When the Assembly knits bitcoin to recycle excess electricity, power plants smile, miners get busy... and digital gold suddenly becomes more French than a baguette under the arm.

France

The preferred savings account of the French is about to face a serious setback. The rate of the Livret A, held by more than 55 million people, will drop to 1.7% on August 1, 2025, down from 2.4% today. This is a significant decline, the largest since 2009, validated by the Banque de France and in accordance with the regulatory formula. In an still fragile economic climate, this decision reignites the debate on the profitability of regulated savings and raises questions about the future choices of savers in search of alternative solutions.

The shadow of Elon Musk looms once again over Europe. The Paris court has opened a criminal investigation into the platform X, suspected of algorithmic manipulation for the purposes of foreign interference. This case, at the crossroads of cybercrime, European justice, and geopolitical tensions, could mark a new escalation in the trade war between the United States and the European Union.

France's economy recorded a trade deficit of 7.6 billion euros in May. A concerning trend for investors.

Since the beginning of July, investors have been lending to Italy at a lower rate than that demanded for France. Indeed, the curve has inverted for the first time since 2005, weakening Paris's position in the hierarchy of sovereign risk in the euro area. Yet, France maintains a better rating. This paradox points to a perceptible reality: markets are doubtful. And in this hesitation, alternative assets are gaining ground.

The drop in mortgage rates marks an unexpected pause. While the market was beginning to restart, the curves are freezing, diverging from forecasts. This turnaround intrigues both buyers and investors, caught between hopes and uncertainties. Why are rates no longer falling, despite a more flexible monetary context? This blockage raises questions about the financing dynamics in France and reveals deeper tensions, at the very moment when real estate is trying to emerge from its stagnation.

Despite a decline in profits, companies in the CAC 40 are increasingly attentive to their shareholders. In 2024, they maintain record payouts, contrary to traditional economic signals. In an environment marked by sluggish growth, rising inflation, and unstable markets, this strategy raises questions. Is it a sign of strength or a risky bet? While shareholder profitability remains a priority, the gap between distributed profits and actual performance raises doubts about the sustainability of this model.

The world of French tech is reaching a new milestone. Sequans, a specialist in IoT semiconductors, chooses Bitcoin to strengthen its financial strategy. A rare, bold decision that carries significant meaning in the current economic context.

A coffee, an unfindable place, a disappearance: in Maisons-Alfort, crypto comes out of the virtual to end up in a bag, version grand banditisme 3.0.

After two years of suffocation, the French real estate market is showing measurable signs of recovery. Driven by falling interest rates and price stabilization, the first concrete signals are confirmed by FNAIM figures and field observations reported by Laforêt. Caution is gradually giving way to a recovery, admittedly still fragile but tangible. In an uncertain economic environment, this flicker gives new life to a sector long paralyzed. The question remains whether this momentum can be sustainable.

Finance: The savings rate of the French is the highest since 1979. We provide you with all the details in this article!

For several months, France has been bustling on the digital scene. At the heart of this excitement: Telegram, the messaging app favored by digital dissidents. Its founder, Pavel Durov, is no longer content with defending freedom of expression: he directly accuses the French authorities. In a recent interview, he raised a serious alarm. According to him, France is drifting, and this drift could precipitate a societal collapse.

