Ray Dalio warns that the post-WWII world order has collapsed, with global leaders acknowledging a new era defined by power, economics, and rivalry.

Finance

Beast Industries has acquired Step to help teens and young adults develop practical money skills through mobile banking and financial education.

Singapore, 16 January 2026 – Veera, a crypto-powered financial services platform focused on inclusion and usability, has raised a total of $10 million across its pre-seed and seed funding rounds to accelerate product development and to expand access to on-chain financial services globally.

Bitcoin increasingly moved independently from US stocks in the second half of 2025. While equities benefited from rate cuts and strong earnings, Bitcoin entered a correction after its October peak, highlighting a clear market divergence.

The GENIUS Act brings long-awaited clarity to U.S. stablecoins but deepens the regulatory divide with Europe, creating fragmented liquidity pools and raising concerns about cross-border stability and settlement friction.

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

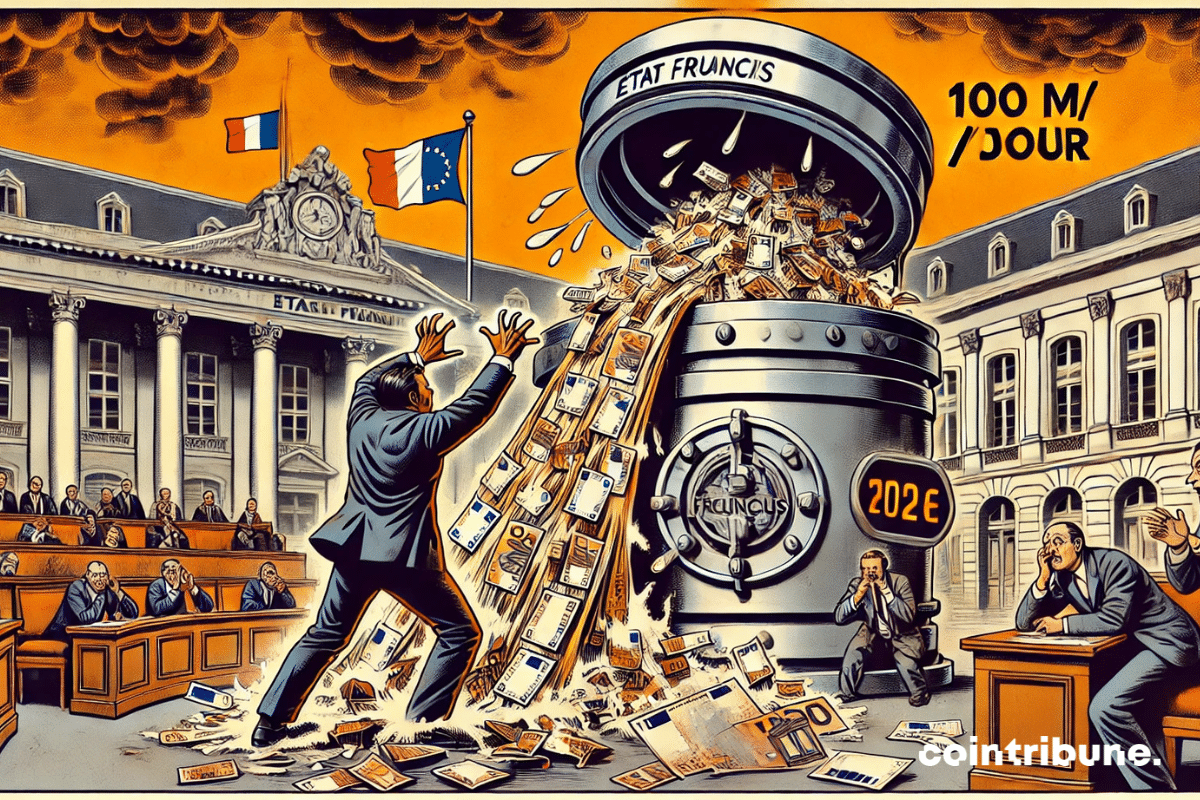

In France, public debt crystallizes political tensions, shocks the markets, and weakens budgetary sovereignty. With more than €3,400 billion to repay and sharply rising rates, the country faces an unprecedented risk. François Bayrou even raised the threat of being put under IMF supervision, while investors are beginning to doubt.

