€635.64 billion is the amount reached by the financial wealth of French households, an absolute record revealed by the Bank of France. This figure far exceeds the national public debt and surpasses the capitalization of the CAC 40. Behind this impressive accumulation lies a societal choice: that of massive savings, oriented towards security rather than yield. A French paradox, at a time when the economy calls for innovation and markets for measured risk-taking.

France

April 2025 will be remembered as a particularly dark month for the Livret A. This savings tool, popular among the French, posted an unprecedented negative balance since 2009, with withdrawals exceeding deposits by 200 million euros. The recent decrease in its interest rate seems to have caused a general disillusionment among savers.

Interrogated in the Senate about the call for economic patriotism made by Emmanuel Macron, who has completely ruined France, Bernard Arnault judged that the state's interference in the operational management of businesses was "very bad" and leads to disaster.

Revolut is setting up in Paris, spending a billion, hiring 200 people... But behind the neobank, will crypto go all in to dominate the European economy? A mystery to follow.

Broken families, threatened lives: the surge of targeted attacks on crypto players in France is disrupting a rapidly growing sector. The Minister of the Interior is deploying urgent measures to ensure their safety and break this climate of fear that threatens the entire industry.

Long limited to its role as a store of value, Bitcoin is making a decisive breakthrough into DeFi. With the launch of the Peg-BTC (YBTC) token on the Sui network, Bitlayer introduces a "trustless" BitVM bridge that eliminates centralized intermediaries. This initiative marks a notable evolution. BTC becomes a fully usable asset within decentralized protocols, previously dominated by native tokens. A new chapter opens, that of an interoperable, mobile Bitcoin now active in programmable finance.

In the face of the increasing number of abductions targeting the crypto sector in France, Interior Minister Bruno Retailleau is organizing an emergency meeting with entrepreneurs this Friday. This decision comes after the attempted kidnapping of the daughter and grandson of the CEO of Paymium on Tuesday in Paris. Is the safety of crypto players becoming a national issue?

Under the guise of progress, Paris is rolling out the red carpet for crypto lombard credit... but the banks couldn't care less, and Bercy is already pulling out the calculator to tax the bold.

When Elon Musk plays politics with Trump, it's Tesla that stumbles at the start. Between free falls, a hesitant board, and angry tweets, the Empire of the tweet dangerously wavers.

Cannes, famous for its film festival and luxury boutiques, is preparing to become one of the first French cities to massively adopt cryptocurrencies. By the summer of 2025, nearly 90% of businesses in the azure city will accept payments in crypto.

The CAC 40 is taking a significant hit. In just a few sessions, the Paris index has dropped over 6.5%, driven by a dramatic return of trade tensions. The announcement by Donald Trump of new tariffs on Chinese and European imports triggered a wave of massive sell-offs. Thus, on April 3, the Paris Stock Exchange fell by 2.25%, indicating a climate of widespread nervousness that revives the specter of a global economic war.

Telegram sent an unequivocal message to its French users this Tuesday, firmly defending the principle of encryption in private messaging. This communication comes after the rejection of a controversial amendment in the National Assembly that aimed to impose "backdoors" in encrypted messaging applications.

Under the pressure of sluggish growth and enduring geopolitical instability, the government is implementing an unprecedented austerity measure. By official decree, 3.1 billion euros in credits are being canceled for 2025, indicating a determined budgetary reorientation. The objective is to maintain the course of restoring public finances in the face of a weakened economic context. The cuts will severely impact key sectors such as ecology, the economy, and research, revealing the priorities of a public management that is now under strain.

At 1.7%, the Livret A no longer inspires dreams. The LEP saves the furniture, while the youth flee to greener, or more volatile, pastures.

A viral video on TikTok claims that a law banning cash has been adopted in France. In just a few days, this clip has reignited fears about the end of cash and a fully digitized society. However, this claim is false, as no legal text confirms such a ban. Behind this misleading narrative, a very real topic deserves attention: the digital euro project put forward by the ECB, which aims to complement cash rather than eliminate it.

