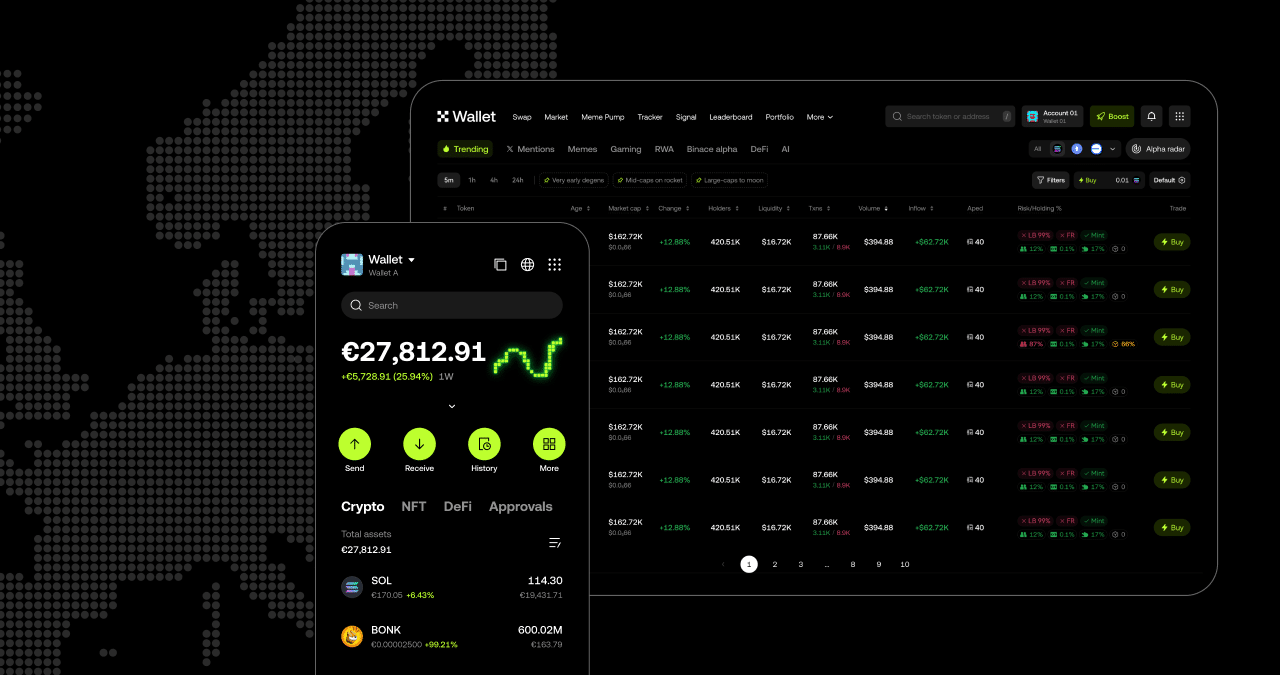

Just a few years ago, stepping into onchain felt overwhelming. Managing private keys was intimidating, moving assets across chains was risky, and earning yield was something only advanced users could figure out. For most people, the onchain world was out of reach. That’s why we started building the OKX Wallet—with one mission: to make onchain simple, secure, and open to everyone.

Exchange

Crypto is good. Crypto + F1 + guaranteed gifts is better. OKX launches a campaign in Europe with McLaren that transforms your first trade (or referring a friend) into a free/complimentary official McLaren F1 Team cap and, for three lucky winners, into a VIP experience at the Netherlands Grand Prix in Zandvoort (August 29–31, 2025). Goal: to give you a tangible and fun reason to try OKX, with an exclusive gift, frictionless with clear rules.

Crypto-expats, come home! The CFTC unveils its magic FBOT passport to revive the American dream. Punitive regulation? A bad memory, sworn and promised...

Hyperliquid has just smashed a world record that redefines the meaning of efficiency. The young decentralized exchange is now generating $1.127 billion in annual revenue, with only 11 contributors. That comes out to a staggering $102.4 million per employee. No company, crypto or traditional, has ever reached this level of productivity.

