BBVA joins a banking consortium to launch a euro stablecoin against dollar stablecoins. All the details in this article!

Dollar

Trump finally places his pawn at the Fed: Kevin Warsh. Monetary hawk, he promises discipline and rigor… While Wall Street and crypto collectively hold their breath.

Tether has quietly become one of the world’s largest private holders of physical gold. The issuer of the world’s biggest stablecoin is buying bullion at a pace that now rivals national governments. Executives say the strategy is driven by rising concerns over monetary stability and declining confidence in paper-based assets. The expanding gold reserves also reinforce the backing of Tether’s gold-linked products.

While the Fed is buying time, the dollar is nosediving. And while Trump congratulates himself, bitcoin is smiling. The global economy, much less so...

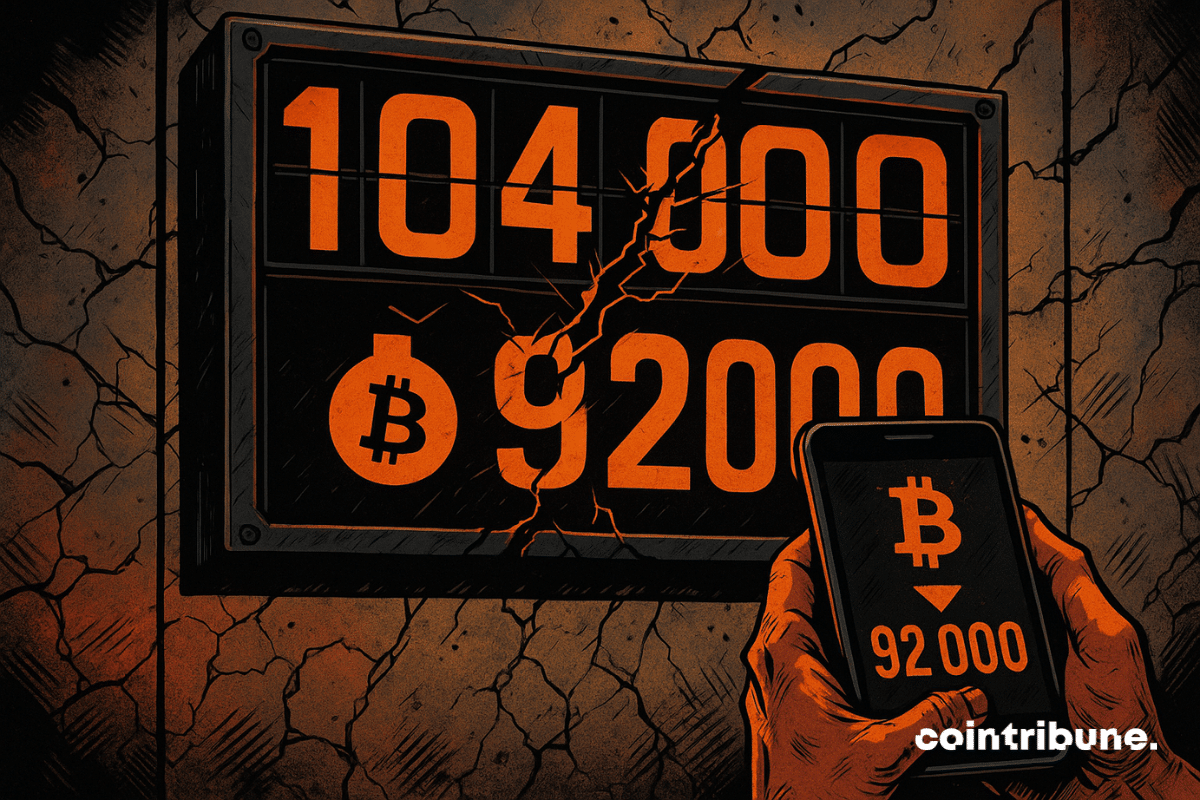

Bitcoin wobbles again, caught in the turmoil of a tense global economic context. As sensitive political deadlines approach, fear returns to the markets and revives a well-known pattern: the fall of the dollar often precedes a bottom for BTC. This inverse correlation, already observed in previous cycles, intrigues investors once again. While bitcoin tries to rebound, macroeconomic signals multiply and suggest a new episode of high tension for the market's leading crypto asset.

Davos 2026: Ripple and Trump unite to transform the United States into a crypto empire. All the details in this article.

Investment firm VanEck expects the first quarter of 2026 to favor risk assets, citing clearer fiscal policy, steadier monetary signals, and renewed interest across several major investment themes. After years of uncertainty, improved visibility is shaping how investors position their portfolios heading into the new year.

When the yen drowns, Metaplanet rows towards bitcoin: a strategy that makes Tokyo smile... except creditors. While Japan goes into debt, others stack BTC.