SharpLink Gaming has taken a significant leap in its Ethereum strategy, expanding its share offering to $6 billion. The company is aiming to deepen its already substantial stake in Ether. This bold move signals SharpLink’s intent to become a powerhouse in crypto-based corporate finance. By channeling most of its offering proceeds into Ethereum, SharpLink is not only reshaping its balance sheet but also making waves across the digital asset market.

Since the beginning of July, investors have been lending to Italy at a lower rate than that demanded for France. Indeed, the curve has inverted for the first time since 2005, weakening Paris's position in the hierarchy of sovereign risk in the euro area. Yet, France maintains a better rating. This paradox points to a perceptible reality: markets are doubtful. And in this hesitation, alternative assets are gaining ground.

For the first time, the idea of putting France under the guardianship of the IMF has crossed the gates of Bercy. Long reserved for countries in crisis, this perspective, now acknowledged at the highest level of the state, reveals the extent of the budgetary derailment. An abyssal debt, soaring interest charges, and pressure from rating agencies form an explosive cocktail. The signal is clear: French economic sovereignty is wavering, and international institutions are now scrutinizing Paris with the same severity as struggling economies.

April 2025 will be remembered as a particularly dark month for the Livret A. This savings tool, popular among the French, posted an unprecedented negative balance since 2009, with withdrawals exceeding deposits by 200 million euros. The recent decrease in its interest rate seems to have caused a general disillusionment among savers.

Global stock markets are plunging with significant losses on Wall Street and internationally. This drop, exacerbated by economic uncertainty, falling oil prices, and the trade war between the United States and China, raises questions about the short-term outlook for financial markets.

April's volatility in the U.S. financial markets is worrying global investors. Since the surprise announcement of new tariffs by Donald Trump on April 2, the S&P 500 has lost 5.4%. However, it is mainly the signals from the bond market and the dollar that raise fears of a deeper movement: an exodus of assets out of the United States.

In response to the turbulence in the financial markets amplified by Donald Trump's trade policies, Susan Collins, president of the Boston FED, announced that the Federal Reserve is preparing to intervene. Among the options considered to stabilize the markets, a reduction in interest rates could become inevitable if the situation deteriorates.

On April 9, 2025, American President Donald Trump announced a 90-day suspension of customs tariffs for most countries. Behind this apparent turnaround lies much more complex and overlooked issues. But what truly motivated this tariff pause?

After a decade of exceptional growth, India's economy is showing signs of slowing down. Government forecasts predict a growth rate between 6.3% and 6.8% for 2025, a significant decline from the 8.2% of 2023-2024.

The employment situation in France is experiencing a worrying deterioration. According to the latest figures published on January 27, 2025, by the Ministry of Labor, the number of unemployed job seekers without activity (category A) surged by 3.9% in the fourth quarter of 2024 compared to the previous quarter. This represents an additional 117,000 unemployed individuals, bringing the total to 3.1 million people, a level not seen in a decade, excluding the Covid-19 period.

For several decades, French budget management has been a source of recurring tensions, but the current situation has reached an unprecedented level. In 2025, the censorship of the budget voted by the Senate plunged the country into a major financial crisis, with losses estimated at 100 million euros per day. In the absence of a new text validated by the National Assembly, the budget for 2024 remains in effect, depriving the state of essential revenue and savings measures. Amélie de Montchalin, Minister for Public Accounts, warns about the repercussions of this deadlock and emphasizes both its economic cost and the institutional challenges it reveals.

The American Federal Reserve (FED) may slow down its interest rate cut cycle in 2025, according to recent statements from its officials. An announcement that sparked panic on Wall Street, where stock indices fell sharply on Friday, shaken by robust economic data! This reinforces the idea that the FED could curb its monetary easing sooner than expected.

In 2025, China continues to demonstrate its resilience under international economic pressures, particularly those exerted by the future Trump administration. Despite attempts by the new American president to hinder China's economic rise, it persists in its openness, marking a significant victory in the war between the two superpowers.