Gemini, the exchange founded by the Winklevoss brothers, has officially filed its S-1 with the SEC for a Nasdaq IPO. In a context marked by the multiplication of crypto IPOs, this initiative raises as much enthusiasm as questions. The platform's repeated losses and the market's persistent volatility indeed call for a thorough analysis. Will Gemini manage to attract Wall Street despite disappointing financial results?

OKB, the native token of OKX, has jumped nearly 160% in a single day after the platform announced sweeping changes to its blockchain ecosystem and tokenomics, including a massive one-time token burn and a fixed maximum supply. The price of OKB jumped from around $45 to as high as $135 on Wednesday, following news that OKX will permanently remove 65,256,712 OKB from circulation. The burn, which comes from historical repurchases and treasury reserves, will leave the total supply capped at 21 million tokens.

Crypto: Changpeng Zhao denies all responsibility in the fall of FTX and asks for the cancellation of the 1.8 billion lawsuit. Details here!

Panic on the crypto planet: panicked whales, small holders bleeding. And Binance picking up BTC like it's raining. Bitcoin itself looks grim…

Binance suspends crypto withdrawals on July 31 for maintenance. A quick cutoff, but one that reveals hidden tensions in the wallet infrastructure. Centralization, risks, strategy: discover what this technical pause really says about the Binance universe.

The crypto market, usually marked by spikes in volatility, displays a puzzling calm. While Bitcoin flirts with historical highs, flows to exchange platforms are collapsing. This unexpected restraint, highlighted by CryptoQuant, contrasts with previous bullish phases where euphoria triggered a wave of sales. A strong signal that raises questions about a profound shift in investor behavior and the structural solidity of the current cycle.

Pump.fun raises 500 million in a flash, while denying liking presales. Behind the bots, rug pulls are piling up. But who is really pulling the strings of the great crypto circus?

