciliatory gestures towards the United States. Alas, despite a partial reduction in tariffs, the outlook remains bleak. The Chinese economy wavers, trapped by its own inertia and a frigid global environment.

When Japan, China, and South Korea sit down at the same table, it's not to discuss the weather. In a world where trade tensions reshape alliances, their recent meeting could very well change the game in Asia... and beyond. Between promises, caution, and joint projects, a new geopolitical chapter seems to be unfolding in three voices.

In the face of economic slowdown and international trade tensions, the Chinese government is deploying an ambitious strategy to boost domestic demand. The State Council has just launched a "special action plan" aimed at revitalizing national consumption, viewed as the new growth engine to achieve the 5% target by 2025.

OpenAI has just announced the launch of new tools for developers, making it easier to create advanced AI agents. This initiative comes as Chinese startups, such as Monica and DeepSeek, are offering high-performing alternatives, often at a lower cost.

The economic confrontation between the United States and China is taking on a new dimension. Indeed, far from being limited to traditional exchanges, this trade war is now affecting the crypto market. Thus, between Donald Trump's announcement regarding the creation of a national strategic reserve of cryptocurrencies and the Chinese response to American economic sanctions, investors are witnessing market movements of rare intensity. The question now arises: is this instability temporary or should we expect a lasting impact?