The possible removal of the 10% tax allowance on retirement pensions is stirring public debate. Announced in a government note, the measure is as concerning as it is divisive. What was once just a budgetary avenue has now become a strong social marker, crystallizing tensions around taxation and the treatment of retirees. In a pressured economic climate, this potential reform raises a central question: how far can the State go without breaking the balance between generations?

Paris Blockchain Week, Europe's premier blockchain and Web3 event, wrapped up its sixth edition at the iconic Carrousel du Louvre, setting a new standard for industry gatherings. The event was a resounding success, drawing over 9,600 attendees from 95 countries, including an impressive 67% C-suite executives, demonstrating the strategic significance of blockchain across global business leadership.

France is struggling with a massive deficit, Bayrou calls for more work, but amid social cuts and political tensions, the reform risks triggering a governance crisis.

Crypto in France is moving out of its phase of euphoria towards a more mature structuring. This 2025 study by Adan (Association for the Development of Digital Assets), conducted with Deloitte and Ipsos, presents a clear assessment: stabilized adoption, asserted industrial ambitions, but persistent challenges. Amid the rise of Web3, institutional openness, and regulatory barriers, the French ecosystem is carving its path towards sustainable integration. This survey sheds light on the springs of a dynamic in full redefinition, where the strategic future of cryptocurrencies in Europe is at stake.

A new trade confrontation is beginning between the two shores of the Atlantic. Through the announcement of a 20% tariff on all European products, Washington directly targets exports from the Old Continent. France, on the front line, faces the threat of a major economic shock. Between the vulnerability of strategic sectors and diplomatic urgencies, Paris must react quickly. Behind this American decision lies much more than a tariff battle: the entire architecture of transatlantic trade relations is at stake.

After a bleak week, the CAC 40 fell by 8%, shaken by the trade war, market volatility, and grim economic outlooks, with a rebound still uncertain.

Donald Trump triggered a new trade earthquake on the night of April 2 to 3, 2025. By announcing an increase in tariffs of up to 20% on products from the European Union, the current head of the White House is reviving transatlantic tensions. But France and Europe are not going to take it lying down and are going on the offensive!

Real estate is regaining its color. After a long period of waiting, prices are rising again in many French cities, signaling an unexpected turning point in the market. This upturn, which began at the start of the year, is intensifying due to more attractive borrowing rates and a gradual return of buyers. Both professionals and individuals are closely watching this emerging dynamic, which reshuffles the cards after months of stagnation. In light of this resurgence in activity, observers are pondering: is this a simple cyclical rebound or a true reversal of the cycle?

In 2025, declaring your cryptocurrencies has never been so strategic. With the entry into force of the European MiCA regulation and the tightening of tax controls, holders of Bitcoin, Ethereum, or other digital assets must be extra vigilant. Mistakes can be costly: penalties, adjustments, or even suspicions of fraud. Here is a powerful guide to navigate the key dates and nuances of the French tax regime, without getting lost in administrative maze.

A global study reveals that real estate remains widely used for money laundering, with gaps identified in all the analyzed countries, including France, which nevertheless ranks among the good students.

Bpifrance has announced a strategic investment of 25 million euros to support blockchain projects with a "strong French footprint." This initiative aims to strengthen France's position in the rapidly expanding global crypto industry.

Finally, the wall of distrust is crumbling. BoursoBank, the French giant of online banking, reaches a historic milestone by incorporating crypto ETPs into its offering. A notable turnaround for this subsidiary of Société Générale, which has long been distant towards digital assets. By partnering with CoinShares, the European leader in the sector, the platform breaks into the traditional world of finance. Bitcoin, Ethereum, XRP... These names now resonate in the portfolios of ordinary investors. One more step towards the normalization of cryptos? Much more: a silent revolution.

The Bank of France finds itself in 2024 facing an unprecedented financial situation with an operating loss of 17.7 billion euros. This loss, far from being anecdotal, highlights deep vulnerabilities within the European financial system, exacerbated by inflation, rising interest rates, and the management of public debts.

Normandy could soon host the first bitcoin mining farm in France, financed by the Sultanate of Oman. This unique project, at the intersection of energy, technological, and geopolitical issues, crystallizes French ambitions in the digital economy. At a time when energy sovereignty is becoming central, this initiative raises questions about the role that France wants to play in the global crypto ecosystem.