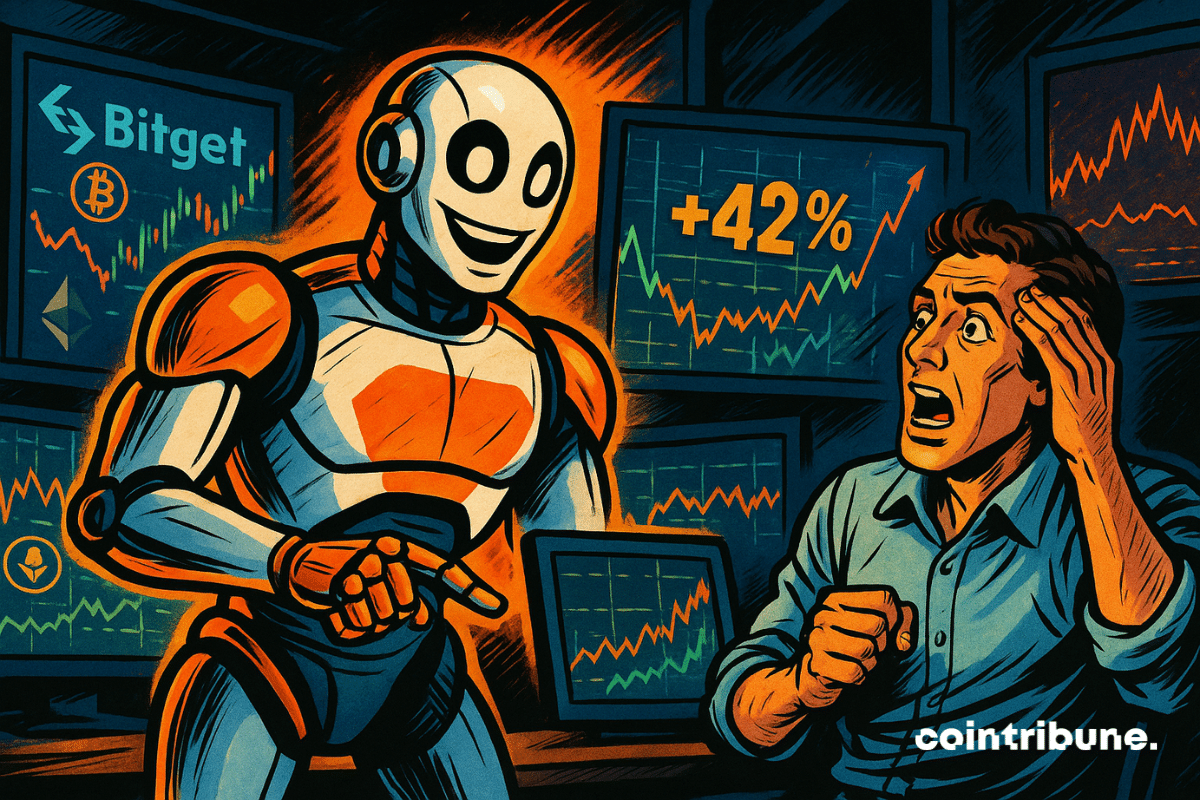

As the crypto market moves to the pulse of global dynamics, anticipation has become a strategic art. Bitget, a rising force in the Web3 ecosystem, is shifting gears. On July 1st, 2025, the platform unveiled GetAgent, an intelligent assistant designed to read the markets like a seasoned trader—without ever blinking.

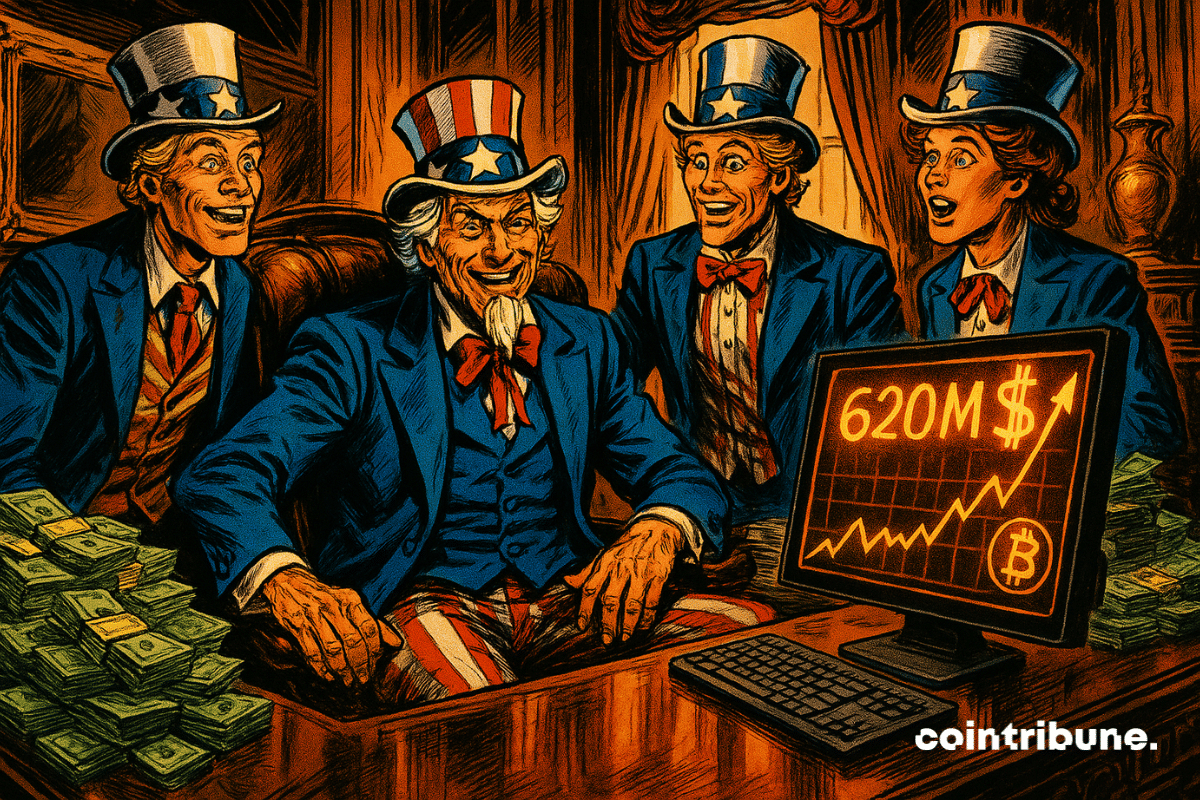

Trump enriched by tokens, his sons in mining, blocked laws: when crypto becomes the secret weapon of a president who loves neither banks nor brakes.

