Bitcoin has fallen more than 22% in one month, casting doubt on its momentum. Yet, behind this pullback, several signals point to a possible return to the symbolic threshold of $112,000. While markets are restless, institutional and retail investors watch four key factors likely to revive the bullish trend. In a context of macroeconomic uncertainty and tension in derivative markets, the scenario of a rebound can no longer be ruled out.

Cmc RSS

Bitcoin is crashing, but K33 Research experts see a golden chance. After a 36% drop, is the sell-off approaching saturation? Discover why this correction could be the relative buying opportunity of the year and what analysts forecast for 2026.

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

Bitcoin crash: Strategy reassures investors with a 70-year plan. New era or last gasp? Analysis of a risky bet.

JPMorgan Chase has just filed an application with the SEC for an innovative financial product that could radically transform the way investors are exposed to Bitcoin. The stake? Potentially massive returns by 2028. But at what cost?

Bitwise's Dogecoin ETF has just received the long-awaited approval from the NYSE, but one question remains: will the market show up for DOGE? Between hopes and uncertainties, this launch could redefine the future of the most famous memecoin. Discover the stakes and projections for investors.

On 26 Aug 2025, BYDFi, a Singapore-based crypto exchange, sealed a multi-year partnership with Newcastle United, a flagship Premier League club. More than a publicity move, this alliance between football and blockchain marks a strategic push into the global market. In a competitive sector, BYDFi is betting on the media power of sport to position itself as a central player in crypto. It is a strong signal sent to the industry and perhaps a turning point in the battle between exchanges.

After three years of forced absence, Polymarket finally returns to the US market. The predictive betting platform, banned in 2022 for regulatory non-compliance, obtains the long-awaited authorization from the CFTC.

QCAD has become Canada’s first fully compliant CAD stablecoin, offering stable value, faster payments, and greater access to digital financial services.

The scene takes place in Saint Petersburg, but one might almost want to classify it under "absurd robberies." A 21-year-old unemployed man tries to steal cryptocurrencies using airsoft grenades. Noise, smoke, lots of panic, but no satoshi will leave the digital vaults of the platform.

Crypto venture funding climbed to 4.65 billion dollars in Q3 2025, driven by major deals and growing support for startups across the sector.

Fresh activity in Metaplanet’s financing plan suggests the company is accelerating efforts to increase its Bitcoin exposure amid ongoing market volatility. A newly executed $130 million loan backed by its BTC reserves signals a continued commitment to a balance-sheet strategy built around borrowing and long-term equity funding.

In an economic landscape weakened by persistent inflation and markets still under pressure, the succession at the head of the Federal Reserve becomes a highly strategic issue. The rise of Kevin Hassett, former economic adviser to Donald Trump and close to the crypto world, reshuffles the deck. At the intersection of classical monetary policy and financial innovations, his candidacy intrigues, divides, and could mark a major turning point in the relationship between Washington and the crypto industry.

This November 20 marks an unprecedented turning point in American budget history. Texas has become the first state to officially integrate bitcoin into its public reserves. At a time when fiat currencies are wavering and institutions are seeking solid alternatives, this decision stands as a strong signal. The Lone Star State paves the way for a new form of financial sovereignty, placing the flagship asset at the heart of its long-term economic strategy.

Bitcoin is close to volatility indigestion, its Sharpe Ratio is falling, and whales are salivating. Should you buy when everything collapses? Here is a crypto puzzle worthy of a financial noir novel.

Faced with a colossal budget deficit and persistent Western sanctions, Moscow is ready to cross a historic milestone: issuing sovereign bonds denominated in yuan for the first time. More than a mere financial maneuver, this decision marks a strategic turning point towards a deliberate dedollarization and strengthened monetary integration with the BRICS. By betting on the Chinese currency, Russia aims both to stabilize its public finances and to structure a new circuit for its energy revenues outside Western channels.