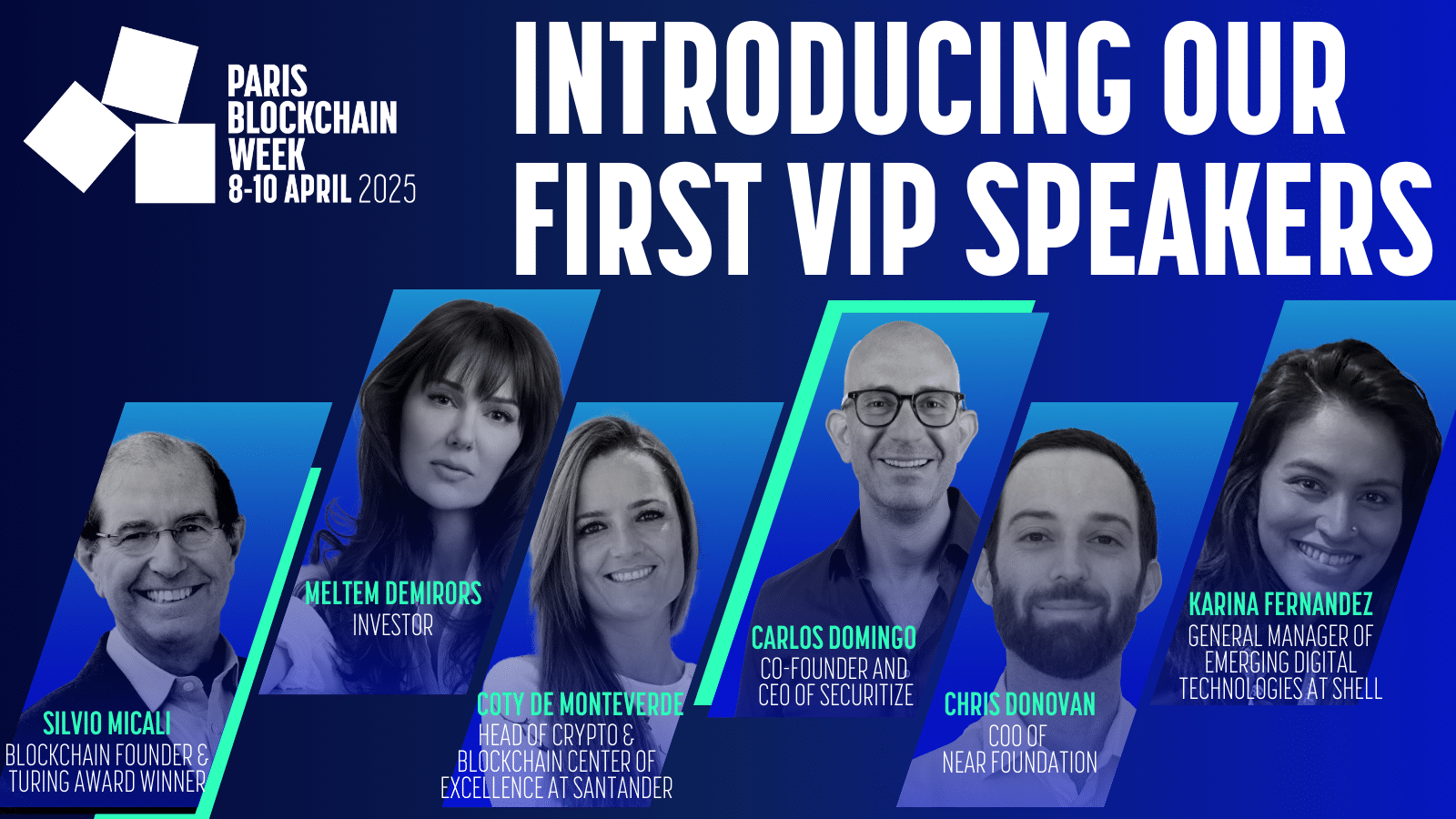

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.