Less than 15% of bitcoins are still accessible on exchanges. Behind this figure lies a silent dynamic: the scarcity of liquid supply. As institutions appropriate the asset, analysts see it as a signal of an increasing imbalance between available stock and strategic demand. A shift is looming in the mechanics of the market.

Bybit, the world's second largest cryptocurrency exchange platform by volume, today announces the official launch of Bybit.eu, a platform exclusively dedicated to users in the European Economic Area (EEA). Operated by Bybit EU GmbH, a crypto-asset service provider licensed under the MiCAR regulation, this initiative marks a major milestone in Bybit's mission: to offer a safe, transparent, and fully compliant digital asset exchange platform in Europe.

Crypto is stolen in 2025: from private keys to state-sponsored attacks. Bybit, a monumental hack. When governments take an interest in crypto-thefts, the game changes completely. Explanations below.

The bitcoin market, usually quick to get excited at the slightest institutional whisper, seems today to be sending a clear message: long-term confidence is present. For 13 consecutive days, Bitcoin ETFs in the United States attracted nearly 3 billion dollars, an undeniable sign that major investors are no longer betting solely on a hype effect but on a solid trend.

When crypto takes to the track, Bitget makes a sharp turn with MotoGP. Speed and trading meet, at high speed and at zero cost for innovation.

As they clash with missile strikes, Israel and Iran are launching attacks... on the blockchain. Nobitex has suffered from it, cryptocurrency hacked, propaganda unleashed.

While some stash their gold under the mattress, Binance piles up billions in bitcoin... and no need for a Swiss safe for crypto to keep shining!

As Israel bombs, Iran fumes, and the markets stir, the old wolves of Bitcoin are shopping. Panic among traders, calm among strategists…

Bitcoin: a massive confidence signal. 3.77 million BTC withdrawn, is the market entering a new bull era?

Mass withdrawals, spontaneous combustion, and the dream of billions: Shiba Inu is playing the big bluff of the memecoin that would like to become a serious crypto… without losing its marketing flair.

What many thought unlikely is now becoming reality: American spot Bitcoin ETFs are set to surpass the symbolic milestone of $1 trillion in transaction volume. In less than 18 months, these financial products have transformed the stock market landscape, establishing Bitcoin as an essential asset in traditional markets. A meteoric rise driven by unprecedented institutional enthusiasm.

Brian Armstrong, CEO of Coinbase, finally publicly acknowledges a "major issue" that has been plaguing his platform for years. The leading American exchange announces an 82% reduction in wrongful freezes. But is this improvement enough to restore trust shaken by recent data breaches?

The crypto exchange Bitget is transforming access to Web3 knowledge with unprecedented support for young people. All the details in this article!

Binance, one of the giants of crypto, reaches 275 million users, of which 80 million joined the platform in five months. This staggering growth highlights the continuous rise of cryptocurrencies in global finance. In a sector undergoing major transformation, Binance positions itself as a key player in this evolution. How can we explain such enthusiasm, and what challenges lie ahead for this essential platform?

Forget bland campaigns and hollow rebrandings. Bitget Wallet has just made a significant impact with its new slogan: "Crypto For Everyone." A rallying cry more than just a simple marketing argument. In an often elitist ecosystem, where technical understanding serves as a gatekeeping requirement, Bitget wants to shake up the norms. And it does so with a wallet designed as a gateway to financial freedom, not as a trader's gadget.

XRP is fueled by risky bets: billions on the table, a coin frozen. A bubble? A takeoff? Derivatives are heating up, but the crypto is still waiting for its green light.

Bitget, the leading cryptocurrency exchange and Web3 company, has announced the listing of Ripple USD (RLUSD) on its spot trading platform. RLUSD, an enterprise-grade USD-backed stablecoin issued by Ripple, enters the Bitget ecosystem at a time when demand for secure and compliant digital assets continues to rise, particularly among institutional participants and developers focused on enterprise-grade blockchain use cases.