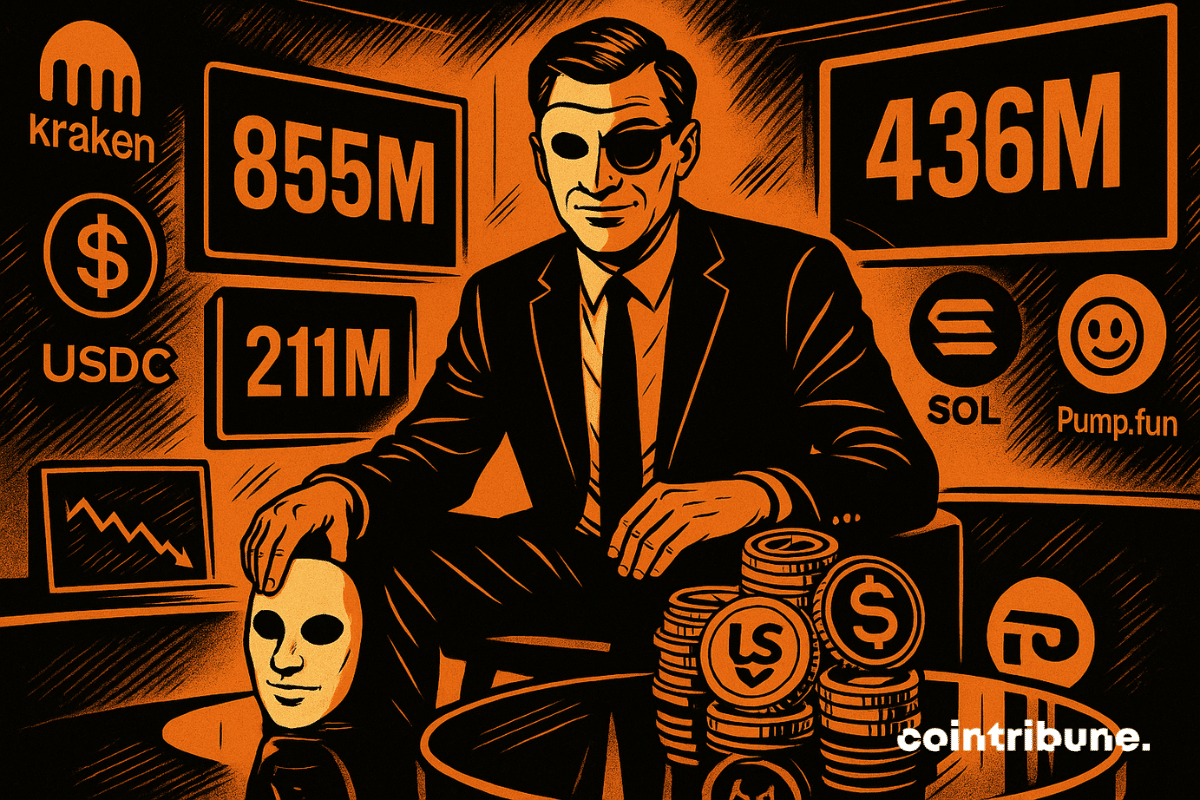

An explosive case shakes the crypto world: Pump.fun accused of siphoning $436M. The founder denies, but doubts remain.

MON token made a strong debut, surging soon after its mainnet launch and attracting backing from major industry players.

Strong market interest returned to TON, with the token climbing to $1.60 after an 8.33% daily rise. Growing activity across Telegram-linked applications, steady technical signals, and a packed month of ecosystem releases added fresh confidence to traders. Even while the broader market continues to struggle, TON stands out as one of the sharpest moves among major networks.

The latest PPI figures for September 2025 have just been released, and they are more alarming than expected. With inflation stubbornly high, the Fed finds itself backed into a corner ahead of its December meeting. A crucial decision is brewing: will it cut rates or risk an economic slowdown?

Bitcoin tumbles, miners migrate to AI. Microsoft pays, stocks rise… But their profits? Still striking. The future is now written between cloud and a gamble.

Behind the new name The Bitcoin Society (TBSO), Eric Larchevêque orchestrates the transformation of a small listed Parisian company, Société de Tayninh, into a hybrid vehicle: both a "bitcoin treasury company" and a network company focused on individual financial sovereignty. In other words: a MicroStrategy the French way, but grafted onto an activist community.

As bitcoin tries to recover after its plunge below $81,000, Strategy, one of the largest institutional accumulators of BTC, has chosen silence. For the first time in weeks, the company did not release any announcement on Monday regarding its weekly acquisitions. An unusual behavior that raises many questions.

Donald Trump has just signed a groundbreaking decree: the "Genesis Mission." Objective? To propel the United States to the forefront of the AI race, with massive investments and strategic partnerships. An initiative that could change everything for global innovation.

Massive cash-out: Pump.fun withdraws $436M in crypto and triggers a shockwave on Solana. All the details in this article.

Ethereum struggles to regain height after its recent correction, oscillating below major technical levels despite the loyalty of its long-term holders. The second largest crypto market capitalization tries to revive its upward momentum, but the demand engine runs at low speed. Without new capital inflows, the recovery remains fragile, dependent on the patience of long-term investors.

While bitcoin briefly rises above $86,000, a dissonance persists: the US dollar remains strong. This strength, usually unfavorable to risky assets, has not hindered BTC's upward momentum. Is it a real sign of recovery or a mere technical rebound masking underlying weaknesses?

Revolut makes a big impact: 75 billion dollars valuation and a historic fundraising supported by Coatue, NVIDIA and Fidelity. How is this European fintech, boosted by crypto, redefining global finance?

Franklin Templeton launched an XRP-backed ETF on NYSE Arca this Monday. This event marks a significant milestone in integrating altcoins into regulated markets. While attention is focused on Bitcoin ETFs, this initiative signals an expansion of institutional interest. After the litigation between Ripple and the SEC, this launch could pave the way for other cryptos previously sidelined by traditional markets.

Banned but coveted, China plays it cool and reconnects its bitcoin machines. Silence in Beijing, but business is booming in provinces where electricity costs nothing.