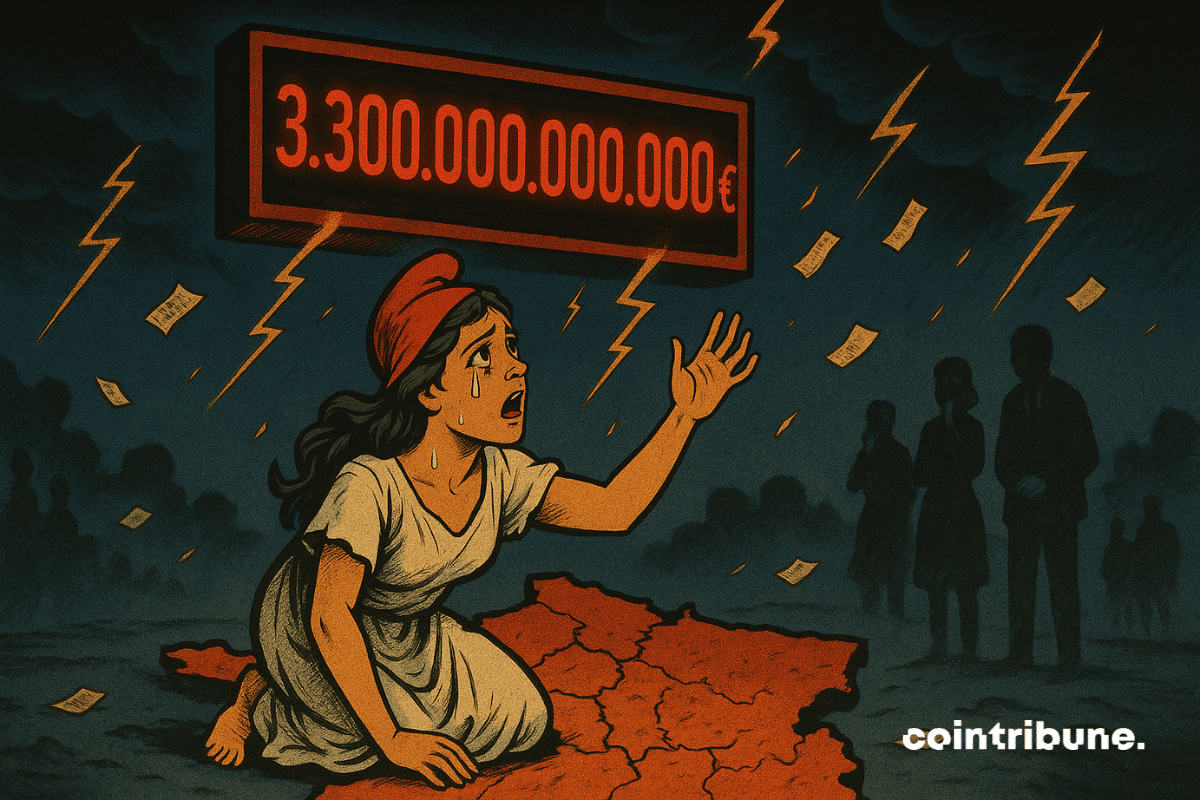

For the first time, the idea of putting France under the guardianship of the IMF has crossed the gates of Bercy. Long reserved for countries in crisis, this perspective, now acknowledged at the highest level of the state, reveals the extent of the budgetary derailment. An abyssal debt, soaring interest charges, and pressure from rating agencies form an explosive cocktail. The signal is clear: French economic sovereignty is wavering, and international institutions are now scrutinizing Paris with the same severity as struggling economies.

At a time when financial distrust spreads in a click, a TikTok video posted at the end of May has reignited fears of increased state control. It claims that starting from October 2025, any transfer of more than 800 euros between individuals would be blocked for 24 hours for tax verification. Within a few days, the rumor has caused unrest among thousands of French citizens. What does the regulation actually say? And why is this viral announcement completely unfounded?

The real estate credit market, long stagnant, is beginning a clear recovery. In two months, the demand for loans has almost doubled, driven by a decrease in rates and a reopening of bank lending. After two years of blockage due to the sharp rise in the cost of money, this turnaround was expected. However, is this improvement sustainable or just a simple catch-up effect? While April marks a turning point, the sector is questioning: are we witnessing the beginning of a cycle or a fragile pause?

New development in the crypto jungle: the police have apprehended another suspect, while the alleged leader, hiding in Morocco, awaits extradition... The noose is tightening.

Nine months after his spectacular arrest at Bourget airport, the founder of Telegram gives his first television interview to Tucker Carlson. Between misunderstanding and mistrust, Pavel Durov firmly contests the French accusations. What is the real story behind this case that has shaken the tech world?

A criminal crypto network, targeted tech figures, a suspect tracked down to Morocco. The case that shakes France and forces the state to react. Between violence, crypto, and security: dive into the burning file that exposes the flaws of an ecosystem.

The public debt of the major economic powers of the G7 is at the center of concerns in 2025. Amid growing worries and heightened vigilance, the fiscal management of these nations is becoming a key indicator of global economic stability. The downgrade of the United States' triple-A rating and disappointing bond sales in Japan perfectly illustrate this new tension and highlight the risks associated with increasingly unsustainable levels of indebtedness. These alarming signals reinforce investors' doubts and amplify the volatility of global financial markets.

A large judicial operation is shaking up the French crypto ecosystem. The Paris prosecutor's office has just indicted 25 individuals, including six minors, for their alleged involvement in several kidnapping attempts targeting figures in the crypto sector. Does this offensive finally mark a turning point in the fight against this new form of crime?

Interest rates are raising concerns. François Bayrou warns that the topics of pensions and debt will need to be revisited. New generations would do well to turn to bitcoin...

After six quarters of decline, the French real estate market surprises with an unexpected flicker: prices are slightly rising again. According to notaries and the Insee, the 0.5% increase at the beginning of 2025 marks a discreet yet strategic break. While many were betting on a continuation of the decline, this signal rekindles bets on the sector's evolution. For investors seeking diversification, including in the crypto sphere, this shift could very well reshuffle the cards of short-term wealth allocations.

The French crypto sector is dragging its feet in the face of MiCA. The AMF is sounding the alarm: will you be ready before the fateful date? Find out why the race against time has just begun!

The judicial police are conducting a large-scale operation this Monday morning. More than a dozen suspects have been arrested in connection with two kidnapping cases targeting crypto entrepreneurs. This offensive highlights a worrying phenomenon shaking the French cryptocurrency ecosystem. But will these arrests be enough to reassure a sector plagued by an unprecedented wave of violence?

€635.64 billion is the amount reached by the financial wealth of French households, an absolute record revealed by the Bank of France. This figure far exceeds the national public debt and surpasses the capitalization of the CAC 40. Behind this impressive accumulation lies a societal choice: that of massive savings, oriented towards security rather than yield. A French paradox, at a time when the economy calls for innovation and markets for measured risk-taking.

April 2025 will be remembered as a particularly dark month for the Livret A. This savings tool, popular among the French, posted an unprecedented negative balance since 2009, with withdrawals exceeding deposits by 200 million euros. The recent decrease in its interest rate seems to have caused a general disillusionment among savers.

Interrogated in the Senate about the call for economic patriotism made by Emmanuel Macron, who has completely ruined France, Bernard Arnault judged that the state's interference in the operational management of businesses was "very bad" and leads to disaster.

Revolut is setting up in Paris, spending a billion, hiring 200 people... But behind the neobank, will crypto go all in to dominate the European economy? A mystery to follow.

Broken families, threatened lives: the surge of targeted attacks on crypto players in France is disrupting a rapidly growing sector. The Minister of the Interior is deploying urgent measures to ensure their safety and break this climate of fear that threatens the entire industry.

Long limited to its role as a store of value, Bitcoin is making a decisive breakthrough into DeFi. With the launch of the Peg-BTC (YBTC) token on the Sui network, Bitlayer introduces a "trustless" BitVM bridge that eliminates centralized intermediaries. This initiative marks a notable evolution. BTC becomes a fully usable asset within decentralized protocols, previously dominated by native tokens. A new chapter opens, that of an interoperable, mobile Bitcoin now active in programmable finance.