The U.S. Secretary of the Treasury, Janet Yellen, recently warned that the U.S. debt ceiling could be reached as early as mid-January 2025. According to her statements, the Treasury expects to hit this new limit between January 14 and 23, at which point extraordinary measures will need to be taken to avoid a default.

The US dollar is establishing itself as the leading currency of 2024, dominating the foreign exchange market without competition. While many global economies face challenges such as rapid inflation and geopolitical uncertainties, the greenback is showing its best performance in nearly a decade. This remarkable progress is based on several solid pillars: a robust US economy, attractive bond yields, and a monetary policy skillfully orchestrated by the Federal Reserve. Additionally, there is a global context characterized by the weakening of competing currencies, such as the yen and the euro, which are unable to compete with the supremacy of the dollar. This rise reflects the resilience of the United States but also highlights the economic fractures shaking the rest of the world.

China is at a pivotal economic turning point. As the combined effects of weak consumption, an intensified real estate crisis, and high unemployment hinder its development, Beijing has just announced an ambitious budget policy for 2025. The stated objective is clear: to stimulate domestic demand and stabilize an economy under significant pressure. To achieve these ambitions, the government plans a significant increase in public spending, coupled with a revision of its fiscal priorities. These measures, detailed during a national conference, reflect a firm commitment to support local communities, expand social benefits, and strengthen resources for struggling businesses. Such a strategy, centered around innovation and strategic technologies, also aims to revitalize trade exchanges in order to adapt debt rules. With this comprehensive approach, Beijing intends to lay the groundwork for more resilient economic growth and to address the structural challenges that hinder its trajectory.

"Great news awaits holders of a Livret d'Épargne Populaire (LEP). Starting December 31, 2024, more than 2.5 million French citizens will benefit from the annual payment of interest. Discover the details and the impact of this measure on their purchasing power."

While most European bond markets show relative stability, the situation in France raises serious concerns. The yields on 10-year government bonds have reached 3.05%, an exceptionally high level for a major eurozone economy. This dynamic reflects a combination of economic tensions and political dysfunction, which reinforces doubts about the country's budgetary management. With public debt exceeding 112% of GDP and a deficit stagnating above 6%, France stands out as a worrying case within the European Union. These developments signal a loss of investor confidence but also highlight the urgency for structural reforms to prevent an even more marked deterioration of its position in financial markets.

All eyes are on Beijing, where a major conference is taking place that could redefine China's economic direction until 2025. As the world's second-largest economy faces a lasting real estate crisis, weakened domestic consumption, and renewed trade tensions with the United States, this annual meeting takes on critical importance. At a time when the global economic balance remains precarious, the decisions made here will have repercussions far beyond China's borders.

Despite the uncertainties surrounding the global context, the French economy surprises with its ability to maintain a precarious balance. While the projected zero growth for the end of the year could have heralded dark days, several indicators suggest an unexpected resilience. However, this picture is neither black nor rosy, according to the words of the Governor of the Bank of France, François Villeroy de Galhau.

As the global economy attempts to stabilize after years of uncertainty, American public debt is drawing renewed attention. Indeed, with a level reaching 125% of GDP in 2024 and a growing budget deficit, this issue concerns international institutions, particularly the European Central Bank (ECB). Thus, recent statements from its Vice President, Luis de Guindos, emphasize the urgency of the situation and its potential repercussions on the eurozone.

The return of Donald Trump to the presidency of the United States after his victory in the election on November 5 raises serious concerns well beyond American borders. Indeed, during a recent address in Lyon, Villeroy de Galhau did not mince his words. For him, "this new Trump administration would increase the risks to the global economy." This statement serves as a reminder to Europeans of the urgency to strengthen their economic resilience and to elevate their autonomy in the face of an increasingly protectionist American model.

France's budget deficit, now reaching 173.78 billion euros, has become a critical issue as it highlights the growing challenges the country faces in maintaining its financial commitments. With the end of the Covid-19 pandemic and the support measures, efforts to restore public finances seem to have encountered major obstacles. This budget gap exceeds forecasts and demands ambitious but controversial revisions. In this context, the government is striving to convince both European institutions and internal political actors of the viability of its austerity plan to avoid a lasting decline in state finances.