The American dollar has lost 10.41% of its value over this year. A significant drop for the world's main reserve currency, amidst economic tensions and loss of confidence. Meanwhile, gold and silver have seen spectacular rises, becoming safe haven assets again. This movement reflects a shift in market balance, where the role of the dollar as a safe haven is increasingly challenged.

While geopolitical fractures weaken the global monetary order, a silent upheaval is taking place. The BRICS, supported by their allies, are taking control of gold. By concentrating nearly 50% of global production and strengthening their reserves, they move from contestation to action. This realignment is no longer speculation, as it marks the emergence of a financial counter-power capable of challenging the supremacy of the dollar and redefining global balances. Gold once again becomes a strategic weapon.

The US dollar has cycled in influence over global debt markets for decades, maintaining its central role despite shifts and challenges.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

While bitcoin briefly rises above $86,000, a dissonance persists: the US dollar remains strong. This strength, usually unfavorable to risky assets, has not hindered BTC's upward momentum. Is it a real sign of recovery or a mere technical rebound masking underlying weaknesses?

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Trump, crowned president of mental mining, dreams of a bitcoin empire while Beijing prepares its tokens... A crypto-crusade to follow between tweets, stablecoins, and the digital yuan under surveillance.

Bitcoin slips, whales abandon, small holders capitulate... what if the famous $92,000 gap became the new stopover? Bearish mood guaranteed.

Wall Street trembles, BlackRock applauds, and the dollar digitalizes without asking the Treasury's opinion… Stablecoins are taking hold, while crypto weaves its planetary monetary web.

In the Sino-American escalation, a subtle lever takes on an explosive dimension: rare earths. Essential in advanced technologies, these materials become the silent weapon of a strategic duel where industrial sovereignty and monetary confrontation intertwine.

The dollar, the cornerstone of the global financial system, once again finds itself at the heart of a geopolitical controversy. Donald Trump accuses the BRICS of wanting to undermine its supremacy. In response, the Kremlin firmly denies any intention of destabilization, stating that the alliance does not target any foreign currency. Behind this tense exchange, one question remains: are the BRICS quietly working to reshape the global monetary order, or is this an alarmist reading of the ambitions of this emerging bloc?

Stablecoins continue to dominate blockchain activity, with Ethereum remaining at the center of this growth. Recent data shows stablecoin transactions on Ethereum hitting record highs, highlighting rising adoption and the network’s expanding role as a global settlement layer. Despite short-term price volatility, network fundamentals remain strong.

On the brink of a total shutdown, Washington shakes global markets. This Monday, September 29, the budget deadlock in the US Congress revives the specter of a shutdown as early as Wednesday, plunging investors and institutions into uncertainty. In an already uncertain climate, marked by central bank hesitations and the fragility of US indicators, this political stalemate raises fears of a major loss of visibility. Investors are repositioning urgently, between a flight to safe havens and anticipation of macroeconomic turbulence.

The People’s Bank of China (PBOC) has just inaugurated an international center dedicated to the digital yuan in Shanghai. A strong signal: Beijing wants to impose its e-CNY as a pivot of a new global monetary order. Can this initiative really challenge the dollar’s hegemony and compete with stablecoins dominated by the greenback?

Europe is stepping up its game on stablecoins. Bullish Europe has just listed USDCV, the new dollar-backed stablecoin launched by Société Générale-Forge. MiCA compliant and supervised by BaFin, this token marks a decisive turning point in Europe’s regulatory battle against American giants in the sector.

For the first time, Washington speaks with one voice on crypto. After years of partisan deadlocks and ideological battles, Democrats and Republicans are finally breaking their divides to build a common regulatory framework. Twelve Democratic senators have just announced their support for negotiations, accelerating the implementation of a law that could redefine the future of a market worth more than 4 trillion dollars.

Over the years, Bitcoin has evolved from a peer-to-peer payment system to a sought-after global asset. Regional governments are now looking to the OG crypto as an inflation hedge, and corporate Bitcoin treasuries have emerged as a rising trend. Yet for Tim Draper, venture capitalist and founder of Draper Associates, Bitcoin’s role goes far beyond a store of value. He maintains that the first-born coin will become a cornerstone in the future of finance and even national defense.

The internationalization of the Chinese currency is no longer a fantasy. The growth of international payments in yuan is skyrocketing. Bitcoin is lurking.

Fitch has downgraded France's sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

It's not just Bayrou's France that is struggling. Europe is going through a systemic crisis that the ECB's printing press can no longer solve. Despite years of massive injections, the eurozone is sinking into a vicious circle of stagnation and unsustainable debt. It seems that this time, unlike 2008, the ECB can no longer save Europe from the crash.

Bitwise published a report predicting that bitcoin will surpass the one million dollar mark before 2035.